metamorworks

Investment Thesis

Unity Software (NYSE:U) announces its merger with ironSource (IS). I don’t believe this will be a significant driver for Unity’s shareholders.

The merger comes under the premise that Unity and ironSource together will be able to have the best games backed by a compelling user acquisition platform.

However, not only was ironSource struggling for growth itself, but this acquisition only sought to distract Unity’s shareholders over the fact that Unity is no longer a hyper-growth company.

Accordingly, if Unity is not a hyper-growth company it should not be valued as richly as it is, even now.

Unity’s Revenue Growth Rates Slow Down

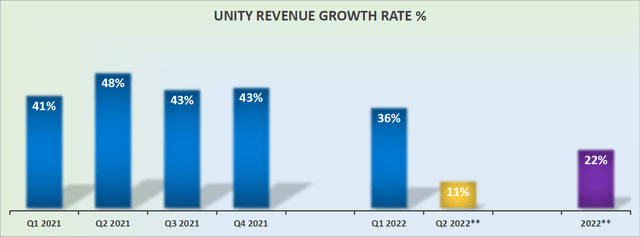

In the first instance, let’s turn our focus toward the core Unity business. Unity has consistently highlighted to investors throughout its earnings call that it would grow its revenues at a 30% CAGR,

As we’ve said before, we expect to grow revenue above 30% for the long-term.

That quote is from its Q4 2021 earnings call, but there have been countless other references.

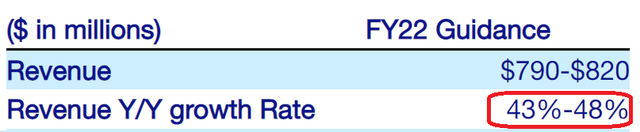

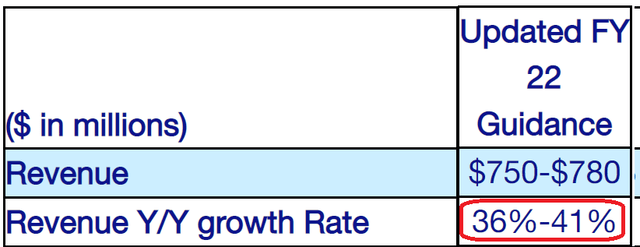

However, yesterday, we now get evidence that this is no longer the case, as Unity updates investors on its full-year outlook.

Unity is a business that had a lot of jazz in the year of its IPO, with much promise over its dominance over the creative content industry, combined with sustained +30% CAGR growth over the long term.

But as time has unfolded, the business appears to be struggling to deliver against investors’ expectations, with its latest guidance of full year 2022 downgrade being the latest evidence of its slowing trajectory.

Naturally, the obvious question is now what sort of sustainable growth rate can we expect from the core business once Unity exits this year? Is Unity likely to sustain a mid-20s% CAGR? Or is Unity actually likely to see sub-20% CAGR growth into 2023?

Next, we’ll turn our focus to what ironSource brings to Unity.

Unity’s Acquisition Of ironSource

Unity is a leading platform for creating and operating interactive, real-time 3D content.

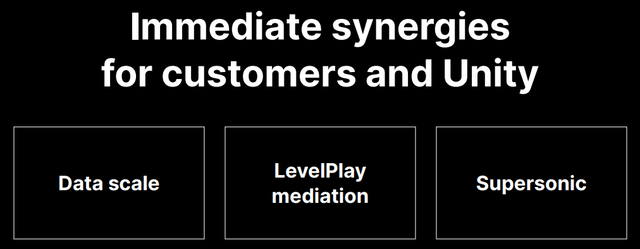

While ironSource is a mobile gaming app enablement platform. ironSource provides gaming infrastructure and product development tools, so developers can monetize and analyze their apps. ironSource allows developers to turn their apps into businesses that can scale.

The two businesses combined will be much less about Unity’s creation platform and increasingly focused on performance-based advertising revenues. Over time, the business will become half creation and half ad-related.

Undoubtedly, ironSource’s crown jewel is its Supersonic publishing engine. Supersonic allows developers to get their apps to become more discoverable. This is the essence of what ironSource brings to Unity.

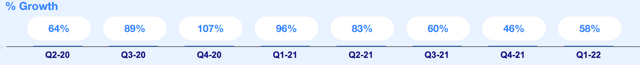

ironSource’s Q1 2022 presentation

However, as you can see above, ironSource was clearly growing a lot faster than Unity. That being said, looking ahead, there was every indication that ironSource’s revenue growth rates were rapidly fizzling out too.

As you can see above, its guidance for 2022 when it reported its Q4 2021 results was over circa 45% y/y growth.

Then, 90 days later, when ironSource reported its Q1 2022 results, its full-year guidance dropped to approximately 39% y/y revenue growth a 600 basis point deceleration in a very short period of time.

The Combined Business Will Be Far From Profitable

Unity and ironSource together will be making $1 billion of EBITDA by 2024. That means that it’s not next year, but even the year after that.

From the investor’s perspective, when the market is particularly short-term oriented right now, this is a very long time to wait for such meager profitability.

To illustrate, for Q1 2022, Unity’s stock-based compensation reached $103 million. If we were to annualize this, we get to +$400 million for 2022.

Plus, keep in mind that ironSource’s stock-based compensation for the trailing twelve months reached $86 million. By my estimates, looking ahead ironSource is likely to reach $100 million of EBITDA over the next twelve months.

Hence, the two businesses’ combined EBITDA in 2022 is likely in my estimation to reach $500 million.

Consequently, the two together, before any capitalization of intangibles and amortization and other pesky add-backs to its EBITDA line, but just from stock-based compensation, nearly 50% of the targetted $1 billion of EBITDA is simply compensation going to the combined companies’ management team.

However, keep in mind that over the next two years, we can be absolutely sure that the level of stock-based compensation will continue to increase.

To illustrate my argument, consider the following. Unity’s stock-based compensation was up 61% y/y as of Q1 2022, even though its revenues were only up 36% y/y. A huge discrepancy between what management is getting paid in stock-based compensation and what shareholders are getting.

My point is thus, there’s every indication that Unity’s combined stock based compensation will be higher than $500 million I estimate for 2022, by 2024.

Altogether, I wouldn’t be surprised to if more than 55% of its 2024 targetted EBITDA ends up being stock-based compensation alone.

U Stock Valuation – Overvalued

If investors look out into the next two years, they’ll get $1 billion of EBITDA. Yet, I make the case that this EBITDA carries less than $400 million of actual ”profitability”.

There was a time when profits didn’t matter. But throughout 2022, investors are increasingly questioning what sort of clean profitability businesses make.

Paying 15x two years forward’ adjusted EBITDA for Unity makes this stock meaningfully overvalued.

The Bottom Line

The two businesses were struggling for growth. This is the reality of the situation. The two companies are coming together under the premise that they will be stronger together.

However, I fail to see how this is the case. From a valuation point of view, Unity remains overvalued relative to its near-term prospects.

Be the first to comment