Jetlinerimages/iStock Unreleased via Getty Images

United Airlines (NASDAQ:UAL) reported earnings before the opening bell on Thursday and shares took off gaining 11% ending the day around 10% higher. Having listened to United’s earnings call what was striking was the extremely bullish tone of the call. It was almost like I was listening to a pitch for investment in airline stocks. I’ve been writing for nearly a decade and I have never listened to a call that felt like a pitch before. While I believe that indeed there is reason to be bullish on airlines right now, I want to take a more measured approach and go by the numbers to see how United Airlines has actually performed and what the opportunities and challenges are going forward.

Flat results

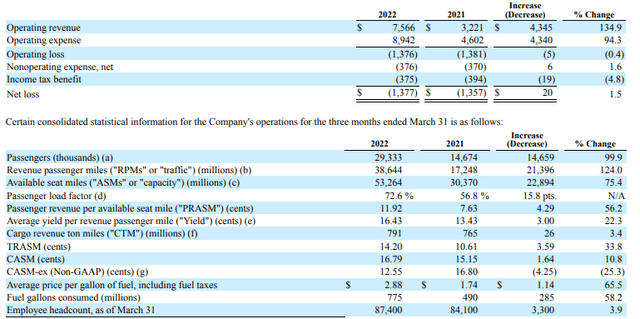

United Airlines Q1 2022 Results (United Airlines)

Right now we can make two meaningful comparisons. The first one is the comparison with last year to show progress or lack thereof in top and bottom line and the second one is a comparison with 2019, which is the level that airlines are aiming to return to. With demand largely improving without doubt airlines were hoping to see extremely strong increases in their results. Those forecasts were ripe for the bin once fuel prices surged. What we see is that United Airlines saw a 135% surge in revenues as demand picked up and unit revenue strongly improved, but all of that topline growth was eliminated on the back of higher costs. Some of those higher costs are related to increased flight activity, which increases the operating costs but a significant percentage namely 20% of United’s higher costs were driven by higher fuel prices. Compared to American (AAL) and Delta (DAL), United had the highest fuel costs per gallon during the quarter. Overall, on CASM the company performed well.

It’s not really useful to say whether the company did good or bad. What we see is that the airline is booking good progress increasing revenues but higher fuel costs dampened eliminated any year-over-year improvements in the earnings and losses.

More interesting is to assess how United Airlines performed compared to its Q1 2019 results and what we observed was that capacity was down 19%, revenues were down 21% partially due to 3% lower TRASM (total revenue per available seat-mile) while cost per available seat-mile is up 21% and 18% when excluding fuel. I think that shows extremely solid progress to getting back to the 2019 numbers.

Upbeat outlook for Q2

For the second quarter, United Airlines expects to be profitable as demand continues to pick up. TRASM is expected to be up 17% compared to 2019, while CASM excluding fuel will be up 16% from 2019 levels on capacity being 87% recovered. Those are strong projections and are topped off by a profit margin expected to be around 10% slightly lower than 2019 even though fuel prices are expected to be significantly higher. So, United Airlines sees demand being so strong in Q2 and beyond that the $3.43 fuel price per gallon is offset. So, the outlook is extremely bullish helped by an improved ex-fuel cost environment as more capacity comes online and demand is extremely robust. Right now, it is a playground for airlines. I remember that during the pandemic some of my readers believed business travel would never come back which completely opposed my view, but United Airlines sees strong bookings for business travel, and this is just the start of the recovery.

The struggles for United Airlines

Boeing 777 United Airlines (United Airlines)

There has been a lot of talk about pilot shortages affecting summer schedules and while there definitely is a pilot shortage, just like Delta, United Airlines feels like it is positioned well to service the capacity requirement for the summer season. The airline has marked itself as a preferred pick for pilots to build a career and doing a quick Google search on salaries does indeed seem to confirm why pilots would want to fly for United. Reality is that as one of the big three United Airlines will have it easier to find pilots. The shortage is real, but United should be able to handle it. The pain will primarily be with the smaller airlines and regional airlines. What United did not address is how it is going to transform its regional operations where 150 regional jets are being grounded due to problems with hiring. In some sense that affects how the airline feeds passengers to the mainline and United did not highlight how it envisions that part of the business going forward. For an earnings call that had such a bullish tone, I would also have expected that the airline would be able to share how it would transform that part of its operations if needed.

Another part on which United Airlines could not provide convincing answers was cargo coupled to Boeing 777. Cargo unit revenues are likely going to come down as more capacity comes online. At the same time, the capacity will shrink as more of the capacity will be utilized to carry passenger bags, yet United Airlines did not provide an answer on the request of an analyst during the call whether in absolute terms revenue would come down. Instead, the company pointed at its Boeing 777s, which it called gigantic cargo machines. Indeed, with the Boeing 777, the carrier can add a lot of capacity in the cabin as well as the cargo holds. The only problem is United Airlines could not provide an estimate on when those aircraft will return. If the FAA clears the aircraft for service again today, it will take 9 months before all of the jets are back in service. So, in early 2023, you will see all jets back in service and United Airlines has been very bullish on that prospect from a cargo perspective as well as CASM improvement but realistically the airline doesn’t know when those jets will be back and the same holds for deliveries of the Boeing 787. So, 2022 will be strong but the question really is about what happens beyond that point not taking into account any timeline mismatch that might affect cargo operations.

A similar thing holds for the Boeing 737 MAX 10, where there might be delays on certification. The MAX 10 likely will have the lowest unit costs of the MAX family and there is no clarity on whether Boeing will be able to get the jets certified and delivered in time. United Airlines still has MAX 8 and MAX 9 jets on order and they will likely take more of those in that case, but those jets don’t have the same unit costs. So, 2022 might nice but really the challenge is going to be beyond that point as the market grows and United wants to grow 30% by 2026.

Conclusion

The outlook for United Airlines and other airlines is very bullish. With strong recovery in demand, 2022 is going to be a good year it seems. United Airlines counts on its ability to hire pilots to fly the jets and brand loyalty coupled with strong business travel performance. I think that just like any airline United Airlines will be able to benefit from the pent-up demand. The big question, however, is how United Airlines is going to efficiently grow beyond that point and that is mainly driven by its wide-body deliveries and service re-entry slipping while the MAX 10 might also be delayed. United Airlines currently views those as timeline mismatches, but I think that is really going to determine whether United Airlines is a nice investment compared to its peers beyond 2023 or not and I believe that the steps United Airlines has made during the pandemic are merely steps to align them with the competition. It could be the case that that makes United Airlines a stronger investment going forward, but there certainly are items in United’s strategy that remain unaddressed at this point.

Be the first to comment