Duncan_Andison

UnitedHealth (NYSE:UNH) is widely regarded as one of the best-run managed healthcare and insurance companies in the country. That distinction has earned the stock a notable premium relative to peers, which may be supported by consistent growth and a strong balance sheet. With the stock trading above $500 per share, investors may be wondering if a stock split is likely. I am of the opinion that the answer is yes for the reasons discussed below.

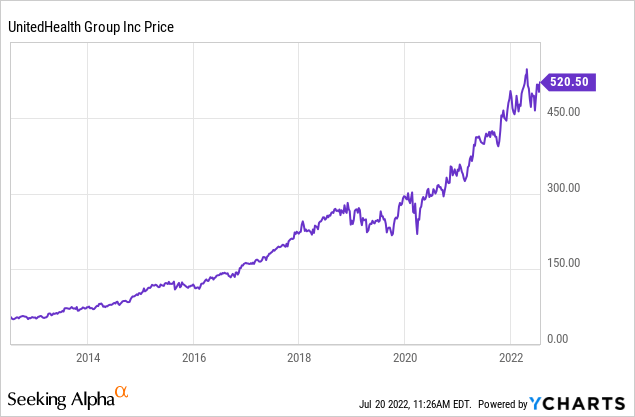

UNH Stock Price

Over the past decade, UNH has delivered 10x returns (including dividends).

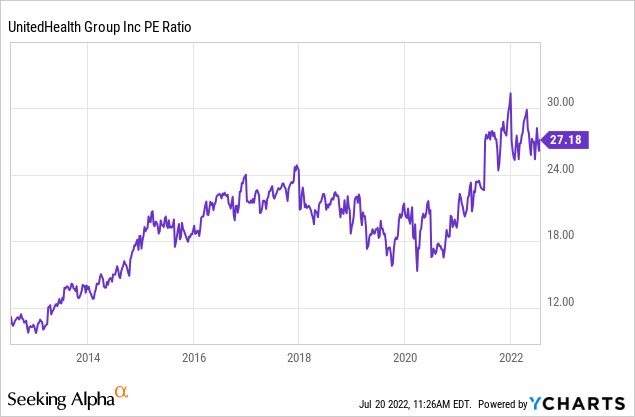

Now trading around $520 per share, UNH is already up 90% from the beginning of 2020 alone. We can see that the outperformance of the past decade was driven, in part, by substantial multiple expansion from the low teens to near 30x as of the present day.

I have a hunch that multiple expansion is not in the cards moving forward – investors should anticipate more modest forward returns.

UNH Stock Key Metrics

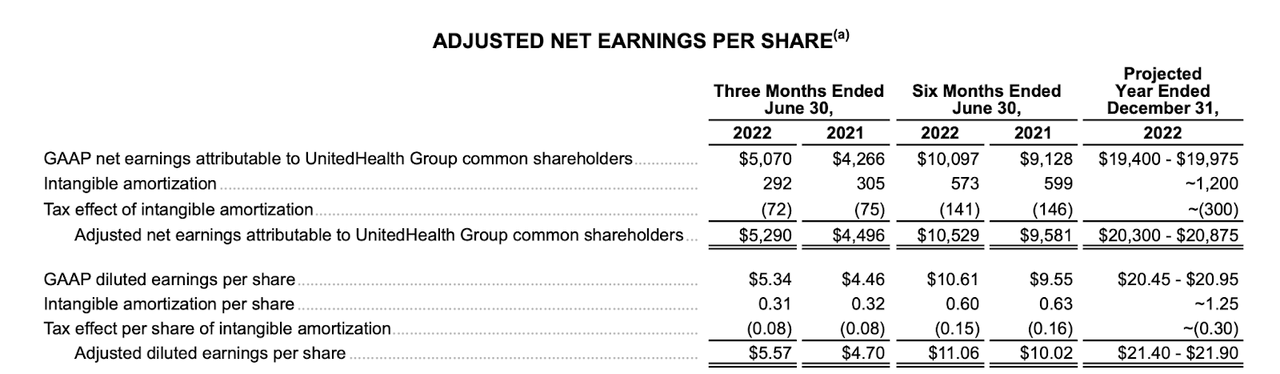

The latest quarter saw much of what investors have come to expect from the company: consistency. Revenues grew 13% to $80.3 billion, but earnings grew faster at 19% due to operating leverage. The operating leverage was driven in part by an improvement in the medical care ratio from 82.8% to 81.5%.

Earnings per share came in at $5.34 and adjusted earnings per share was $5.57. Investors should use adjusted earnings because the main adjustment is backing out non-cash intangible amortization.

2022 Q2 Press Release

The company returned $4 billion to shareholders through dividends and share repurchases and increased the dividend by 14% to $1.65 per share.

As typical for the company, it increased earnings outlook to $21.90 in adjusted earnings per share. The company had previously increased that outlook to $21.70 in adjusted earnings per share in the previous quarter, which itself was already an increase from the initial $21.60 per share outlook given in the fourth quarter.

UNH had $70.8 billion between cash and long-term investments versus $76.2 billion split between medical costs payable and long-term debt.

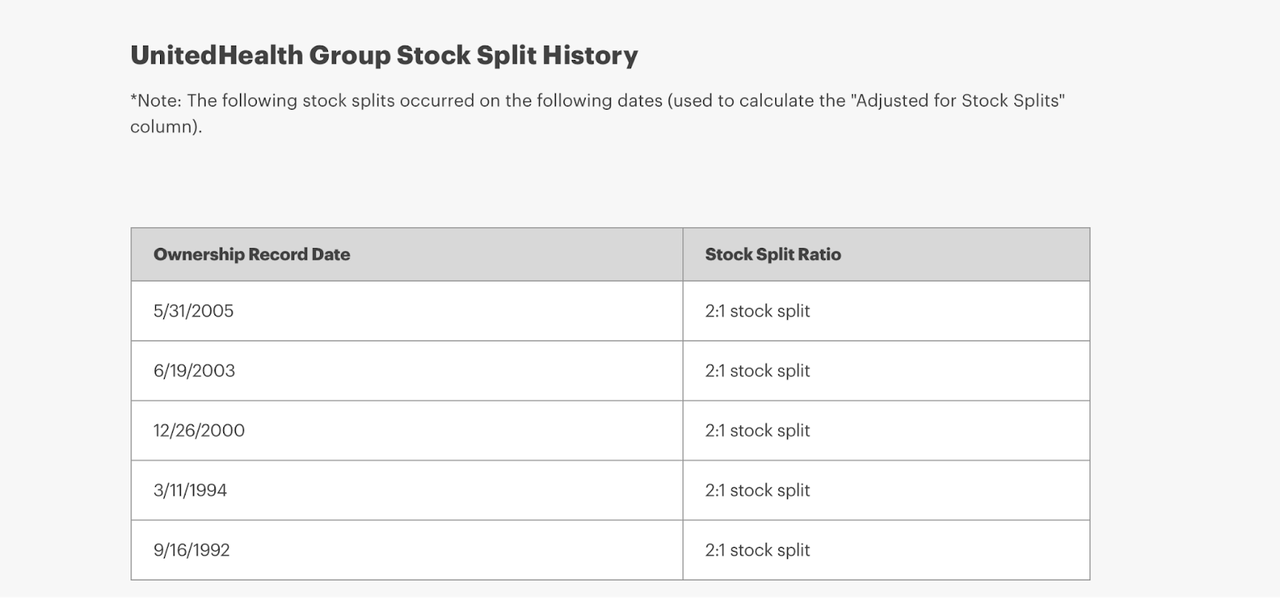

When Was The Last Time UNH Stock Split?

UNH last split in 2005 when it did a 2-for-1 stock split. The company has done 5 splits in total.

UnitedHealth Investor Relations

Is UnitedHealth Stock Likely To Split Again?

In the days prior to the most recent stock splits, the stock traded around $100 per share – far lower than current prices. What’s more, with the stock trading near 30x earnings, I would not be surprised if the company utilized the stock split as a catalyst for future upside, as valuations are arguably quite full. For reference, Cigna (CI) is trading at only 12x forward earnings. While stock splits do not create any fundamental value, there is the perception that it can lead to outperformance due to the increased liquidity.

What Is UNH Stock’s Long-Term Outlook?

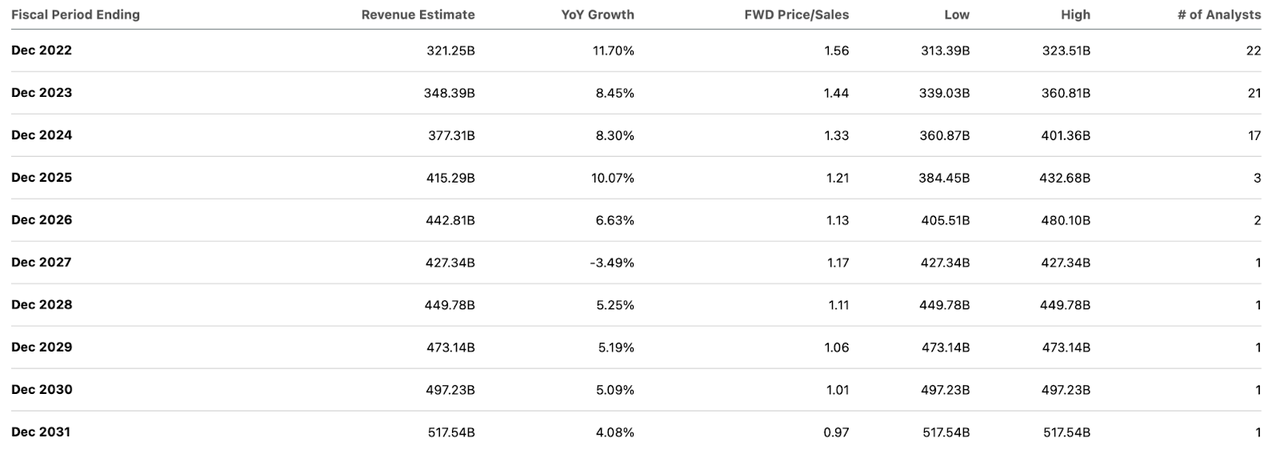

UNH is expected to sustain high single-digit revenue growth over the next decade. That outlook makes sense considering that UNH should grow in line with a growing workforce.

Seeking Alpha

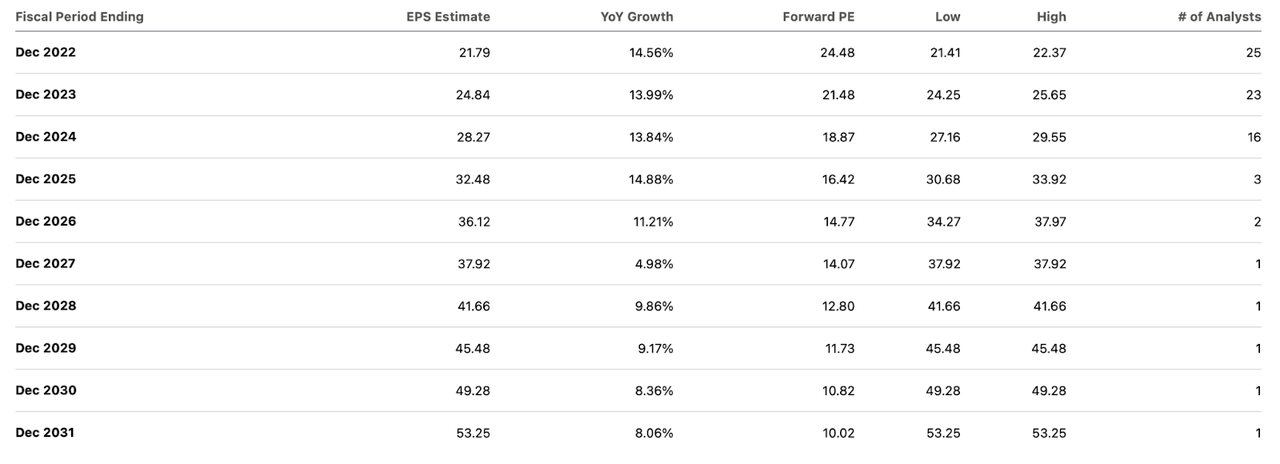

That revenue growth is expected to lead to double-digit earnings growth due to operating leverage.

Seeking Alpha

While UNH’s earnings multiple is quite rich, it has an attractive earnings growth outlook, with consensus estimates that look quite reasonable.

Is UNH Stock A Buy, Sell, Or Hold?

My view with UNH is that over the long term, its growth rates should eventually fall in line with peers like CI or Elevance Health (ELV) (formerly known as ‘Anthem’). CI trades at 12x earnings and ELV trades at 17x earnings. Sure, one could argue that UNH deserves some premium to CI due to the faster growth and stronger balance sheet, but ELV is generating comparable growth rates and arguably has a stronger balance sheet. I could see UNH eventually see its earnings multiple compress to the 12x to 15x range based on the long-term 4% to 5% revenue growth rate. That means that the stock might experience considerable multiple compression over time whereas its peers CI and ELV might not. UNH has an attractive capital allocation policy of returning cash to shareholders through dividends and share repurchases and can lever up its balance sheet over time, but both CI and ELV are also returning cash to shareholders. The relative premium to peers is too rich, leading me to rate UNH as a “hold” with a strong preference for the cheaper peers.

Be the first to comment