AndreyPopov/iStock via Getty Images

Investment Thesis

The iShares MSCI USA Min Vol Factor ETF (BATS:USMV) is the most popular low-volatility ETF on the market, with $26 billion in assets under management. iShares charges just 0.15% in fees for a well-diversified portfolio of about 175 U.S. equities that, in aggregate, have low volatility characteristics relative to the broader market. YTD, it’s outperformed the SPDR S&P 500 ETF (SPY) by 6.50%, so it seems to be doing a decent job in this down market.

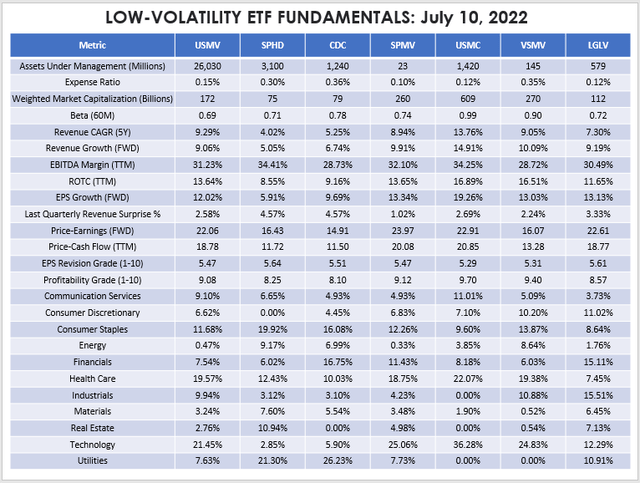

However, I want to point out that a dozen other low-volatility ETFs are doing better this year, and the reason for USMV’s relative mediocrity lies in its methodology. While the portfolio’s 0.69 five-year beta suggests it’s one of the least volatile, it is also one of the most expensive on numerous valuation ratios, including price-earnings and price-cash flow. I’ll discuss these metrics and many others in this fundamentals-heavy article, comparing USMV with several others worthy of consideration. In the end, I hope you’ll better understand how low-volatility ETFs like USMV work, when to use them, and when to avoid them.

ETF Overview

Strategy and Exposures

USMV tracks the MSCI USA Minimum Volatility Index, favoring stocks with the following characteristics:

- Low beta relative to the parent index

- Lower volatility than the parent index

- Lower cap bias

- Bias towards stocks with low idiosyncratic risk

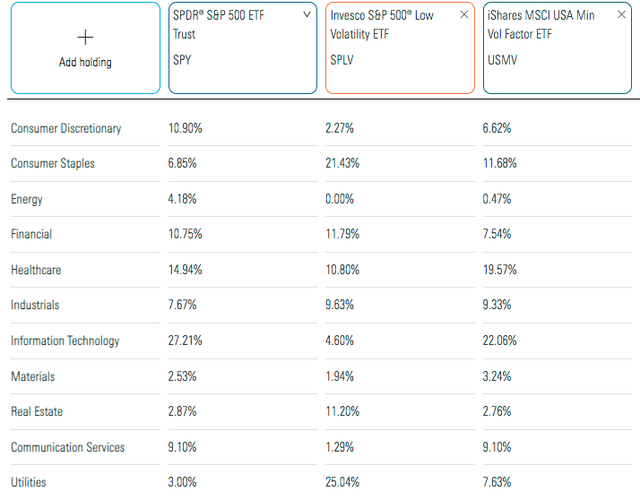

The Index is optimized semi-annually in May and November to achieve the lowest estimated volatility. One key constraint is that sector exposures can’t deviate more than 5% each from the MSCI USA Index. As a result, USMV holds over 20% in Technology stocks that some would consider “dinosaurs.” Examples include Cisco Systems (CSCO), Texas Instruments (TXN), and Oracle (ORCL). Sector allocations relative to SPY and the second-most-popular fund in the category, the Invesco S&P 500 Low Volatility ETF (SPLV), are below.

SPLV, a low-volatility approach with no minimum sector exposure requirements, has just 4.60% exposure to Technology compared to 22.06% for USMV. In exchange, SPLV overweights the Consumer Staples sector (21.43% vs. 11.68%), while USMV overweights Health Care (19.57% vs. 10.80%) and Communication Services (9.10% vs. 1.29%).

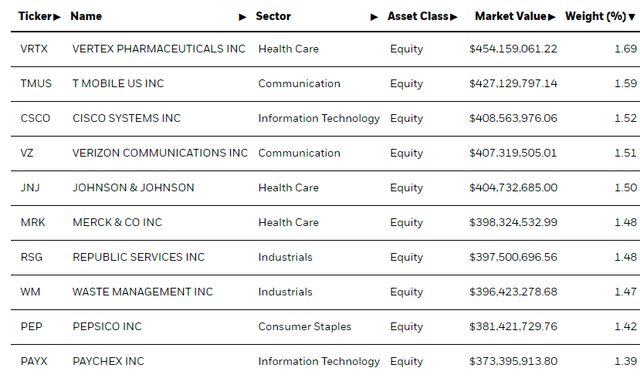

USMV’s top ten holdings are below, including Vertex Pharmaceuticals (VRTX), T-Mobile (TMUS), Waste Management (WM), and PepsiCo (PEP). Paychex (PAYX) and Cisco Systems are the most volatile stocks here, each with 0.98 five-year betas. However, the remaining eight have a 0.58 average beta.

Performance Analysis

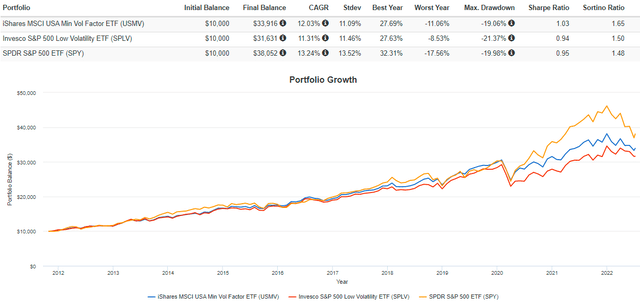

Since its inception, USMV has gained an annualized 12.03% compared to 13.24% for SPY and 11.31% for SPLV. I attribute this outperformance relative to SPLV to its sector constraints that ensured a substantial weighting in the Technology sector. Especially since 2017, exposure to these stocks was a must if you wanted a decent shot at keeping pace with SPY.

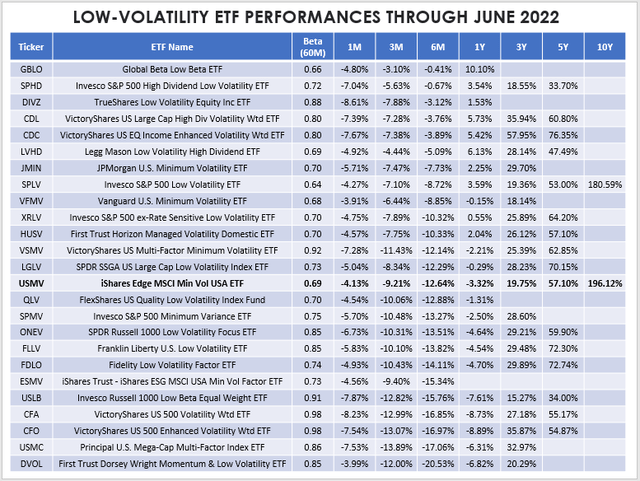

However, these same constraints are responsible for its mediocre performance relative to other low-volatility ETFs this year. The table below summarizes the performance of 24 peers. Eight others focus on small- and mid-caps, but I excluded them since USMV primarily holds large caps.

I’ve sorted these ETFs by YTD (i.e., six-month) returns, and USMV placed 14th out of 25. Its 12.64% YTD loss through June 2022 was more than 7% better than SPY but about 4% worse than SPLV. USMV and SPLV are the only two ETFs with at least a ten-year history, which helps explain their dominance. You may start your fund selection process by looking for the best performers over the medium and long term. However, I hope this simple table can help broaden your horizons a bit since several ETFs have performed better not only this year but also over the last five years.

For example, CDL and CDC are part of VictoryShares’ low-volatility lineup, and the latter has outperformed USMV by nearly 20% in the last five years (review here). There’s also the Invesco S&P 500 ex-Rate Sensitive Low Volatility ETF (XRLV) and the SSGA US Large Cap Low Volatility ETF (LGLV), which have betas very close to USMV’s. In short, there are many choices if you don’t mind deviating from the broader market’s sector exposures.

Fundamental Analysis

Industry Snapshot

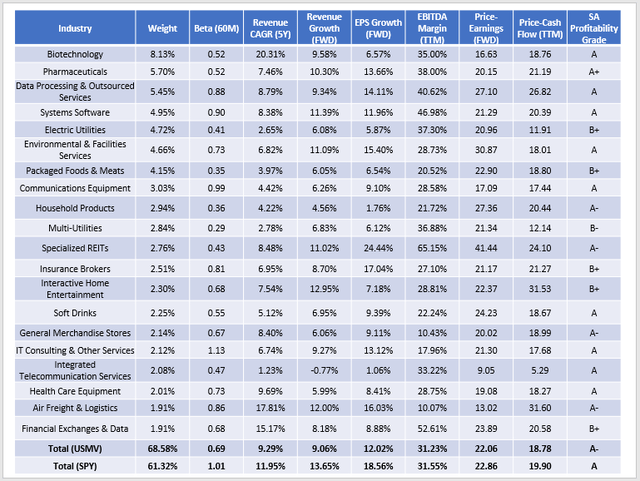

The following table highlights volatility, growth, valuation, and profitability metrics for USMV’s top 20 industries compared to SPY. Along with concentration, these are five areas I like to start with when evaluating an ETF.

USMV is much less volatile than SPY, as indicated by its 0.69 five-year beta. Generally, that means less upside in bull markets but more downside protection in bear markets. USMV’s constituents have grown revenues at a rate of 9.29% per year over the last five years compared to 11.95% for SPY. Analysts are estimating that gap to widen over the next twelve months and for earnings per share growth to be about 6.50% less. EBITDA margins are roughly equal at 31%, as are the two fund’s forward price-earnings ratios (22.06 vs. 22.86) and trailing price-cash flow ratios (18.78 vs. 19.90). Finally, Seeking Alpha’s Profitability Grade suggests low-volatility investors are giving up some quality. It’s expected, as USMV’s weighted-average market capitalization is significantly lower ($172 billion vs. $523 billion), and size is often strongly correlated with profitability.

In my view, these metrics aren’t favorable to USMV. The amount of potential growth given up is too much for the small discount in valuation, and the decrease in quality doesn’t help either. Investors should also remember that SPY is already off nearly 20% from its high set in late December. Low-volatility strategies work best before market bottoms, so unless another 20% is in store for us, it’s likely not the best trade given the probabilities.

Alternatives To USMV

As mentioned, USMV is a low-volatility ETF for investors wanting their sector exposures reasonably in line with the broader market. However, it’s not ideal for investors needing pure exposure to the low-volatility factor without any sector constraints. As an alternative, I’ve identified three ETFs that should provide more downside protection in the event of a market crash:

- Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

- VictoryShares US EQ Income Enhanced Volatility Weighted ETF (CDC)

- Invesco S&P 500 Minimum Variance ETF (SPMV)

For those looking to be more aggressive but still desire some downside protection, may I suggest the following:

- Principal U.S. Mega-Cap Multi-Factor Index ETF (USMC)

- VictoryShares U.S. Multi-Factor Minimum Volatility ETF (VSMV)

- SPDR SSGA U.S. Large-Cap Low Volatility ETF (LGLV)

Briefly, here are some key summary statistics on these six ETFs.

I recommend viewing these results in the context of what else you own. For example, if you own lots of risky assets, SPHD, CDC, and SPMV are efficient ways to reduce your portfolio’s volatility. On the other hand, if you already lean defensive and want to capture more market upside, USMC, VSMV, and LGLV will let you do that while still sticking to the low-volatility theme.

One that stands out as a potential alternative to USMV is VSMV. Its sector exposures are remarkably similar, but it trades at just 16.07x forward earnings compared to 22.06x for USMV. CDC is another low-volatility ETF growing in popularity, but the portfolio has switched to 75% cash in preparation for a potential downturn. This automatic rule can help investors who don’t want to trade frequently.

Investment Recommendation

USMV is a solid pick for investors wanting a market-like ETF with a low-volatility lean, but its sector exposure constraints limit its defensive capabilities in a recession. That’s why other low-volatility ETFs without such restrictions have outperformed YTD, but it’s also why the reverse will be true in a bull market. Remember that sector exposures drive a majority of a portfolio’s returns. Even if you choose the least-volatile stocks in each sector, which is USMV’s strategy, it’s challenging to escape macro pressures. Stocks like Cisco, Texas Instruments, and Oracle are still down substantially this year, like the entire Technology sector, and USMV doesn’t have a mechanism to avoid this.

The key takeaway is that USMV is better used as a substitute for a broad market ETF like SPY rather than a compliment. ETFs like SPHD, CDC, and SPMV offer more pure exposure to the low-volatility factor, while others like USMC, VSMV, and LGLV offer less but have more growth potential. USMV falls in between, but if that sounds good to you, I think it’s a nice choice for the moderately conservative investor.

Be the first to comment