Torsten Asmus

Year to date, the best-performing asset class is commodities. Within commodities the best-performing sector is energy.

The best-performing commodity ETFs are the ones with the highest weight in energy and one ETF with a lower energy weight: the United States Commodity Index Fund (NYSEARCA:USCI). This is a so-called “optimized” ETF that is designed to outperform traditional commodity ETFs when the market is in contango. And although the market isn’t in contango, USCI is already performing strongly.

In a previous article we explained why the iShares S&P GSCI Commodity-Indexed Trust (GSG) is our top-pick. GSG is a traditional, “front-month ETF. Today we take a look at optimized ETFs. These ETFs try to avoid the negative roll yield that front-month ETFs incur when the markets are in contango.

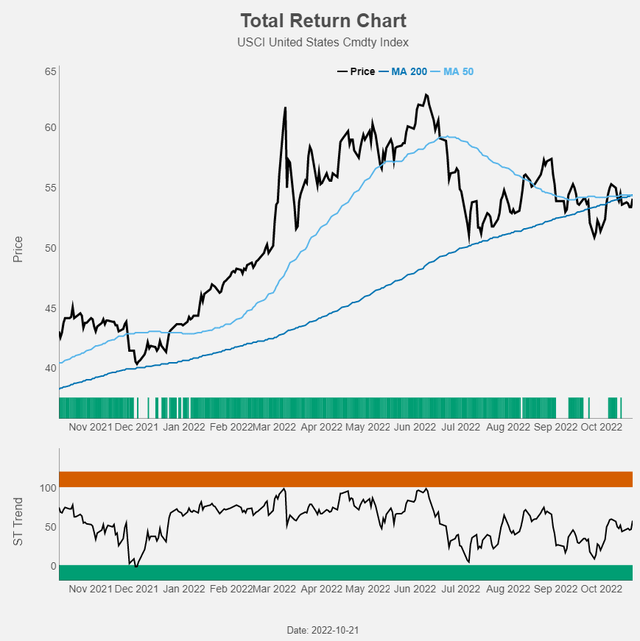

USCI is by far the best performing optimized commodity ETF this year. Even in the current backwardated environment USCI performs in line with the traditional ETFs. We expect the outperformance versus other well-diversified optimized commodity ETFs to continue and if markets would move to contango we expect USCI to outperform also the traditional commodity ETFs: buy the United States Commodity Index Fund.

Backwardation and contango

The spot price of a commodity is the price for immediate delivery. In practice, few investors have the ability to take physical delivery of raw materials like oil because of the significant storage and insurance costs they would incur. The closest approximation to the commodity spot market is an ETF or fund that invests in rolling front-month futures contracts. GSG is such an ETF.

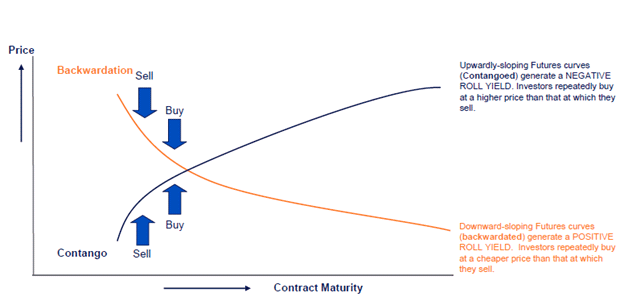

But the prices of commodity futures with longer-term expiration dates differ usually from the price of the nearest-term or front-month contract. If the price of the front-month contract is higher than the price of the next contract, you make money if you “roll” into the new contract. Selling high and buying low. Your “roll yield” is positive.

Such a futures market is said to be in backwardation. This term was coined by Keynes. Commodity producers fear that the price at harvest will be lower than today and are willing to pay a premium to hedge this risk. As a consequence, future prices will be lower than the spot price and Keynes named this condition (normal) backwardation. This implies that a futures price of a commodity is appreciating as it is getting closer to maturity.

The opposite of backwardation is contango. The price of the front-month contract is lower than the price of the next contract, and you lose money if you “roll” into the new contract. Selling low and buying high. Your “roll yield” is negative.

Figure 1: Backwardation and contango (PTMC)

Futures: three sources of return

The first source of return is simply the change in the spot price of a commodity. If oil rises e.g. from $80/barrel to $90, that is clearly a profit for an investor. The second source of return is the roll yield we already talked about. When a futures curve is in backwardation the roll yield is positive and when a futures curve is in contango the roll yield is negative.

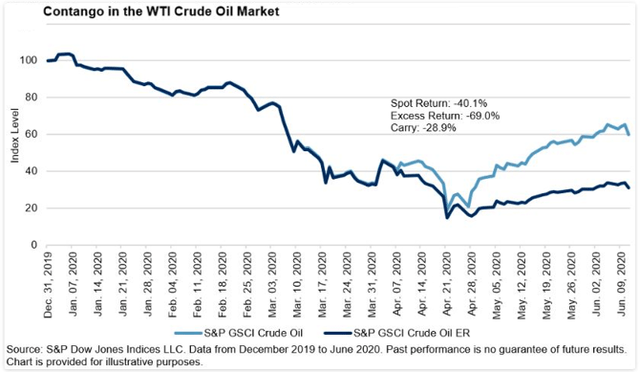

Figure 2 shows the impact of contango on the WTI crude oil market by illustrating the difference in performance between the S&P GSCI Crude Oil spot return (excluding roll yield) and the S&P GSCI Crude Oil Excess Return (including roll yield) since the beginning of 2020.

Figure 2: Contango (S&P Global)

The impact of roll yield can be important!

The third source of return is the so-called collateral yield. Investors in commodity futures must set aside collateral. This collateral generates interest income. With the recent rise in short term interest rates the importance of collateral yield is no longer negligible.

Front-month or optimized?

Famous commodity indices like the S&P GSCI Index and the Bloomberg Commodity Index use a basic strategy: the front-month roll. In this case investors receive the closest exposure they can get to the spot price of a commodity, as the front-month and spot prices tend to move closely together. A possible drawback of this strategy is the negative roll yield when the market is in contango.

To circumvent this problem so-called optimized strategies were developed. Such strategies try to maximise (roll) yields by systematically choosing commodities and futures contracts with the strongest backwardation or the mildest contango.

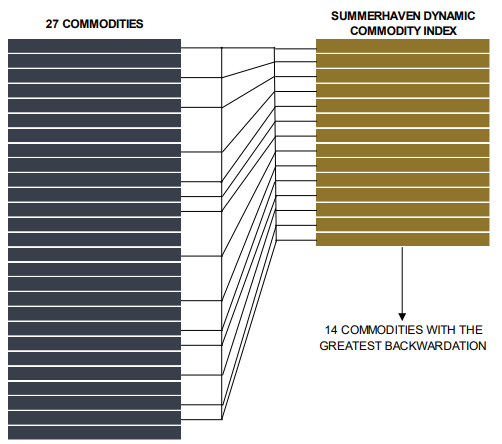

The SummerHaven Dynamic Commodity Index (“SDCI”) is an example of such an optimized strategy. The SDCI “tracks the performance of a fully collateralized portfolio of 14 commodity futures, selected each month from a universe of 27 eligible commodities based on observable price signals, subject to a diversification requirement across major commodity sectors.” The commodity sectors for the SDCI include Precious Metals, Industrial Metals, Energy and agricultural products such as Livestock, Softs, and Grains.

In a first step the 14 commodities with the greatest backwardation (or the least contango) are chosen.

Figure 3: SummerHaven Dynamic Commodity Index (SummerHaven)

To make sure that the index is well diversified at least one component from each of four primary commodity sectors (Precious Metals, Industrial Metals, Petroleum, and Grains) has to be included. If a primary sector is not represented after selecting the 14 commodities, the commodity with the highest backwardation among the commodities of the omitted primary sector is substituted for the commodity with the lowest backwardation among the 14 selected commodities.

Finally, for each of the 14 selected commodities, the contract month with the greatest backwardation (or the least contango) is chosen.

The SummerHaven Dynamic Commodity Index is used as a benchmark for the USCI ETF. How did USCI perform compared to traditional commodity ETFs and other optimized commodity ETFs?

Performance

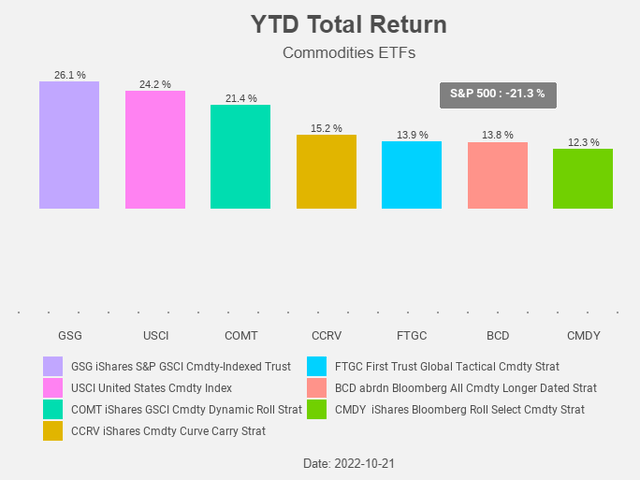

The seven commodity ETFs we will use in our screening are:

- iShares S&P GSCI Commodity-Indexed Trust (GSG),

- First Trust Global Tactical Commodity Strategy Fund (FTGC),

- United States Commodity Index Fund (USCI),

- abrdn Bloomberg All Commodity Longer Dated Strategy (BCD),

- iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT),

- iShares Bloomberg Roll Select Commodity Strategy ETF (CMDY),

- and iShares Commodity Curve Carry Strategy ETF (CCRV).

Only GSG is a traditional front-month rolling ETF and the others are optimized ETFs that try to enhance the roll yield.

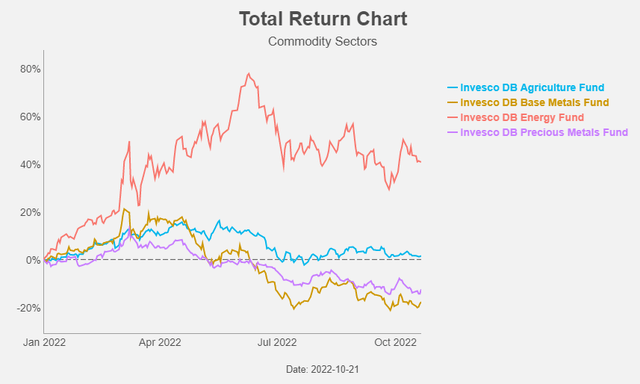

When we look at the performance of the different commodity sectors it becomes quickly clear that the real star this year is energy.

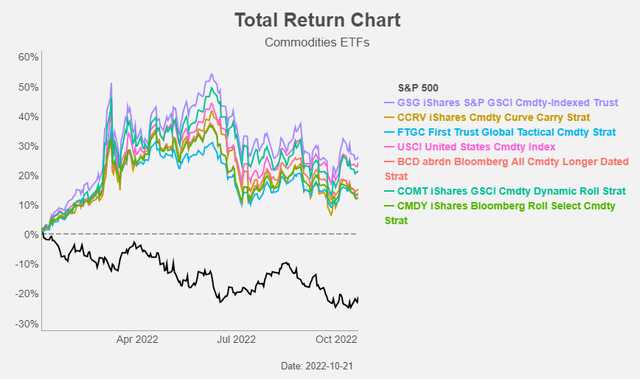

Figure 4: Total Return Chart (Yahoo! Finance, Author)

Given the strong energy performance it comes as no surprise that GSG and COMT are performing strongly; around two thirds of their assets are invested in energy. For the other ETFs this is more or less one third of assets. For CCRV we have no clue what the holdings are.

Figure 5: Total Return Chart (Yahoo! Finance, Author)

Given the lower weight in energy, the strong performance of USCI is really remarkable. Besides the details about the index construction, there is little information available about the primary drivers of this nice performance. This lack of information can be an explanation for the relatively low assets under management for this ETF.

Figure 6: Total Return Chart (Yahoo! Finance, Author)

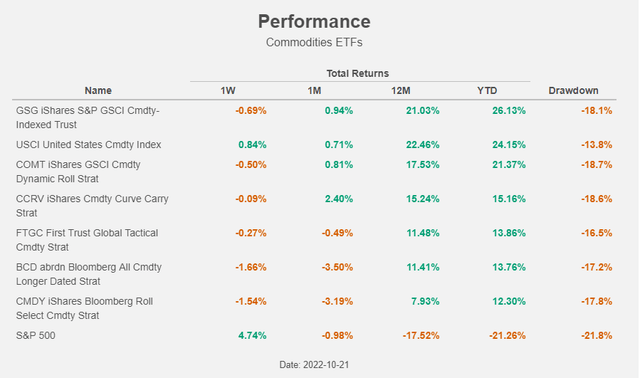

Table 1 gives an overview of the performance of the Commodity ETFs (sorted by YTD total return).

Table 1: Performance (Yahoo! Finance, Author)

Please note that the best performing ETF in Table 1 over the past 12 months is USCI!

Figure 7: Total Return Chart (Yahoo! Finance, Author)

What’s next?

While we expect USCI will continue to outperform other well-diversified optimized commodity ETFs, the outperformance versus traditional ETFs will depend on the answer on the next questions:

- Will energy keep outperforming other commodity sectors and

- Is the market in backwardation or contango?

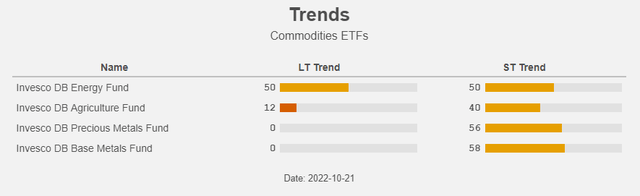

For the first question we will take a look at the long-term trend (LT trend) of the different commodity sectors, to get a first idea about which ETF might be the most promising.

The only commodity sector that is not in a downtrend is energy. So, for the time being we should expect a performance from USCI in line with those of ETFs like GSG. When the performance of the other commodity sectors starts to trend up, the odds of USCI outperforming GSG increase strongly.

Table 2: Trends (Yahoo! Finance, Author)

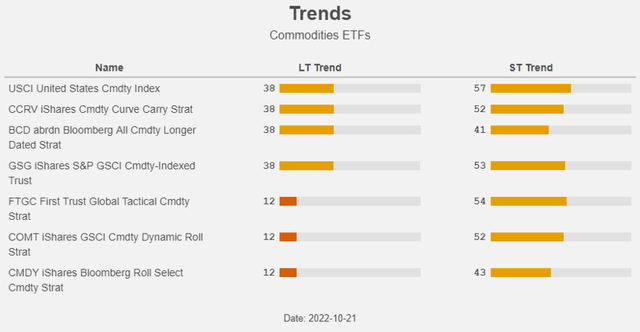

The only commodity sector that is not in a downtrend is energy. We would expect that the most energy-heavy ETFs score best on LT trend and this is only partly the case. GSG scores as expected, but COMT isn’t. GSG is profiting from the backwardation and the accompanying positive roll yield, while COMT is moving away from the front-month roll and hence not enjoying the same positive roll yield.

Table 3: Trends (Yahoo! Finance, Author)

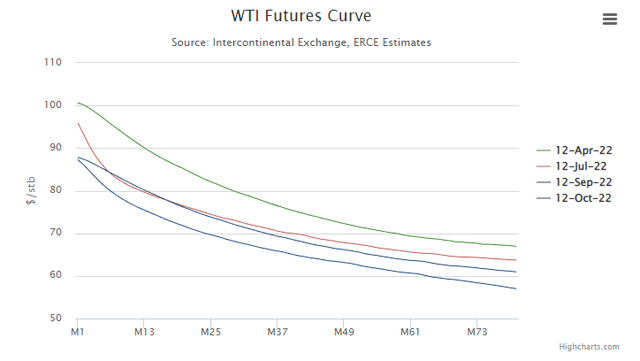

As for the second question, the answer is clear: the oil market remains in backwardation.

Figure 8: Oil futures curve in backwardation (ECRE)

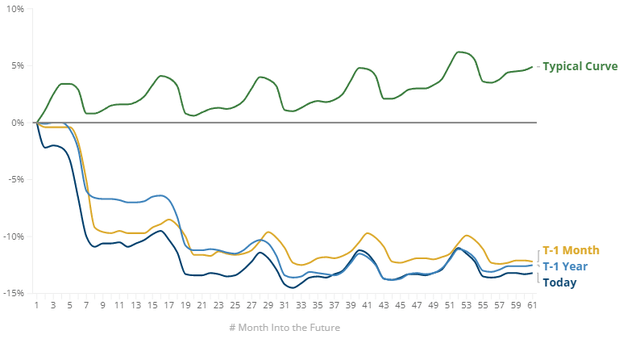

This is not only the case for oil, but also for other commodities like natural gas, copper and gold.

Figure 9: Commodity backwardation (MAN Group)

So, again, we can expect a performance from USCI that continues to be in line with those of traditional commodity ETFs. When markets would move from backwardation to contango, USCI should start outperforming “by design” the front-month ETFs.

Conclusion

Given the strong performance of energy and the fact that most commodity markets are in backwardation, one would never expect USCI to have such a nice return this year.

The best is yet to come for the well diversified USCI when other commodity sectors start trending upwards and/or when commodity markets move to contango.

USCI is the kind of all-weather ETF that performs well in all circumstances. Buy!

Be the first to comment