mixmotive/iStock Editorial via Getty Images

Union Pacific (NYSE:UNP) is down 24% from its highs of about $275 a share in late March. The company issued a warning at the UBS Global Industrials and transportation conference. However, the stock did not make a significant move on the day, suggesting that news was already being priced.

So far, the company has been delivering impressive EPS growth despite the challenging environment. Furthermore, a couple of internal and external catalysts may temporarily offset part of the inflationary pressure and potentially support higher growth revenue for Union Pacific in the next couple of years. Therefore, I still believe that the company is worth investing in.

First Quarter results

Union Pacific delivered first-quarter results beating expectations despite the service disruption across its rail network.

The company posted operating revenue of $5.86 billion, 17% higher than last year’s Q1 of precisely $5 billion. During the same period, expenses increased by 16%. Fuel costs saw the most considerable increase among all costs, rising by 74% compared to the same time last year. Despite the significant rise in expenses, revenue growth was even higher during this challenging environment.

Furthermore, the net income was $1.63 billion compared to $1.34 billion a year ago. This was an increase of approximately 22%. Earnings per share, on the other side, saw an even more meaningful rise. The business reported EPS of $2.58 compared to $2.01 last year, an increase of 28% boosted by 6% through the share repurchase programme. In the first three months, the company repurchased 11 million shares for a total cost of $2.8 billion.

These results have come on the back of severe service problems, which started at the end of 2021 and continued into the first quarter. Many customers have experienced difficulties with deliveries and delays, which have impacted their operations.

According to the management of Union Pacific, many of the issues are related to labour shortages as the company cut too many jobs during the pandemic to improve the efficiency of the rail network. However, according to CEO Fritz, the company has learned its lesson and has taken measures to improve the situation for the rest of the year, which could turn into a boost. But surprisingly, there might be a few more catalysts that the West Coast railway did not expect but could further grow the business.

Catalysts

Internal

Earlier this month, the company came with a letter notifying its customers that the number of service problems the company has been experiencing will be resolved as soon as possible. Since January, the firm has added 50 new locomotives and promised to bring another 100 and ramp up hiring.

In 2021, the company had graduated over 250 new transportation employees, and another 400 employees are expected to graduate by 2022. The firm also has a strong training pipeline with approximately 500 employees and aims to hire around 1,200 employees this year.

External

Among the catalysts for the impressive growth of Pacific railways was the cargo surge on the West Coast ports. In mid-February, as many as 77 container ships were still waiting to be unloaded. Meanwhile, the warehouses were full of stock. Since then, the situation has not improved and could only worsen.

According to the recent news, boxes coming into the U.S. are gradually picking up and could rise substantially as the Shanghai port is opening after the two-month closure of the whole city to fight the COVID outbreak there. According to Gene Seroka, the Port of Los Angeles executive director, the companies ordering “just in case” are not helping unclog the port. His expectations are that situation may not get better until early next year if the velocity of taking the containers off the ships and the port does not increase.

To make matters worse, inflation is on the rise. The consumer price index accelerated to 8.6% in May. The core CPI, which excludes food and energy, has also come in at 6%. Both indicators came in higher than expected. Inflation has caused a lot of headaches in the White House, as the government has been thinking about policies in an attempt to tame inflation. This has pushed president Joe Biden to reconsider some of the tariffs imposed on China during Trump’s presidency as a way to slow it down. Such a decision could only boost imports from China which most likely will end up on the West Coast and primarily at the L.A. and Long Beach ports. This could create a massive backlog of stock for companies such as Union Pacific and support higher business growth for them than the businesses on the East Coast.

So, is the stock a Buy?

Recent concerns about the U.S. economy slowing down are accompanied by challenges, such as rising fuel costs, labour shortage, and the company’s inability to manage delays. This has resulted in banks and investment institutions such as UBS becoming sceptical about whether the company will execute its volume growth strategy in the coming years. These risks of slowdown or, worse, a recession cannot be ignored, as proof could be seen in the recent downgrade of the stock by Goldman Sachs. The bank quickly lowered Union Pacific’s price target from $276 to $252 on the concerns that it may miss its margin targets.

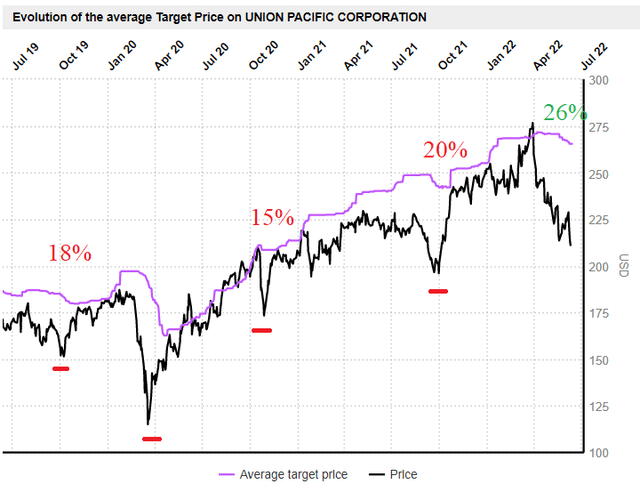

Union Pacific stock is down 16% year-to-date and 24% from its peak at the end of March. Analysts have given the stock a price target of $267, suggesting a 28% upside potential. However, all the railroad companies are down and trade at 15% and 25% discounts from their target price.

In addition, Union Pacific trades at 18 times forward earnings, slightly higher than competitors such as CSX Corporation (CSX) and Norfolk Southern Corporation (NSC), which both trade at 16.5 times forward earnings. However, the company is among the most efficient ones, with a 5% better operating ratio than them.

The firm may experience some headwinds in the form of delays, rising fuel costs, and a shortage of labour. The previous expectations for an operating ratio of 55% may seem unlikely, but this should come as somewhat worse news for the peers that are less efficient, potentially taking their operating ratios 5% higher in the neighbourhood of 65%.

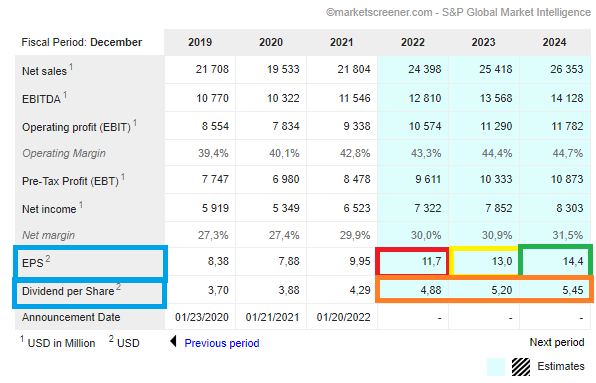

The company has projected earnings of $11.7 a share for 2022. Although the earnings revisions from the financial institutions may take the consensus down 5% in the next couple of weeks and bring it closer to $11 a share, the long-term estimates of $14 a share are still realistic if we take into account the potential tailwinds coming from Biden’s drop on tariffs.

Union Pacific Earnings Estimates (MarketScreener)

Furthermore, the stock currently trades at 26% below its target price. If we look back three years, Union Pacific has deviated three times (4 if we include the start of the COVID pandemic) significantly from its target price, resulting in a robust rally of between 15% and 20% in a concise period of time.

Union Pacific Price Target (MarketScreener)

Meanwhile, the company offers a 2.45% dividend yield based on a rather generous 45% payout ratio of net earnings, which is better than the S&P500’s 1.65%.

Risks

The company will most likely continue to face its challenges for a while. Inflation could soon peak. However, the inability to hire staff and manage delays and disruption could take a further toll on operating margins.

Fuel costs have increased dramatically in the past year and may continue to rise. The company has to offset those costs relatively quickly to mitigate the impact on operating margins.

Conclusion

I believe that UNP stock has still room to grow. Although the company may experience some near-term challenges, rising input costs and wages, which may impact the margin growth in the near term, it is likely that these costs will be offset by the improvement of efficiencies and the extra labour force. Investors cannot expect growth stock type of returns, but UNP could be a good dividend stock and an outstanding defence stock in these turbulent times.

Be the first to comment