Pgiam/iStock via Getty Images

Investment Summary

There are endless opportunities within the broad healthcare space for those willing to do the digging and undercover the selective names. Here at HBI, we’re seeking out these long-term compounders as we seek to move up the risk spectrum, always with a focus on quality, innovation and risk management.

It would be no surprise therefore to learn we are tremendously constructive on uniQure N.V. (NASDAQ:QURE) following the recent developments around its Hemgenix therapy, and the potential it has in capturing additional share the Hemophilia B treatment market. Net-net, we rate QURE at price objectives of $31.5 and $49, and we’re back today to discuss our findings of the company’s market opportunity, and the opportunity for investors downstream.

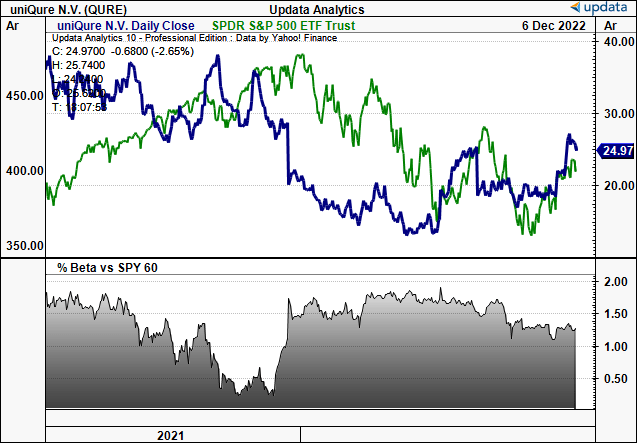

Exhibit 1. QURE 2-year price evolution vs. S&P 500.

Note: High equity beta, meaning with every uptick in the benchmark, we look to see upside at a factor of 1.2.

Data: Updata

QURE: Hemophilia pure-play

It is of our opinion that QURE is a hemophilia pure play given its niche expertise to this cornered segment of the market.

Its multi-year clinical development of etranacogene dezaparvovec, an investigational adeno-associated virus five (AAV5)-based gene therapy, in combination with Australian biotech giant CSL (OTCPK:CSLLY) is clear evidence of this.

The therapy is called Hemgenix. QURE signed a license agreement with CSL in 2020 to commercialize the therapy, with QURE eligible to receive >$2Bn in royalties and milestone payments.

The duo completed their Phase 3 HOPE-B gene therapy trial in December FY21′, meeting all primary and secondary endpoints.

Hence, when the FDA gave thumbs up for Hemgenix approval last month, we were immediately constructive on QURE.

This opens up a wide market for the company and its agreement with CSL will enable the Aussie biotech giant to do the heavy lifting with respect to commercialization, distribution etc, reducing the execution risk for QURE. For CSL, the pipeline risk was nullified in getting Hemgenix’s approval.

This has several advantages to QURE. It will manufacture the supply until the capacity is transferred over to CSL. Until then, CSL will do the heavy lifting as mentioned, helping QURE to retain upside at the EBIT margin. It can also leverage CSL’s deep customer and distributor networks to pour the therapy out into the field. We believe this to be key to our investment thesis.

QURE’s Hemophilia B market opportunity

In order to fully comprehend where our buy thesis is stemming from, it’s essential to have a grasp on the complexities of Hemophilia B, and just why we believe this to be a catalyst to move the needle for QURE.

Hemophilia B is an inherited X-linked recessive disorder that is caused by mutations in the coagulation factor IX (“FIX”) gene. The mutant FIX gene results in decreased or absent clotting factor IX activity, leading to an inability of the blood to properly form clots. Hemophilia B is the second most common type of hemophilia after hemophilia A, and is estimated to occur in about one in every 25,000 male births.

Clinical manifestations of hemophilia B can be divided into 3 categories:

- Spontaneous bleeding,

- Bleeding related to trauma or surgery, and

- Bleeding associated with immune-mediated inhibitors.

Spontaneous bleeding usually occurs in the joints, muscles, soft tissue, and gastrointestinal tract, and can result in pain, swelling, and deformities. Bleeding related to trauma or surgery is often severe due to the decreased FIX activity. Immune-mediated inhibitors are antibodies that are produced in response to infused clotting factor concentrates. These inhibitors can reduce the effectiveness of the clotting factor concentrate and lead to prolonged bleeding.

The diagnosis of hemophilia B is confirmed by measuring FIX activity in the blood. A FIX activity of <1% is considered to be diagnostic of hemophilia B. Additionally, genetic testing can be utilized to identify the underlying mutation in the FIX gene. The treatment of hemophilia B is typically tailored to the individual’s symptoms and severity of disease. Replacement therapy with factor IX concentrate is used to treat bleeding episode, and Desmopressin can be used to increase the circulating levels of FIX, but is not effective in patients with severe hemophilia B.

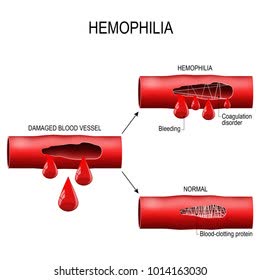

Exhibit 2. Visual demonstration of Hemophilia

Image: Shuttershock

Alas, there exists an unmet clinical need to make a statistically meaningful change in this complex disease segment.

Now looking at the economics of the segment. The global hemophilia treatment market was estimated to be worth around US$ 18.3 billion in 2019 and is expected to reach US$ 27.3 billion by 2027, registering a CAGR of 6.1%. The market is highly competitive with a large number of players competing to gain market share.

The market is segmented by product type into factor VIII, factor IX, and recombinant factor IX. Among these, factor VIII is currently the dominant product type, accounting for >66% of the total market share in 2020. This can be attributed to continuous investment in the development of new products, as well as ongoing government initiatives to increase access to treatment.

The factor VIII segment is further divided into plasma-derived and recombinant products, with the latter dominating the segment with a market share of ~90%. The factor IX segment is dominated by recombinant products, accounting for >85% of the total market share in 2020.

QURE technical analysis

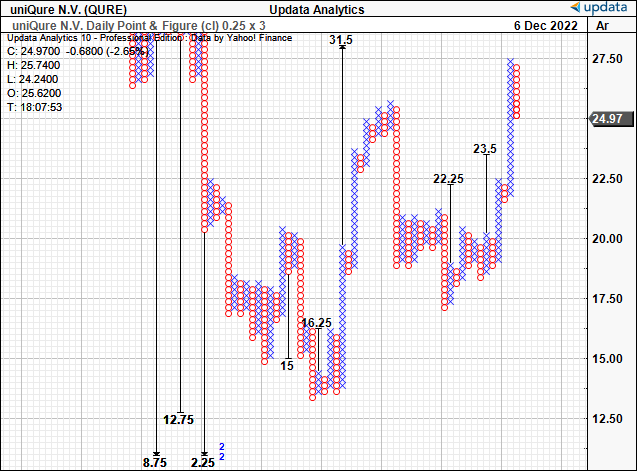

In the absence of fundamental data to position against, we’ve relied on technical studies to gauge price visibility looking ahead. You can see below that it’s been a volatile year for QURE on the chart, however H2 FY22 has been net positive for the stock.

From August to November it formed a base for 14 weeks, facing resistance at the 50DMA and 250DMA.

At the same time however, the volume trend was ascending. The combination of ascending weekly volume with sideways price action is evidence of strong support in our opinion.

Following the Hemgenix announcement, the stock has broken out above previous highs and is aloft the 50DMA and 250DMA.

Exhibit 3. QURE 18-month price evolution [weekly bars, log scale] – shares have broken out above resistance, trading back above previous highs

We have upside targets to $31.5 after the previous $23.50 target was taken out very recently. This is incredibly important in the investment debate as it demonstrates the buying support for the stock to this level, supported by the volume studies above.

We have long-term price targets from our point and figure studies to $49, and these two figures serve as our two price objectives in the stock.

Exhibit 4. Upside targets to $31.50, and $49 [not shown]

Data: Updata

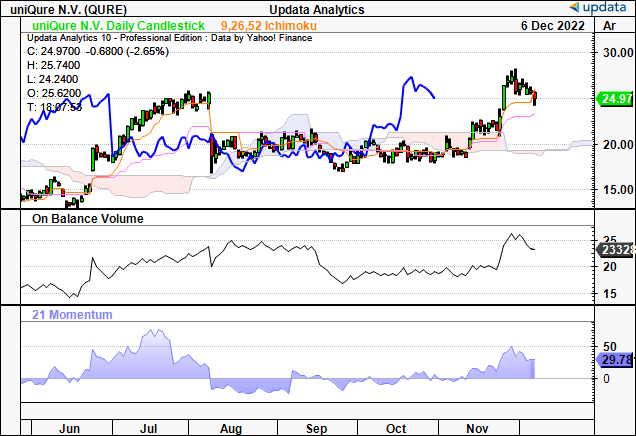

Adding validity to the trend, shares are trading above the cloud with additional support from on balance volume and momentum.

Exhibit 5. Trading above cloud support

Data: Updata

In short

Net-net, we rate QURE a buy based on its recent developments in the Hemophilia B market, namely, the Hemgenix approval. We see upside capture in QURE ahead, with price objectives of $31.5 and $49 from technical studies. We estimate this to be the alpha opportunity, and also opine that entry at current market prices is warranted.

Be the first to comment