Eloi_Omella

Investment Thesis

ReneSola (NYSE:SOL) develops and sells power projects in the US, Canada, Europe, and globally. The company’s share prices have been very turbulent due to the current European energy crisis and inflation. The company has lost approximately 27% over the last year in share prices.

To explain this trend, I’ll refer to the company’s Q2 transcript call.

Yumin Liu,” we are also aware that the current energy crisis and inflation in Europe is causing significant instability in the region, increasing risks of a recession.”

Due to the uncertainty caused by the crisis, European investors are currently hesitant to invest in the traditional energy sector. With green energy on the rise both in the U.S. and Europe, investing in renewable energy is more promising at the moment.

Despite the volatility, the company has been on an upward trajectory since May. Looking at the company’s business environment, I can attribute the promising trend to some tailwinds. For this article, I will focus on the rising price of the power purchase agreement [PPA] and the regulatory environment. In my discussion, I will put the two aspects in the context of the short-run and long-run view of the company’s growth and success.

As mentioned above, I am bullish on the stock due to the good legislative environment, the strong demand for solar, and the soaring prices. I rate the stock a buy because the valuation metrics and the share repurchase program suggest the company is undervalued.

Perspective on the Company’s Near-Term Future

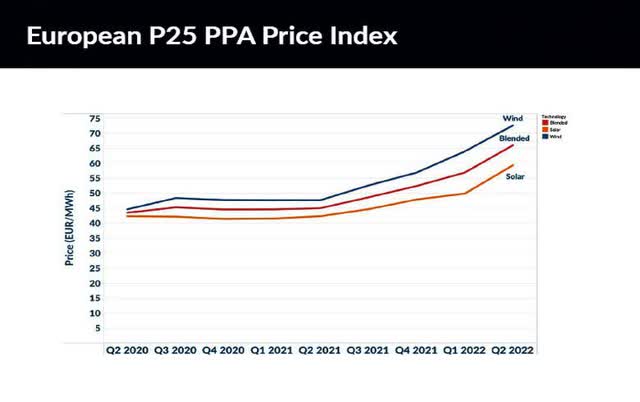

This section will focus on the company’s short-term performance and growth catalyst. To begin with, in the company’s biggest market, Europe, the PPA prices should benefit the company immensely as they remarkably continue to rise. In Q2, PPAs prices for European solar projects climbed by 19% quarter over quarter and by 47% annually.

Solar PPAs are still competitive, even with these price hikes, compared to the much higher wholesale energy price. In June, for instance, the average wholesale price of energy in Poland soared by more than 300%, from over 55 euros per megawatt hour 2 years ago, before the Russian-Ukrainian crisis began. This impending energy crisis drives E.U. energy policies towards energy independence and boosts European renewable energy projects. In the U.S., the company’s second-largest market, there is a similar trend of hiking prices and growing demand for solar PPAs. In Q2, solar prices rose 8% for all U.S. independent system operators.

Bloomberg NEF 2022

Demand rises, which bodes well for the company’s revenues. The company’s revenue should increase due to the new, higher prices and stable or increasing demand.

Shares repurchase Program

The company’s share repurchase program is another near-term growth driver. In Q2, SOL announced the repurchase of 7 million ADS at $6 per ADS totaling U.S.$ 42 million, equivalent to 13.2% of their market cap. The plan shows their commitment to shareholders. The repurchase price gives insight that the stock is trading at a discount, suggesting that potential investors should seize the chance to buy into a good company at a discount. The management’s commitment to shareholders should entice potential investors.

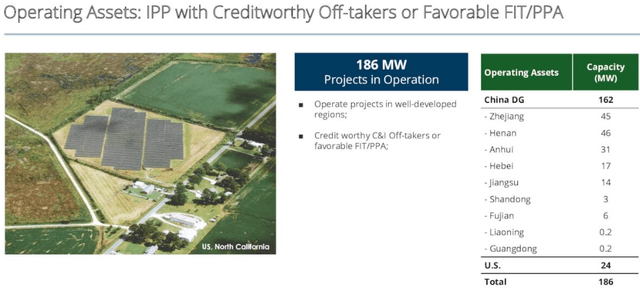

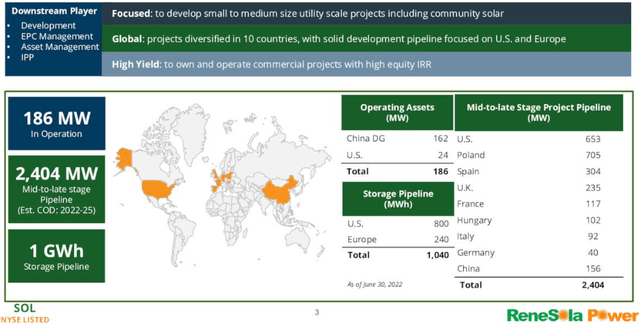

China IPP Assets

Lastly, in the near term, SOL is focusing on the Chinese Independent Power Producer [IPP] Assets which is both a short-term and long-term intervention. The IPP assets are facilities the company owns in China that produce solar energy and sell it to its customers. In Q2, they reported a revenue of $8.2 million, which they primarily attributed to the energy production from their China IPP assets and the product sales in the U.S. Currently, the company is producing a total of 186mw both in China and the U.S. with the most considerable proportion of this capacity in China.

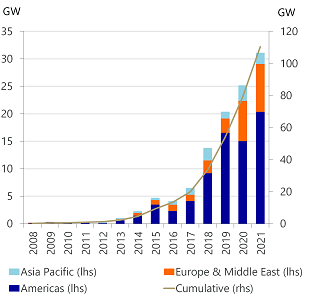

With the demand for solar in China growing and likely surpassing 100 GW, the company will likely reap more in the coming quarters, especially with the completion of more assets currently under construction, which will have a capacity of 156MW, as illustrated under the long run section below. It’s important to note that SOL has an edge in many high-demand emerging markets, such as the E.U., the U.S., and China.

Efforts to Satisfy Demand

To meet rising demand in the solar industry, the company intends to increase output by about 2.4 GW by the end of 2024. SOL achieves this by extending its capacity in other states based on the available prospects.

I am very confident this is feasible because of its liquidity. Currently, the company has $207.9million as cash and zero amount in short-term borrowings. The figures show how easily they can fund their short-term financial obligation developments since they do not pay dividends yet and they have no short-term debts to pay. That leaves them much freedom to support their development projects, explicitly scaling up production through building new facilities. In my view, the company’s short run is a boom, and it’s something the investors should strive to be part of.

Possible Long-Term Success

I find the company’s long run revolving around development and extensive geographical reach. To achieve this goal, the firm is expanding its IPP base in China and seeking M&A across Europe to capitalize on rising solar PPA pricing and a favorable regulatory environment.

The Regulatory Environment

I examine the regulatory environment, which seems key to the company’s long-term success, precisely the inflation reduction act of 2022. SOL is firmly rooted in the U.S., Europe, and China. It is imperative to note the inflation act will have the most significant impact in U.S. China and Europe, too, have suitable regulation environments, which I will discuss.

Yumin Liu,” Further, on the regulatory front, we welcome the passage of the inflation Reduction Act into the law in mid-August which earmarks $369 billion for U.S. energy security and fighting climate change and makes it the biggest investment in clean energy ever made in the U.S. history.”

The Inflation reduction Act of 2022

The Inflation Reduction Act of 2022 [IRA] proposes limiting inflation by cutting the deficit, lowering prescription medicine prices, and investing in domestic and clean energy production. The act was ratified by President Biden on August 16, 2022, after it was passed by the U.S. Congress. As framed, the law will bring in $738 billion and allow $391 billion for energy and climate change investment. The statute constitutes the most significant expenditure in American history to mitigate climate change.

The bill focuses on home energy efficiency to reduce domestic energy costs. Measures include $9 billion in residential energy rebate programs and ten years of consumer tax credits for heat pumps, rooftop solar, high-efficiency electric heating, ventilation, air conditioning, and water heating. Clean energy production receives funding courtesy of the legislation. This funding comprises the $30 billion production tax credit and $10 billion investment tax credit for sustainable energy industries, including solar, wind, and energy storage. In addition to the few positives I’ve highlighted, the legislation provides tax incentives for the green energy revolution, and the solar sector benefits greatly.

I see the bill as a significant boost to the company’s long-term ambition. The act offers consumers incentives to increase solar consumption, tax incentives, and cash to expand the solar sector.

China’s Renewable energy plan

The Chinese government prioritizes investing in renewable energy because it helps the country combat air and water pollution and reduces socioeconomic instability. China’s vast production and consumption potential support its determination to invest in renewables. For these reasons, China has a plan for renewable energy.

According to the source cited above, China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) plan to spend more than $360 billion on developing renewable energy. China’s climate pledge called for 1,200 gigawatts (G.W.) of wind and solar power capacity by 2030 and 25% of energy consumption from non-fossil fuels by 2030. In my view, the Chinese government is committed to supporting renewable energy; therefore, SOL being a player in the country, would benefit from such interventions. For instance, the move to increase solar power means more demand for solar.

The E.U.: REPowerEU Plan

In the wake of Russia’s invasion of Ukraine, the European Commission presented the REPowerEU Plan to make Europe independent from Russian fossil resources long before 2030. The plan has given green energy a central role.

As part of the plan, they have the E.U. solar energy strategy, which will boost the roll-out of photovoltaic energy. This policy seeks to install 320 GW of solar P.V. by 2025, double today’s level, and 600 GW by 2030. In my view, the plan, together with the landmark E.U. solar strategy, will lead to massive growth in the solar sector and thus result in a vast market and demand for SOL and other solar companies to leverage. The European Union [E.U.], like China and the United States, is committed to promoting renewable energy, notably solar power, which is a crucial factor in SOL’s future growth.

Valuation

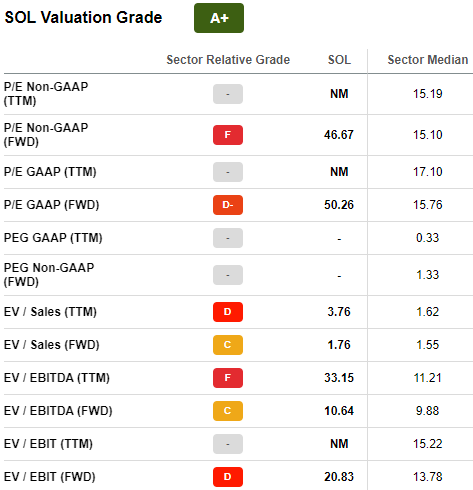

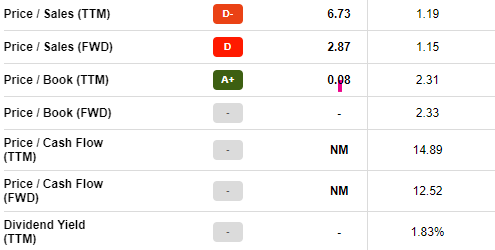

After elaborating on the company’s short- and long-term growth prospects and estimating the share price appreciation, investors can expect a promising future. In terms of price valuation indicators, the company’s price/book [TTM] ratio indicates that it is extremely undervalued. The company has a figure of 0.08 compared to the industry’s median of 2.31, which indicates a discount to its peers of over 95%.

However, the other valuation metrics suggest otherwise, as shown below.

Seeking Alpha Seeking Alpha

The reason for this is that the company hasn’t been around long enough to establish a positive cash flow or positive earnings. These poor financial results are the reason for the negative values for most valuation metrics. Most valuation metrics are negative; therefore, they can’t stand the test of valuation.

When I evaluate the price at which the firm repurchases its shares, I tend to conclude that the company is undervalued. I believe they’re buying shares because they believe the company is undervalued. The worth of the company’s assets justifies a greater valuation and potential future growth. I rate the company a buy because of its future growth and potential undervaluation.

Conclusion

SOL is a promising company for investors looking to diversify their portfolios in the wake of the green energy revolution, specifically in the solar sector.

I rate the company a buy for the following reason;

- First, the current fight against climate change and the rising demand for solar energy will steer the company toward excellent performance.

- I see the supportive legislative environment as a tailwind.

- The valuation metrics and the share repurchase plan suggest the company is undervalued. This valuation offers an opportunity for potential investors to enter the company at a discount.

Be the first to comment