Jose Martinez Calderon

While the biggest story in the financial markets yesterday was undoubtedly the June inflation print of 9.1%, there was another story in the crypto market that was largely ignored by many of the traditional financial media outlets. Disney (DIS) just announced the latest participants in its Accelerator program and Polygon (MATIC-USD) was one of the selected companies. I think this is a fairly big deal and the crypto market action yesterday seems to indicate that many others agree.

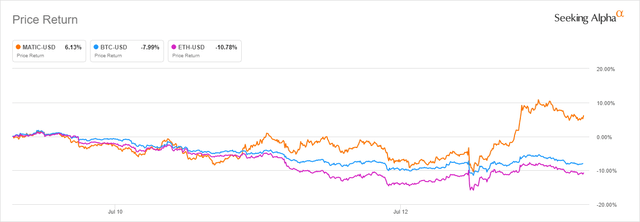

5 Day Performance (Seeking Alpha)

Despite a highly negative reaction to the CPI number more broadly speaking, MATIC has seen a nice run over the last 24 hours and has enjoyed some separation from top dogs like Bitcoin (BTC-USD) and Ethereum (ETH-USD) since the Disney announcement. While I think it’s probably likely that the gain in MATIC could get faded if the broad market continues to struggle, since my last article about Polygon was five months ago, I think the Disney news is a big enough catalyst to revisit the Polygon thesis.

What is the Disney Accelerator program?

Simply put, Disney’s Accelerator program is a months-long brainstorming session for growth-stage companies that have an innovative vision for the entertainment industry. The teams that are selected to join the program get access to a co-working space in Los Angeles where they can collaborate on new ideas during the summer. Following this summer period of idea-sharing, the companies in the program present what they’ve come up with in October during what is called “Demo Day.” This is how Disney describes the goal of the program:

Through the Disney Accelerator, select companies will gain access to the range of creative expertise and resources of The Walt Disney Company to help them develop new entertainment experiences and products.

In addition to the co-working space, the companies that get into the Accelerator program get capital for investment and access to Disney executives and entrepreneurs for support and guidance. The two most well-known success stories from the program in the past are probably Epic Games and Kahoot!. It’s an interesting program, and I think it’s a big deal that Polygon was selected.

Who will Polygon be collaborating with?

The other companies that will be working with Polygon in this year’s Accelerator program are interesting because they all seem to share a Web 3/Metaverse type of product set. Here’s the list of the five other companies with a brief explainer of what they are:

- Flickplay – social media app with NFT/AR components

- Inworld – AI character-based gaming/metaverse experiences

- Lockerverse: Web3 creator platform

- Obsess: virtual 3D store builder

- Red 6: AR headset company

Right off the bat, Flickplay looks like an obvious potential collaborator because of the NFT aspects of the platform. That said, I think this is a well-curated group that could potentially have quite a bit of synergy in creating an innovative product for Disney. In my opinion, businesses that have content and collectible segments are probably going to be among the biggest winners in the Web 3 space, and a company like Disney has arguably the most valuable content IP library in the entire media space. I think the selection of Polygon and these other five companies is a clear indication that Disney is thinking about much more than just growing a streaming business for incremental revenue.

Polygon’s Network Activity

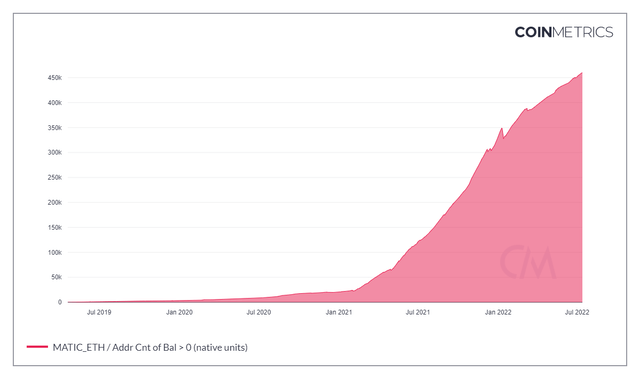

From a raw network activity standpoint, I think we’re seeing decent metrics across the board in the on-chain data. For starters, wallets with non-zero balances continue to move higher.

Year to date, we’ve seen a 39% increase in non-zero wallet addresses from a little under 332k addresses to over 460k addresses now. This has no doubt been driven at least partly by the NFT activity happening on Polygon.

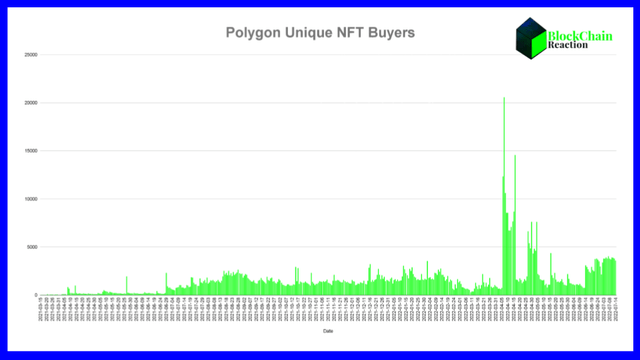

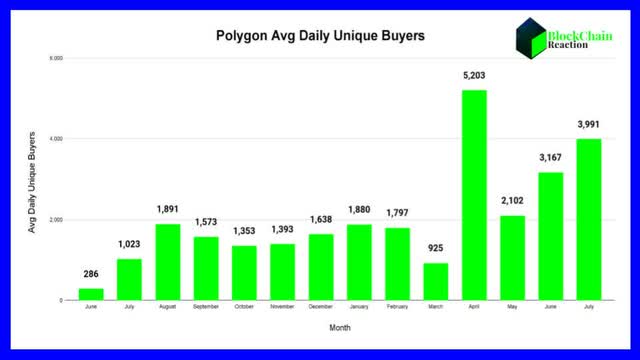

According to Cryptoslam, there have been at least 3,000 unique NFT buyers on the Polygon network 34 of the last 43 days. That’s the largest stretch of unique buyers of that magnitude since the chain launched. We can really get a sense of the performance over the last two months by showing this data reflected as monthly averages. Below is the average daily unique buyers by month.

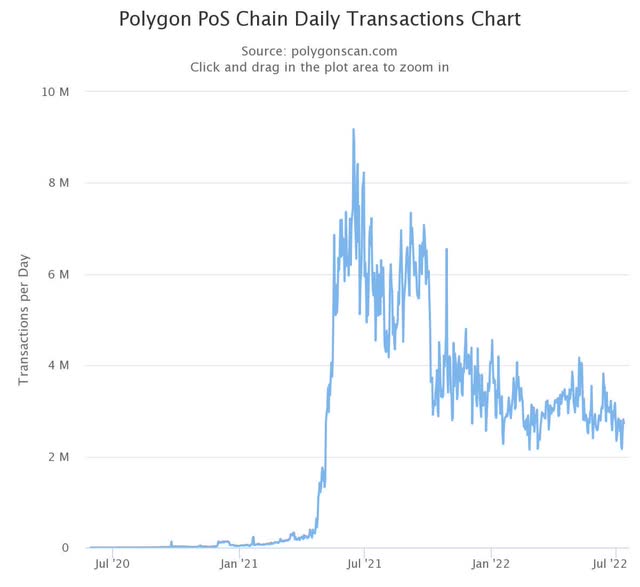

April is a clear outlier month that is likely skewed by a high-demand project or mint. With that as an exception, the growth over the last two months has been tremendous. The June average was up nearly double the average in December and more than 10 times the average from June 2021. Considering the crypto market has broadly been collapsing over the last couple of months, the network activity despite the doomy-looking price optics should be a good sign that this NFT buying via Polygon is a reflection of sustainable network adoption. That said, that’s just the NFT aspect of the network. The total daily transactions are down year to date.

Purely from a network transactions standpoint, Polygon has been essentially basing over the last few months with daily transactions generally falling somewhere between 2 million and 4 million each day. While this is well off highs, it’s still significantly ahead of what Ethereum does on a typical day.

Comparison to Peers

My biggest attraction to Polygon back in February was the realization that it was quickly becoming a viable chain for decentralized app developers. In that article, I compared Polygon’s market cap rank to four other Ethereum scaling chains. Those layer 2 networks were Loopring (LRC-USD), OMG Network (OMG-USD), Immutable X (IMX-USD), and SKALE Network (SKL-USD).

| Asset/Chain | Symbol | CMC Rank 2/14 | CMC Rank 7/14 |

| Polygon | MATIC | 15 | 15 |

| Loopring | LRC | 69 | 71 |

| OMG Network | OMG | 99 | 113 |

| Immutable X | IMX | 118 | 122 |

| SKALE Network | SKL | 127 | 148 |

Source: CoinMarketCap

To this point, Polygon has held up better than the rest based on CoinMarketCap rank as most of these layer 2s have seen declines since mid-February. From a DeFi perspective, Polygon even holds its own against layer 1 blockchains that are competing with Ethereum directly. Here are the top 10 blockchains ranked by Total Value Locked:

| Rank | Name | Protocols | TVL |

| 1 | Ethereum | 512 | $46.74b |

| 2 | Binance (BNB-USD) | 422 | $6.11b |

| 3 | Tron (TRON-USD) | 10 | $5.7b |

| 4 | Avalanche (AVAX-USD) | 229 | $2.75b |

| 5 | Solana (SOL-USD) | 72 | $2.56b |

| 6 | Polygon | 273 | $1.64b |

| 7 | Cronos (CRO-USD) | 70 | $1.2b |

| 8 | Waves (WAVES-USD) | 5 | $839.36m |

| 9 | Fantom (FTM-USD) | 252 | $819.2m |

| 10 | Arbitrum | 95 | $660.9m |

Source: DeFiLlama

Not only is Polygon the top-ranked layer 2 chain in the top 10, but it also claims the third most protocols building on the network. This would indicate there is an ease of adoption on the developer end in addition to the adoption seen from NFT and DeFi end users.

Risks

Like all things crypto, MATIC has risks. Year over year inflation printed 9.1% for the month of June. There are now some who are calling for a Federal Reserve rate increase of 100 bps. As rates have increased, risk assets have sold off considerably. Recession concerns are a factor as well as a broad economic slowdown might force companies like Disney to position themselves defensively. This could be to the detriment of innovation initiatives like building out blockchain-based products.

Summary

Polygon is a top 5 position in the crypto portfolio that I share with BlockChain Reaction subscribers. I rank it that high because I think it can help facilitate broader blockchain adoption at both the user and developer levels. Polygon is quickly becoming one of the most utilized blockchains in the space. Even after the retreat from daily transaction highs a few months ago, at 2 to 4 million per day, Polygon is handling 2 to 3 times the daily transactions of Ethereum on a daily basis. Finally, I think Polygon’s acceptance into Disney’s Accelerator program has the potential to generate something really special in the foreseeable future. During crypto winter, MATIC is one to add to on weakness.

Be the first to comment