JacobH

Uranium Energy Corp (NYSE:UEC) is a US-based uranium company with projects in several states as well as Canada and Paraguay. And although it currently doesn’t mine any uranium, it has been an active consolidator in the space; completing two major buyouts this year alone.

The company is growing its asset portfolio in anticipation of substantially higher uranium prices in the not-too-distant future. Management believes that creating a North American-based portfolio that is, nevertheless, geographically diversified within the US and Canada can provide the company with future advantages. That seems like a reasonable strategy given recent geopolitical tensions and the US government’s renewed emphasis on securing energy supply chains.

However, the company’s aggressive deal-making is not without its costs and, more importantly, its risks. This article will discuss those issues along with their potential impact on UEC’s stock price.

Company Backgrounder

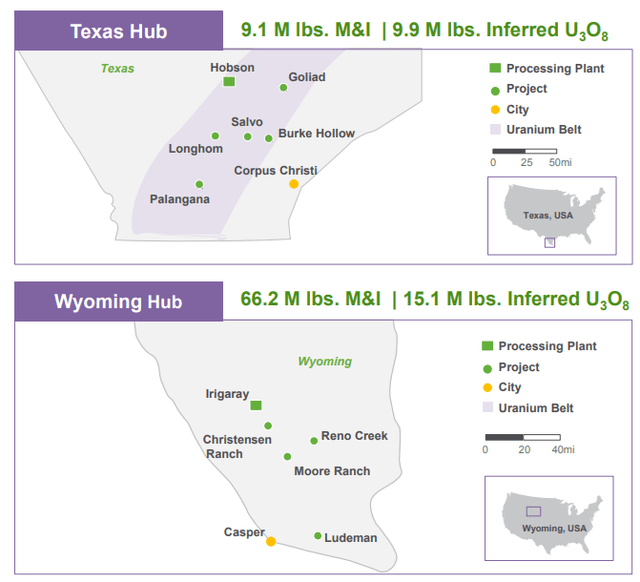

UEC has several early-stage projects in multiple states, but its main US property holdings are located in the mining-friendly jurisdictions of Texas and Wyoming. In both those locations, the company has managed to accumulate several uranium-bearing properties and processing facilities. The combined resource size of its Texas sites sums to a respectable 9.1 million pounds (M&I) of U308 while the Wyoming properties register an impressive total of 66.2 million pounds (M&I).

UEC Texas and Wyoming Properties (Investor Presentation)

The company plans to use hub-and-spoke models whereby a central processing plant will be fed uranium extracted from the nearby properties. All of the sites are currently in care and maintenance, but the intention is to eventually use in situ recovery (‘ISR’) processes at all the properties in both Wyoming and Texas. The ability to use ISR is tremendously advantageous as it is both cheaper than conventional mining and has a much smaller environmental footprint.

Both South Texas and Wyoming are fully licensed and could be operating in short order if management decided to begin production. The Wyoming processing plant has a production capacity of 2.5 million pounds per year while Texas can churn out 2 million pounds per annum. Management has indicated that once the decision is made to restart, both locations can be brought to full production within 12 months; UEC also has 5 million pounds of yellowcake sitting in a warehouse that can be sold to finance that process. On July 31st the company had over $32 million in cash to tide it over while it waited for uranium prices to rise.

So, given this set-up, the only thing management and shareholders needed to do was sit back and wait for uranium prices to go up. Granted, that’s not the most action-packed investment strategy, but good things come to those who wait.

However, over the last year it’s become apparent that management is pursuing a very different strategy. That’s not necessarily a bad thing, but it does change the characteristics of the investment.

The Deals

This past June, UEC acquired Canada-based UEX Corp. in an all-stock transaction. The deal provided UEC with a large portfolio of pre-production uranium assets in Canada, including access to the world-renowned and uranium-rich Athabasca Basin. The acquisition was billed as complementing, “UEC’s near-term production-ready and brownfield assets in the U.S. with medium and long-term production potential in Canada.”

Although, it should be noted that with the exception of Wheeler River, of which UEX only had a 5% stake, all of these assets will employ conventional mining methods which are much more expensive than ISR.

The UEX transaction was quickly followed by the purchase of Rio Tinto Group’s (RIO) Roughrider Uranium Project in October which is also located in the Basin. The acquisition, which cost $150 million, requires UEC to pay $80 million in cash and issue $70 million of its stock to Rio. UEC’s rationale for the deal was that it purchased a, “world-class project in a premier uranium mining jurisdiction.”

The Costs of Expansion

There’s no question that the assets purchased in these deals will hold some value in the long-term. But pursuing a roll-up strategy will always have its risks, and that is especially true when none of the companies involved are generating revenue from their mining operations, as is the case here.

In its FY22, UEC booked revenue of over $23 million which came mostly form the sale of uranium held in inventory. The company’s Cash Flows From Operations (“CFFO”) was a negative $53 million after having been about -$41 million the year before.

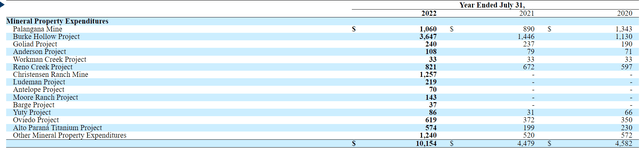

The addition of non-producing assets will likely only serve to ensure that CFFO falls further into negative territory as long as the company remains idle. That’s because the purchase of idle properties brings with it care and maintenance costs that can add up. The exhibit below shows how UEC’s growing list of properties brings with it higher costs; an issue that will only be made worse by higher rates of inflation.

Granted, exploration costs are also included in the figures above, but the bulk of mineral property expenditures last year were directly related to maintaining operational readiness and permit compliance.

That shouldn’t be much of an issue if uranium prices rise sharply in the near term. In that case, the properties would be brought back into production and those care and maintenance costs would go away. But if uranium prices continue oscillating around the $50 per pound level for a few years, these expenses could become a real problem.

They will be a cash drain on the company and may force it to sell some of its yellowcake inventory. UEC may even be forced to issue new shares in order to raise cash to cover maintenance expenses, and dilute existing shareholders in the process.

Takeaway

That’s what makes UEC’s stock a bet on an imminent jump in uranium prices. The company’s growing portfolio of non-productive uranium assets should rise in value quite substantially if uranium prices get to a level that justifies renewed production. But by the same token, if prices remain around current levels for an extended duration, long-term shareholders may be heavily impacted by the company’s cash burn. The company’s recent deal-making has made its stock a riskier bet in my view.

Be the first to comment