MF3d/iStock via Getty Images

Year-to-date, the Sociedad Química y Minera de Chile S.A. (NYSE:SQM) stock price is up 95%, due to hiked lithium prices and the company’s increased lithium sales volume. The lithium market condition is still in favor of SQM, as lithium prices in October and November were higher than in previous months. I expect SQM’s 4Q 2022 financial results to be as strong as in 3Q 2022. Moreover, due to the increasing demand for lithium batteries around the world, and lithium supply and demand imbalances, SQM can continue making huge profits in the following years. The stock is a buy.

Quarterly outlooks

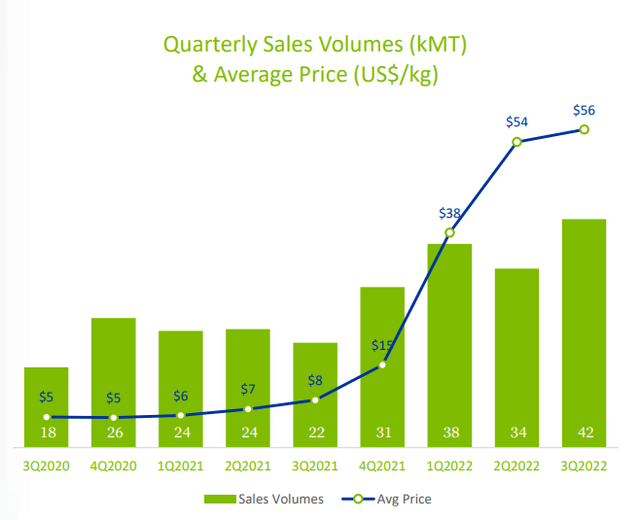

In its 3Q 2022 financial results, SQM reported total revenues of $2958 million, compared with 3Q 2021 and 2Q 2022 total revenues of $662 million and $2599 million, respectively. In the nine months ended 30 September 2022, the gross profit for the lithium and derivatives segment accounted for 77% of SQM’s consolidated gross profit. It is worth noting that in the nine months ended 30 September 2021, the gross profit for the lithium and derivatives segment accounted for 32% of SQM’s consolidated gross profit. The company reported lithium and derivatives revenues of $2335 million, compared with 3Q 2021 revenues of $185 million, driven by higher sales volumes (up 89% YoY) and higher average selling price. Also, SQM’s lithium and derivative revenues in 3Q 2022 were 26% higher than in 2Q 2022. The company’s lithium sales volume of 42 thousand metric tons in 3Q 2022 was 22% higher than in 2Q 2022. Moreover, SQM’s lithium average selling price reached record high levels. SQM reported an average selling price of $56000 per metric ton, compared with $54000 per metric ton in 2Q 2022.

The company reported 3Q 2022 adjusted EBITDA and adjusted EBITDA margin of $1660 million and 56.1%, respectively, compared with 3Q 2021 adjusted EBITDA and adjusted EBITDA margin of $251 million and 37.9%, respectively, and 2Q 2022 adjusted EBITDA and adjusted EBITDA margin of $1325 million and 51.0%, respectively. SQM reported a net income of $1100 million, or $3.85 per share in the third quarter of 2022, compared with a 3Q 2021 net income of $106 million, or $0.37 per share, and 2Q 2022 net income of $859 million, or $3.01 per share.

The market outlook

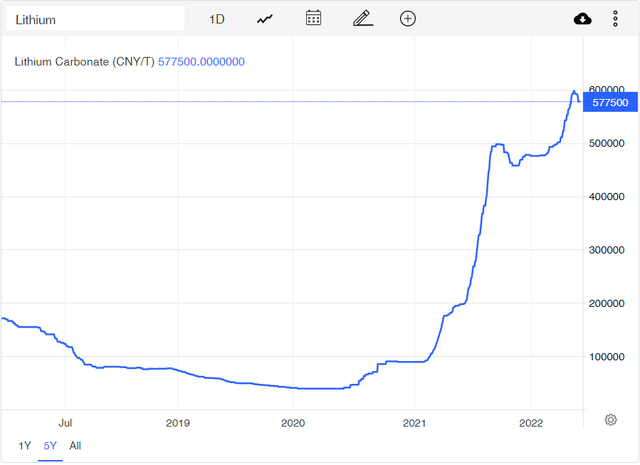

Lithium prices have tripled in the past year. Due to the long-term supply shortage of this chemical element, which is used in batteries for electric vehicles (“EVs”), lithium prices are expected to remain high. Figure 1 shows that lithium carbonate prices in China increased significantly in the past two years.

From March 2022 to August 2022, lithium carbonate prices didn’t experience significant changes; however, in the past months (until mid-November), lithium prices hiked due to climbing demand and tight supply. As decarburization goals in China caused local governments to pass cash incentives for the purchase of electric cars, plug-in electric car sales in China in October 2022 were 75% more than a year ago. In the past two weeks, lithium prices decreased as subsidies for Chinese battery manufacturers will end by the end of the year, meaning that their demand for lithium may decrease for a short time. However, in the long term, the demand for lithium will be strong as the EV market in China is projected to grow by 15% from 2022 to 2027.

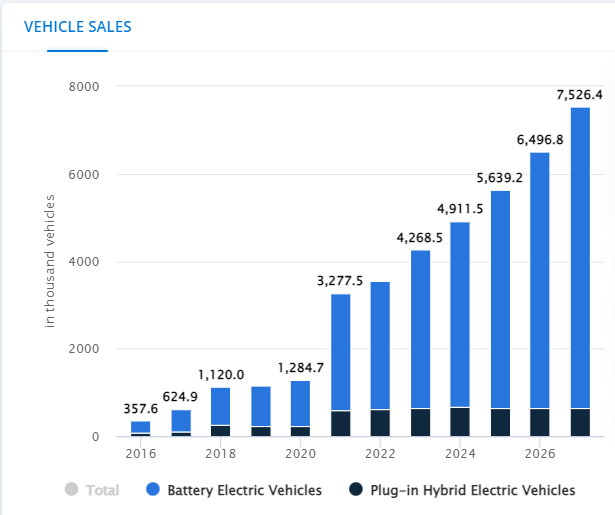

The number of EV sales in China in 2023 is expected to be 20% more than China’s EV sales in 2022 (see Figure 2):

“On top of the strong demand growth, similar to what we have seen in the past, new lithium supply outside SQM has been delayed and slow to come online, consequently. We believe that supply/demand balance will be tight for the remainder of the year and that this high environment could continue for the remainder of 2022 and into 2023”, the company explained.

Figure 1 – Lithium carbonate prices in China

Figure 2 – China’s number of EV sales

insideevs.com

Meanwhile, to expand the manufacturing of batteries for EVs, the Biden administration announced it was granting $2.8 billion to 20 companies to build and expand commercial-scale facilities in 12 states to extract and process lithium, graphite, and other battery materials. Different researches show that the lithium market outlook is promising. According to Mordor Intelligence, due to the surging demand for rechargeable batteries used in electric vehicles, the market for lithium hydroxide is expected to grow at a CAGR of over 10% from 2022 to 2027. Also, according to Grand View Research, the global lithium market size was valued at $6.83 billion in 2021. It is estimated to reach $7.49 billion in 2022 and $18.99 billion in 2030 (with a CAGR of 12% from 2022 to 2030).

Figure 3 shows that in the past few quarters, SQM’s quarterly lithium sales volumes and lithium average price increased significantly. The company’s quarterly lithium sales volume increased from 18 kilotons in 3Q 2022 to 22 kilotons in 3Q 2021 and 42 kilotons in 3Q 2022. Also, its lithium average price increased from $5 per kg in 3Q 2020 to $8 in 3Q 2021 and $56 in 3Q 2022. SQM expects its 2022 lithium sales volume to be more than 150 kilotons and all of its sales volume for 2022 is contracted. Thus, the company’s 4Q 2022 lithium sales volume will be more than 36 kilotons, which is lower than in 3Q 2022. On the other hand, lithium prices in the fourth quarter of 2022 are higher than in the third quarter. I estimate that SQM’s lithium average price to be between $60 to $62, and its 4Q 2022 lithium and derivative revenue to be $2160 million to $2294 million.

Figure 3 – SQM’s Lithium quarterly sales volumes and average price

SQM’s performance outlook

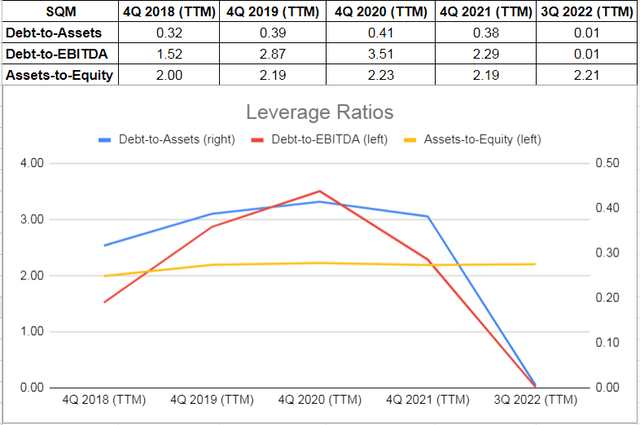

The debt-to-assets ratio is one of the significant calculations that measures the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. The higher the ratio, the greater the degree of leverage and financial risks. According to Figure 4, the company’s debt-to-asset ratio increased from 0.32 in 2018 to 0.41 in 2020. However, due to hiked lithium prices and increased demand for electric cars, the company was able to pay its debts while increasing its assets. Thus, SQM’s debt-to-asset ratio dropped to 0.01 on 30 September 2022. Also, SQM’s debt-to-EBITDA ratio (which determines the probability of defaulting on debt) plunged from 3.51 at the end of 2020 to 2.29 at the end of 2021 and 0.01 at the end of the third quarter of 2022. However, despite improving the debt-to-asset ratio and debt-to-EBITDA ratio, SQM’s asset-to-equity ratio remained above 2.00 in the past years. From 31 December 2021 to 30 September 2022, SQM’s total assets increased from $7044 million to $10253 million, and its total current liabilities increased from $992 million to $3275 million. As the market is in favor of SQM, the company can cover its obligations.

Figure 4 – SQM’s leverage ratios

Summary

In terms of the market outlook, lithium prices should remain high as demand for lithium batteries is increasing and the lithium supply will remain tight. I expect SQM’s fourth quarter financial results to be strong. Also, in the long term, Sociedad Química y Minera de Chile S.A. can make huge profits, as it is well-positioned to increase its lithium production capacity significantly. Buy SQM.

Be the first to comment