Huber & Starke

Unity Software (NYSE:U) received an unexpected acquisition offer today. It came from AppLovin (APP) and it appears to undervalue Unity, even though the business combination seems to make sense from a business perspective.

Background

As I’ve covered in a previous article, I’m bullish over the long term on Unity due to its great position in the mobile gaming sector, being a leader in the gaming development industry given that its game-engine platform is used to develop the majority of the world’s top 1,000 mobile games.

Unity’s software is used to create and operate interactive, real-time 2D and 3D content, being therefore well-placed to benefit from the potential development of the metaverse. However, this may take several years to develop, thus in the short term its business is mainly exposed to mobile gaming.

Its business model is based on its game-engine software, which has highly recurring revenues. Additionally, the platform allows other monetizing solutions, such as in-game advertising, which create further upside to increase total revenue per customer.

Indeed, its platform consists of two sets of solutions, namely its Create and Operate Solutions. In Create, content creators use Unity’s software to develop 2D and 3D games, generating revenue through monthly subscriptions. In Operate, the company offers customers the ability to monetize their content, while Unity generates income from revenue-share and usage-based revenue models.

Despite its strong industry position, Unity continues to invest in business growth both through internal development of its software and external acquisitions. Since my last article, Unity has been on a shopping spree, considering that since last October 2021 it has announced (and completed some) four acquisitions, namely Weta Digital, SyncSketch, Ziva Dynamics and, more recently, ironSource (IS). These acquisitions have been made mainly in advertising technologies used to monetize games, with substantial synergies both in terms of revenue and costs expected over the medium to long term.

Considering Unity’s acquisition background, and its market value of about $15 billion, it was quite surprising to me that Unity received a buy offer from AppLovin, which is a company with a similar market value.

Acquisition Offer

AppLovin submitted an offer to buy Unity in an all-stock deal, valuing Unity at close to $20 billion or at about $58.85 per share when the deal was announced. AppLovin is plunging today more than 10%, while Unity is, as I write this, up by only 2% to around $51 per share. This means that the market reaction was somewhat muted and there is a high chance that Unity’s shareholders will not accept the offer, considering that AppLovin’s offer requires Unity to walk away from its pending acquisition of ironSource and the premium offered is only 18% compared to its share price before the announcement.

Based on the proposal, each Unity share will be exchanged for 1.152 class A voting shares of AppLovin and 0.314 class C non-voting shares (and not listed) of AppLovin, valuing the combined company at some $35 billion enterprise value. If the deal is successful, Unity shareholders will hold some 55% of outstanding shares of the combined company, with the class A shares representing about 49% of the combined firm’s outstanding voting rights.

The merger is expected to generate substantial revenue growth, cash flow and operating synergies, which according to AppLovin, can reach over of $700 million in EBITDA in 2025, with a minimum of around $500 million by 2024.

As a shareholder of Unity, I see the potential synergies as a positive factor of this deal, but on the other hand the possibility of receiving non-listed shares is not particularly attractive to me, while the premium compared to its previous share price close is also somewhat low, as I see upside over the medium to long term being much higher than that.

Like most growth stocks, Unity’s share price has collapsed in recent months as the market corrected from the metaverse hype, and Unity was naturally not immune to this trend. Since its all-time high reached last November, Unity’s shares have declined by about 75%, a move that is justified by a valuation de-rating rather than fundamental issues.

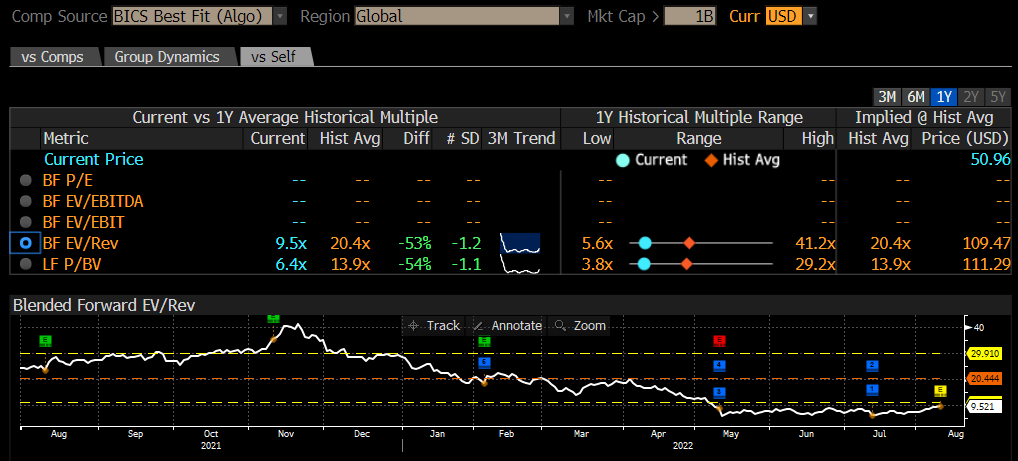

Indeed, as shown in the next graph, Unity was valued on average at some 20x forward revenues over the past year, with a peak valuation of close to 40x forward revenues, while today is valued at about 9.4x forward revenues. This is a strong valuation reset, and AppLovin seems to be making an opportunistic offer at a relatively low valuation without a substantial premium.

Valuation (Bloomberg)

Moreover, considering Unity’s growth prospects the offer also seems to undervalue Unity, given that using roughly the same revenue multiple as Unity is trading today, Unity’s shares can easily double over the next two years as revenues are expected to grow from $1.351 billion in 2022, to more than $2.5 billion by 2025. Therefore, Unity shareholders who accept AppLovin’s offer seem to be exchanging their shares at a low price that doesn’t account for the company’s growth prospects over the medium to long term, even though the business combination may make sense.

As I’ve discussed, Unity has bought several companies over the past few months, enhancing its business profile regarding the monetization of mobile games. AppLovin seems to be a good fit regarding this business strategy, given that its core business is the offer of an integrated platform for customers to grow their mobile apps. Therefore, Unity and AppLovin seem to have complementary business profiles, being a key reason why significant revenue and cost synergies are expected from this business combination.

Regarding its financial profile, while Unity is still unprofitable, AppLovin has generated profits in recent quarters and was able to report a net profit of $35 million in 2021. For 2022, AppLovin is expected to report revenues of around $3.3 billion (vs. $1.35 billion for Unity) and have a net income of around $100 million (vs. an adjusted net loss of $106 million for Unity). Moreover, according to sell-side estimates, Unity is not expected to break-even over the next four years, while on the other hand AppLovin is expected to report profits every year during this period.

This means that the combined company will have a stronger financial profile and higher profitability than Unity on a stand-alone basis, which is a positive change in the current market environment that is clearly penalizing unprofitable companies.

Conclusion

Unity is a high-growth company and its prospects are quite good in its existing business, boosted by gaming and other applications of real-time 3D content. The company has made several acquisitions in recent months to boost its software and app monetizing potential, of which the ironSource deal was the largest one. AppLovin made an unexpected offer to buy Unity, which seems to have high overlap to the ironSource acquisition.

While this business combination may make sense from a strategic perspective, from a financial standpoint, it undervalues Unity and the prospect of receiving unlisted shares is not particularly attractive to Unity shareholders. Considering this, the probability of this deal going through may be somewhat low, explaining why Unity’s share price reaction was muted today.

Investors should note that Unity will report quarterly earnings today after the market close and management is expected to discuss this acquisition, thus Unity’s share price may be especially volatile in the next couple of days.

Be the first to comment