coffeekai/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on June 25th, 2022.

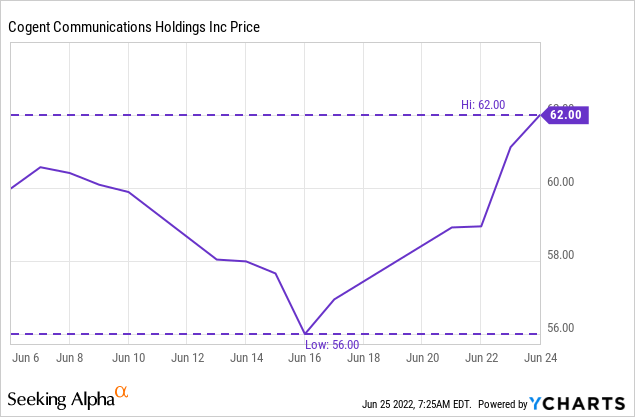

Cogent Communications Holdings, Inc. (NASDAQ:CCOI) has been just as volatile as the rest of the market. We see losses on a YTD basis, and shares are off 23% from their 52-week highs. At one point, the declines from the highs were even deeper as shares touched as low as $55.18.

CCOI is “an Internet Service Provider operating one of the largest fiber-optic networks, solely built for Internet traffic.” They have a relatively long history of operations, going back to 1999. The founder is still the CEO today, Dave Schaeffer.

This is a watchlist name for me. We’ve taken the opportunity of this volatility to make a trade on CCOI. We’ve sold puts at a $55 strike price on the July 15th, 2022 expiration date. For that, we collected $1.07. Shares at first went lower after the trade, then began running higher. This was mostly just along with the broader market and nothing business-specific.

Ycharts

Since our previous coverage, there have been several changes worth updating for this company. They have increased their dividend a couple of times, continuing their quarterly increase trend. They have pulled out of Russia, as have a lot of other companies. They’ve also replaced some of their debt, extending the maturity but also increasing their costs.

Russia Update

The atrocities committed by Russia are certainly nothing to take too lightly. I would have hoped this issue would have resolved itself by now (ideally never happening in the first place,) and the needless suffering and deaths ended.

However, this is about the business. So, without trying to sound too inhumane, it actually doesn’t mean too much for CCOI.

They do not provide any service within Russia, but in Ukraine, they have some services and infrastructure. After terminating service to Russia’s government and those linked to Russia, they provided that those customers made up less than 0.3% of the revenue for the previous quarter. Ukraine is around 0.4% of revenues for the quarter. In total, we are looking at less than a 1% impact on revenues going forward even if everything was completed halted there.

Following the Russian invasion of Ukraine in February 2022, we terminated services to customers linked to Russia and the Russian government. These customers represented less than 0.3% of our consolidated revenues for the three months ended March 31, 2022. We do not provide service within Russia but we do provide services in Ukraine via our Ukrainian subsidiary, TOV Cogent Communications Ukraine (“Cogent Ukraine”). As a result of the damage to facilities caused by the war, our services in Ukraine have experienced periodic outages which our third-party fiber provider repairs for us. We have taken steps to enhance our network security, provide financial flexibility to our Ukrainian customers and assist our Ukrainian employees. We do not believe that the termination of services to certain Russian customers or the impact of the war on our ability to provide services in Ukraine will have, taken together, a material impact on our network, financial statements or operating results. Cogent Ukraine represented less than 0.4% of our consolidated revenues for the three months ended March 31, 2022 and less than 0.7% of our consolidated assets as of March 31, 2022.

So, while the Russian aggression is completely uncalled for, it doesn’t have a high impact on CCOI at the end of the day.

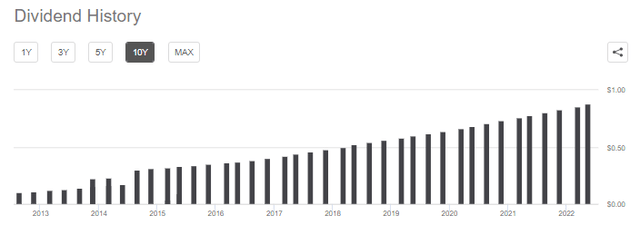

Continuing Dividend Increases

There have been two dividend increases since our last update as well. This continues their trend of increasing the dividend every single quarter. This latest one brings the streak to 39 consecutive quarterly increases.

CCOI Dividend History (Seeking Alpha)

Considering the yield is already at a high of 5.68%, this is quite impressive. The $0.88 in the latest quarter works out to an increase of 12.82% from the year-ago quarter payout of $0.78. In fact, the 5-year growth CAGR comes to an impressive 15.49%.

That’s the good news, but it requires consistent growth to continue to put through those types of increases. While CCOI is expected to continue to grow, I still foresee a slowdown in the increases or potentially even stopping the quarterly increases. Going to a more normal annual increase could provide them more time between increases to still put through a meaningful increase.

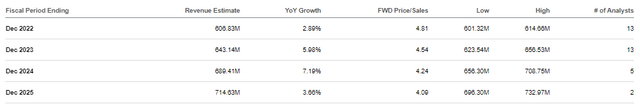

Analysts believe revenue will increase on an average of around 5% over the next four years.

CCOI Revenue Estimates (Seeking Alpha)

The EPS, in this case, isn’t too relevant because of the significant amount of depreciation for the company. As an example, in the last quarter, they reported an EPS of $0.02. That would certainly send up massive red flags if it were other companies that were paying $0.88 per quarter.

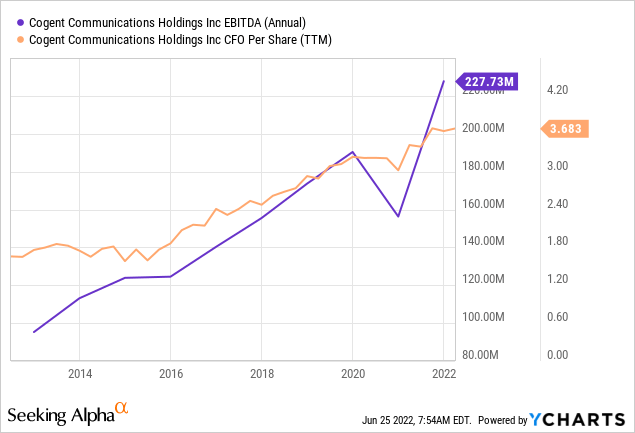

Instead, we can get a better sense of the direction of their earnings by watching EBITDA. We can also see the cash from operations per share, which helps provide us with a better understanding of the dividend coverage.

Ycharts

For the last quarter, it came to a per-share amount of $1.06. That’s where we can start to see that they can cover their dividend when the depreciation and amortization of non-cash expenses are taken out. On the other hand, it means that they don’t have a lot left over for growth in building out their network. Building out infrastructure is a huge cost, and those costs are only increasing with inflation.

As they highlighted in their last earnings release, net cash from operating activities increased 4.9%, and revenue increased 1.6%. EBITDA increased by 2.9% as well. Those numbers will catch up at some point, and the 12%+ dividend increases will have to slow down.

Net cash provided by operating activities increased from Q4 2021 to Q1 2022 by 37.3% to $49.4 million for Q1 2022 and increased from Q1 2021 to Q1 2022 by 4.9%.

To sum up, they can cover their dividend with the cash coming in but leaves little for growth. That’s where debt comes in to provide growth in the future. Now that those debt costs are rising, it could put some pressure on the increases in dividends going forward or risk pushing the payout into unsustainable levels.

At this point, I simply don’t believe that the growth going forward can achieve the growth we experienced in the past in terms of dividend increases. I think they’ll continue to increase, but the pace could slow.

Higher Debt Costs

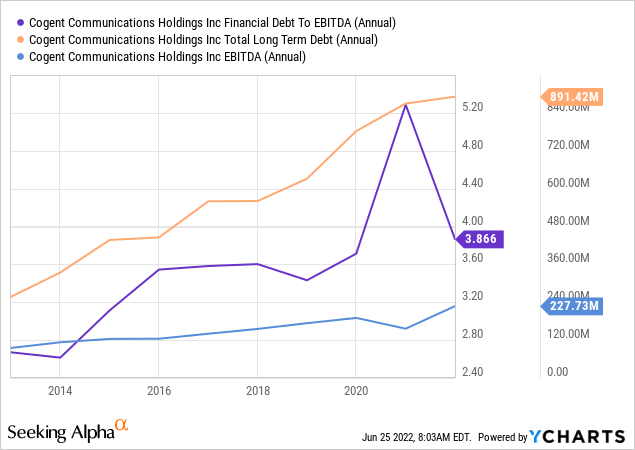

This company has had an explosion of debt over the last decade. It has translated into some rapid growth, but the debt/EBITDA is starting to become quite elevated.

Ycharts

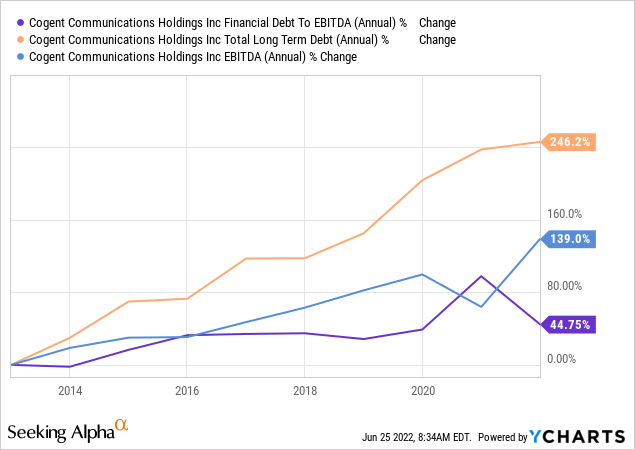

The above is in terms of dollars and cents. Here’s a look at the percentage changes for a better context of the same period.

Ycharts

Earlier in the month, they had announced that they are offering $450 million in senior notes due 2027. These will replace the €350 million 4.375 unsecured notes that were due in 2024. While it pushed out the maturity of when this debt would come due, it is also pushing up the interest rate on these to 7%. Future debt in a rising rate environment will likely be at a similar rate or even higher. That means fueling growth through debt will become more costly. Again, putting pressure on what cash would be left over for investors in terms of the dividend.

Conclusion

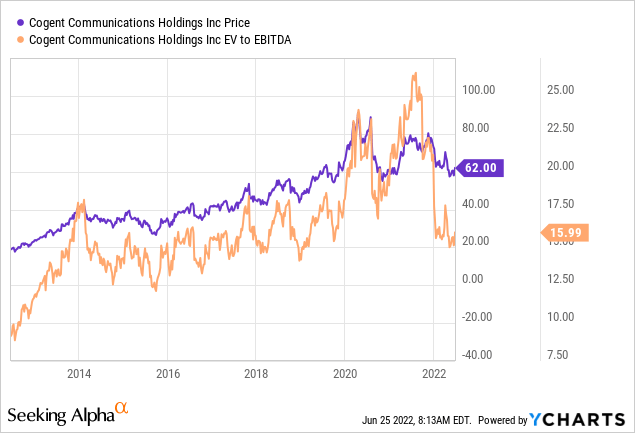

Despite the growth headwinds with higher interest rates going forward, it seems that it is pretty much business as usual for CCOI. They continue to grow, but the costs of growth also appear to be increasing for them – as one would expect in a company that grows via debt in a rising rate environment. On the other hand, the valuation of the shares has come down quite considerably.

EV/EBITDA is down to 16, from 18.86 when we previously touched on this company.

Ycharts

The volatility of the overall market has been pushing the valuation down as well. We took the opportunity to sell some puts recently, but I believe anything below $60 is worthwhile. At that level, I think there are reasonable expectations of upside going forward with more limited downside.

Be the first to comment