FatCamera

Investors in defensive sectors have done much better than the broader market this year. Given the trillions of dollars of wealth that have evaporated in equities in 2022, defensive outperformance makes sense. One of the names that has benefited from this is healthcare giant UnitedHealth (NYSE:UNH), which has been an outstanding stock over just about any time period. The last decade has seen the stock almost 10X as the company is extremely well managed in a space that continues to grow organically every year.

However, the near-term outlook for the stock is murky following Q3 earnings, and below, we’ll take a look at why I’m a bit cautious on UNH following its most recent report.

The last time I covered the stock was about a year ago, and at the time, I was neutral on it, noting the high valuation. Of course, at that time I had no idea we were four months away from a nasty bear market that would see money flood into defensive areas, so UNH has outperformed nicely since then. That trade looks a bit long in the tooth to me, so I’m not sure betting on that continuing is prudent.

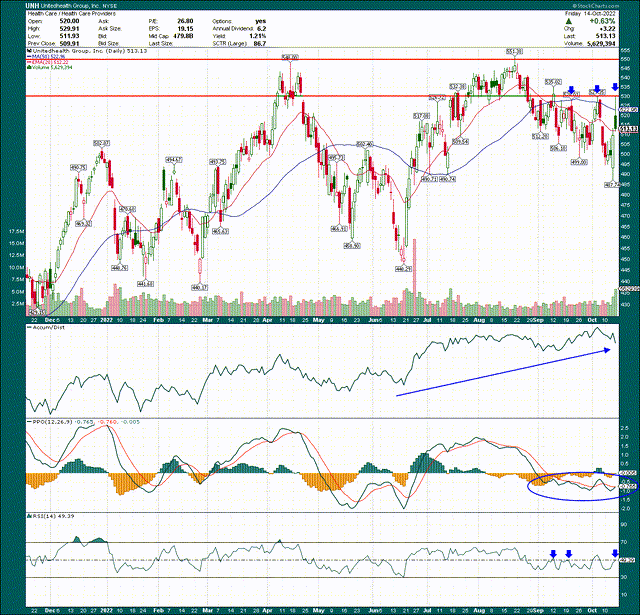

A messy chart, and resistance overhead

Let’s start with a daily chart, which shows the initial pop from the earnings release of about 3% quickly faded throughout the day. That on its own isn’t a great look, but check out where the initial pop failed; right at recent price resistance.

There’s a zone of congestion around $530 that UNH reached on Friday, only to immediately fail and decline about 3% into the close. The way I’m viewing this is that if a great earnings report (and guidance boost) isn’t enough to get through resistance, I’m not sure what is.

You can see we have lower lows in place for the past couple of months while the $530 area has held fast. That increases the odds of a low retest, and given the momentum picture, that’s what I’m expecting to see.

The accumulation/distribution line looks great, but that’s about where the good news ends. The PPO has been in negative territory for about six weeks, and showing no signs of life. And the 14-day RSI keeps failing at the centerline, meaning there’s simply not enough bullish momentum on either time frame to move this stock higher. Given this, combined with the resistance that has proven so difficult to get through, I think we’re more likely to see a retest of the recent lows than a breakout over $530.

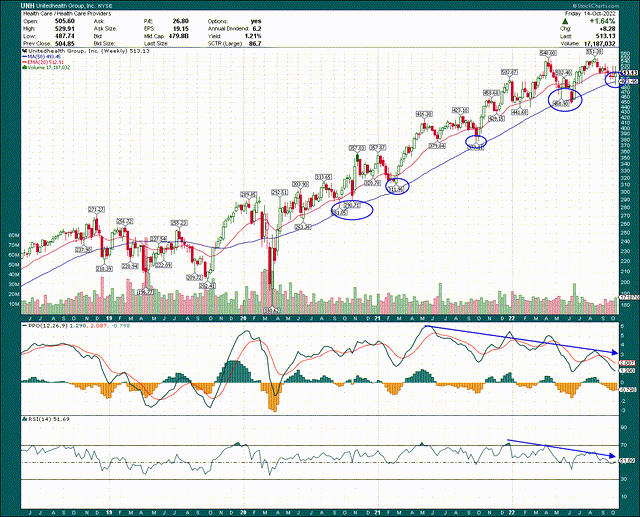

Let’s briefly look at the longer weekly time frame as well, because I don’t see a lot of support for the bulls there, either.

We’ll keep this one simple. I’ve circled 50-week moving average tests that have occurred since COVID, and each has been successful in generating a meaningful rally. That test happened again last week, but given the messy daily chart, I’m not sure this one is going to produce the same bounce. In addition, the momentum picture on the weekly chart is pretty ugly, with a massive negative divergence being put in place on the PPO and 14-week RSI. In essence, price keeps making new highs without any sort of confirmation from momentum, indicating the velocity of each rally continues to wane. That is no guarantee, but can often portend the end of a bullish phase. Time will tell but this doesn’t look overly bullish to me.

Another great earnings report

Anyone that has followed UNH for any period of time knows that this company delivers. It doesn’t seem to matter how high analysts set their targets, UNH finds a way to exceed them. Management is pretty famous for providing guidance that can fairly easily be beaten, so guidance raises are normal for UNH. But even so, it’s Q3 performance is another impressive quarter in a long history of such reports.

Revenue was nearly $81 billion, up 12% year-over-year, and about half a percentage point better than expected by analysts. UNH has a tremendously lucrative mix of business between UnitedHealthcare and Optum where both are generating double-digit top line growth, with Optum leading the way in terms of growth.

The UnitedHealthcare business posted $62 billion in revenue during the quarter, and operating earnings of $3.8 billion. It has also added about 850k customers so far in 2022.

Optum, which is the smaller, but faster-growing of the two, saw 17% top line growth to almost $47 billion, and operating earnings of $3.7 billion. Revenue per customer flew 31% higher in Q3 as UNH continues to invest heavily in the Optum business to bolster growth.

The medical care ratio, which is just a way to measure how much of the company’s premiums are spent on care (lower is better), was 81.6% in Q3, down from 83.0% a year ago. This metric has been all over the place since COVID began, as customers temporarily stopped going to the doctor during the initial phases, causing the medical care ratio to plummet. It has since returned to normalized levels, but it’s still a bit more volatile than normal. It’s critical for profit margins, so keep an eye on it as UNH reports in coming quarters.

Adjusted earnings were up 28% year-over-year to $5.79 per share in Q3, and management boosted EPS guidance for the year slightly. The company is looking for $21.85 to $22.05 now, with those values up 40 cents and 20 cents, respectively, over prior guidance.

Lacking upside catalysts

Before I get into why I think stock looks pretty fully valued here, I’ll reiterate that this business is outstanding. It has one of the best growth records of any company in the market, and it’s in a space that has lots of organic growth potential over time. However, even stocks that fit this description have periods where they need to take a breather, and that’s where I view UNH at the moment.

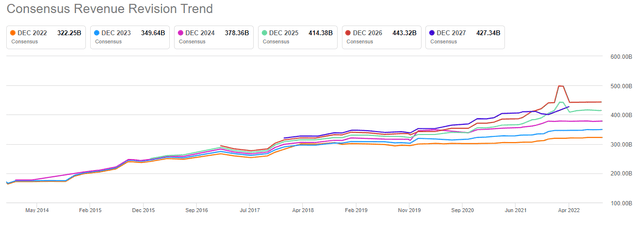

Let’s have a look at revenue revisions to start off.

Over time, these are moving up and to the right, and that’s what you want from any stock you own. However, the revisions we’ve seen have been very small, meaning that while UNH is outperforming expectations, it’s only very slight. There’s high-single digit growth built into these forecasts, and that’s about where UNH has been over the long-term. Optum is growing more quickly than that, but it’s also smaller than the UnitedHealthcare business, so its overall contribution is less.

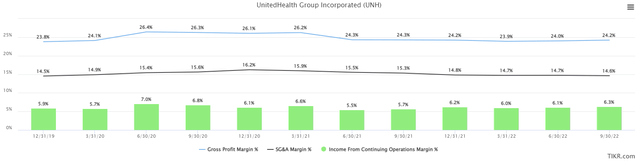

The other thing is that margins are pretty steady for UNH. The company has been managing its costs through COVID, and we can see below there was a spike in profitability when customers initially stopped seeking care. That tailwind is gone, however, and we’re right back where we were in terms of operating profits.

The above is trailing-twelve-months gross margins, SG&A costs, and operating margins to give us an idea of the company’s profitability. On this measure, UNH is typically around 6% of revenue, and that’s where we find it today. That is to say, I don’t see a lot of cause for meaningful margin growth on the horizon, given UNH has grown revenue immensely in the past three years without any sort of meaningful expansion of margins. I’m not sure why that would change going forward.

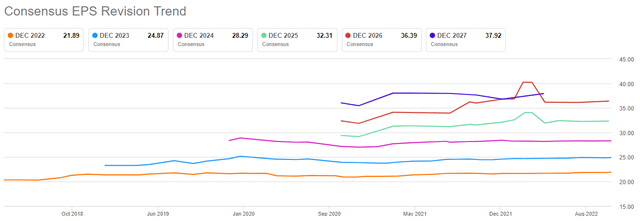

Now, let’s take a look at EPS revisions, because the product of revenue and margin growth is what we see below.

These lines are much flatter than revenue growth in terms of revisions, so we’re not looking at a bunch of upside surprise potential here. There’s ample growth between the lines, with low-double digit growth expected annually for the foreseeable future. That’s a very nice place to be, but it looks priced in.

Speaking of priced in…

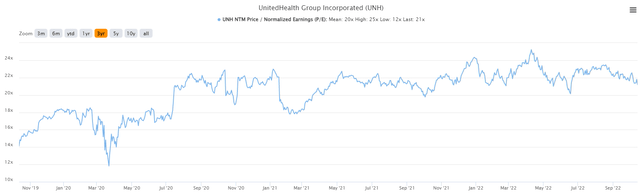

Let’s take a look at the stock’s forward P/E ratio for the past three years to get an idea of how it’s been valued recently.

This period includes the COVID panic low of early-2020, so the average for this period is 20X forward earnings. Since 2021, the stock has traded pretty reliably between 20X and 24X earnings. Today, it’s at 21X forward earnings, so it’s right in the area you’d expect. In other words, it’s not expensive, but I certainly would not say it’s cheap, either.

With that being the case, if we think about the ways a stock could have upside catalysts, I’m not necessarily seeing it here. Earnings revisions have been roughly flat for a long time, margins are flat, and revenue growth is quite predictable. As I said above, I don’t see any of those as being factors for an upside breakout of the $530 area. The valuation is fair today, so I don’t think fundamental buying based upon the valuation is going to do it either.

The Q3 earnings report was great, and another terrific report in a long line of beating and raising guidance for UNH. However, the reaction of the stock was ugly, and I don’t see any reason why a breakout should be expected near-term. For that reason, I’m sticking a hold rating on UNH following Q3 results.

Be the first to comment