USD/JPYAnalysis

- USD/JPY topside breakout appears ahead of Fed and BoJ interest rate meetings

- Japan’s dependency on oil imports softens the Yen’s outlook.

- USD/JPY key technical levels analyzed – 120.00 in sight

Yen Weakness and Oil Dependency Favors USD/JPY Breakout

The Japanese Yen has been a rather frustrating pair to watch due to its tendency to trade in a sideways manner since the invasion of Ukraine. Typically, in times of geopolitical uncertainty, the Japanese Yen appreciates in line with its ‘safe-haven’ appeal, but not this time.

Japanese Yen crosses have largely benefitted from a recent depreciation in the Asian currency as it sees its trade balance continue to struggle. The value of Japanese imports have outpaced exports since August last year apart from November when it temporarily recovered above zero.

Chart: Japanese Trade Balance Showing Downward Trend Since Nov ’21 Peak

Source: Refinitiv, prepared by Richard Snow

With Japan importing around 80% of its oil consumption, rising oil costs will further elevate import costs, placing downward pressure on the Yen. Contrast that with a US dollar which is actually receiving a safe-haven bid and has remained elevated ever since the FOMC started talking up the probability of a March 2022 rate hike in response to multi-decade inflation.

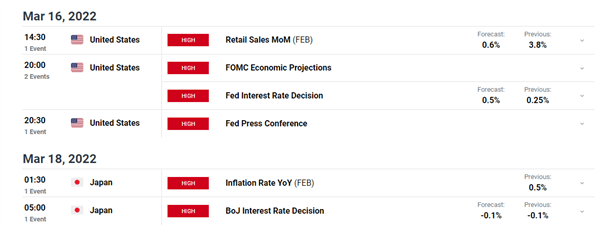

Risk Events in the Week Ahead

The economic calendar is stacked with high importance, scheduled risk events next week with the Federal Reserve and Bank of Japan (BoJ) interest rate decisions. It is also worth mentioning that the Bank of England also has its rate setting meeting should there be any spillover effects, however, this seems unlikely but nonetheless something to keep tabs on.

Rates markets currently anticipate a 95% chance of a single 25 basis point hike from the Federal Reserve Bank with a 5% outside chance of a 50 basis point hike. Prior to the invasion of Ukraine, bullish Fed officials advocated for a 50 basis point hike but such rhetoric has calmed significantly since Russia’s military aggression and subsequent oil price volatility.

Customize and filter live economic data via our DaliyFX economic calendar

USD/JPY Key Technical Levels

The recent topside breakout in USD/JPY could have some to gallop as the US dollar remains well supported amidst the ongoing conflict and the Yen continues to depreciate. Additionally, Japan won’t be hiking rates anytime soon due to inflation being nowhere near the 2% target although, the Japanese economy could make great strides towards the target in the coming months should oil prices remain elevated. Therefore, the dollar could rise further against the Yen.

The daily chart shows the strong triangle breakout to the upside. Further bullish price action would bring the 117.95 and 118.00 levels into focus as resistance (trendline resistance) and 118.60 (2017 yearly high) thereafter. Oversold conditions on the RSI saw a sizeable pullback at the start of this year, however, the indicator has not yet risen to such levels meaning there may still be some room to the upside before a reasonable pullback could appear.

It is essential to consider that the current uncertainty around the Ukraine conflict means that market sentiment can change with little or no notice. Any positive diplomatic development could deflate the recent dollar strength which could see a dip towards the 116.36 level, rendering the latest move a false breakout.

USD/JPY Daily Chart

Source: IG, prepared by Richard Snow

The 4 Hour chart helps to locate the time of the move which was 00:00 GMT on Friday morning, which would place the move around 9AM in Tokyo.

USD/JPY 4-Hour Chart

Source: IG, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Be the first to comment