Was this guy entering the AFFO estimates? Sergeeva/iStock via Getty Images

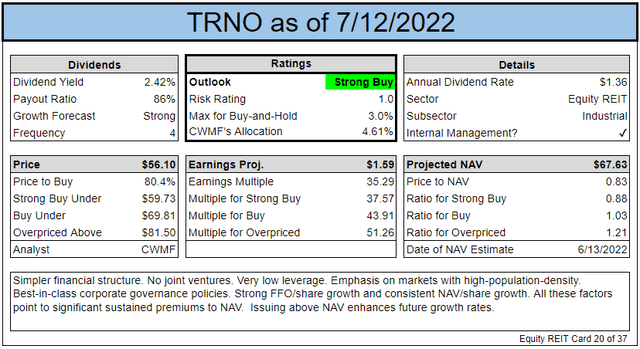

Terreno Realty (NYSE:TRNO) is one of my growth machines. It delivers monstrous leasing spreads, which lead to massive growth in AFFO per share. Some investors complain that the multiple is too high. It isn’t. Not even close. TRNO’s property is leased at vastly below-market rates. During Q2 2022 the cash leasing spreads came in at 55.4%. Combined with Q1 2022, that’s 42.8% year-to-date. I recently posted an update on TRNO for subscribers of The REIT Forum going through all the latest information from the Q2 2022 report.

However, I want to bring another note to all my readers:

- Analysts are underestimating TRNO’s AFFO per share.

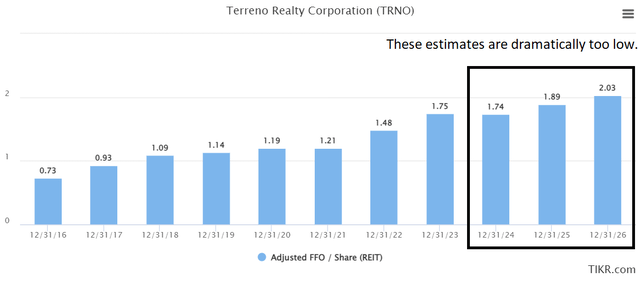

To demonstrate this, I pulled the consensus estimates for TRNO’s AFFO per share. Starting in 2024, the estimates are stupid. Sorry, was that not politically correct? I don’t care. Look at the numbers and tell me if you feel I’m being too harsh:

Pretty clear? In 2024, AFFO per share is not going to drop by $.01. By these estimates, AFFO per share would increase from $1.75 in 2023 (okay, that’s a reasonable estimate) to $2.03 in 2026. That’s only a 5% annualized growth rate. TRNO would achieve the majority of that growth just from escalators built into their leases. They would be near 5% growth if the customers could simply extend leases with 3% escalators, without getting hit by the leasing spreads. Remember those? We’re talking about the leasing spreads where year-to-date TRNO is recording increases greater than 40%.

Without a single lease getting a big bump in those years, TRNO would still achieve a growth rate around that level. What do you think happens when TRNO jacks up the rent by over 40% because supply and demand are severely out of whack? Growth rates go up!

That’s precisely why you see a huge increase in the projected AFFO per share from 2021 to 2022 and again to 2023.

But what about those years from 2018 to 2021 where AFFO per share wasn’t growing fast enough? Well, one issue is that we’re stuck using these consensus figures. If we switch over to using REIT/BASE AFFO (a superior method), the AFFO per share increased by 15% rather than 11%.

However, that’s still not fast for a 3-year period. What else was going on?

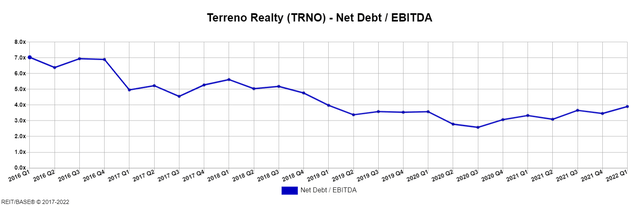

TRNO was aggressively deleveraging:

That dramatic reduction in leverage across those years resulted in an artificially low growth rate for AFFO per share.

That’s how you ended up with a period where growth was relatively low. TRNO has no reason to aggressively reduce leverage today. The current level of leverage is already quite low, especially for an industrial REIT that should see dramatic growth in EBITDA (earnings before interest taxes, depreciation, and amortization) due to massive leasing spreads.

How Do Bad Estimates Exist?

The consensus estimate is built by averaging the available estimates. If the analysts with more expertise didn’t plug in estimates beyond 2023, then the consensus estimate could become severely flawed. This is a significant risk factor for investors who want to rely on using earnings growth estimates in picking stocks.

Conclusion

TRNO is a great deal. Shares are underpriced. The consensus estimates for 2024 through 2026 are much too low. Think I’m wrong? Leave a comment with your estimate, then set an alarm on your phone to return here in 3 years so you can quietly delete it.

It’s time to try our service.

Don’t make me write longer advertisements. I hate advertising. Read the reviews. See the happy customers. The customers who improved their investing. That’s all the advertising any analyst should need. Click the link to get your two-week trial. Unlike Netflix, I’m not jacking up prices, removing content, restricting device usage, or making my paid customers listen to advertisements.

Don’t make me write longer advertisements. I hate advertising. Read the reviews. See the happy customers. The customers who improved their investing. That’s all the advertising any analyst should need. Click the link to get your two-week trial. Unlike Netflix, I’m not jacking up prices, removing content, restricting device usage, or making my paid customers listen to advertisements.

You can even access our service from any country with internet service. It’s part of our revolutionary strategy called: “We value our customers”. Brilliant!

Be the first to comment