JHVEPhoto

Recap

We wrote in our article titled “UA: The Story Has Not Yet Changed” that while Under Armour (NYSE:UAA) (NYSE:UA) saw a jump in sales, such a trend could be short-lived just because people were returning from social restrictions. Furthermore, we expressed concerns about the company’s long-term revenue growth trajectory after going south in the last couple of years.

Has our stance changed since then? Is there any change in the fundamentals that could justify a buying opportunity?

Probably More Discounting Than Expected

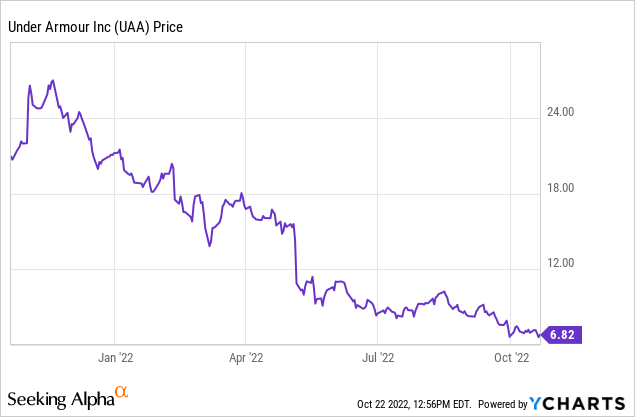

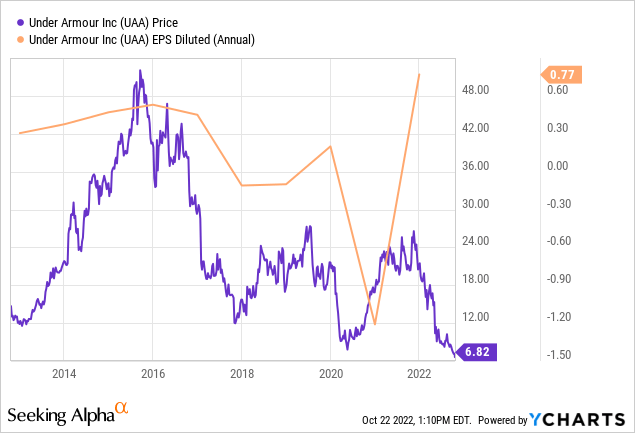

These months have not been good for athletic apparel companies, as they are facing supply chain issues, including elevated freight costs and surging inventories, that came as repercussions following the global pandemic. As a result, UA’s stock price fell from $27 per share to below $7 per share in less than a year.

Perhaps the most sizable decline happened in early May, during which the stock slid by a third after the company recorded an operating loss of $46 million and a net loss of $60 million. Gross margin also eroded to 46.5%, declining from 50-51% in the previous quarters.

In addition, the management revised its FY2023 guidance presented in the so-called transition quarter:

- Top-line growth to reach 5-7%

- Gross margin to decline 150bps to 200bps

- Operating income to reach $375 million to $400 million

- Adjusted diluted earnings per share to be in the range of $0.63 and $0.68

The revised guidance is as follows:

- Top-line growth to reach 5-7%

- Gross margin to decline 375bps to 425bps

- Operating income to reach $300 million to $325 million

- Adjusted diluted earnings per share to be in the range of $0.47 and $0.53

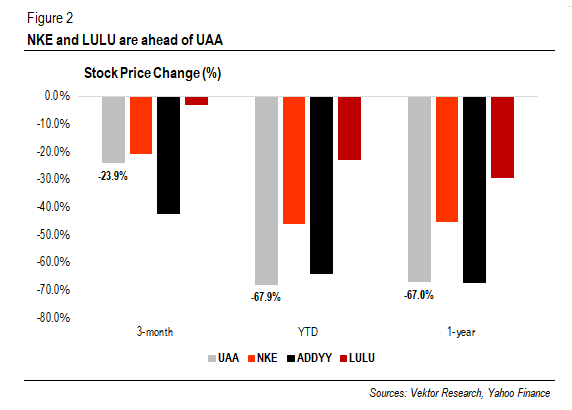

Moreover, UA’s stock has performed the worst among its peers YTD (see Figure 2). As near-term headwinds will likely intensify in the following quarters, how will UA tackle those challenges?

UA’s Stock Price Change (%) (Vektor Research, Yahoo Finance)

First, ocean freight costs were significantly down, but they have not returned to the pre-pandemic levels, as cited in the Washington Post. Accordingly, ocean carriers hope to alleviate the price decline by cancelling 50% of sailings.

Instead, late delivery and factory closures overflow retailers with excess inventories. The problem is that out-of-season inventories arrive at the same time, and retailers have no choice but to increase promotional activities and markdowns. In addition, ocean delivery times have improved but remained elevated vs. pre-COVID time, said Meghan Frank, Lululemon (NASDAQ:LULU) CFO.

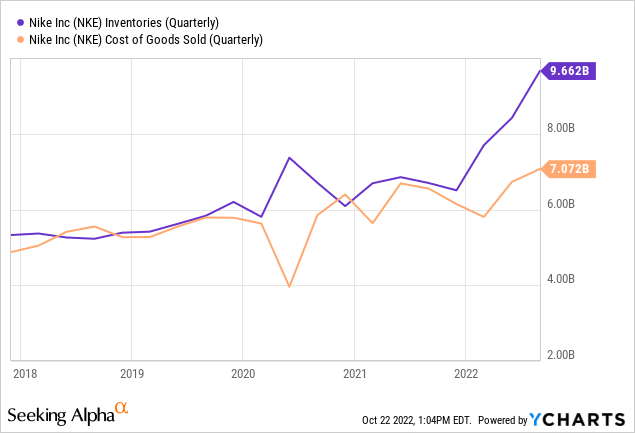

Take, for example, NIKE (NYSE:NKE). CFO Matthew Friend said this during the 1Q23 earnings call:

So when we look at our overall inventory, we think that there’s about 10% of the inventory that we’re focused on in terms of trying to drive more accelerated liquidation. And while our inventory was high at the end of the first quarter, we do expect to see sequential improvement in inventory balances from here over the next three quarters.

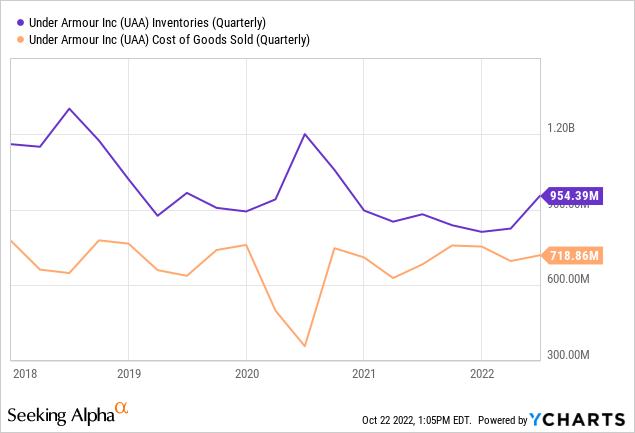

However, things are different with UA, whose inventory balances were relatively lean. Patrik Frisk said that the company was “very-very selective” with its investments. As it stands, UA is rebuilding its inventories, aiming to be “in a better supply chain position relative to product availability.”

We initially assumed that being leaner in inventories would likely give UA a privilege for not discounting many of its items. Indeed, the market is doing more promotional and markdowns, and UA will have no choice but to play a part to “stay in the game.” But the company will do it “in a very strategic way” and not “go deeper than competitors,” especially as it is building its premium brand image.

Nevertheless, the company expects a gross margin decline of 550bps to 600bps in 2Q23 (1 July – 30 September) from a record 51% in 3Q21, a significant of which will stem from promotional and discounting, the company said.

As said during the 1Q23 earnings call:

And then relative to gross margin for Q2, the lion’s share of the impact is anticipated elevated promotional activities as we manage through the environment. So that is probably close to a 3-point impact over prior year quarter.

While in the 3Q21 earnings call:

Due to higher-than-expected demand during the quarter, we further reduced promotions and realized higher-priced sell-through, which of course you see in our gross margin results.

Will UA do more significant discounting than expected? By looking at NIKE’s 1Q23 results, we can get a glimpse of the back half of the year since NIKE’s reporting period for the first quarter ends in August. NIKE “only” recorded a gross margin decline of 220bps in 1Q23 (1 June – 31 August), despite a need to accelerate the liquidation of 10% of its inventories. Moreover, the management expects more aggressive out-of-season discounts that would put more pressure on the gross margin (350-400bps decline in 2Q23).

In our view, as UA expects notable gross margin deterioration in the next quarter, we see that UA probably will have to do more promotions and discounting despite its lean inventory balances. In addition, as inflation is persistently high, we believe that consumers are still looking for bargains, all more reasons to do more discounting to stay competitive.

Will the management revise its FY2023 margin guidance on the next earnings call? Will significant discounting impact the premium brand image it is currently building? If that is the case, we believe those will put more pressure on the stock price.

The Stock Looks Cheap. But Does It?

But what about the long term? UA is trading at 14x its forward earnings, lower than its historical P/E. Does the current price offer an attractive buying opportunity? Have its fundamentals improved?

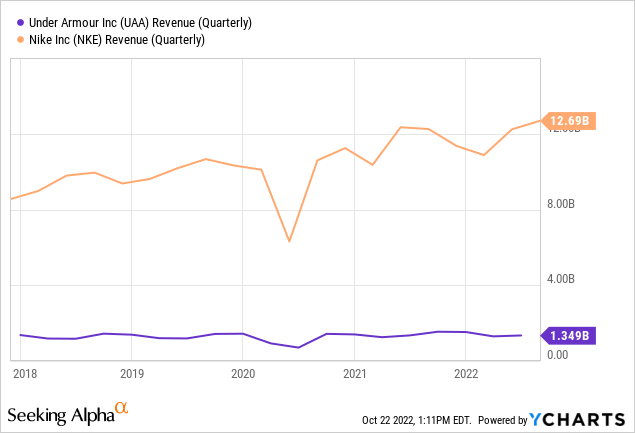

UA has struggled to return to its former glory after its revenue growth fell from 20%-30% to low-single digit. Figure 6 shows UA’s quarterly revenues in the last five years were flattish, while NIKE managed to grow its revenue.

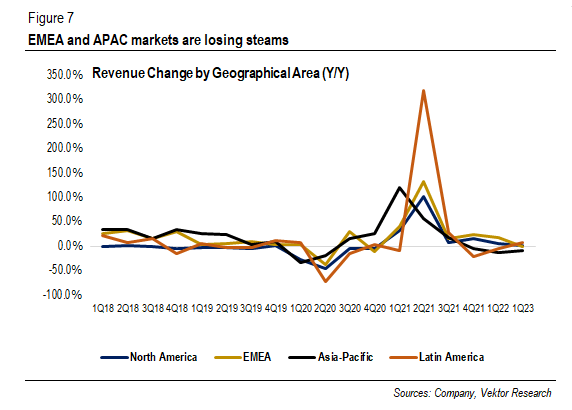

The EMEA and APAC markets, which became UA’s growth drivers, appear to have lost their steam, with the latter remaining under pressure because of the prolonged COVID-related restrictions in China (see Figure 7). Furthermore, the competitive landscape in China has recently intensified, for more consumers seem to prefer to buy domestic brands over Western ones.

Revenue Change by Geographical Area (%) (Company, Vektor Research)

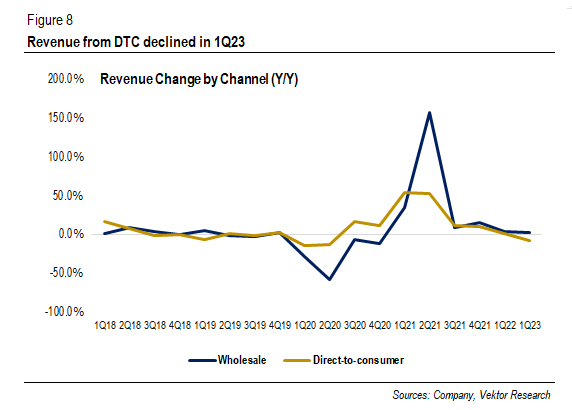

Revenue Change by Channel (%) (Company, Vektor Research)

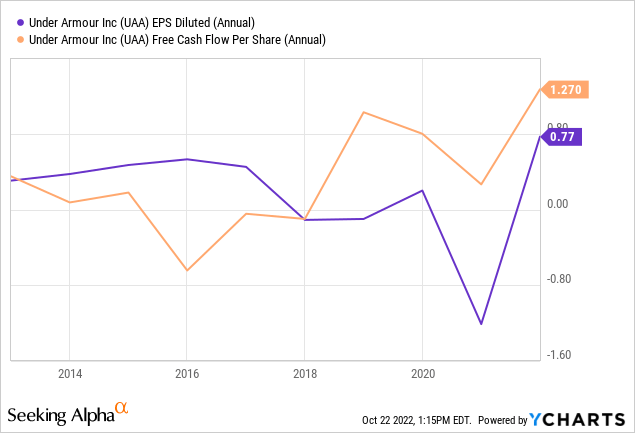

In addition, UA’s earnings per share remain tepid. Yet, the company managed to grow its free cash flow, which can be seen as good news as UA is striving for operational excellence. Still, we see that UA has not yet been able to drive its long-term revenue growth trajectory.

But perhaps the more important factor is its brand strength. Brand Finance, a brand valuation consultancy, placed UA as the 30th most valuable apparel brand in 2022, a drop from 19th place in 2018. On the other hand, NIKE still retains its position as the most valuable apparel brand, and Adidas (OTCQX:ADDYY) has still been in the top 5 in the last five years.

Is A CEO Change A Game Changer For UA?

UA announced in May that Patrik Frisk was stepping down from the President and CEO roles and appointed Colin Browne to assume the interim role. Retail Dive noted that the CEO transition might signal the possibility of the company shifting from “playing defense” by focusing on operational excellence to pursuing faster growth.

Trends continuously change, and retailers must stay relevant to capture growth opportunities. Take, for example, LULU, an athleisure brand, a style that has been the key trend in the last few years. As a result, LULU completed its Power of Three goals two years ahead of schedule and now seeks to double its revenue by 2026.

Will UA be poised to move beyond its focus on performance to a more up-to-date trend in the future? Will the new CEO put the company on a more “offensive” side? It remains to be seen whether a new leadership could change UA’s story, but it can potentially become a game changer for UA, in our view.

Conclusion

All in all, we have not yet seen reasons to justify a higher multiple for UA, as we have concerns over UA’s long-term revenue growth trajectory. Moreover, current headwinds in the industry will likely prompt UA to do significant discounting, in our view, despite its lean inventory balances. Ocean freight costs should still be above the pre-pandemic levels as carriers are cancelling ships to offset rapidly declining prices, and elevated costs should put pressure on UA, as it is rebuilding its inventories.

What do you think? Will the management revise its FY2023 guidance once more during the upcoming earnings call? Can a new leader navigate the company to a stronger position in the industry? If you have any thoughts, please do not hesitate to comment below.

Be the first to comment