Bill Oxford

Last weekend we covered a Utilities-based CEF, the Reaves Utility Income Fund (UTG), which has outperformed the market in 2022 due to the perceived defensive nature of the Utilities sector.

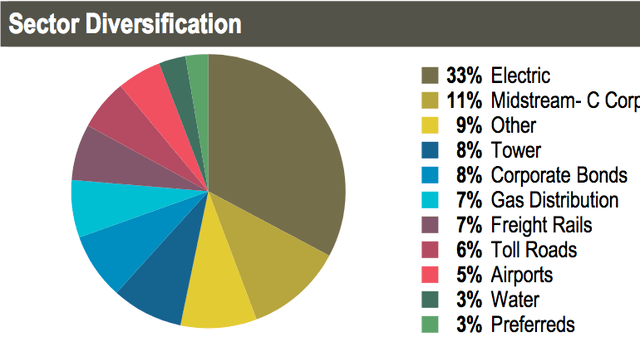

The Cohen & Steers Infrastructure Fund (NYSE:UTF) also has exposure to Utilities, 36%, but, as its name denotes, it owns infrastructure assets as well, such as Midstream Energy, 11%, Cell Towers, 8%, Gas Distribution, 7%, Freight Rails, 7%, Toll Roads, 6%, and Airports, 5%:

Profile:

The Fund’s objective is to achieve total return, with an emphasis on income. Under normal market conditions, the Fund will invest at least 80% of its managed assets in securities issued by infrastructure companies, which consist of utilities, pipelines, toll roads, airports, railroads, ports, telecommunications companies and other infrastructure companies.

The fund benchmarks the performance of its portfolio against a composite index of 80% FTSE Global Core Infrastructure 50/50 Net Tax Index (FTSE 50/50) and 20% BofA Merrill Lynch Fixed-Rate Preferred Securities Index. It was formerly known as Cohen & Steers Select Utility Fund, Inc. Cohen & Steers Infrastructure Fund, Inc. was formed on January 8, 2004 and is domiciled in the United States. (UTF site)

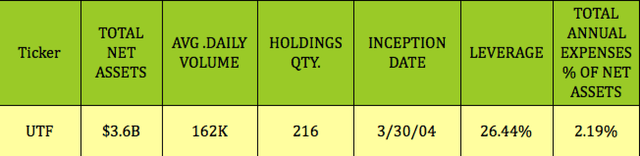

Management employs leverage to ramp up the fund’s returns – leverage was at 26.44%, as of 5/31/22. UTF holds 216 positions, with average daily volume of 162K, and $3.6B in assets. The expense ratio is 2.19%, on the high side vs. some other CEFs we’ve covered.

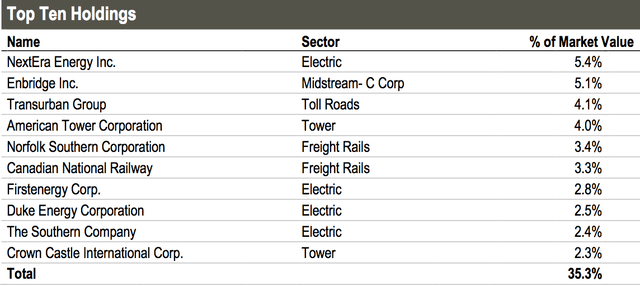

UTF Holdings:

UTF’s top 10 positions form ~35% of its portfolio, with a mix of well-known Utilities and Infrastructure names, such as Next Era Energy, Enbridge, Duke Energy, and American Tower, among others.

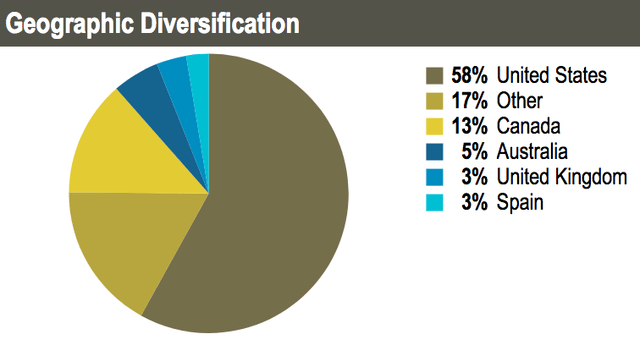

Along with 58% in US holdings, there’s some international exposure, with 13% in Canada, 5% in Australia, and 3% each in Spain and the UK:

Performance:

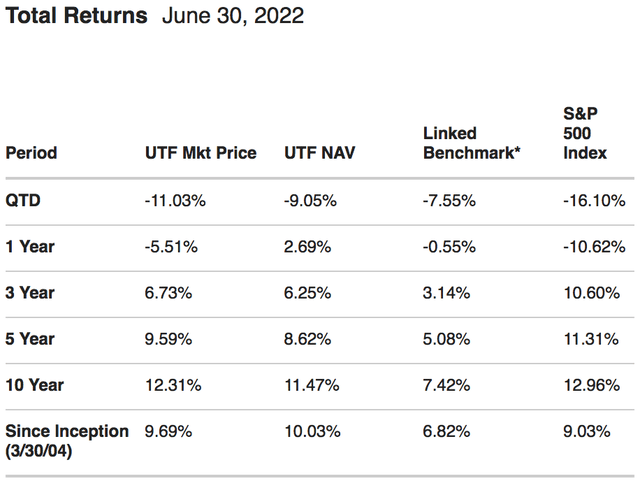

As of 6/30/22, UTF has outperformed the S&P and its benchmark over the past 10 years. Over the past three-year and five-year periods, it has trailed the S&P, but has beaten its benchmark, but it has trailed them both over the past one-year period, and in Q2 2022:

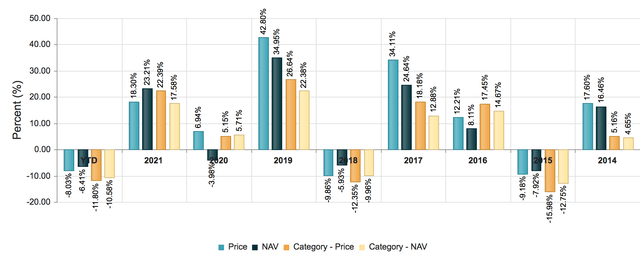

UTF outperformed the Morningstar US CEF Sector Equity category on a NAV basis in 2017-2019 and in 2021, and outperformed it on a Price basis in 2017- 2020, and 2014-2015:

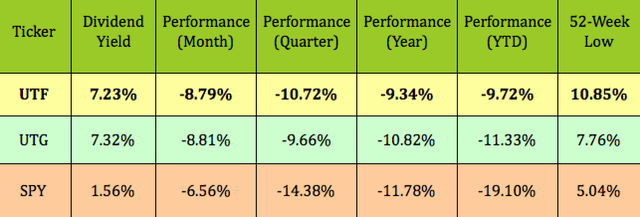

As of intraday 7/12/22, UTF was 10.85% above its 52-week low. It has a very similar dividend yield to UTG, at 7.23%, which it has outperformed so far in 2022 and over the past year.

UTF has also outperformed the S&P by a wide margin thus far in 2022, and by smaller margins over the past year and past quarter:

Dividends:

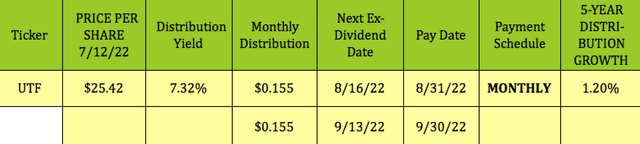

At $25.42, UTF yields 7.32%. Management has maintained monthly $.155 distributions since Q1 2018, hence the low 1.2% dividend growth rate. It goes ex-dividend next on 8/16/22, with an 8/31/22 pay date.

Taxes:

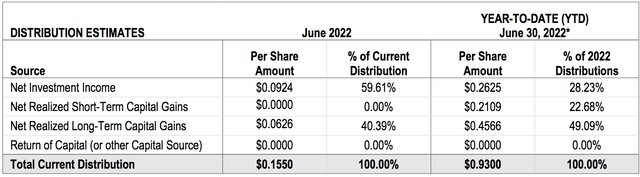

There has been no Return of Capital in UTF’s Jan. – June 2022 distributions, which were comprised of ~49% long-term gains, ~23% short-term gains, and ~28% in NII.

NAV Pricing:

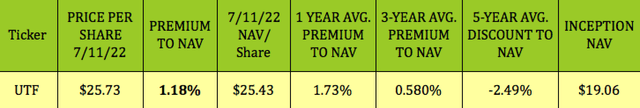

At its 7/11/22 $25.73 closing price, UTF was selling at a 1.18% premium to its 7/11/22 NAV/Share of $25.43. That’s cheaper than its 1.73% premium but more expensive than its 3- and 5-year Price/NAV valuations.

Since NAV/Share is calculated at the end of each trading day, you have to look at the most recent closing values to determine the current NAV discount or premium.

Buying CEFs like UTG at a deeper discount than their historical average discounts/premiums can be a useful strategy due to mean reversion.

Management has increased UTF’s NAV/share by 35% since its inception, growing it from $19.06 to $25.73, in addition to paying out steady, high-yield distributions.

Parting Thoughts:

UTF offers you some defense in the current pullback environment, as well as an attractive 7%-plus yield, via its monthly distributions.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment