RiverNorthPhotography/iStock Unreleased via Getty Images

These days, one of the most well-known companies in the salty snacks category is Utz Brands (NYSE:UTZ). Over the past few years, management has done a good job growing the company’s top line and improving its profitability and cash flows. That growth has continued now through the 2021 fiscal year and is even continuing, on the top line, into 2022. Having said that, even attractive Companies may not make for attractive investments. Despite revenue slated to grow at a rapid pace this year, profitability should be more or less flat. Add on top of this how expensive shares currently look, and I cannot help but to rate the business a ‘sell’ for now.

Taking A Bite Out Of Utz Brands

As I mentioned already, Utz Brands focuses on producing salty snacks like its own name brand Utz chips. It also produces other products like ON THE BORDER, Zapp’s, Golden Flake, and others. You might think that a company like this would be fairly stable during a down market. However, investors have punished this enterprise just as much as they have punished many other firms. While the S&P 500 is down by 11.6% as of this writing since I last wrote an article about Utz Brands in March of this year, its shares are down 10.6%. I, for one, I’m not terribly surprised at this drop. Because of my last article on the company, I rated it a ‘hold’, indicating that I felt it would more or less follow the broader market for the foreseeable future.

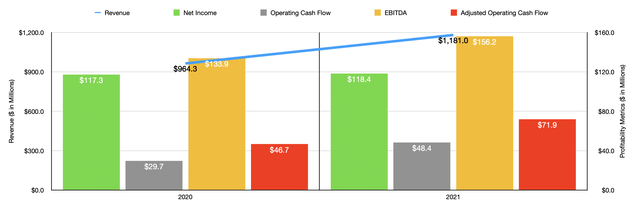

Author – SEC EDGAR Data

Fast-forward to today, and we now have some additional data that helps us to evaluate the enterprise. You see, when I last wrote about the firm, we only had financial performance figures covering through the third quarter of the company’s 2021 fiscal year. Today, we now have data covering the entirety of 2021, as well as through the first quarter of this year. To begin with, we should briefly discuss how the company ended last year. For the year as a whole, management reported revenue of $1.18 billion. That translated to a year-over-year growth rate of 22.5% compared to the $964.3 million reported in 2020. While this may seem like a rapid growth rate for a well-established snack company, it’s not the first time the company has demonstrated strong upside. Between 2018 and 2020, for instance, annualized growth for the company was 11.8%.

As revenue increased, profitability for the company also improved. Net income in 2021 came in at $118.4 million. That’s slightly higher than the $117.3 million generated in 2020. Operating cash flow performed even better, skyrocketing from $29.7 million to $48.4 million. If we adjust for changes in working capital, this data is even more impressive, with the metric climbing from $46.7 million to $71.9 million. Meanwhile, EBITDA for the company also improved, climbing from $133.9 million in 2020 to $156.2 million last year.

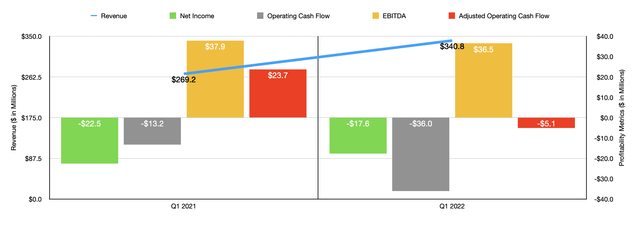

Author – SEC EDGAR Data

Strong growth for the company’s revenue continued into the 2022 fiscal year. For the first quarter, sales of $340.8 million dwarfed the $269.2 million achieved just one year earlier. This translates to a year-over-year improvement of 26.6%. Some of this improvement, totaling about 9.4% of the company’s top line growth, came from a favorable price and product mix. However, the majority of the upside was attributable to acquisitions. Examples include the following acquisitions: Vitner’s, Festida Foods, and R.W. Garcia. What management refers to as its power brand also performed remarkably well, growing by 27.7% year over year.

Although revenue improved drastically, some of the company’s profitability metrics worsened year over year. Net income did manage to improve, turning from a net loss of $22.5 million in the first quarter of 2021 to a loss of $17.6 million the same time this year. On the other hand, operating cash flow went from a negative $13.2 million to a negative $36 million. Even if we adjust for changes in working capital, it would have turned from $23.7 million to negative $5.1 million. EBITDA also saw a slight worsening year over year, dropping from $37.9 million to $36.5 million. Even though revenue increased, the company suffered from higher costs in certain areas. For instance, the company’s gross profit margin contracted from 35.4% to 30.5% due mostly to higher commodity and wage inflation that ultimately outpaced the company’s pricing actions. Selling, distribution, and administrative costs also rose relative to revenue, mostly because of higher acquisition and integration costs associated with the purchases the company made during the year. The company also suffered from contract termination expenses and other impairments, but this was fairly small by comparison.

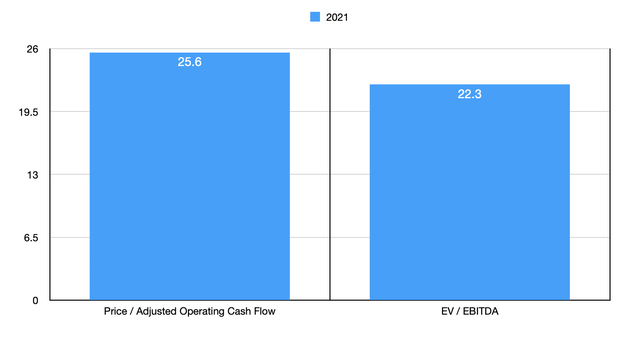

Author – SEC EDGAR Data

For the 2022 fiscal year, management expects revenue to continue growing. However, that growth will ultimately be weaker than what we saw in the first quarter. At present, revenue should climb by between 10% and 13%, with organic revenue expanding by between 8% and 10%. The company provided only a vague assessment of profitability, saying that we should see a marginal improvement in EBITDA compared to the $156.2 million the company generated in 2021. Because of management’s language on this matter, I decided just to assume that financial performance for 2022 will more or less match with what the company saw last year. In that case, shares of the company do look rather pricey, with the firm trading at a price to adjusted operating cash flow multiple of 25.6 and at an EV to EBITDA multiple of 22.3. To put this in perspective, I decided to compare the company to the same five firms that I compared it to when I last wrote about it. On a price to operating cash flow basis, these companies range from a low of 4.9 to a high of 72.7. And using the EV to EBITDA approach, the range was from 2.9 to 33.9. In both cases, three of the five companies were cheaper than Utz Brands.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Utz Brands | 25.6 | 22.3 |

| Sanderson Farms (SAFM) | 4.9 | 2.9 |

| Hostess Brands (TWNK) | 13.6 | 13.7 |

| The Simply Good Foods Company (SMPL) | 29.9 | 25.1 |

| Cal-Maine Foods (CALM) | 72.7 | 33.9 |

| Whole Earth Brands (FREE) | 12.8 | 9.0 |

Takeaway

The data right now shows that while revenue for Utz Brands is slated to continue growing, profitability is coming under some pressure. Margin contraction is not a great thing to see, especially if we are heading into a recession. Add on top of this the fact that shares of the company have gotten more expensive (from a valuation perspective) than when I last wrote about it, and I cannot help but to rate it a ‘sell’ at this time.

Be the first to comment