CHUNYIP WONG

By Rob Isbitts

Summary

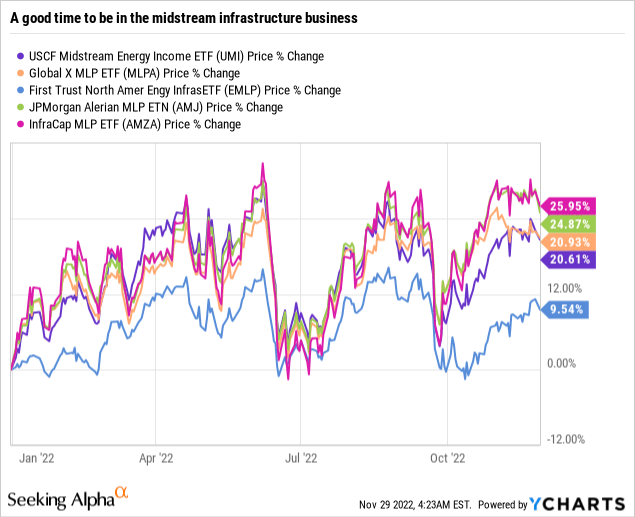

USCF Midstream Energy Income Fund (NYSEARCA:UMI) focuses on mid-stream energy infrastructure companies. UMI is a fairly new fund, having only started trading in March of 2021, but it has started with a bang, showing a net return of 25.9% YTD and 20% since inception.

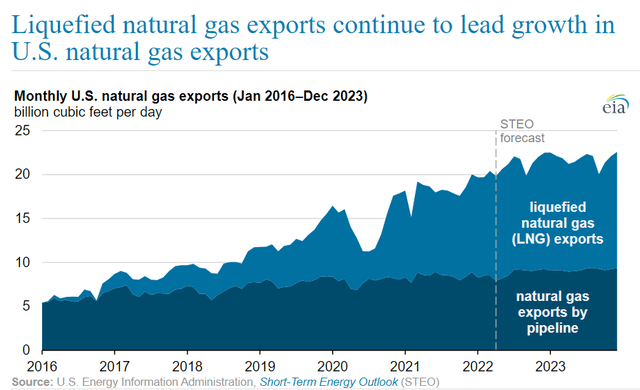

For the uninitiated, mid-stream energy infrastructure is a sector to pay attention to. Upstream energy is extraction, downstream is end user, midstream is the process to get from up to down. For example, in the liquified natural gas (‘LNG’) industry, the plants or trains that convert natural gas to a liquid would be considered midstream. Also, the trains that regasify the LNG would be considered midstream.

With the sanctions imposed on the Russian pipelines, Europe is scrambling to find alternative energy supplies as they have essentially maxed out the traditional supplies. As a result, they are feverishly working to develop midstream energy infrastructure before the winter. The demand for U.S. exports has never been higher and U.S. midstream companies are investing heavily in expansion.

Because of the dramatic rise in demand for midstream oil and gas infrastructure, we rate UMI a Buy.

Demand for U.S. LNG keeps going up (U.S. Energy Administration)

Strategy

As per the USCF prospective:

“The Fund is an actively managed exchange-traded fund. The Fund’s investment sub-adviser, Miller/Howard Investments, Inc., utilizes a bottom-up fundamental research process to evaluate these midstream energy infrastructure companies on a number of key metrics, including income, growth of income, distribution coverage, leverage, direct-commodity price exposure, and contract quality.

The midstream energy sector primarily includes publicly-traded master limited partnerships and limited liability companies taxed as partnerships (MLPs), and companies structured or who elect to be taxed as C-corporations that derive the majority of their revenue from operating or providing midstream energy services. The sub-adviser considers midstream energy services to be transportation, storage, and gathering & processing infrastructure that primarily collect fees for transporting customers’ oil, natural gas, and other products.

The fund may directly invest up to 25% of its total assets in equity securities of certain MLPs treated as publicly-traded partnerships. The fund will invest more than 25% of the value of its total assets in the energy, oil, and gas industries.”

Proprietary ETF Grades

-

Offense/Defense: Offensive

-

Segment: Oil and Gas

-

Sub-Segment: Midstream Infrastructure

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Undetermined due to age of fund

Holding Analysis

UMI holds a tight concentration of 26 total assets. These assets are almost exclusively (90%) in the industrial infrastructure sector. The largest individual holdings are Enbridge Inc (ENB), a Canada based conglomerate that owns and operates the largest network of oil and gas pipelines in North America, Cheniere Energy (LNG), the largest exporter of LNG in America with liquefaction plants in Texas and Louisiana, and Energy Transfer (ET) which is a U.S. based conglomerate that invests in pipelines for oil and propane and is the parent company of Sunoco (SUN). Each of these companies represents an 8% stake in the fund.

The fund’s holdings are exclusively in North America, with 76% in the U.S., and the rest in Canada. The top ten holdings represent 64% of the entire fund. The fund rebalances twice a year.

Strengths

It’s rarely a bad time to be in the energy business, and now is a particularly good time, especially the midstream energy infrastructure business. UMI may be a new fund, but they already have $190 million in assets under management, and that number should continue to grow as word gets out.

Oil companies are turning record profits, and global supply issues are creating increased demand for existing energy sources. The current available infrastructure is stretched to capacity, and the demand is only increasing. There is plenty of oil in the ground, but getting it from point A to point B seems to be where the real challenge is. UMI’s investment in the companies that are working on that challenge has so far paid off handsomely.

Weaknesses

As with any narrow focused fund, the greatest strength can very quickly become the greatest weakness. Today demand is at record highs, and countries are building infrastructure at breakneck speeds.

However, Russian gas, which had previously been the main supplier of Europe until this year, can quickly come back under the right condition, decreasing the demand for costly midstream infrastructure projects.

Additionally, the Russian shock to the energy system may also inspire a more rapid transition to greener energy sources.

Opportunities

Right now, the opportunity with UMI is pretty clear. Diminished supply from traditional sources has created a demand. Several companies are well suited to meet that demand and have demonstrated that they are willing and able.

If the fund continues to only invest in North American midstream energy infrastructure, it has a very good chance to produce high returns. When the fund was initially started way back in 2021, that was where the opportunity was. Now, however, suddenly the demand for infrastructure is just as great in Europe as it is in the U.S.

Perhaps the fund can seize on this and expand its holdings to include European midstream infrastructure companies. That would be a very interesting development, but that is purely speculation at this point.

Threats

The oil and gas industry is extremely regulated and subject to strict environmental requirements. The Keystone Pipeline construction began in 2010, is still not finished, and may never be. With an industry as high profile and arguably controversial as this, the risks are always prevalent and hard to predict.

What looks like clear skies today could quickly turn into a giant quagmire tomorrow. The LNG industry works very hard to assuage concerns for safety and environmental hazards, but it’s hard to predict what future obstacles may arise.

Long term the biggest threats are likely that supply will meet demand and the need for continued infrastructure development will cease, or at the very least abate. However, that day does not seem to be anytime soon.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Buy

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

As a new ETF, UMI is still evolving, but by focusing on a very narrow sector and a small collection of holdings, the growth curve may not be that steep. A few interesting tidbits to note, though, are the elevated expense ratio (.85%, not out of line with similar ETFs) and the dividend yield which to date has been 2.99%.

ETF Investment Opinion

As stated above, we like UMI. The model combined with the sector demands make it a very appealing prospect moving forward. We believe the trend away from reliance on Russian gas will continue, even after this war ends. This creates a market inefficiency that needs to be resolved. For now, companies are pouring billions of dollars into infrastructure investment, and it is reflective in the fund performance. We rate UMI a buy for the short term, because we believe the demand will continue to grow. When that demand is finally met, and no one knows when that will be, we still believe that UMI has merit as a hold.

Be the first to comment