400tmax/iStock Unreleased via Getty Images

NEW YORK (November 26) – United Parcel Service, Inc. (NYSE:UPS) delivered impressive results in a challenging macro environment in yesterday’s earnings report. We believe efficiencies, margin growth, and an attractive PE ratio make it a “buy.”

Top Line

Top line earnings adjusted EPS for 2022Q3 grew to $2.99, up 10.3%, year-on-year. Adjusted operating profits grew 6% on revenues that grew just 4.2%. Volumes declined 1.5%, year-on-year.

The Nitty-Gritty

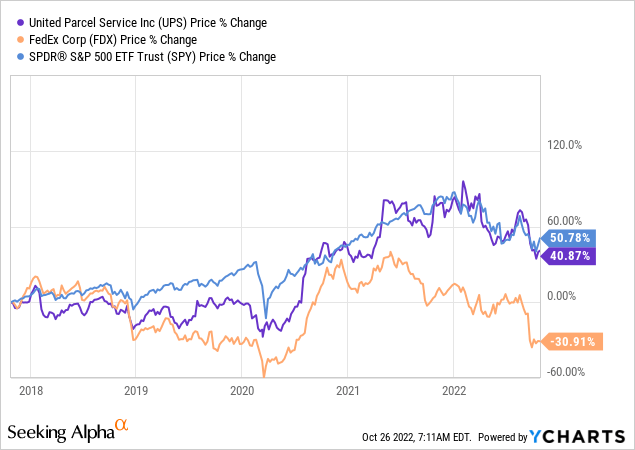

Over the last five years, UPS shares have performed better in terms of its stock price percentage change than its leading competitor, FedEx Corporation (FDX). Both have underperformed the S&P 500, so neither will allow investors to achieve “alpha” that we are all here to seek. But those who wish to invest in the sector should look to UPS over FedEx.

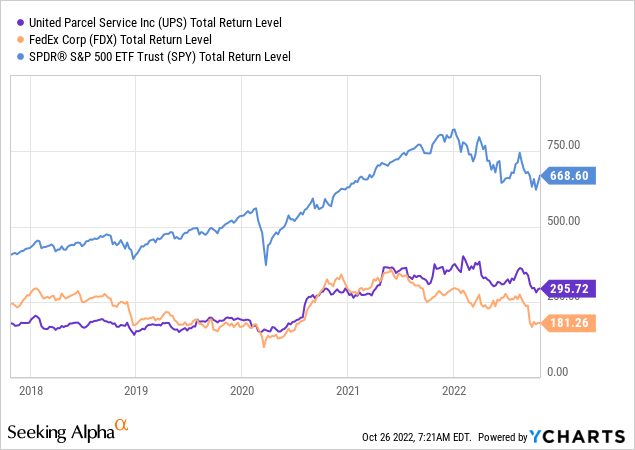

In terms of total returns over five years, UPS also bests in leading competitor.

For this sector — global, U.S.-based, logistics companies — it’s clear that FedEx holds the shareholder advantage.

Other Reasons UPS is a “Buy”

CEO Carol Tome has directed several initiatives are directed at achieving higher free cash flow, via margin growth driven by: (1) efficiencies; and (2) the Bomi acquisition.

- PACKAGE TRACKING: UPS introduced “Smart Package; Smart Facility,” to use RFID tags last year to avoid “misloads,” where a package is put on the wrong truck. In the words of CEO Carol Tome, “That means that it cannot be delivered… It has to come back into the center, go through the sorting process again and get reloaded the next day for delivery.” It had been happening, on average in one in 400 packages. Now, it happens with 1 in 1,000 packages. That’s far far from the “Six Sigma” level Tome claimed (Six Sigma level is 3.4 defects per million), but it still holds potential to improve on-time deliveries and reduce the resource suck of doing something again. It is currently live in 101 facilities. On a larger scale, it will add additional savings.

- DELIVERY DENSITY: This is in very early stages, but seems promising. It allows packages with the same delivery day commitment to the same customer to be consolidated. UPS has joined with drop-shipping company CommerceHub to effect delivery from multiple retailers and create similar efficiencies in the B2B delivery chain.

- COLD CHAIN LOGISTICS: Cold chain logistics, the storage and delivery of items that must be kept cold (or ultracold), such as the Pfizer mRNA vaccine, is perhaps the most challenging element of logistics. It is more costly to maintain and comes at a higher cost. UPS pending acquisition of Bomi, which has markets primarily in Europe and South America. married with UPS efficiencies and innovations, will likely have good results to expand UPS Healthcare’s footprint.

- FORWARD EARNINGS REAFFIRMED: Forward revenues were reaffirmed at $102 billion. with an operating margin of 13.7% and ROIC above 30%. This compares very favorably with FedEx, which warned September 15 that its earnings would not meet expectations.

Enhanced Risks

- The macro environment will continue to be challenging as we experience a global slowdown and, most likely, a recession. This will affect all businesses, but particularly retailers and, consequently, companies like FedEx and UPS.

- Higher interest rates will obviously increase debt and capex costs, the bigger risk is with the UPS pension funds. UPS has a generous benefits package, including a defined-benefit pension plan. As rates go up, both bonds and stocks will obviously be affected. Thankfully, the company is legally obligated to follow Pension Benefit Guaranty Corporation rules. Wise pension managers will use the relative low assumed PBGC assumed rates of returns to avoid riskier investments.

- The Bomi Acquisition carries with it the same risks of any acquisition, with exposure “unknown unknowns.”

- Foreign competition maybe be “sneaking up” on both FedEx and UPS to decrease volumes, along with recession demand destruction. As I reported in my most recent article on FedEx, “SA commenter pg99, who says he lives in Thailand, reports that goods he formerly received from Amazon (AMZN) via FedEx now come via Shunfeng, a Shenzhen, China.”

Summary

For those who wish to participate in U.S.-based, multinational, logistics sector, the clear competitive advantage goes to UPS. It is clearly a better-managed, better-executing company than FedEx.

____________________________

Note: Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be underperforming and include strategies that we would recommend were the companies our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions with respect to such companies here, however, assume the company will not change).

Be the first to comment