PrathanChorruangsak/iStock via Getty Images

I came across United Fire Group, Inc. (NASDAQ:UFCS) while scanning for stocks that are trading near their 52 week high. When the overall markets are very weak (the S&P 500 Index is down 18% YTD) and a stock trades near its 52 week high, it usually means there is something unique happening at the company that is worth investigating.

Upon closer review of the company’s operations and history, I believe United Fire is in the midst of an operating turnaround and would recommend long-term investors accumulate shares ahead of a re-rate opportunity.

Company Overview

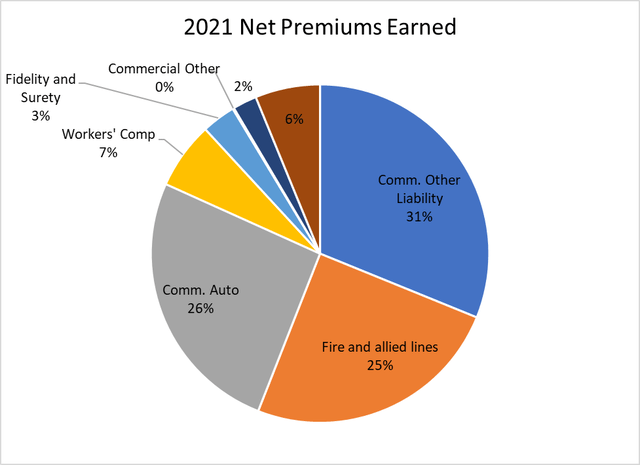

United Fire Group was founded in 1946 and is a small-cap P&C insurer that primarily provides commercial insurance including commercial property, liability, inland marine, workers compensation and other lines through 1,000 independent insurance agents. Commercial insurance accounts for 91% of Net Premiums Earned in 2021, with the single biggest insurance line being Commercial Auto at 26% of NPE (see Figure 1).

Figure 1 – UFCS insurance lines breakdown (author created with data from United Fire’s 2021 10-K)

P&C Insurance 101

P&C Insurance is a very simple (or complex, depending on who you ask) business; the insurer writes a portfolio of policies (Net Premiums Written, NPW) and over time, the insurance premiums are earned (Net Premiums Earned) and a certain percentage of the policies experience “losses” (captured by Loss Ratio). The insurer incurs “expenses” in providing the insurance (captured by Expense Ratio). As long as losses and expenses (captured by Combined ratio) together are less than premiums earned, the insurer has generated an underwriting profit. The insurer can also invest the collected premiums in bonds and equities and earn “investment income”. The combination of underwriting and investment income is the main sources of revenues for most P&C insurers.

The complexity in insurance lies with actuarial assumptions and the pricing of the insurance policies. If the policies are priced too cheaply, the insurer will write lots of business, but that business will be written at a loss (either the frequency or severity of claims assumptions are wrong). If the policies are too expensive, the insurer will not write enough business to justify the infrastructure.

When policies are priced right (underwriting profit), P&C insurance can be a marvelous money-making machine, as customers entrust the company with insurance premiums (float) that the insurer can invest for its own benefit. Berkshire Hathaway (BRK.A) (BRK.B) is a prime example of a well-run insurance conglomerate that has generated enormous wealth for shareholders by following this model (with the caveat of having one of the all-time best investors running the investments).

United Fire Has Had Poor Operating Results

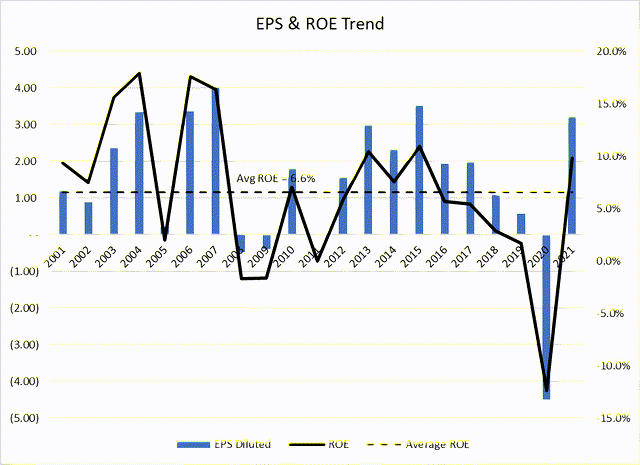

Studying United Fire’s consolidated financials, it is clear that the company has not been well run the last couple of years. Figure 2 depicts the company’s historical EPS and ROE since 2001. While there was a burst of profitability in the early 2000s, on average, ROE has only been 6.6% over the 20 years, and there has been a clear downtrend in earnings from 2015 to 2020.

Figure 2 – United Fire EPS and ROE (author created with data from roic.ai)

This has caused United Fire’s valuation to languish, with its Price-to-Book valuation dropping steadily from 1.25x in 2017 to bottom at just 0.6x at the end of 2020 (Figure 3).

Figure 3 – United Fire Price-to-Book Valuation (tikr)

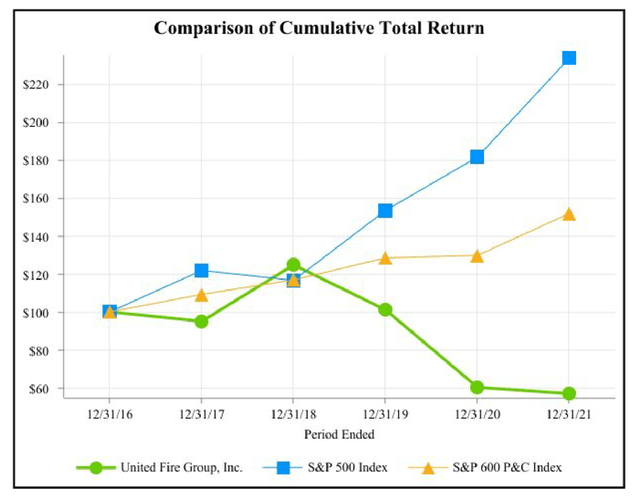

Likewise, United Fire’s poor equity performance has caused it to lag significantly behind the S&P 500 and P&C insurance peers in the past 5 years (Figure 4).

Figure 4 – UFCS has underperformed S&P500 and peers (United Fire’s 2021 10K)

Poor Underwriting Was The Root Cause

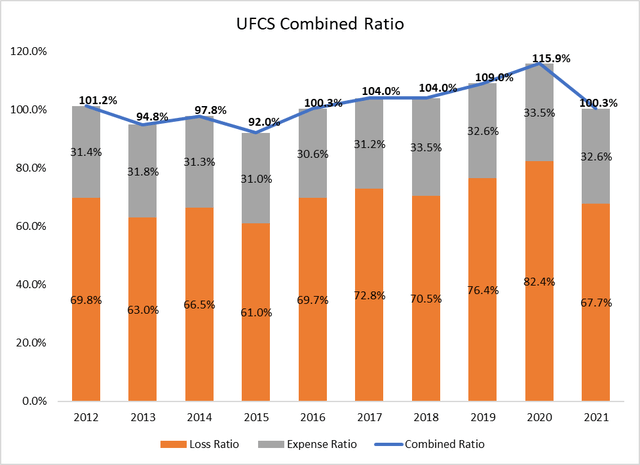

Analyzing United Fire’s operations further, it is clear that the root cause of the weak earnings was poor underwriting. From a combined ratio of 92% in 2015, UFCS’s combined ratio steadily deteriorated, to a high of 116% in 2020 (Figure 5).

Figure 5 – United Fire’s Consolidated Combined Ratio since 2012 (author created with data from United Fire’s 10K filings)

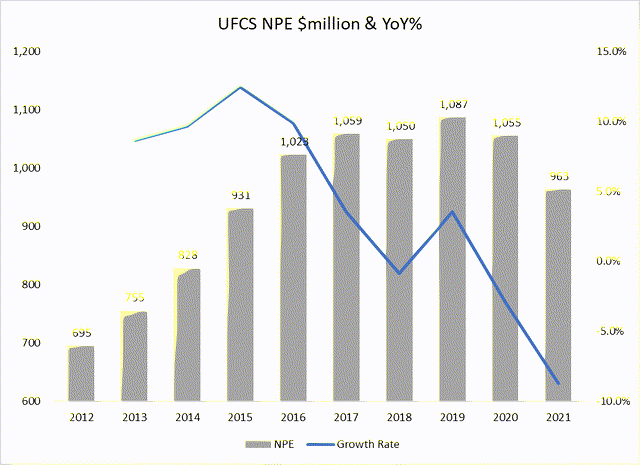

What caused the weak underwriting result? Recall our earlier discussion on insurance basics? I believe United Fire had mispriced its insurance policies, and had grown too quickly by writing policies at a loss. Between 2012 to 2016, NPE grew at a 10% CAGR from $695 million to $1,023 million (Figure 6).

Figure 6 – United Fire NPE and yoy growth rate (author created with data from United Fire’s 10K filings)

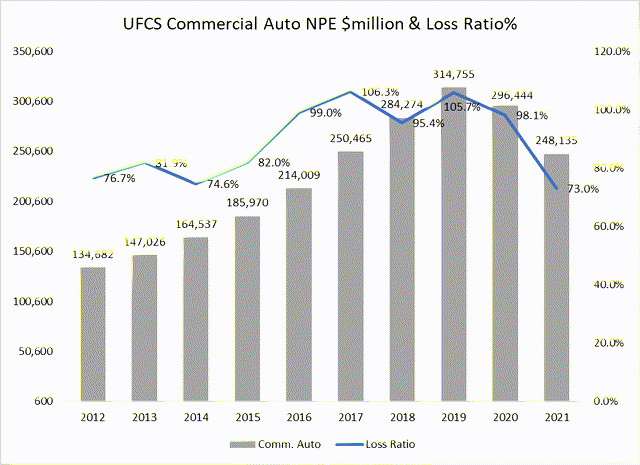

This is especially true in United Fire’s commercial auto business. United Fire’s commercial auto premiums grew from $135 million in 2012 to $315 million in 2019 but the underwriting loss ratio also steadily deteriorated, from 77% to 106%, driving overall underwriting losses for the company (Figure 7).

Figure 7 – UFCS fast growth but poor underwriting in Commercial autos (author created with data from United Fire’s 10-K filings)

Management Turnaround Took Time To Have Effect

To management’s credit, they recognized the issue in the commercial auto business beginning in 2017. UFCS tried to improve the business profitability through

“…more aggressive underwriting and pricing actions, particularly on marginally performing accounts.”

– Quote from United Fire Group’s 2017 Annual Report

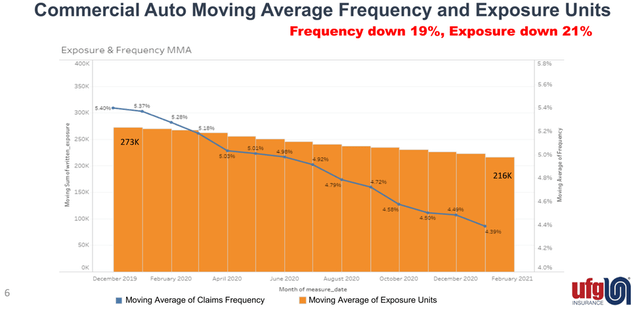

However, management’s actions had little immediate effect, as underwriting losses continued to escalate. It wasn’t until late 2019 that claims frequency finally began to ease. Figure 8, taken from a recent investor presentation, highlights exposure and frequency peaking in December 2019 and decreasing by 20% through February 2021.

Figure 8 – Commercial auto claims frequency and exposure began declining in late 2019 (United Fire investor presentation)

As we can see from Figure 6 and 7 above, 2021 was the turnaround year, with consolidated combined ratio finally decreasing to 100.3%, roughly breakeven, and the loss ratio normalizing to 73%.

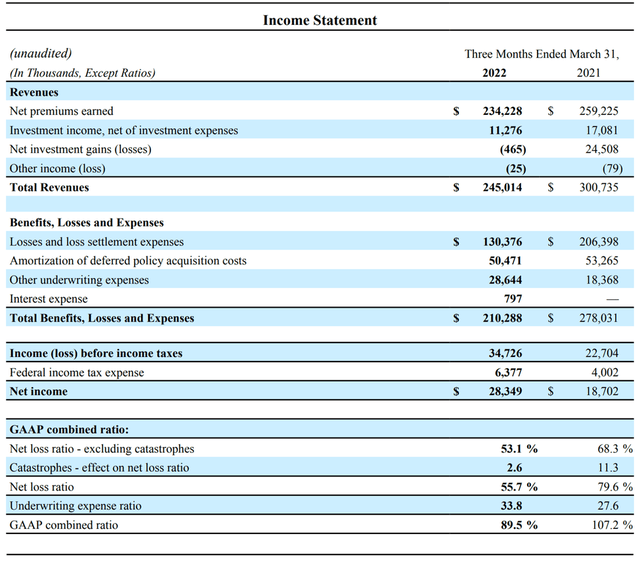

The positive underwriting momentum continued in 2022, with Q1 results that were recently released showing a combined ratio of 89.5% and EPS of $1.13/share (Figure 9).

Figure 9 – United Fire Q1/22 income summary (United Fire’s Q1 2022 earnings release)

Valuation Discount And Re-Rate

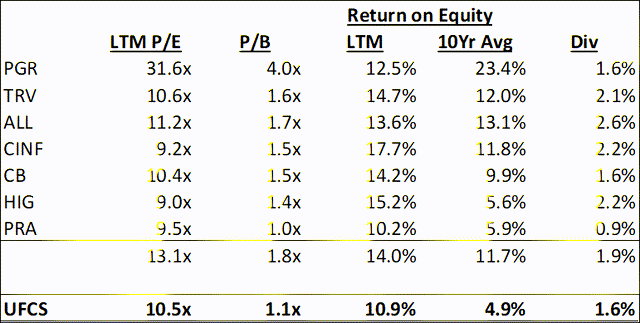

Insurance businesses are typically valued on a Price-to-Book (P/B) or Price-to-Earnings (P/E) basis. Figure 10 summarizes some key P/E and P/B metrics for a selection of United Fire’s P&C insurance peers. Currently, UFCS is trading inline on a LTM P/E basis, but significantly undervalued on a P/B basis. How can United Fire close this valuation gap?

Figure 10 – Valuation comparables table (author created with data from tikr.com)

I believe if United Fire can demonstrate that its business has indeed turned around and if the company can consistently deliver ROEs in the mid-teens like it did in the most recent quarter, we will see its Price-to-Book valuation re-rate higher.

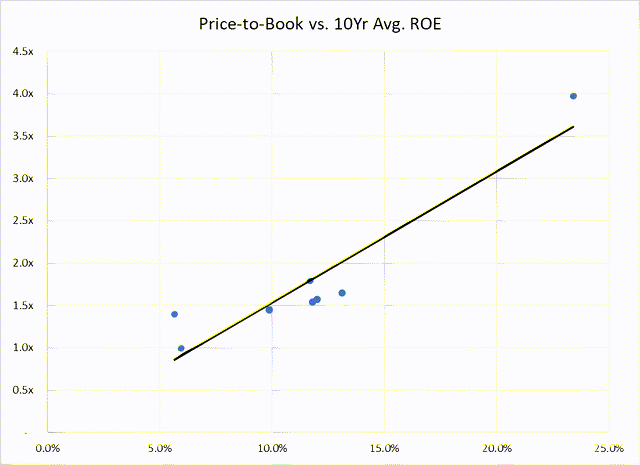

Figure 11 shows that the peer group P/B valuation has a linear relationship with respect to a 10-year average ROE. The higher the average ROE (meaning consistently high earnings), the higher the valuation. If United Fire can improve its average ROE from the 5% currently towards 10% for example, UFCS’s valuation should trend towards 1.5x P/B. With currently book value of $33.27/share, a 1.5x P/B valuation point towards a $50 stock price, offering almost 40% upside.

Figure 11 – P/B to Average 10yr ROE (author created with data from tikr.com)

Key Investment Risks

Market Volatility Could Negatively Impact Investment Portfolio

Up to now, we have only analyzed United Fire’s underwriting business and noted the potential for a valuation re-rate as management brings the loss ratio under control. The other half of the insurance business has to do with the investment portfolio.

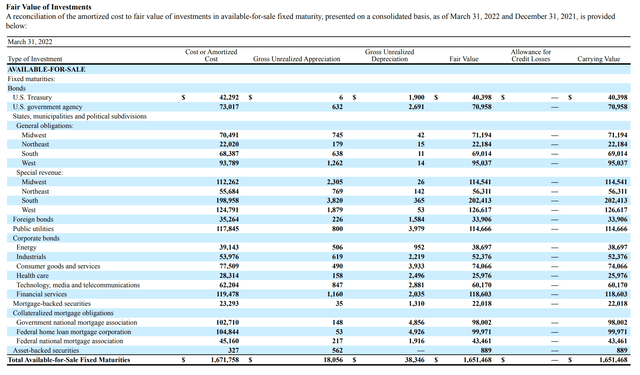

Figure 12 summarizes United Fire’s latest $1.7 billion fixed income investment portfolio. UFCS also holds almost $200 million in equities, for a total portfolio of $1.9 billion at quarter-end. Note United Fire, like most P&C insurers, primarily invests in bonds as they need to pay out claims from this portfolio and cannot bear the higher volatility from equities.

Figure 12 – United Fire fixed income portfolio (United Fire Q1/22 10Q)

However, given the recent market volatility and rise in bond yields, it would not be surprising for United Fire and other insurers to show large mark-to-market losses in the upcoming quarters. This could translate into weak headline earnings, and if the investments are sold to fund insurance payouts, realized losses.

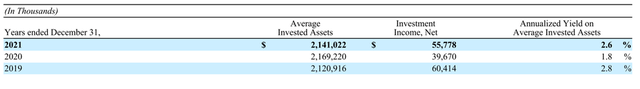

The flip-side of higher yields is that premiums collected can be re-invested into fixed income securities at higher yields. For example, in 2021, UFCS earned $56 million in investment income on average invested assets of $2.1 billion for 2.6% annualized yield (Figure 13). With rising interest rates, we can expect to see the average yield of the portfolio to trend higher as the investment portfolio gets reinvested at higher rates.

Figure 13 – United Fire’s annualized investment yield (United Fire Q1/22 10Q)

High Inflation Could Worsen Loss Ratio

Insurers take on insurance policies in today’s dollars and pay out claims at a future date. If inflation is very high (for example the material and labor costs to fix a car) and the insurer did not take that into consideration when setting the policy rate, then actual loss ratios could be higher than expected.

On this topic, management seems to be aware of the high inflation and commented in their latest earnings call,

“…And as we’ve kind of said, we feel that we’re getting adequate rates right now to cover inflation. We probably would prefer to get more rate, but right now, rate increases have moderated a little bit but are still adequate in our opinion.”

– Quote from United Fire’s Q1 2022 earnings call

We will be closely watching the upcoming earnings releases to see if United Fire has indeed priced adequate inflation into their policies.

Catastrophes Are Hard To Predict

As a P&C insurer, there is always the risk of catastrophic losses due to storms and natural disasters. For example, 2021 saw $99 million in losses due to catastrophes, or 10.2% of NPE. On this front, UFCS follows industry practice and utilizes reinsurance to limit catastrophic losses.

Counterintuitively, catastrophes can sometimes be a good thing for insurers. Provided they have adequately ceded risk to reinsurers, single event catastrophes tend to be limited, and often act as an impetus for the industry to raise prices and “harden” the market.

Recent Price Action and Technicals

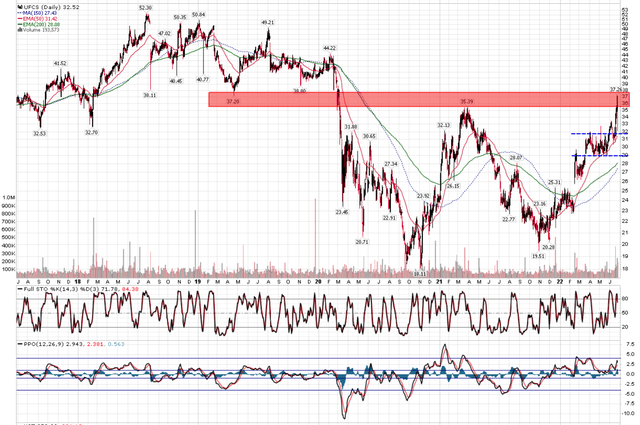

Since bottoming in late 2021, United Fire’s stock price rallied strongly in February of this year on the release of the Company’s 2021 earnings which showed a return to full year underwriting breakeven (100.3% combined ratio). Subsequently, the recent release of Q1 earnings in May sparked a breakout out of a multi-month consolidation zone (See Figure 14).

Currently, the stock is challenging key resistance around $35 (double bottom neckline) and $37 (2019 lows). Long-term investors who believe in the turnaround story may wish to accumulate shares near current levels. For those that prefer to see more operating results confirming the turnaround story, long positions can be initiated above the resistance zone noted above.

Figure 14 – United Fire trading near 52-week high (author created with chart from stockcharts.com)

Conclusion

After many years of sub-par underwriting performance, United Fire is showing signs of successfully turning around its commercial auto business, posting sub 90% consolidated combined ratios in its two latest quarters. If management can continue to deliver strong underwriting and earnings results, UCFS’s shares should re-rate form the current 1.1x P/B towards 1.5x P/B. At current book value per share of $33.27/share, this could translate into a $50 share price. I recommend long-term investors accumulate shares at current levels.

Be the first to comment