halbergman/E+ via Getty Images

DXPE Is On A Balancing Act

The energy price’s firmness and stability in some economic indicators have been holding DXP Enterprises, Inc.’s (NASDAQ:DXPE) hopes high. An operating margin expansion in Q1 reflects its significant organic sales growth and high margin from the recent acquisitions. Diversification into the countercyclical food, beverage, and transportation-related end markets should help stabilize cash flows in the coming months.

However, supply chain and pricing issues are the economy’s primary challenges. It is unclear at this point how the MRO (Maintenance, Repair, and Overhaul) and wholesale supply companies will scrape through if the recession slows economic activities considerably. High leverage and low cash flow can also question the balance sheet strength as we advance.

The stock is reasonably valued versus its peers at this level. Investors might want to hold it and expect moderate returns in the short term.

The Indicators And Their Implications

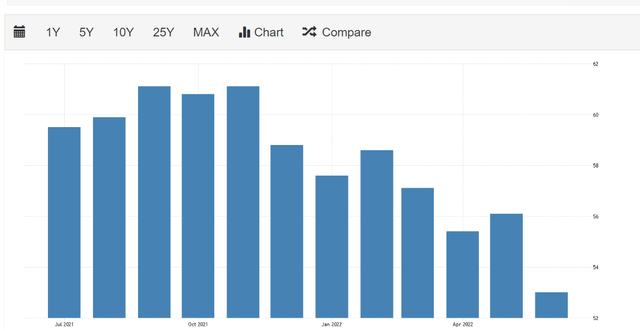

Let us first look at the current business environment. The ISM Manufacturing Prices Index fell to 53 in June from 56.1 in May. Factory activity and new order contracts were low in June. The industrial end markets account for 73% of its business. While the business index has worsened over the past few months, it is still in line with the historical average. Unemployment remains low, and wages increase, but the stress on supply chains and increased gasoline pricing can dent the economic growth engine. Read more about the company’s strategies in my previous article here.

Although business sentiment remained optimistic, supply chain and pricing issues are the economy’s primary challenges. DXPE’s management is not alarmed by the recent fall or the general concern over the rate hike and the resulting recession in the U.S. Instead, the management sees moderate inflation helping the company’s performance while rising interest has a limited financial impact. I, however, slightly differ from this optimistic view and would rather have investors take caution at this juncture, given the uncertainty in the market.

While the industry is a key performance indicator, DXPE also depends on the energy sector (about 27% of its revenues). Upstream capex and production largely determine the energy sector business performance. The energy sector has performed well in 2022. From January to March, its sales per day went up from $4.1 million to $5.8 million. While this also reflects the impacts of price increases from the company’s suppliers, it has positively affected its performance.

The Strategic Focus

At the start of Q2, DXPE acquired Cisco Air Systems. The acquisition added a platform for compressed air and will complement the company’s primary focus markets, including food and beverage and transportation-related end markets. So, its pipeline continues to grow. The company plans to grow inorganically through more acquisitions in 2022. Such acquisitions have enhanced its end markets, margins, and cash flow profile.

The third leg of its strategy is managing pricing effectively to counter the supply chain, dynamics, and inflation. The company’s backlog in the Inventory Pumping Solutions segment in Q1 was comparable to the 2017-level. While balancing growth, the company’s secondary focus is to find opportunities in diverse markets, including biofuels, food and beverage, and water and wastewater. Recently, it acquired Cisco Air Systems – a distributor of air compressors and services related to food & beverage, transportation, and industrial markets. The acquisition should also complement its other APO Pumps & Compressors and Total Equipment acquisitions.

The Q1 Segment Performance Analysis

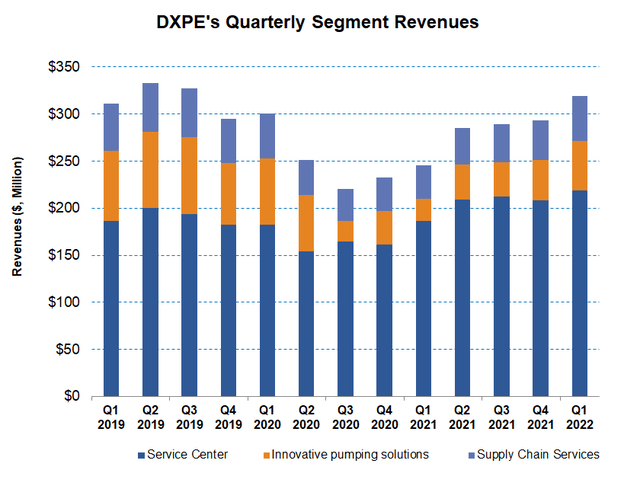

DXPE’s Service Center segment, which accounted for 69% of its Q1 revenues, saw a 5% revenue growth from Q4 2021 to Q1 2022. The growth rate moderated in Q1 after the segment produced stellar performance over the past couple of years during COVID. The demand for maintenance, repair, operating, and production products has dropped in recent months.

DXPE’s IPS segment witnessed a 23% quarter-over-quarter revenue rise in Q1, the highest among the company’s operating segments. While the company manages to keep the topline steady in the legacy products, it seeks opportunities in biofuels, food and beverage, and water and wastewater. Also, the pricing dynamics have become critical given the supply chain

Sequentially, the Supply Chain Services segment revenue increased by 13% in Q1. Increased activity with existing contracts and new contracts led to the revenue rise. However, the segment operating income growth was relatively muted (8.5% up sequentially) because the procurement costs ran high following the inflation.

Margin-level Performance

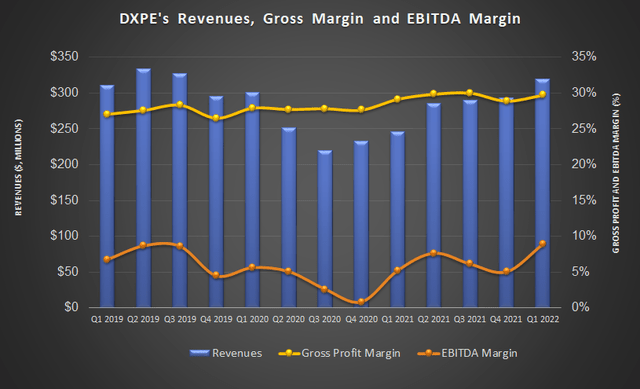

From Q4 2021 to Q1 2022, DXPE’s gross margin inflated by 83 basis points due primarily to the IPS and Service Center’s performance. The EBITDA margin growth was even more impressive (385 basis points up) due to improved operating leverage and significant organic sales growth. The recent acquisitions also added to the margin expansion.

Debt Level And Cash Flows

In Q1 2022, DXPE’s cash flow from operations (or CFO) was down by 69% compared to a year ago. Despite higher revenues, CFO deteriorated due to a significant rise in inventory following the need to manage supply chain shortages and lead times. So, free cash flow dipped in Q1 2022. While working capital as a percentage of sales has remained in line with the past average, it can increase in the coming months, leading to lower FCF.

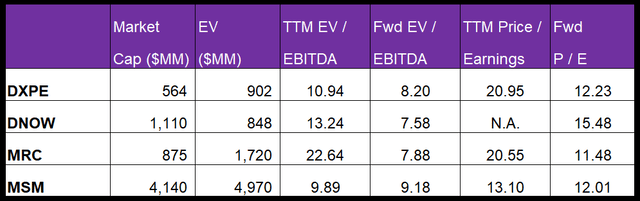

As of March 31, 2022, the company’s cash balance plus the available credit facility was $169 million. Its leverage (0.88x) is higher than its peers’ – NOW Inc. (DNOW), MRC Global (MRC), and MSC Industrial Direct (MSM) – average of 0.48x. With the available liquidity, DXPE does not risk meeting its near-term financial obligations. However, it might want to strengthen FCF generation in the medium-to-long term because of the high leverage.

Linear Regression Based Forecast

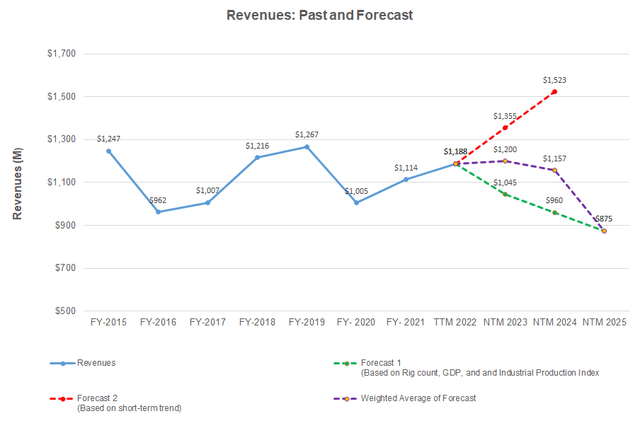

Author created, Seeking Alpha, Baker Hughes, FRED Economic Research, and EIA

A regression equation based on the historical relationship among the U.S. GDP, rig count, Industrial Production Index, and DXPE’s revenues for the past seven years and the previous four-quarters suggests the revenues will remain nearly unchanged in the next twelve months (or NTM) 2023. It will decline mildly in NTM 2024.

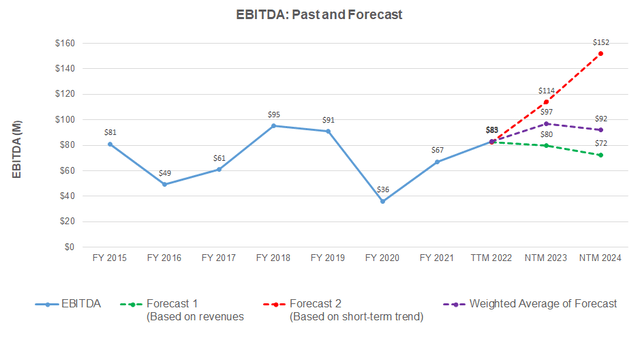

Author Created and Seeking Alpha

Based on a simple regression model using the average forecast revenues, the company’s EBITDA can increase steadily in NTM 2023. However, it can decline in NTM 2024.

Target Price And Relative Valuation

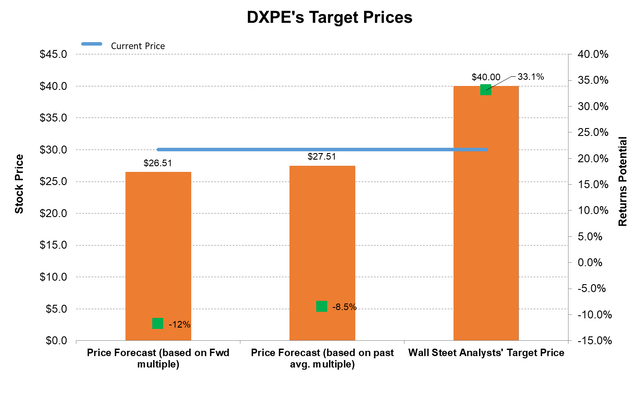

Author Created and Seeking Alpha

Returns potential using the forward multiple (8.2x) is lower (12% downside) than the returns potential using the past average multiple (8% downside). The sell-side analysts, however, expect positive returns (33% upside) from the stock.

DXPE’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less sharp than its peers, which typically results in a lower EV/EBITDA multiple than its peers. The company’s EV/EBITDA multiple (10.9x) is lower than its peers’ average of 14.2x. So, the stock is reasonably valued at the current price.

What Has Changed Since My Last Call?

In my previous iteration, I favored suggesting a buy for the stock. A year ago, I wrote:

“the sentiment remains optimistic but less buoyant compared to the start of Q2. I think the PMI holding steady will keep the performance of industrial suppliers like DXPE resilient. The current index is above the average for the last 12 months and is a positive indicator for FY2021.”

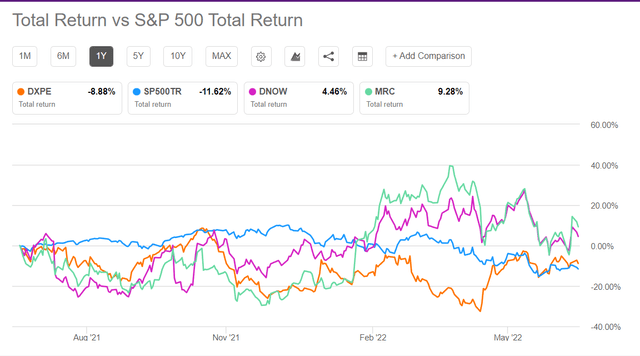

In Q4 2021, rising consumer confidence and energy price stabilization were helping the stock to remain steady and led to an improved outlook for the company in the near-to-medium term. Since then, the stock declined until May as the economy started going through interest rate hike proposals and a slowdown. However, the company currently focuses on food and beverage and transportation-related end markets, which are countercyclical. Also, the energy industry has remained steady due to the demand side sturdiness.

Relative valuation-wise, I now expect the stock to move sedately but do not expect it to decline. These factors have caused me to change my stance on the stock. I also think a soft landing of the economy in the event of gradual rate hikes can make the stock attractive to investors.

What’s The Take On DXPE?

From January through March, DXPE’s sales per day increased considerably, reflecting the impacts of price increases from the company’s suppliers. The company’s gross and operating margin improved markedly in Q1, reflecting its operating performance stability. Opportunities in diverse markets, including biofuels, food and beverage, and water and wastewater, will drive the company in the long term.

However, the demand for maintenance, repair, operating, and production products has dropped recently. Despite the margin expansion, its cash flows fell in Q1. As a result, the stock performed in line with the SPDR S&P 500 Trust ETF (SPY) in the past year. Despite having robust liquidity, its leverage is high. With the culmination of several factors, I think the stock will produce modest returns.

Be the first to comment