RamilF/iStock via Getty Images

Atkore (NYSE:ATKR) is a leading manufacturer of electrical, safety, and infrastructure products for both commercial and residential construction. They have a top one or two market share in the US. Despite supply chain disruptions caused by the pandemic, ATKR manages to raise its top line significantly thanks to its strong competitive pricing strategy. As of this writing, the company’s total revenue stands at $3,808.7 million, up from $1,765.4 million in fiscal year 2020. In fact, it has a growing short-term accounts receivable of $737.3 million, indicating the company’s substantial competitive advantage in the industry. Additionally, ATKR acquisition initiatives will strengthen its position for long-term growth. However, given the concerns of a looming recession and, in particular, the declining non-residential construction forecast over the next two years, that makes this stock unappealing today.

Company Overview

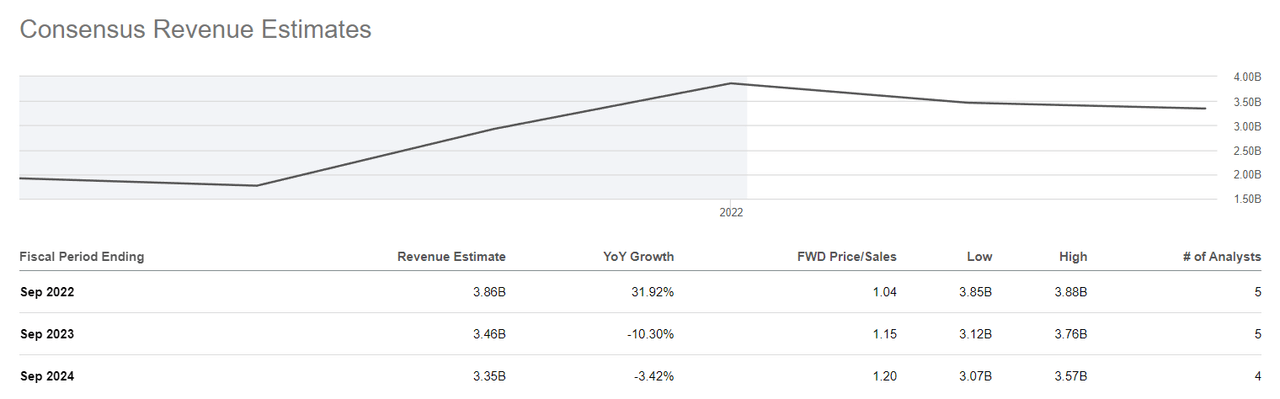

One of the interesting catalysts for ATKR is its acquisition spree since 2021. It highlights its investment in sustainable High-Density Polyethylene (HDPE) conduit once again in 2022, with the acquisition of Cascade Poly Pipe & Conduit and Northwest Polymers in August 2022. As a result, ATKR is well positioned for the growing HDPE market. However, as of this writing, we have not seen material upward revision from analysts in the company’s consensus total revenue.

ATKR: Declining top line (Source: SeekingAlpha.com)

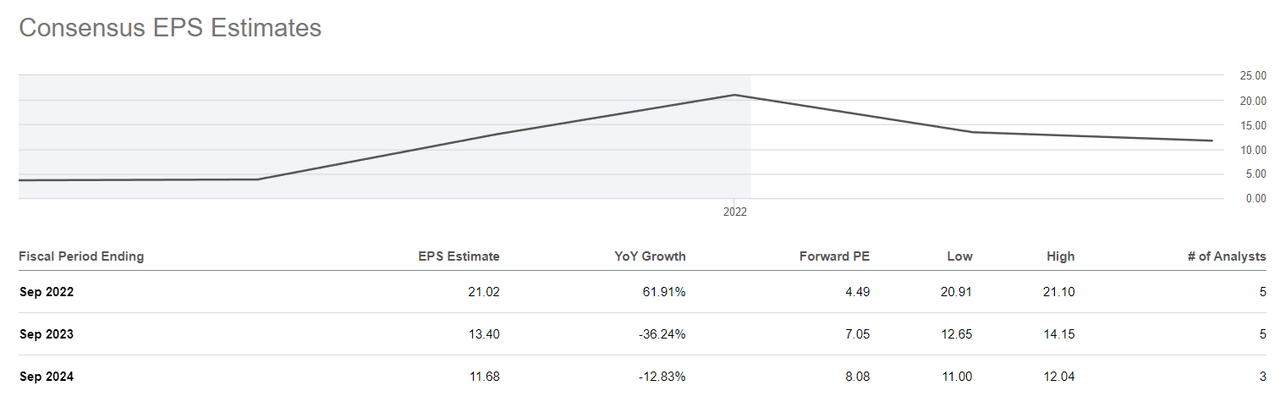

On top of the declining construction volume forecast mentioned earlier, this declining outlook is due to price normalization of its products such as steel and PVC conduit. My prediction is that ATKR will have a harder time finding the right price balance, particularly when the demand for its products begin to fall. In fact, the management guided a slower adjusted EBITDA to be around $800 to $900 million in FY ’23, down from its estimated $1,322 million to $1,342 million in FY ’22. This will translate to a declining forecast of adjusted EBITDA margin of 35% in FY ’22 as compared to its 25% in FY ’23. Furthermore, a potential recession may continue to put pressure on the company’s future margins, ultimately hurting its EPS, as indicated in the image below.

ATKR: Slowing EPS outlook (Source: SeekingAlpha.com)

Strong 2022 Ahead But,

ATKR’s full year 2022 is estimated to grow exponentially with EPS YoY growth of 61.91% and its total revenue YoY growth of 31.92%. However, I believe that its pricing strategy in FY ’20 will not be as strong over the next few years due to the possible recession, particularly considering its all-time high inventory record of $444.7 million. This also supports its declining EPS outlook mentioned earlier, making ATKR unattractive as of this writing. Considering its estimated earnings per share of $11.68 and implied P/E multiple of 10.47x and a conservative discount rate of 10%, I believe ATKR trades above its estimated fair price of $92, implying an unfavorable long set-up.

Acquisition Benefits May Alter Negative Catalyst

As part of its growth strategy, I expect Atkore will continue to invest in high-growth markets and increase its capacity, as seen by its recent partnership with NEXTracker, a market leader in utility-scale solar trackers. I believe this partnership will help the company to cater the opportunities from the growing solar market. Additionally, ATKR continues to invest in its non-steel products such as High-Density Polyethylene (HDPE) as mentioned earlier which aims to service the growing opportunities in telecommunications and renewable energy market. I believe positive growth coming from these catalysts may alter its current negative top line and revenue consensus estimate, especially considering management’s positive outlook.

…HDPE industry overall coming from outside consultants and so forth is supposed to double over the next five, seven years. And that’s tied exactly to all the things, including the $1.2 trillion infrastructure. So for us, without giving specific numbers, I think it can be a reasonable portion of our business.

I got here to say today is going to be the largest exactly in the middle, but it’s going to grow, I think, with our investments and acquisitions inorganically, and it’s going to be strong markets to go all the fiber optic lines that having broadband access for everyone in the country, the infrastructure build to help subsidize that.

And then there’s a lot of times where a customer could use either PVC conduit or HDPE, I could get into the details of why there’s different preferences. But as we look to put electrical lines underground, so they’re not knockout with storms and so forth, this will play well for both HDPE and PVC markets for us. Source: Q3 2022 Earnings Call Transcript

Not In A Good Place To Be Aggressive

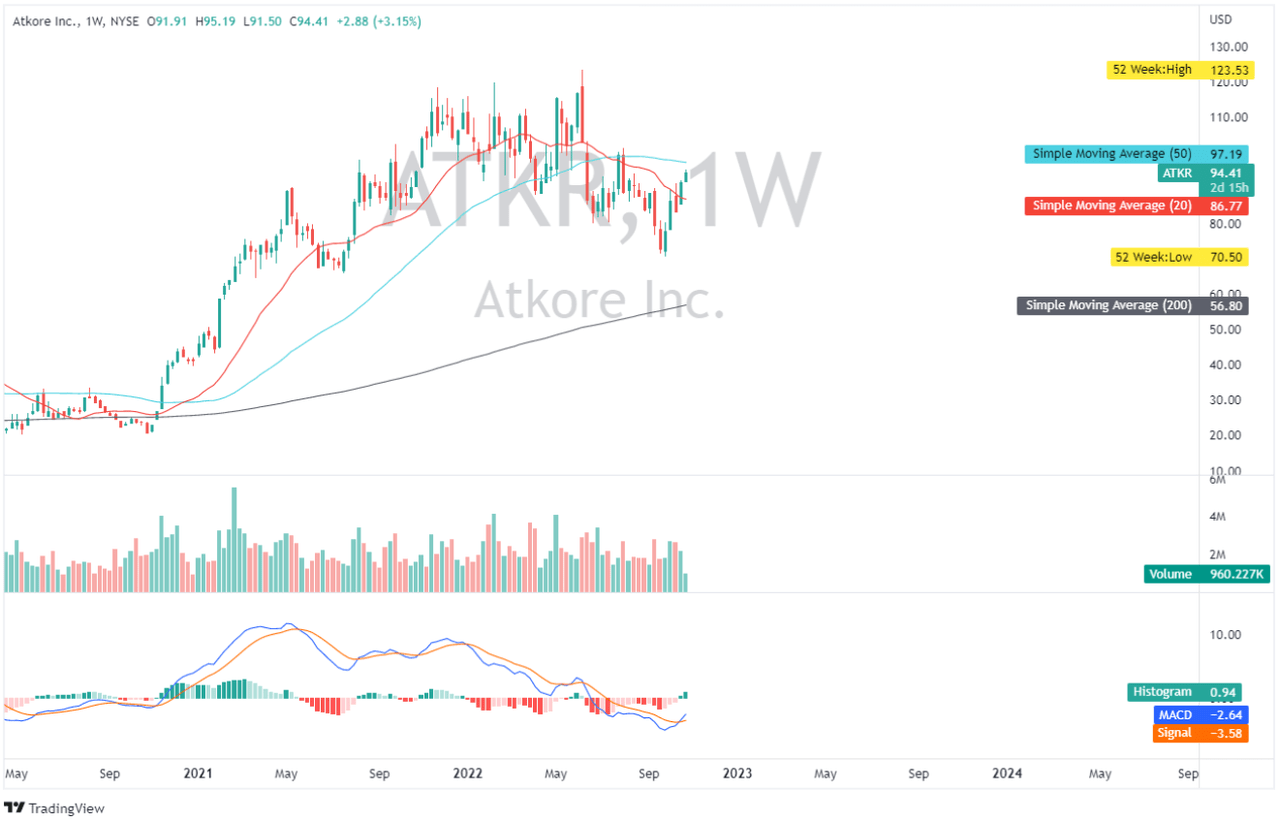

ATKR: Weekly Chart (Source: TradingView.com)

With today’s uncertainty, I believe there is no need to rush to scale in, particularly given ATKR’s weekly chart, which shows its price near its 50-day simple moving average, which may operate as a resistance zone to consider. Looking at its MACD indicator, it has crossed above its signal line, suggesting positive price action, which may lead its price to test its previous swing high of $101.

Concluding Thoughts

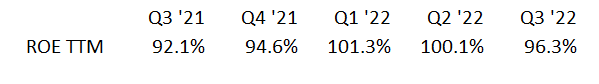

ATKR: Slowing Trailing ROE% Trend (Source: Data from SeekingAlpha. Prepared by the Author)

ATKR ended its Q3 ’22 with a growing ROE of 96.3%, up from its 92.1% recorded in Q3 ’21, however, looking at the image above, it consecutively posted three times a declining ROE which show some early profitability concerns. Despite the negative outlook on its profitability, I believe ATKR remains liquid with its better current ratio of 2.77x compared to its 2.58x 5-year average and improving debt to equity ratio of 0.70x, better than its 3.16x 5-year average.

With no clear outlook, I believe ATKR’s future remains questionable, especially in light of its 2023 and 2024 outlook. However, given the current trend towards the underground electrical cable and the potential growth from its meaningful partnership in the renewable sector, I believe ATKR may have a long run of growth ahead, making this company one to keep an eye on.

Thank you for reading and good luck everyone!

Be the first to comment