Jonathan Kitchen/DigitalVision via Getty Images

Rose’s Income Garden – “RIG”

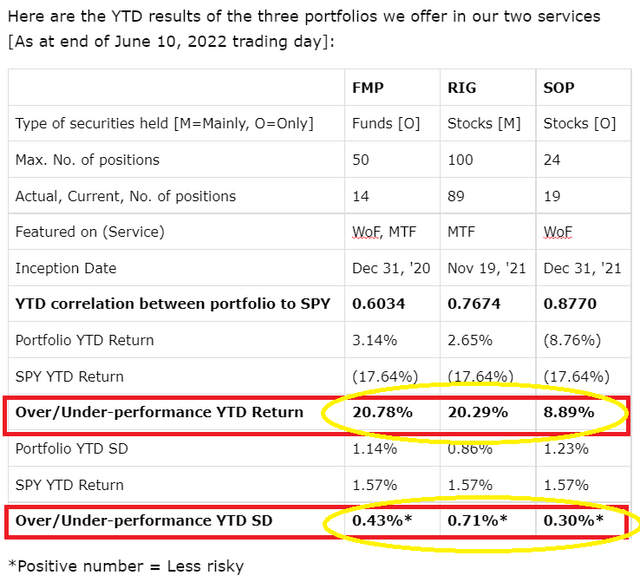

RIG is found at the Macro Trading Factory, a macro-driven service, led by The Macro Teller and RoseNose.

The service offers two portfolios: “Funds Macro Portfolio” and “Rose’s Income Garden”; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

Each of the portfolios, spanning across all sectors, offering you a hassle-free, easy to understand and execute, solution.

Macro Trading Factory Performance (Macro Trading Factory Service)

RIG is beating SPY year to date to June 16th by over 18.9% but the bear has now taken a red bite. Value is down by 1%, but dividends help and are now offering a 5.4% yield.

Dividends do help with total return and the goal continues to be holding defensive income at 50% or more. Utilities provide stable reliable income, an attractive yield, somewhat reasonable dividend growth along with capital gains.

8 Utility Investments in RIG

There are 6 pure utility companies in the following chart shown with their S&P Credit ratings and a summary for all 8 investments follows. Current Price was from June 14th, 2022.

|

Stock |

Stock |

S&P |

Current |

Estimated |

Est |

|

Ticker |

Company Name |

Cr Rating |

Price |

2022 Div$ |

Div Yield |

|

(DUK) |

Duke Energy |

BBB+ |

$99.92 |

4.04 |

4.04% |

|

(XEL) |

Xcel Energy |

A- |

$65.68 |

1.95 |

2.97% |

|

(SO) |

Southern |

A- |

$66.33 |

2.72 |

4.10% |

|

(MGEE) |

Madison Gas El |

A+ vl |

$74.85 |

1.6 |

2.14% |

|

(DNP) |

Duff N Phelps |

silver |

$10.86 |

0.78 |

7.18% |

|

(D) |

Dominion |

BBB+ |

$74.44 |

2.67 |

3.59% |

|

(KEN) |

Kenon Holdings |

na |

$52.21 |

13.75 |

26.44% |

|

(WEC) |

Wis Energy |

A- |

$91.68 |

2.91 |

3.17% |

Company Information and Metrics

Utilities are generally supported/ regulated by states and can recover most all costs which brings stability to their prices and owning them. Most have very secure investment policies, highly rated credit and offer exceedingly safe dividends. They are therefore very defensive to own as most everyone needs energy in our lives.

The summary information is from Yahoo Finance. The prices and P/E information that follow were taken from FAST Graphs, a subscriber service from Chuck Carnevale. Rising dividend payment years comes from The “CCC” list continued and updated by Justin Law and it remains free to subscribe.

Duke Energy Corp.

Headquartered in Charlotte NC since 1904 as Duke Energy Holding Co. it changed to the current name in 2005. It operates as a regulated electric utility with 8.2 million customers in 6 states primarily in the Carolinas, Florida and The Midwest. Gas and pipelines provide service to 1.6 million customers in the Carolinas, Tennessee, southwest Ohio, and northern Kentucky. Lastly it currently operates in commercial renewables using wind and solar farms across 22 states.

Statistics:

– 17 years of a rising dividend.

– Dividend yield of near 4% with a 5year “DGR” dividend growth rate of 3%.

– Normal 5 year P/E of 18.1 and it trades a bit higher today at 18.9 and a price of ~ $100.

Xcel Energy

Xcel incorporated and became headquartered in Minneapolis, MN in 1909. It is a regulated electric utility, as well as natural gas and other segments. It invests in rental housing projects and procures equipment for renewable generation facilities. Its customers number 2.1 million for natural gas, 3.7 million for electricity and are primarily in the states of Colorado, Michigan, Minnesota, North and South Dakota, Wisconsin and Texas.

– 18 years of a rising dividend

– Dividend yield of 3% with 6.1% 5 year DGR.

– Normal 5 year P/E of 21.9 and recently very close at 21.6 at the price of $65.31.

The Southern Company

SO incorporated in 1945 and is headquartered in Atlanta GA. It has 8.7 million electric and gas customers and operates, as its name indicates, mostly in the southern USA states of Illinois, Georgia, Virginia and Tennessee along with Alabama and Mississippi. It is involved in almost all types of energy aspects including hydroelectric, fossil fuels, storage, renewables, nuclear power and pipelines. It also offers digital wireless communications and fiber optic services.

– 21 years of a rising dividend.

– Dividend yield of 4.1% with a 3.3% 5yr DGR.

– Normal 5 year P/E of 18 and now is at 19.2, a bit rich, at the price of $65.95.

MGE Energy, Inc./ Madison Gas & Electric

MGE is a publicly run holding company headquartered in Madison, Wisconsin that provides regulated electric and gas services mostly in WI. It also owns or rents generating services in Iowa. It has provided as of Dec 2021 electricity to 159,000 customers in Dane County, WI and natural gas to169,000 customers in 7 WI counties.

– 46 years of a rising dividend.

– Dividend yield of 2.1% with a 4.7% 5yr DGR.

– Normal 5 year P/E of 28.8 and selling now at 24.8 and a price of $74.62.

Duff & Phelps

DNP Select Income Fund is a “CEF” or closed end balanced mutual fund managed by Duff and Phelps headquartered in Chicago, IL since 1986. It invests in fixed income bonds and mostly utility equities, which consist of a broad diverse list. It offers stable high yield income similar to most CEF types.

I have owned it for more than 20 years and it rarely adjusts the monthly payment from 6.5c and yearly 78c. It will usually sell over its NAV and rarely have I seen it at a discount.

– Dividend yield of 7.3% at a price of $10.67.

Dominion

Dominion Energy Inc. is headquartered in Richmond VA since 1983. It distributes energy through 4 segments: Virginia, gas distribution, SC, and Contracted Assets which is mostly marketing. It serves about 7 million customers through its related services. It changed its name in May 2017 from Dominion Resources to Dominion Energy.

– cut the dividend Dec 2020 and raised it most recently for March 2022.

– Dividend yield is 3.6% and a 5yr DGR of -2.1% but more recently is raising it as noted above.

– Normal 5 year P/E of 20 and sitting now at 18.8 with a price of $74.19.

Kenon Holdings

Kenon Holdings Ltd. incorporated in 2014 is headquartered in Singapore. It operates as an owner, developer, and operator of power generation facilities in Israel, the United States, and internationally. It also holds a smaller portion of its assets in a container shipping line : ZIM Integrated services. It pays dividends in various amounts and at varied times, which makes it unreliable for a constant stable payment, but no foreign tax is taken with owning it.

– Dividend paid usually 1- 2x yearly. It has paid $3.50 already in January 2022. It just announced it will pay $10.25 for the next one. Its smaller asset holding of Zim, with its last $17 dividend, is the main reason for the nice increased payment for Ken shareholders which just got approved for July 5th. Ex-date is June 24th, so own it by June 23rd.

– Dividend yield is 7% with the $3.50 last payment, but with the additional $10.25 as shown the yield will be an amazing 26+% at the current now price of ~$50.

Not much more company information is available and this one might be considered a speculation of sorts, but a huge thank you goes to The Fortune Teller for the suggestion/trading alert from his service the Wheel of Fortune back in June of 2021 when it was priced near $35.

Wisconsin Energy Group

Wisconsin Energy Corporation changed its name to WEC Energy Group in June 2015. It is a regulated natural gas and electric utility that incorporated in 1981 and is headquartered in Milwaukee, WI. The company operates primarily in Wisconsin, Illinois, and a few other states. It generates and distributes electricity from natural gas, oil, hydroelectric, wind, solar, and biomass sources along with providing electric transmission services, retail natural gas distribution services, transports natural gas, and generates, distributes, and sells steam.

– 19 years of a rising dividend.

– Dividend yield of 3.2% with a 6.5% 5yr DGR.

– Normal 5 year P/E of 22.4 and selling now at 21.75 at a price of $91.37.

Analyst Price Targets

Nasdaq $PT = Nasdaq $ price target along with some guidance from them, with : B = Buy, SB = Strong Buy, H = hold

M* FV $ = Morningstar Fair Value $

Yahoo Fin $ = Yahoo Finance for 2023.

VL mid fv$ = Value Line mid price fair value for end of 2023.

VL safety = Value Line safety rating; 1 is the safest, 5 is the worst

VL Fin = Value Line financial safety rating from A++ to C.

na = Not Available

All prices are from June 16th, 2022.

|

Current |

Stock |

Nasdaq |

M* FV |

Yahoo |

VL |

VL |

VL |

Low |

High |

|

Price |

Ticker |

$ PT |

$ |

Fin $ |

mid fv$ |

safety |

Fin |

52 Week |

52 Week |

|

$99.54 |

DUK |

117 B |

101 |

$116.33 |

$114.00 |

2 |

A |

$95.48 |

$116.33 |

|

$64.95 |

XEL |

77.78 SB |

57 |

$76.29 |

$81.00 |

1 |

A+ |

$61.16 |

$76.63 |

|

$66.28 |

SO |

75.77 H |

65 |

$74.59 |

$78.00 |

2 |

A |

$60.12 |

$77.24 |

|

$75.23 |

MGEE |

74 H |

72.92 |

$74.57 |

$83.00 |

1 |

A+ |

$69.23 |

$84.97 |

|

$10.41 |

DNP |

na |

na |

$10.35 |

$12.00 |

||||

|

$74.38 |

D |

90.75 B |

82 W |

$89.94 |

$94.00 |

2 |

B++ |

$70.37 |

$88.78 |

|

$52.08 |

KEN |

58.32 |

na |

$30.40 |

$72.90 |

||||

|

$91.21 |

WEC |

107.82 B |

94 |

$106.04 |

$114.00 |

1 |

A+ |

$86.84 |

$108.39 |

Utilities in general are somewhat over valued for their safe attributes. Prices have descended quite a bit, but many are still above 52 week lows. With KEN offering the excellent dividend its one to consider owning if you don’t already have it. I especially also like the wonderful dividend growth rates of >6% for XEL and WEC, making them very attractive to own, which I keep as core holdings for that very reason.

Summary/Conclusion

The portfolio continues to perform as designed to provide safe quality income using the goal of 50% income from defensive sectors and stock/investments.

The following are the number of stocks in each defensive sector along with a link to that article. My goal is an article a month for each individual sector and its holdings.

– Consumer Staples– 13 stocks – February article.

– Healthcare – 9 stocks – May article

– Utilities – 8 stocks is this current June article

– Communications – 5 stocks – April article

There are other non-defensive sector articles, such as from January about the 8 industrial investments and March for Material stocks.

I look for quality low debt / high credit rated companies and review those in RIG often and now provide a nice “WTB” want to buy price list for all 89 stocks along with a Non-RIG list for subscribers to follow.

The search is always on going and the goals and specifics I want include the following:

– quality rated dividend paying stock

– undervalued, but can be at fair value for extra quality ratings.

– low debt / great high credit rating.

– pay out and cash flows to easily cover the dividend along with a rising dividend growth rate

– defensive in nature with products or service I understand and can easily follow.

This market has definitely turned into a bear, my cash, currently at ~4.6%, is probably not as much as I would have hoped. However, with an established quality dividend portfolio like RIG, I am confident it will survive the valuation roller coaster while dividends / income continue to flow in as expected using the desired goals. I truly am not expecting any dividend cuts, freezes maybe, but most all of RIG is created with continued upward income on mind.

Rose’s Income Garden Portfolio “RIG” is only 1 portfolio found at MTF service along with The amazing Macro Teller and his Funds Macro Portfolio that is “macro” in nature offering funds that need minimum attention as it continues to outperform the market as shown in the charts.

Happy Investing to all.

Be the first to comment