Quick Take

UnitedHealth’s (NYSE:UNH) Optum division is in advanced talks to acquire AbleTo for $470 million, according to a news report.

AbleTo has developed a virtual behavioral health therapy and personal support telehealth service.

With the deal, UNH’s Optum would add an important capability to its suite of offerings.

UNH stock has performed well with other healthcare stocks in the stock market selloff and now economic recession.

Although my DCF indicates it is fully valued, my bias on UNH is Bullish through at least the end of 2020.

Target Company

New York, NY-based AbleTo was founded to provide consumers with behavioral healthcare services delivered remotely via its proprietary platform.

Management is headed by CEO Trip Hofer, who has been with the firm since July 2018 and was previously General Manager at NovoLogix and Vice President of Product Development at CVS Specialty.

Below is an overview video of AbleTo:

Source: AbleTo

The company connects licensed therapists with consumers via either telephone or secure video conference.

Investors have invested at least $46.6 million and include Bain Capital Ventures, Horizon Healthcare Services, HLM Venture Partners, Aetna and .406 Ventures.

Market & Competition

According to a 2019 market research report by IBISWorld, the market for telehealth services in the U.S. will reach an estimated $2.6 billion in 2020. This represents a year-over-year growth rate of 9.2%. Telehealth services will have grown at an estimated average annual rate of 25.2% from 2015 to 2020.

The main drivers for this expected growth are an aging population requiring more health services, increased technology capabilities, and a need for the existing healthcare system to more efficiently deal with larger numbers of patients with chronic conditions.

Major vendors that provide telehealth services include:

- American Well

- Teladoc (NYSE:TDOC)

- CareClix

- Doctor on Demand

- MD Aligne

- MDLIVE

- Specialists on Call

- MeMD

Source: Research Report

Acquisition Terms & Financials

According to the report, Optum is discussing paying $470 million, which represents 10x forward revenues.

If the deal is done for that amount, it would likely represent more than double an aggregate of publicly held company valuations, per an NYU Stern School data set for Healthcare Information and Technology companies, which were trading around a 5x Price/Sales multiple in January 2020.

A review of the firm’s most recently published financial results indicates that, as of March 31, 2020, UNH had $21.6 billion in cash and equivalents and $127.5 billion in total liabilities of which $35.8 billion was long-term debt.

Free cash flow for the twelve months ended March 31, 2020, was $16.2 billion.

In the past 12 months, Optum’s stock price has risen 24.3% vs. the U.S. Healthcare industry’s rise of 16.95 and the U.S. overall market index’s fall of 3.7%, as the UNH chart indicates below:

Source: Simply Wall St.

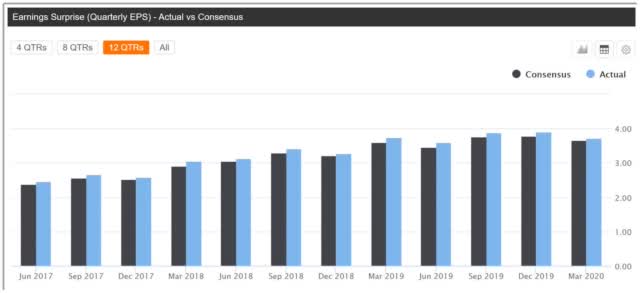

Earnings surprises versus analyst consensus estimates in all twelve of the last twelve quarters, as shown in the chart below:

Source: Seeking Alpha

Valuation Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$273,200,000,000 |

|

Enterprise Value |

$304,980,000,000 |

|

Price / Sales |

1.11 |

|

Enterprise Value / Sales |

1.24 |

|

Enterprise Value / EBITDA |

13.91 |

|

Free Cash Flow [TTM] |

$10,810,000,000 |

|

Revenue Growth Rate |

6.44% |

|

Earnings Per Share [FWD] |

$16.23 |

Source: Company Financials

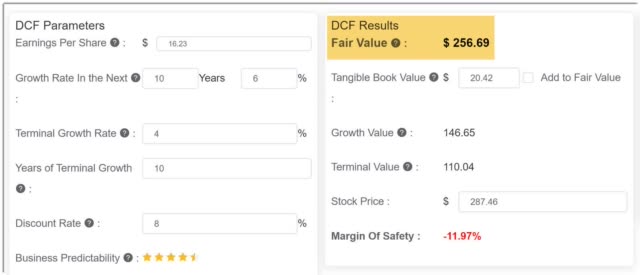

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Assuming the above generous DCF parameters, the firm’s shares would be valued at approximately $257 versus the current price of $287, indicating they are potentially currently fully valued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary

UNH’s Optum division may be acquiring AbleTo add telehealth capabilities to its list of service offerings.

With the COVID-19 pandemic, the need for being able to offer remote services not only fills a need for greater efficiency but also provides customers with services in the comfort and convenience of their own home as well as through the means of their choice, by phone or video.

If the deal is done as the news report indicates, Optum will likely be paying a premium to acquire the system.

Strategically, it appears to make sense. Financially and depending on the deal terms, UNH may be getting AbleTo for less than otherwise, since UNH stock has performed quite well vis a vis the overall market.

As for UNH stock, my DCF indicates it is fully valued at its present level, given generous assumptions.

However, healthcare stocks have performed quite well throughout the market volatility and may continue to do so through the recession, which is expected to be deep and sharp.

My bias would normally be neutral based on the DCF, but given the recession reality and the strong performance of healthcare stocks despite economic tailwinds, my bias on UNH is Bullish.

I research IPOs and technology M&A deals.

Members of my proprietary research service IPO Edge get the latest IPO research, news, market trends, and industry analysis for all U.S. IPOs. Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment