tadamichi

Introduction

When 2022 began, it looked like an uneventful year for USD Partners (NYSE:USDP) but this quickly changed upon seeing their incentive distribution rights eliminated along with a relatively sizeable acquisition of the Hardisty South Terminal, as my previous article discussed. Whilst at the time, this seemed to offer short-term pain for long-term gain, disappointingly, it seems that this investment is not coming together as expected with their high distribution yield of 9.80% no longer looking as desirable. Judging by their unit price sliding almost 9% lower directly following their report on the 4th of August, it seems that I was not the only investor left surprised.

Executive Summary & Ratings

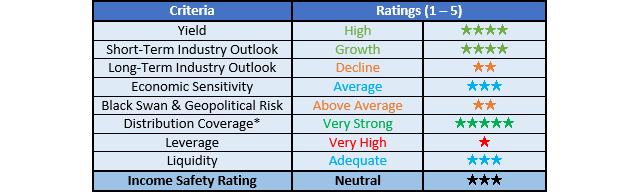

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

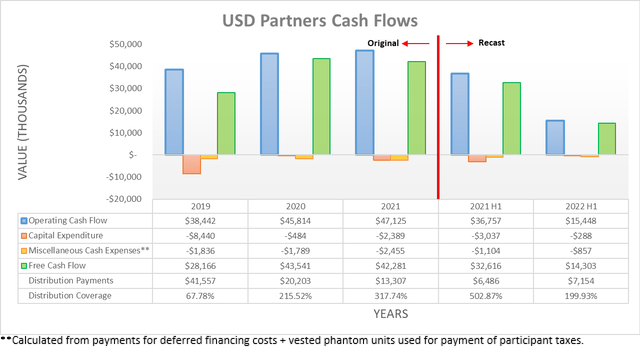

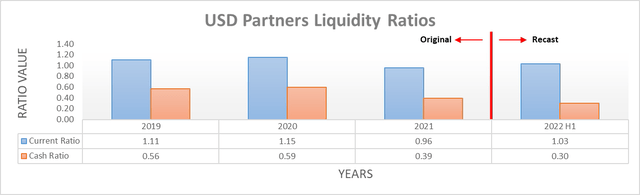

Following their Hardisty South Terminal acquisition, their financial statements were recast because the acquisition represented a business combination between entities under common control. When presenting data within this analysis, their historical results for full-year 2021 and earlier have been left original, whilst their results for the first half of 2021 have been recast to aid the comparison with their latest results.

When first looking at their cash flow performance for the first half of 2022, it clearly was weaker than expected with operating cash flow of $15.4m down more than half versus their previous result of $36.8m during the first half of 2021. Even if removing their temporary working capital movements, it still sees their underlying operating cash flow of $18.4m during the first half of 2022 down 30.10% year-on-year versus their equivalent previous result of $26.3m during the first half of 2021. Even if adding back the $0.5m and $2.6m expenses relating to their acquisition during the first and second quarters of 2022 respectively, it still sees this result down a disappointing 18.33% year-on-year.

If zooming into their second quarter of 2022, they saw operating cash flow of only $6.2m versus their previous result of $24.2m during the second quarter of 2021. Once again, even removing their temporary working capital movements leaves their underlying result down 34.15% year-on-year to $9.7m versus their equivalent previous result of $14.7m during the second quarter of 2021. When looking elsewhere, this is broadly shared by their accrual-based results with their adjusted EBITDA of $11.6m for the second quarter of 2022 down comparably from their previous result of $16.3m for the second quarter of 2021, as per their second quarter of 2022 results announcement. Given this gap of $4.7m, this does not entirely result from their $2.6m of acquisition-related expenses but rather a series of weaker operational results, as per the commentary from management included below.

“The Partnership’s operating results for the second quarter of 2022 relative to the same quarter in 2021 were primarily influenced by lower revenue at Hardisty South due to revenue that was recognized in the second quarter of 2021 associated with an early contract cancellation payment with no similar occurrence in 2022. In addition, revenue at the Stroud Terminal was lower in the second quarter 2022 associated with a decrease in contracted volume commitments at the terminal that became effective August 2021. The Partnership also had lower storage revenue generated at its Casper Terminal associated with the end of one of its customer contracts that occurred in September 2021 coupled with lower throughput volumes at the terminal.”

-USD Partners Second Quarter Of 2022 Results Announcement (previously linked).

It seems they saw what could be described as a lull across the majority of their assets that dragged their revenue and thus earnings lower, remembering that this is a very small partnership, relatively speaking. Whilst they saw minor cost savings, these were negatively impacted by inflation that hindered their financial performance, as per the commentary from management included below.

“Partially offsetting the decreases mentioned above were higher operating and maintenance costs at the Hardisty and Hardisty South terminals for increased operational supplies, fuel and utilities costs primarily due to increased inflation rates.”

-USD Partners Second Quarter Of 2022 Results Announcement (previously linked).

When combined, this made for a disappointing quarter and by extension, a disappointing first half of the year but thankfully, they can still easily afford their distributions. Even after issuing 5.75 million units for their acquisition and incentive distribution rights elimination, their latest outstanding count of 33,379,431 still only sees quarterly distributions costing $4.1m. They saw free cash flow of $14.3m during the first half of 2022, despite their operational setbacks and working capital build, which would still provide very strong coverage of around 175%. Thankfully there was no mention of significant capital expenditure or new investments relating to their new assets, thereby implying that their capital expenditure should remain around its usual very low levels and thus not levy too much pressure upon their distributions whilst they navigate this operational lull. The bigger uncertainty heading forwards stems from contracts expiring at the end of the second quarter of 2022, as per the commentary from management included below.

“At the end of June 2022, contracts representing approximately 26% of the combined Hardisty Terminal’s capacity expired. In addition, the remaining contracted capacity at the Stroud Terminal also expired at the end of June 2022.”

-USD Partners Second Quarter Of 2022 Results Announcement (previously linked).

When combined with their weaker financial performance thus far into 2022, it remains to be seen how their financial performance will shape up during the third and fourth quarters of 2022 in light of these contract negotiations. Whilst their very strong distribution coverage provides a safety net, there are still flow-on impacts to their financial position that require consideration.

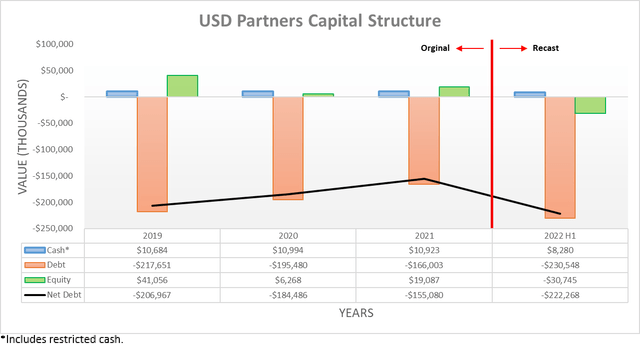

The second quarter of 2022 saw their net debt spike higher following their Hardisty South Terminal acquisition, as was expected when conducting the previous analysis. This now sees their net debt sitting at $222.3m versus its previous level of $149.3m when the first quarter ended, which represents an increase of $73m, which is essentially the same as the $75m cost of their acquisition with the gap stemming from their excess free cash flow after distribution payments. When looking ahead, their net debt should resume its downwards trend as their free cash flow continues outpacing their distribution payments, although the exact extent remains unknown as it will depend upon their yet-to-be signed contracts.

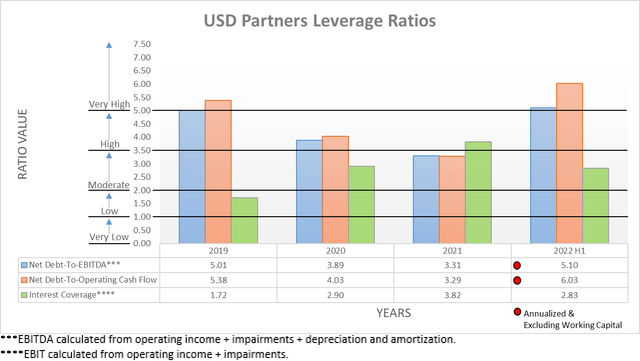

After seeing their net debt spike higher and far lower than expected financial performance, it resulted in their leverage climbing quite significantly with their net debt-to-EBITDA and net debt-to-operating cash flow increasing to 5.10 and 6.03 respectively. Apart from being well above their previous results following the first quarter of 2022 of 3.64 and 3.81 respectively, they also now sit above the threshold of 5.01 for the very high territory. Even though these should trend down with their net debt, if they are to see significantly lower leverage, it will need to see financial performance recover, which remains largely dependent upon how their contract negotiations transpire. Whilst their very high leverage does not necessarily endanger their distributions, it still inhibits their growth outlook for the coming year.

Despite their leverage surging higher in the short-term, it was a relief to see their current ratio of 1.03 effectively unchanged versus their previous result of 1.04 following the first quarter of 2022. Whilst the combination of a cash ratio of 0.30 would have traditionally led to a strong rating, looking further afield, it seems that only an adequate rating is now warranted as a flow-on from their Hardisty South Terminal acquisition.

They funded this acquisition via their credit facility, which is routine but in this case, it matures as soon as November 2023 and given it holds the entirety of their debt, it will need refinancing. Normally, this would not even get mentioned but it nevertheless should be closely watched and considered given their need to contract out terminal capacity, especially as monetary policy tightens and further pulls liquidity out of capital markets. Apart from this medium-term hurdle, they potentially also have another more pressing short-term hurdle given the terms of their credit facility, as per the commentary from management included below.

“As a result, the Partnership’s available borrowings will be limited to 5.0 times its 12-month trailing consolidated EBITDA through December 31, 2022, at which point it will revert back to 4.5 times the Partnership’s 12-month trailing consolidated EBITDA.”

-USD Partners Second Quarter Of 2022 Results Announcement (previously linked).

In the past, the covenant limiting their leverage was not discussed as they were comfortably below and steadily deleveraging, although depending upon their new contracts, this may pose risks. Upon reaching the start of 2023, they will be required to keep their total debt at less than 4.50 times their twelve-month trailing EBITDA. As it stands right now, their total debt of $230.5m requires earnings of $51.3m per annum at the barest minimum to avoid exceeding this level, or more realistically, circa $60m per annum to create a margin of safety.

If utilizing their second quarter adjusted EBITDA of $11.6m as a basis, it only annualizes to $46.4m and clearly well below this level. Whilst yes, admittedly, this result saw $2.6m of costs relating their acquisition but even excluded, this would only annualize to $56.8m and thus still rather on the low side. This will make the third quarter of 2022 particularly important, not only to see how their earnings fare in this environment but also to see how their contract negotiations transpire because if they disappoint with weaker results, it may be difficult to stay below the covenant limit in 2023, which would be a very bad omen for their distributions.

Conclusion

Disappointingly, it seems that this investment is not coming together as expected with weaker than expected financial performance and concerns surrounding their credit facility and as such, I no longer consider their distributions to be safe. Although at the same time, they are not under strain at the moment given their very strong distribution coverage and thus are not necessarily risky but rather, in my eyes they have a neutral outlook, whereby they could go either way. As a result, I will be downgrading my rating from strong buy to hold until more light comes to pass on their contract negotiations. Despite their recent drop, their current unit price remains well above its $3.62 level when first issuing a buy rating back in December 2020, as per my earlier article.

Notes: Unless specified otherwise, all figures in this article were taken from USD Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment