VioletaStoimenova

Here at Mare Evidence Lab, we accurately cover European insurance. Over the last years, we intensively analyzed and commented on Zurich, AXA, Generali and Allianz. The specter of stagflation hangs in the minds of investors with an economic scenario characterized by low growth and high inflation. This is certainly not the ideal context for non-life insurance as this sector generally records a performance slightly above the GDP. Despite this, our internal team is optimistic for three reasons and expects the sector to outperform again this year.

- The first reason is related to resilient revenues: many insurance products are mandatory and consequently, the purchase is made out of necessity rather than choice, which makes turnover safer;

- The second reason is the strong power to determine prices which in Europe are established independently while respecting the laws of market competition. This is something that does not happen in the US where there is a pricing system;

- The third reason is the positive correlation with interest rates: the business model of non-life insurance companies allows them to gather large pools of resources and benefit from attractive investment returns. Against this backdrop, insurers’ reinvestment rates are likely to rise more than maturing bonds and therefore our internal team expects an upward revision of yield targets.

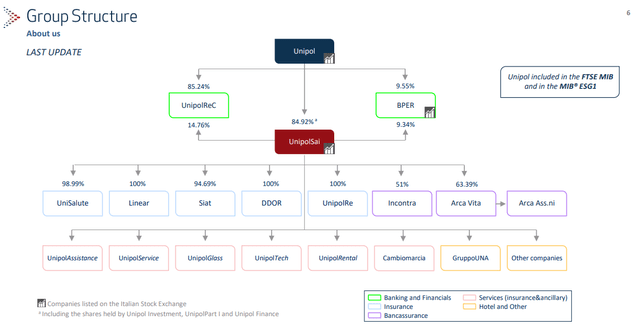

Keeping in mind the above consideration, today we are looking at UnipolSai Assicurazioni S.p.A. (OTCPK:UNPLF). The company engages its activities in the Italian insurance business. It is headquartered in Bologna and is a subsidiary of Unipol, the group structure is presented below.

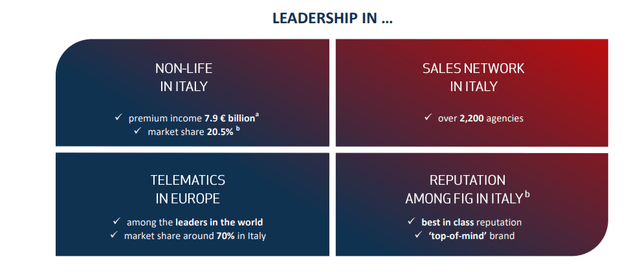

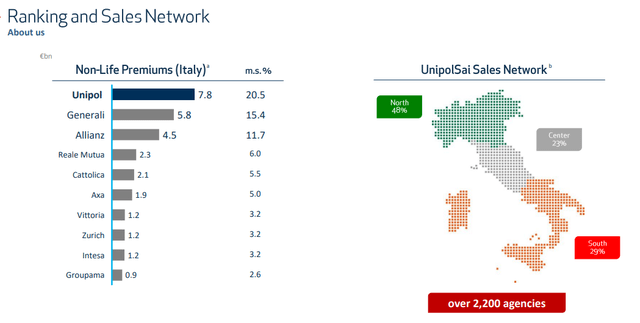

UnipolSai’s primary business is non-life insurance. The company is a clear leader thanks also to a strong agencies network made of more than 2.200 points of sale.

There are three reasons why we consider Unipol attractive: 1) the special skills in telematics, i.e. the black boxes installed in the cars of its policyholders (here the combined ratio was 92.5% in 2021 and the target for the two-year period 2022-2024 is 93.9%); 2) a very strong collaboration with two banking groups with over 2.600 branches, namely Banca Popolare di Sondrio and BPER Banca (82.9% non-motor combined ratio in 2021 and a 2022-2024 target of 85.9%); and lastly, 3) very high solvency equal to 278% for UnipolSai and 209% for the Unipol Group, which allows for sufficient flexibility to rapidly seize growth and new opportunities.

Looking at the top three insurers of the Italian market, Unipol, Generali and Allianz, we see that the average combined ratio in the years 2017-2021 was approximately 93%. Their strong profitability is explained by three key trends: the high degree of concentration (in 2021, Unipol, Generali and Allianz had a market share of 59%, the top five operators 71%), the greater use of telematics (Unipol has 4 million devices installed, Generali over 1 million), the Italian legislative reform of 2012 which led to a sharp drop in the costs of personal injury compensation claims.

Comment on the strategic plan and latest results

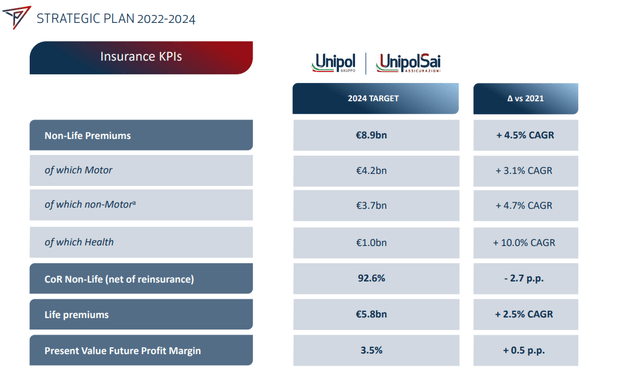

UnipolSai approved the first quarter financial statements and the strategic plan for the three-year period 2022-2024 called “Opening New Ways“. The financial targets for the period are considerably up compared to the previous Mission Evolve business plan, which envisages a cumulative profit of €2.3 billion (€2 billion in 2019-2021) and cumulative dividends of €1.4 billion (1.3 billion in 2019-2021 plan). At the industrial level, UnipolSai has set the Non-Life sector at €8.9 billion up by €1.1 billion compared to 2021, of which €1 billion is in the Health sector.

The growth rate for car premiums is estimated at 3.1% in the three-year period 2021-2024. UnipolSai plans to further improve its margins by accelerating settlement speed, introducing a new and cheaper telematics system, and increasing wholesale spare parts purchases.

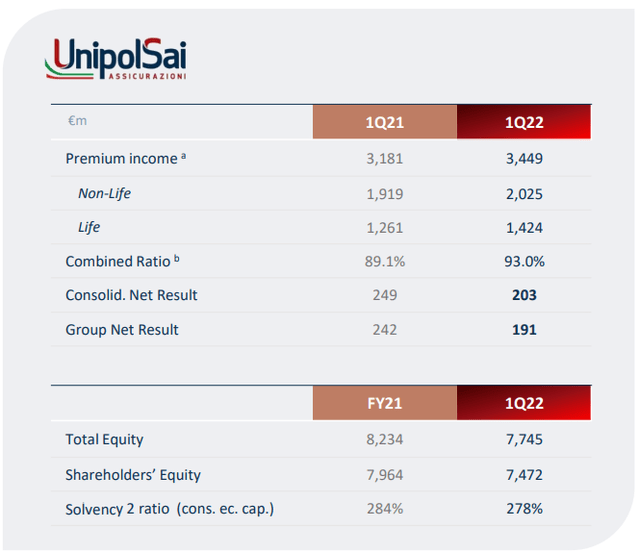

Looking at the latest financial results, in Q1 UnipolSai achieved a net income of €203 million, down by 18.6% compared to the result of €249 million in the corresponding period of the previous year, which had a positive effect due to a real estate asset sale in Milan. Commenting on the specific division, the performance of the Non-Motor segment was very positive, with premiums of €1.086 billion, and a growth of 10% over the first quarter of 2021, a result to which all the main business lines and all the Group’s sales channels contributed. Particularly significant was the development of UniSalute (+ 17.9%), and the increase marked by the bancassurance segment active in the Non-Life sector.

The combined ratio of the group net of reinsurance stood at 93.0% against 89.1% in the first quarter of 2021, with a loss ratio equal to 65.0%, against 62.3% in the first quarter 2021 which had still benefited from a significant reduction in the Motor claims frequency due to the restrictive measures for COVID-19.

In the Life sector, in the three months, the direct deposits of the group recorded an increase of 12.9% and amounted to €1.424 billion thanks to significant growth in multi-branch products.

Valuation

With the new plan in place that raises the bar on capital distribution and a company with a very high solvency ratio, we see no reason why UnipolSai is trading at a P/E of 8.2x compared to a five-year average of 9.7x. Thanks to the latest upgrade by Moody, which increased the rating to “Baa2” from “Baa3”, one level above Italy’s rating, we confirm UnipolSai’s improvement of its financial profile, in particular with reference to profitability and capital solidity. The supportive macro scenario on raising yield and the very strong market position make UnipolSai a buy. Based on a P/E ratio of 10x, we value the Italian insurance at €2.7 per share, in the meantime investors can enjoy a juicy dividend of more than 8%.

Be the first to comment