syahrir maulana/iStock via Getty Images

The market has been so brutal to technology stocks that even solid results aren’t rewarded anymore. Upwork (NASDAQ:UPWK) survived a major business disruption when business was hit with the Russian invasion of Ukraine, yet the stock trades at the recent lows anyway. My investment thesis remains ultra-Bullish on the freelance marketplace with the gig economy set to thrive in worsening job market and workers well equipped for remote work.

Strong Quarter

Upwork reported Q3’22 revenues of $158.6 million, slightly beating analyst estimates. What really matters is that the freelance marketplace grew revenues by 24% YoY despite the Russian issues.

The company will continue to benefit from the shift to remote and hybrid work, opening up an opportunity to include freelance workers as part of this workforce. Regardless though, Upwork is facing a tough environment with high comps from prior years and macro weakness slowing growth in the short term.

Both Gross Services Volume and Active Clients saw weaker growth in the quarter. GSV topped $1 billion for the quarter, but the amount only grew at a 14% clip. Active Clients only grew 9% to reach 818K with the company overcoming mid-20% growth rates back in 2021.

Despite the strong growth, Upwork continues to see softness in the market demand with enterprises reigning in spending and costs. Though, the freelance marketplace continues to promote customers saving up to 50% by using their marketplace over alternative hiring options.

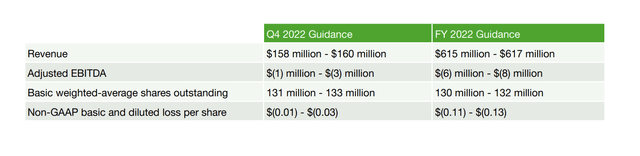

In a lot of cases, turmoil in the macro environment can cause potential clients to pause plans before implementing a directive to further utilize a cheaper marketplace option. As such, Upwork guided to Q4’22 revenues sequentially flat with Q3 with revenues of $159 million growing ~16% YoY.

Source: Upwork Q3’22 shareholder letter

Analysts expected revenues generally in line with these estimates at $160 million, but the expectation was for revenues to grow ~$2 million sequentially. The market can nitpick with such scenarios, but investors shouldn’t stress flat numbers in this macro environment during the holiday quarter.

Historically Cheap

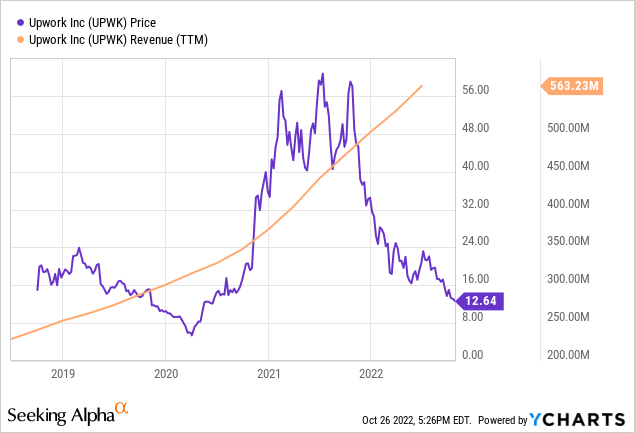

The stock value has fallen to $1.6 billion, yet the company guided to 2022 revenues of $616 million. Upwork only traded lower during the early days of covid, yet the company has grown revenues substantially during both covid and a war in Ukraine placing up to 10% of revenues at risk.

As the below chart highlights, the stock market is far too dramatic with the price swings of the stock. While revenues continue to grow at a consistent clip, Upwork has bounced from a covid low of $6 to a high over $60 in late 2021 with a roundtrip all the way back to $12 now.

The market is starting to confuse covid pull forwards in a lot of cases in the tech and marketplace spaces and not really understanding that a company like Upwork is producing at a far higher sales level. As an example, the company only reported Q4’19 revenues of $80 million while guiding for nearly double the revenues in Q4’22 despite a couple of massive headwinds to the business during the period.

The company should definitely report the slowest growth rate since going public in the current quarter, but investors should be careful extrapolating too much into the deceleration. Upwork saw revenue growth peak at 42% in Q2’21 after reporting only 18% in Q2’20 and these revenue pull forwards make the hurdle higher to top, especially in a weak economy.

Upwork is pretty much EBITDA breakeven here with a plan to reach EBITDA positive next year. The company has a cash balance of $678 million (offset by debt of $564 million) providing the capital to invest in growing the freelance marketplace without overly focusing on profits.

As a reminder, management decided to spend aggressively in brand marketing this year with a hit to the bottom line. Upwork forecasts spending $19 million on brand marketing during Q4 with total spending of $80 million for the year.

A decent cut to the brand marketing spend would quickly flip the forecasted $7 million adjusted EBITDA loss for the year to a profit. Upwork plans 30% to 35% adjusted EBITDA margins over the long term, as the marketplace grows into a $1+ billion platform.

Takeaway

The key investor takeaway is that guidance will definitely leave the stock depressed in the short term. The market loves to over-extrapolate on near-term numbers leading to the wild price swings in Upwork over the last couple of years.

Investors should use this weakness to load up on Upwork leading into a 2023 that could be vastly better after the Fed pauses or pivots on rate hikes. The company doesn’t need perfection from here to reward investors with the trading close to 2x 2023 sales targets.

Be the first to comment