Sundry Photography/iStock Editorial via Getty Images

Micron (NASDAQ:MU) has been on a rollercoaster ride over the last year, but its stock is essentially back to where it was 52-weeks ago. However, Micron is in a much better place technically and fundamentally now. Moreover, Micron is remarkably cheap at approximately 7.6 times forward earnings estimates. The company is set to report earnings on Tuesday, March 29th, and it has illustrated a solid tenacity for surpassing analysts’ estimates in recent quarters. Furthermore, Micron should continue to grow revenues and EPS in future years. As the company expands and becomes more profitable, it could continue to surpass analysts’ expectations. Additionally, the company should benefit from the “multiple expansion” effect. Therefore, Micron’s stock could increase through its upcoming earnings announcement and should appreciate considerably in future years.

The Technical Setup

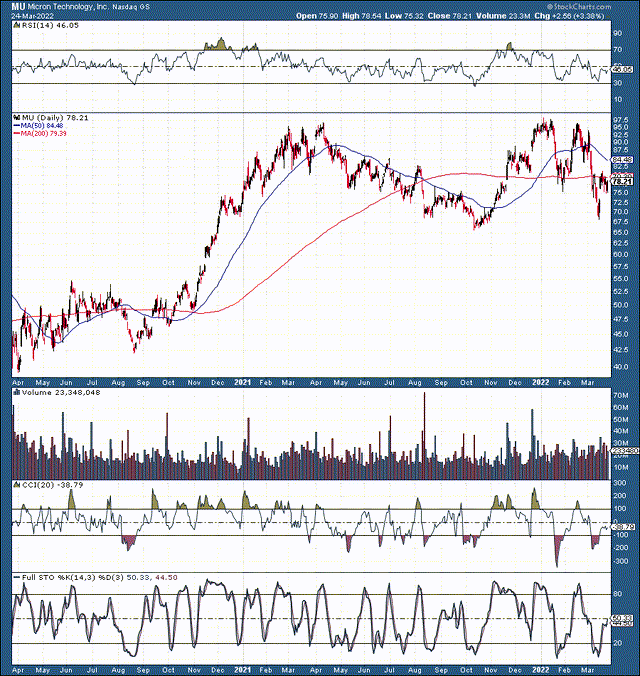

Micron 2-year chart

Micron got an excellent lift going into 2021, but we see that the stock hasn’t done much since then. Micron’s stock is trading at essentially the same price as when 2021 started, but it appears like it is going through a prolonged consolidation phase and could soon break out to new highs. Recently, the stock bottomed above the crucial support level at $65, and a move above the double top resistance around $95-100 should send shares to new highs relatively soon.

Why Micron Deserves to Go Higher

When we look for quality chip stocks, we are often confronted with a similar image. Relatively high P/E ratios are typically the norm when evaluating top chip makers with growth prospects. For instance, Nvidia trades at about 50 times forward EPS estimates, AMD at around 30, and Micron at about 7.6. Why is Micron so cheap? While it may not have the growth dynamics of an AMD or an Nvidia, the company is expanding revenues and EPS at a constructive pace and is probably very undervalued now. Moreover, when we assess specific companies using the PEG ratio analysis, some chip makers are relatively inexpensive, but you may be surprised to see just how cheap Micron is.

Here are some examples:

Advanced Micro Devices (AMD) – AMD should earn about $4.05 in EPS this year, and the stock is at around $120 today. Thus, we are looking at a valuation of about 30 times forward EPS estimates. We’re also looking at a solid 25% regarding YoY EPS growth. AMD trades at a reasonable PEG ratio of 1.2 now.

Nvidia (NVDA) – With Nvidia, we should see around 27% EPS growth this year, and the stock is trading at about 50 times forward EPS estimates. Nvidia trades at a relatively high 1.86 PEG ratio.

Broadcom (AVGO) – Broadcom trades at 17 times forward EPS estimates and should grow EPS by approximately 24% this year. Broadcom trades at a relatively low 0.70 PEG ratio.

Taiwan Semiconductor (TSM) – TSM should deliver roughly 35% YoY EPS growth and trades at 20 times forward EPS. TSM trades at a relatively low 0.57 PEG ratio.

Micron – Micron should deliver about $10.22 in EPS this year, placing its forward P/E multiple at just 7.6, substantially cheaper than any of the above stocks. Additionally, Micron should deliver YoY EPS growth of about 37%, the highest of the names mentioned. Furthermore, growth should remain robust, as analysts anticipate Micron will show approximately 27% EPS growth next year. If we do a PEG ratio analysis on Micron, the stock is trading at a rock bottom 0.2, implying that the stock could see significant multiple expansion as we advance. We would need to see Micron’s stock price almost triple to get it up to the nearest PEG valuation equivalent to TSM’s.

Recent Earnings Implying Future Outperformance

Micron’s TTM PE is about 10.5 here, and the company should deliver approximately $10.20 in EPS (consensus estimates) in its next 12 months of operations. Therefore, the company’s stock is trading at only 7.6 times forward consensus EPS estimates now. However, Micron has illustrated a robust tenacity for surpassing analysts’ expectations.

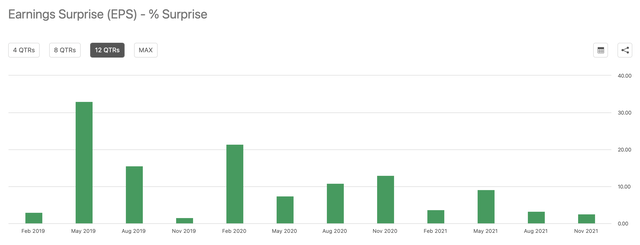

Micron’s EPS surprises

Micron has surpassed all twelve of its last EPS and revenues forecasts (consensus). I don’t see a reason why this trend of outperformance won’t continue as the company advances through 2022 and beyond. Micron has beat by about 5% in its past four quarters, and I suspect we can see similar outperformance over consensus expectations in future quarters. This dynamic implies that we will probably see around $10.75 in EPS in the next four quarters out of Micron. Therefore, the stock is likely trading around 7.25 forward earnings right now. This valuation is remarkably cheap, and we will probably see significant multiple expansion and substantial stock price appreciation in future years.

Here is what Micron’s financials could look like in future years:

| Year | 2022 | 2023 | 2024 | 2025 |

| Revenue | $33B | $41B | $46.5B | $52B |

| Revenue growth | 14% | 24% | 13.4% | 12% |

| EPS | $10.75 | $13.60 | $16.60 | $19.90 |

| P/E ratio | 10 | 12 | 13 | 14 |

| Stock price | $108 | $163 | $216 | $279 |

Source: The Author

Micron’s stock price can appreciate rather precipitously with some moderate EPS growth and multiple expansion. We may see this dynamic play out as the company advances through 2022 and future years. Micron is a unique semiconductor company with notable growth prospects but trades at a rock bottom valuation. The market may reprice Micron soon, which should propel its stock price significantly higher in future years.

Risks to Micron

While Micron is cheap here, there is the risk of an earnings decline as we advance. Increased competition or a change in market dynamics could cause specific chip prices to decrease, leading to margin compression and less income for Micron. Also, the company may not see the robust revenue and EPS growth that analysts are factoring in for future years. Additionally, the company’s P/E ratio could remain depressed, and the shares may not receive more robust demand in the future. Furthermore, a broad market decline could pull Micron’s stock price lower with the general market and technology stocks. Please consider these risks carefully before moving forward with an investment in Micron.

Be the first to comment