desertsolitaire/iStock via Getty Images

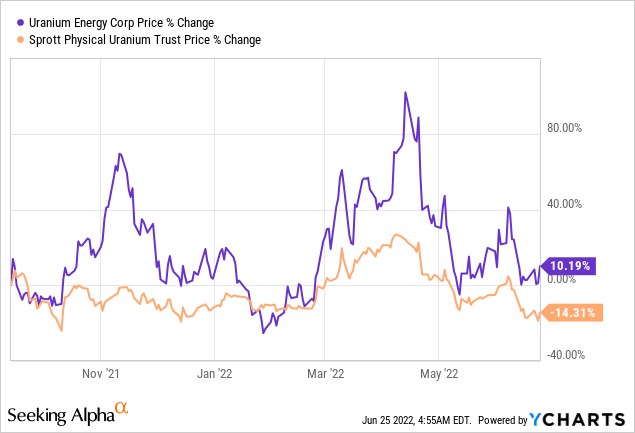

Uranium Energy Corp. (NYSE:UEC) is in the uranium industry, but it is not currently really a mining company. The stock price often trades with the uranium spot price, but the reality, however, is their actual business model is just constantly issuing additional shares in the market. Their biggest risk is a massive amount of uranium held by Sprott Physical Uranium Trust (OTCPK:SRUUF) overhanging the market. Purchases by the trust were a major force driving up uranium prices over the last year, and when these purchases slowed, the uranium spot price dropped.

Business Model – No Operations

A number of people are confused about Uranium Energy. They keep mentioning their “uranium mining operations”. They don’t mine and have not mined uranium for a number of years. UEC just owns assets. They own:

*Just over 1.7 million pounds of uranium ($82.4m market value).

*15 million shares of Uranium Royalty (UROY) ($39m value). (Read Golden Panda’s excellent article on UROY).

*93.3 million shares of Anfield Energy (OTCQB:ANLDF) ($5.6m value).

*Mineral rights and a large number of uranium mines that are not currently operating.

Almost all their revenue in the last nine months was from the sale of uranium from their purchased uranium inventory-not from current mine operations. In fiscal 2021 they did not even have any revenue. I take a rather cynical view of their business model and feel that their real business model is just to sell more shares to the public to stay in business. As of June 14, 2022 they had 286,287,179 shares outstanding compared to 161,175,764 on July 31, 2018. Almost all of that increase was from ATM sale of additional shares. Their $128.5 million acquisition of Uranium One Americas, Inc. in December was for cash – not for stock.

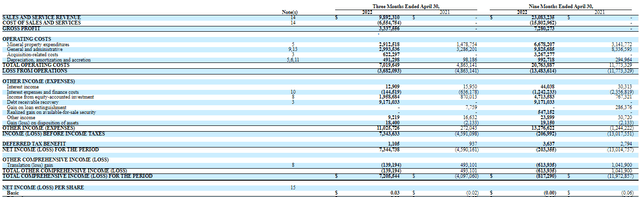

Income Statement

During the quarter ending July 31, 2021 UEC started buying uranium as an investment (speculation). They bought 1.0 million pounds at just under $30 per pound. During the nine months ending April 30, 2022 they bought 1.1 million pounds of uranium and also sold 0.5 million pounds, which they made a gross profit of $7.28 million. After April 30, 2022 they received an additional 200,000 pounds at a cost of $9.08 million. UEC has purchase commitments for a total of 3.2 million pounds over the next four years for a total of $125.14 million or an average price of $39.11 per pound. Since they don’t have any cash flow from operations, I assume these purchases will be paid from proceeds of selling additional shares. Their current purchased inventory of uranium has an average cost of $37.10 per pound compared to the latest spot price of $48.45. This is about $0.067 paper profit per UEC share.

Problems of Uranium Inventory Held By a Trust

The problem for UEC and other uranium companies is the very large uranium inventory of over 56.8 million pounds held by Sprott Physical Uranium Trust. This trust is a pure uranium play but has slightly underperformed UEC since I wrote my last UEC article published on September 14, 2021.

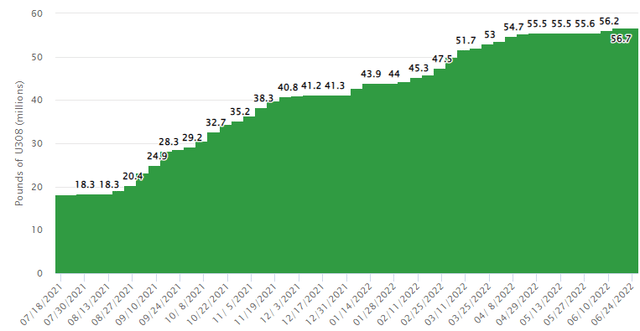

The purchases by this trust were a major factor behind the increase in uranium prices over the last year. The price did increase because of actual final demand for uranium, but by speculative buying by SRUUF traders who bought trust units, which caused the trust to buy uranium additional inventory.

Sprott Physical Uranium Trust Uranium Inventory

SRUUF Uranium Inventory (sprott.com)

Uranium Spot Price

Uranium Spot Price (tradingeconomics.com)

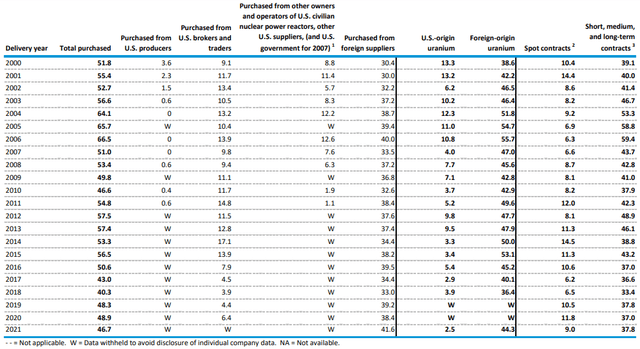

The problem is what happens when investors turn bearish on uranium and want to liquidate SRUUF units? Since the trust’s current uranium holdings of 56.8 million pounds is significantly larger than the latest annual purchases by domestic non-government utilities of 44.7 million pounds, I wonder if there could be some future U.S. regulatory issues. (I plan to go into more details about potential government intervention in a future SRUUF article.)

Uranium Purchases By Utilities

Domestic Utility Purchases (www.eia.gov)

I think investors know about the uranium trust, but they do not realize how large it has grown over the past year. When I wrote about the impact the trust could have on the uranium market last September, the trust owned 24.9 million pounds of uranium. Now it owns 56.8 million pounds and its influence has increased to a very uncomfortable level, in my opinion. The price of uranium has been pushed higher mostly because of purchases by this trust and not because of a surge in demand/purchases by actual uranium users. Because of the difficulties for investors in the U.S. to now buy SRUUF units and the NYSE denied in late April their request for listing, the dramatic growth of the trust might be over.

Uranium Energy is Buying UEX Corp.

UEC recently announced plans to buy UEX Corp. (OTCBQ:OTCQB:UEXCF) by issuing 0.0831 UEC shares for each share of UEX, which is about $US162 million using the latest UEC stock price and CAD exchange rate. The deal is subject to approval by shareholders of both companies. UEX is another company with no actual revenue from operations, which results in significant negative cash flow each year. They also stay in business by issuing new shares and just own a long list of mostly mineral interests, but no actual current operations. Most of their “operations” have been just “shuffling” mineral interest paper around between other uranium “mining” companies. Current UEX shareholders will own 13.7% of the combined company. I don’t see any real benefit at all for current UEC shareholders from this deal.

There is a very small arbitrage play by going long UEXCF (or UEX on the Toronto Stock Exchange) and shorting UEC, but the carrying costs for the trade for a few months do not currently make this a rational trade. (For example, going long 10,000 UEXCF shares and shorting 831 UEC shares.) Traders, however, with “sharp pencils” may want to monitor the stock prices to take advantage of any potential larger arbitrage trades.

France is a Major PR Uranium Industry Problem

The French electric utility, Electricite de France SA, closed many of their nuclear power plants earlier this year because of stress corrosion found in these power plants. It is unclear when these nuclear plants will be back generating electricity. French consumers have been told to cut back on their electric usage.

This has been a major PR disaster for the uranium industry because the world is currently reevaluating sources of electricity due to the Russian invasion. France also had major problems with many of their nuclear power plants back in 2016. This French nuclear problem could have a major negative impact on world leaders deciding on what are the best sources for future electric needs.

The closing of so many French nuclear power plants has a negative impact on uranium usage that could have a future negative impact on both spot and long-term contract uranium prices. This is happening at the same time Cameco (CCJ) is restarting uranium operations at their McArthur River mine, which will increase the supply of uranium.

$4.3 Billion for the U.S. Uranium Industry

Since the news report earlier this month was only “according to sources” that the federal government is going to try to seek $4.3 billion for the uranium industry, I will wait to give much coverage on this until I read the plan, if it is actually proposed. I think most of the money is for a domestic enrichment plan. While this would help the domestic uranium industry, these proposed projects take years, if not decades, to become operational because of red tape. I would expect multiple lawsuits and subsequent appeals regarding an enrichment plant.

These reports often make just good “headline” trades, but then reality hits traders. This is also part of the “Russia trade” that had a rather dramatic, but short-lived, impact on uranium company stock prices.

Conclusion

Uranium Energy is an over-priced “lottery ticket” on uranium prices. Uranium prices seem to have not risen because of increased final usage, but because of speculative buying via Sprott Physical Uranium Trust. This huge uranium inventory held by the trust now overhangs the market. The problems in France with their nuclear power plant throw water on the bull case for future nuclear power plant construction, in my opinion. Any federal uranium program involves too many “ifs” to have a rational impact on Uranium Energy.

Uranium Energy has no operations, and it is unlikely they will have any revenue from operations in the foreseeable future. Their only revenue might come from uranium sales from their purchased uranium inventory. They stay in business only from the cash raised by selling additional shares. UEC is rated a sell.

Be the first to comment