Spencer Platt

Investment Thesis

Due to supply chain problems, most sportswear companies have significantly increased their inventory balance. However, Under Armour (NYSE:UA) (NYSE:UAA) was able to keep inventory at pre-pandemic levels. Bulls like the potential of the Curry line and a significant discount to peers. However, we remain neutral. Firstly, Under Armour is still in search of a permanent CEO. The CEO largely determines the vector of the company’s development and their absence is an important argument in favor of staying away. Secondly, high margins provide a margin of safety in the event of an increase in costs, and Under Armour is characterized by low and unstable margin. According to our valuation, Under Armour is trading near fair market value. We rate shares as a Hold.

Company Profile

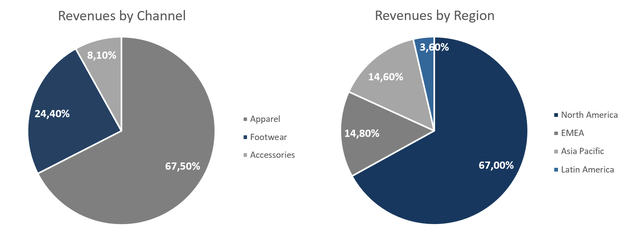

Under Armour specializes in the manufacture and sale of sportswear, shoes and accessories worldwide. The manufacturer produces its products under the brands UNDER ARMOUR, UA, HEATGEAR, COLDGEAR, HOVR, UNDER ARMOUR UA Logo, and others. The company operates through 1,400 own and partner stores/outlets in North America, EMAE, Asia Pacific and Latin America. The revenue structure is presented below:

Effective Inventory Management

At the end of September, Nike (NKE) released its first quarterly report, where management predicted a decrease in margins due to a 44% increase in inventory. Investors apprehensively perceived the news about the problems of the largest sportswear company, Nike shares fell and pulled peers, including Under Armour.

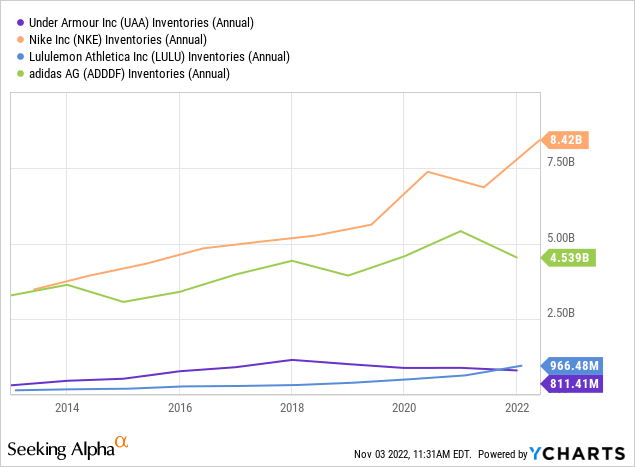

Due to supply chain problems, most sportswear companies have significantly increased their inventory balance. Under Armour is one of the few companies that was able to keep stocks at pre-pandemic levels.

In addition, over the past five years, Under Armour has reduced the inventory level as a percentage of revenue, while the main competitors either remained in place or significantly increased the indicator.

| 2019 | 2020 | 2021 | 2022 | TTM | |

| UAA | 22.34% | 17.28% | 22.86% | 14.88% | 16.14% |

| NKE | 13.84% | 16.85% | 14.79% | 15.70% | 17.12% |

| ADDYY | 15.21% | 15.58% | 23.68% | 18.54% | 19.39% |

| LULU | 15.58% | 15.69% | 16.20% | 18.07% | 16.46% |

Effective inventory management is one of the two main bullish arguments regarding Under Armour. Indeed, maintaining a reasonable level of inventory indicates that demand for the product remains and ensures a steady operating cash flow.

A Billion Deal

One of Under Armour’s main ambassadors is Stephen Curry, the Golden State Warriors point guard and one of the greatest basketball players in NBA history. Steven signed his first contract with UA back in 2013, after leaving Nike. In 2020, a separate CurryBrand was created. Curry’s current contract expires in 2024 and costs the company about $20 million annually.

In a recent interview for Rolling Stone, the athlete said that he is going to sign a lifetime contract worth more than $1 billion. Thus, Stephen will stand alongside such celebrities as Michael Jordan, LeBron James, Cristiano Ronaldo, and Lionel Messi.

Today, Jordan earns a cosmic $600,000 for Nike every hour, which can be equated to $5.26 billion a year (about 11% of Nike’s revenue). Considering that the clothing manufacturer contracts with Michael cost about $150 million a year – the deal seems very profitable.

LeBron James’ share of Nike’s revenue is more modest and in our opinion more amenable to comparison with the future Curry brand. LeBron’s line brings in about $600 million annually, with a contract value of $30 million for the clothing manufacturer. Stephen Curry will be able to demonstrate similar figures after a certain time.

The signing of Curry can give a new impetus to the growth of Under Armour because as practice has shown, great athletes continue to influence sports and business even after their careers. Given the status of the greatest performer of 3-point shots in the history of the NBA and its significance for the whole of basketball, Curry’s popularity will not disappear even years after the end of his career.

About Risks And Valuation

As we noted above, one of the two main bullish arguments regarding Under Armour is effective inventory management. The second argument is a significant discount of the company with peers. Indeed, Under Armour is trading cheaper than Nike, adidas (OTCQX:ADDYY), and Lululemon Athletica Inc. (LULU).

| UAA | NKE | LULU | ADDYY | |

| P/E | 8.86x | 24.68x | 37.53x | 14.17x |

| EV/S | 0.59x | 3.08x | 5.87x | 0.98x |

| P/B | 1.51x | 8.58x | 14.31x | 2.86x |

| P/CF | 4.53x | 31.95x | 54.98x | 11.02x |

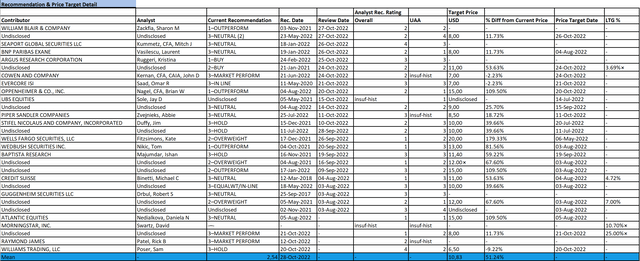

However, a significant discount is due to several objective reasons. Firstly, Under Armour is still in search of a permanent CEO. Former CEO Patrik Frisk had stayed in this post for a year and a half and left the company in May. The CEO largely determines the vector of the company’s development and his absence is an important argument in favor of staying away.

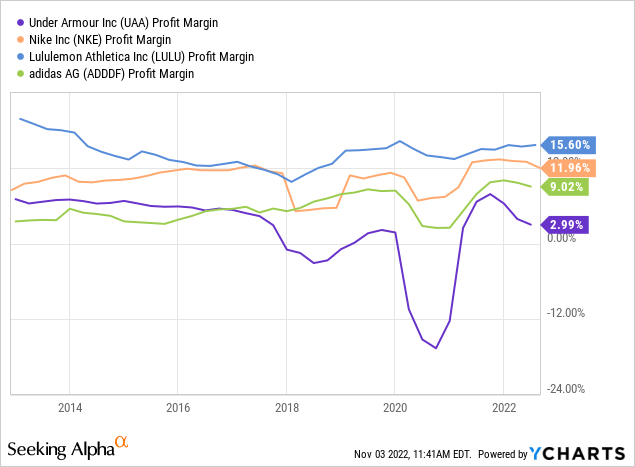

The second reason is the low and unstable net margin of Under Armour. This is important because high margin provides a margin of safety in the event of an increase in costs. A 5% increase in costs and expenses for a company with a 10% margin will cost 45% of net profit, and for a company with a 30% margin, the bottom line will decrease by only 12%.

Low margin complicates DCF estimation at the stage of making assumptions since an increase in future expenses by several percentage points leads to a significant deviation from the forecasted cash flow and estimated fair market value. This is the reason for the wide range of price targets from investment banks.

A significant deviation in the estimated fair value implies a potentially high standard deviation of the shares. This is probably one of the main reasons for the discount.

Our UAA Stock Valuation

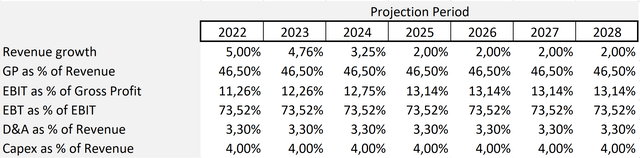

The DCF model is based on several assumptions. Revenue for the full year is expected to increase by 5% year-on-year, by the lower limit of the forecast range provided by the company’s management. We expect revenue to grow at an average annual rate of 2% from 2025 until the end of the forecast period, by the Fed’s inflation target.

Under Armour management predicts that by the end of the year gross profit will decrease by 375-425 basis points compared to last year. We assume that the indicator will decrease by 400 basis points to 46.5% and will remain at this level until the end of the forecast period. This assumption is not too conservative, since until 2020 the gross profit was in the range of 45.1-46.9%.

We expect operating profit for the year to be $312.5 million – management guidance ($300-325 million). This corresponds to an operating margin of 5.2%. Further, we expect operating margins to grow due to a reduction in fixed costs as a percentage of revenue. This assumption is not conservative, since the operating margins Under Armor have always been unstable.

Future capital expenditures as a percentage of revenue are also in line with management’s forecast. DD&A as a percentage of revenue is equal to the average value for the four years 2018-2021. The terminal growth rate is 2%. Our assumptions are presented below:

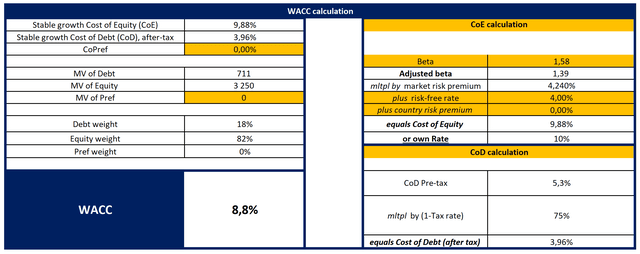

With the cost of equity equal to 9.88%, the Weighted Average Cost of Capital (WACC) is 8.8%.

With a final EV/EBITDA of 5.7x (which corresponds to the current indicator for the consumer sector at discretion), our model predicts a fair market value of $3.58 billion, or $7.86 per share, which is below the Wall Street consensus estimate of $10.8. Therefore, the company is trading near the estimated fair market value.

You can see our model here.

Conclusion

The bullish arguments regarding Under Armour are clear and fair: the company was able to keep inventory at the same level, and the signing of Stephen Curry, one of the best basketball players in NBA history, can contribute to the growth of UA. In addition, the company trades at a significant discount to competitors. However, the discount has objective reasons. Firstly, the absence of a permanent CEO creates risks for shareholders. Secondly, low and unstable net margins lead to a significant deviation from the forecasted cash flow and estimated fair market value. We are watching the company from the outside.

Be the first to comment