USD/ZAR Update:

- Local Elections: 90% of all votes said to finalized by this evening

- ZAR drivers continue to dissipate as USD/ZAR pull back may be short-lived

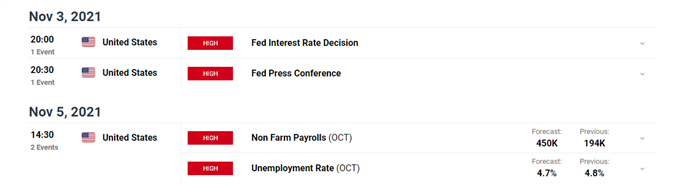

- US Non-Farm Payrolls (NFP), FOMC dominate this week’s economic calendar

Local Elections Nearing the Home Straight

Yesterday, South Africans cast their vote in the 2021 Municipal Elections amid promises from Eskom (the national electricity provider) that the lights will remain on for the day. This evening 90% of the votes should be tallied and accounted for meaning most regions will have a good idea of which party, or parties in the event of a coalition, will govern their cities.

ZAR Attempts to Halt Losses

The Rand has surrendered all of its recent gains in the last two weeks as a massive reversal took shape. Load shedding has been implemented once more and softer Rand-linked commodity prices (gold, platinum, ore) have weighed on the ZAR in the lead up to the local elections.

The daily chart shows a dragonfly doji appearing at the 15.38/9 level which coincides with the major high (August). Continued bullish momentum in the USD/ZAR pair could see a move towards 15.57 and the crucial 15.70 level – more on that later.

However, profit taking and buyer fatigue could see a pullback towards 15.25 where bulls can consider any bullish continuation plays.

USD/ZAR Daily Chart

Chart prepared by Richard Snow, IG

Taking a step back to analyze the longer-term trajectory for the pair, USD/ZAR is approaching the upper bound of the 14.00 – 15.50 area which has contained the majority of price action – apart from the massive blowout during the peak of the pandemic.

The key level to watch here is 15.70, a level where ZAR bulls have outweighed bears to bring prices back to around 14.50. That being said, the anticipated Fed tapering announcement and crucial NFP data are set to boost volatility and could see a breach, even momentarily, above 15.70.

However the South African Reserve Bank holds its final Monetary Policy Committee (MPC) meeting of the year on the 18th of November where it is still unclear whether rates will remain on hold or indeed see an increase.

Once more, the path of central bank timing remains key. Rate hikes from the SARB this year or early next year may provide a slight reprieve for the ZAR, at least until the Fed starts its hiking cycle, which is anticipated for H2 2022

Weekly USD/ZAR Chart

Chart prepared by Richard Snow, IG

Economic Calendar Dominated By the US (FOMC, NFP)

This week sees the FOMC rate decision and press conference where Powell is likely to elaborate on the timing of withdrawing current levels of stimulus. Staying with the US, we will have a better understanding of the labor market on Friday when Non-Farm Payroll data is due with expectations of 450k.

For all market-moving data releases and events see the DailyFX Economic Calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Be the first to comment