jiefeng jiang

Overview:

Ultra Clean Holdings (NASDAQ:UCTT) are set to report Q3 earnings tomorrow (26 October) after markets close.

Q2 results delivered beats on both revenue (by about 3%) and earnings (by about 1.2%), however the share price was down almost 7% the following day.

Quarterly results (revenue) (Bloomberg Terminal)

In fact, the average price move following earnings is a massive 9%, with positive changes of as much as 32%, and negative moves of as much as -21% over the last 5 years.

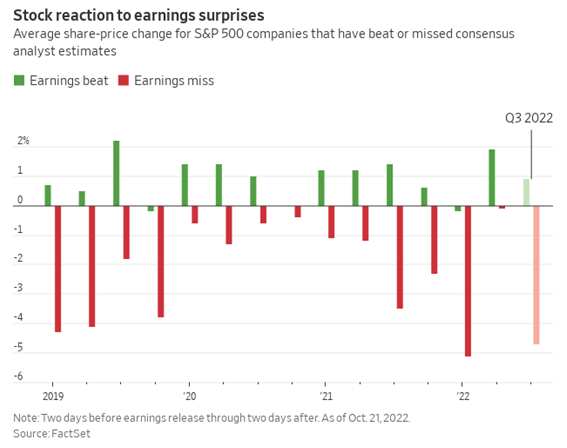

Given the current market environment where higher interest rates, slower growth and increasing talks about the possibility of a recession have become the norm, we have seen investors react strongly when companies announce misses or lower-than-expected guidance, but have certainly not rewarded them to the same extent on the other end. This is clear from the below FactSet graph from the WSJ.

Share price movements after earnings release (WSJ )

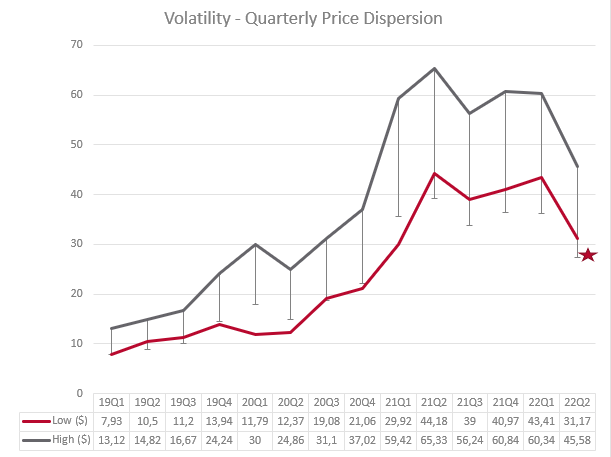

When I previously discussed Ultra Clean Holdings exactly 1 year ago, I noted one of the company’s “weaknesses” was the volatility in its share price – and this has again been on full display over the last 12 months, with the share down 33% since.

Price volatility. I believe this is in large part due to their positioning in the market – UCT mainly delivers to OEMS, who deliver to the foundries and IDMS, and ultimately the end producer. UCT, in other words, are even further towards the tip of the bullwhip in an industry that is known for its cyclicality. The graph below indicates the extreme volatility in UCT’s share price. The difference between the lines represents the difference between the highest and lowest share price in any given quarter since 2017. The smallest delta in any given quarter was 22%, with the largest at 61%. The average drawdown in any quarter was a massive 40%, as indicated by the error lines.

Share Price Volatility (Created by Author)

Due to the recent regulatory changes aimed at curtailing Chinese semiconductor capabilities, this quarter’s results (or perhaps rather the next quarter’s outlook) might again cause some volatile moves.

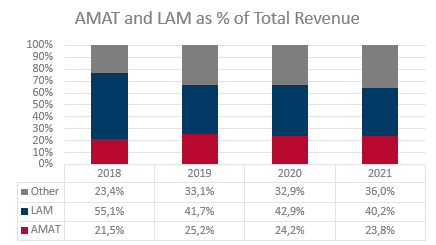

UCTT is unlikely to be directly affected by any of the new regulations, but their 2 biggest customers, Applied Materials (AMAT) and Lam Research (LRCX) will certainly be affected to some degree. UCTT generates the bulk of its revenue (>60%) from these two, however that number has been steadily declining over the years as they broadened their footprint in the industry.

Main Customers (Created by Author)

Uncertainty in their outlook will almost likely flow through to that of UCTT, and given that it operates at lower margins than the upstream capital equipment providers, hits to its topline could potentially have larger effect on its bottom line. I believe the doom and gloom is limited though, both LRCX and AMAT have released statement and updates about the effect on their businesses, and it was not as bad as some market participants initially feared.

Earlier this year UCTT noted that their outlook for 2023 remains favorable, and that they have seen no major cancellations. Like most other companies in the space, they have also indicated that weakness in consumer demand (i.e., more advanced semiconductors) is offset by continued strength and growth in the automotive and IoT sectors. This forms a major part of the thesis behind the semiconductor industry at the moment – the end uses are expanding, leading to less vulnerability in semi businesses due to a slowdown in any particular end-market.

Stay the course

Investors would do well to stay the course, and not sell the current weakness.

With a market cap of just over $1.2 billion and sales just north of $2 billion (P/S < 1), UCTT does not get nearly the same airtime as its upstream peers, however that does not mean there isn’t opportunity for substantial capital appreciation, in fact the opposite.

Using what I believe to be quite conservative growth and margins targets, and a long enough outlook (5 years in this case), I believe UCTT has more than 80% upside from the current share price, and a FV closer to $50. I reiterate – this is using conservative estimates, as I will show below.

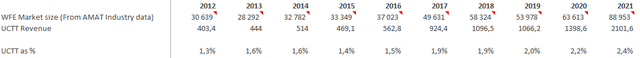

- Over the 10-year period from 2012 to 2021, WFE has grown at a CAGR of 12.6%. UCTT has grown revenues at 20.1%.

- This means they have increased their stake of the WFE pie from 1.3% to 2.4% over that period – so roughly 1% over 9 years.

UCT market share as % of WFE (Created by Author)

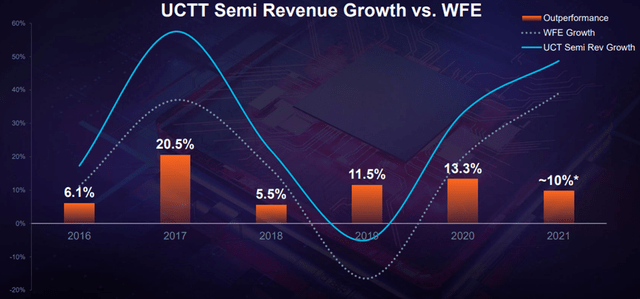

- My current revenue assumptions result in a CAGR of 6.4% between 2021 and 2026, versus 30% between 2016 and 2021. This would mean that UCTT does not continue to grow its share of the WFE market at all over my forecast period. (Again, I believe these estimates are very conservative)The industry as a whole is still expected to reach $1 trillion by 2030, which would imply a CAGR of about 6.6%, and UCTT has OUTGROWN the industry by leaps and bounds in the past, as seen below.

UCTT outgrowing the market (UCTT Earnings Reports)

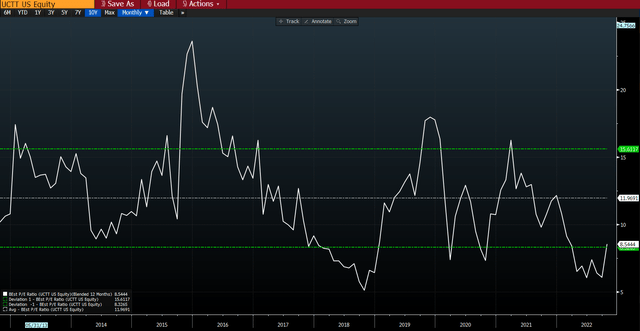

- I apply a forward looking multiple of 12x – their 10 year average – even though the prospects of the business, and the entire industry, are now arguably better than in the past.

Bull Case

Assuming slightly more aggressive growth numbers (still low compared to what has been achieved in the past), leads to a CAGR of 9.7% over the forecast period, and applying a slightly higher forward multiple of 14, leads to a FV of $70, upside of 140% to the current share price. I believe this is a more accurate reflection of UCTT’s potential.

Bear Case

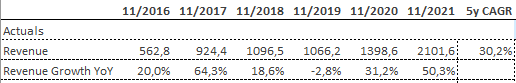

To get even more confidence in the long term prospects for UCTT, its helpful to look at what the current share price has baked in. Assuming a 10% revenue decrease in 2023, flat in 2024, and then returning to growth in 2025 and 2026 (CAGR of 4.5% over the period, vs 30% over the previous 5 years) and applying a multiple of 10x earnings, leads to a FV of $27.5, pretty close to the current share price. Put it context, that would mean UCTT manages to grow revenue from roughly $2.4 billion (2022 consensus) to $2.62 billion by 2026. The same company that did this?

UCTT Revenue Growth (Author, data from 10K)

Seems unlikely…

Relative Valuation

On a relative basis, UCTT is also looking cheap today, trading 1 full standard deviation below its long term (10 year) average forward multiple. This is also true when considering 7,5 or 3 year periods.

Merely returning to its long term forward multiple (which is not asking much from a company outgrowing the industry by such a wide margin), would already result in a gain of 30% from current levels.

UCTT PE (f) (Bloomberg Terminal)

What does Wall Street Say?

100% of the Wall Street Sell Side analysts (all 4 of them) also currently have a buy rating on the stock, and the average upside from their targets is about 57%, however their price targets have, of course, come down significantly as the sector cooled over the last year.

- Cowen: 68 to 42 (Feb to Aug)

- DA Davidson: 80 to 55 (Apr to Aug)

- Needham: 66 to 42 (Apr to Aug)

- Stifel: 85 to 77 (Jul to Aug)

- Craig-Hallum: 73 to 50 (Jul to Aug)

Conclusion

UCTT is not well known, and not broadly covered. However, they stand to benefit from the same secular tailwinds behind the rest of the industry, and over the past decade they have executed their strategy effectively, outgrowing the market by a large margin.

Those not prepared to face any volatility might want to steer clear, but for investors with a sufficiently long time horizon – UCTT offers compelling value and a great opportunity for capital appreciation.

Be the first to comment