greenbutterfly

The modern era has been defined largely by a few key technologies. One of these is undoubtedly the cloud. And with the rise of cloud computing, the demand for various services related to it have also developed. One company that you can point to as an example of an expert when it comes to this space is F5 (NASDAQ:FFIV). As a multi-cloud application security and delivery company, with enterprise-grade solutions and a variety of other offerings, F5 has created for itself a rather interesting niche in the market. When it comes to financial performance, the recent past has been rather interesting. Revenue for the company continues to climb, but it has run into some issues of declining margins. Even with this, however, shares of the firm look cheap on both an absolute basis and relative to similar firms. So because of that, and my view as a whole when it comes to this space, I do feel optimistic moving forward.

Mixed Q4 earnings results from F5 but shares are attractive

Keeping up to date with how a company performs from a fundamental perspective is incredibly important for any investor. And what better time to look at updated numbers than when they are first reported. On October 25th, after the market closed, the management team at F5 announced financial results covering the fourth quarter of the firm’s 2022 fiscal year. During that quarter, sales came in strong at $700 million. In addition to representing a 2.6% increase over the $682 million reported the same time last year, the revenue generated by the company also beat expectations by $8.13 million.

Although systems revenue for the company dropped by 5% driven in large part by the ongoing semiconductor shortage, the rest of the enterprise experienced attractive growth. Most notably, we had the 13% increase in software revenue that the company experienced. Admittedly, software growth for the company was weaker than what management had hoped for. But now, software accounts for 51% of the company’s total product mix. Just five years earlier, it totaled less than 15%. It’s also worth noting that about 76% of the company’s total software revenue it’s in the form of subscription-based services, including the company’s SaaS (Software-as-a-Service) offerings and utility-based revenue. The rest of this revenue came from perpetual license sales. Seeing any company generate a significant portion of its revenue from subscriptions is always a positive in my book. This is because of the ongoing nature of the relationship between provider and customer, and the stability in revenue and cash flows that should offer.

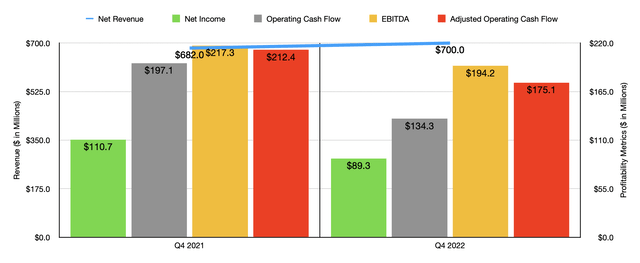

Although the company experienced some nice results on the top line, bottom line figures could have been better. For starters, net income in the final quarter of the year came in at $89.3 million. That’s down from the $110.7 million generated the same time last year. On a per-share basis, the company reported a profit of $1.49. While this was higher than the $1.42 that analysts thought the company would report, it did come in lower than the $1.80 per share experienced in the final quarter of 2021. Particularly painful for the company was the fact that systems revenue mix in the latest quarter was higher than the company thought it would be and that higher costs associated with procuring and expediting critical components took a toll on the company’s bottom line. In fact, the gross profit margin for the company came in at just 78.9%. That’s compared to the 82% to 83% range management thought they would see. Naturally, this had a negative impact on the company’s other bottom line results. Operating cash flow in the latest quarter came in at $134.3 million. That stacked up unfavorably against the $197.1 million reported the same time last year. If we adjust for changes in working capital, the picture would have been slightly better, with the metric declining from $212.4 million to $175.1 million. Meanwhile, EBITDA for the company declined from $217.3 million to $194.2 million.

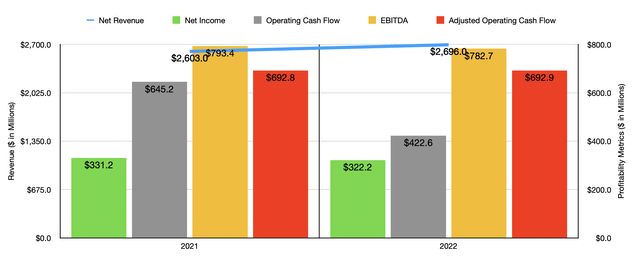

Thanks to the reporting of the final quarter, we now know what the company’s results looked like for 2022 as a whole. During that time, sales came in at $2.70 billion. That’s up 3.6% compared to the $2.60 billion reported in 2021. The primary growth factor for the year as a whole, software, was far more impressive than it was in the final quarter. In 2022, software revenue growth stood at an impressive 33%. But offsetting that was a 13% drop in systems revenue, once again driven largely by the ongoing semiconductor shortage affecting the globe. For the year as a whole then, the same factors affected the company’s bottom line. Higher costs led to net income dropping from $331.2 million last year to $322.2 million this year. Operating cash flow fell even harder, plunging from $645.2 million to $422.6 million. But if we adjust for changes in working capital, we actually would see an improvement here over a year, with the metric climbing from $692.8 million to $692.9 million. Meanwhile, EBITDA for the company also dropped, declining from $793.4 million to $782.7 million.

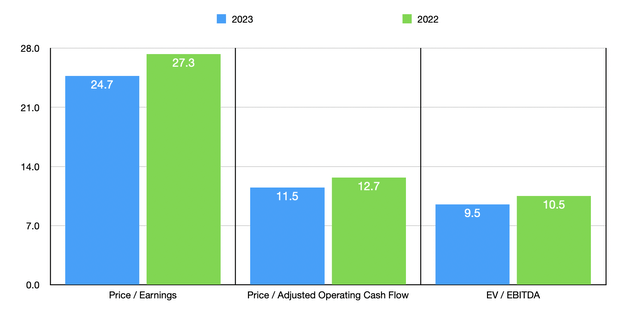

When it comes to the future, management has provided some guidance. They currently anticipate revenue growth of between 9% and 13% for 2023 as a whole. At the midpoint, that would translate to revenue of $2.97 billion. They also forecast non-GAAP earnings per share growth in the low to mid-teens rate. Applying this same logic to total earnings per share, this would imply net income of $356.5 million. No guidance was given when it came to other profitability metrics. But if we assume that they would increase at the same rate the net income should, then we should anticipate adjusted operating cash flow of $766.7 million and EBITDA of $866 million.

Using these numbers, we can calculate that the company is trading at a forward price to earnings multiple of 24.7, at a forward price to adjusted operating cash flow multiple of 11.5, and at a forward EV to EBITDA multiple of 9.5. Using the data from 2022 instead, we end up with multiples of 27.3, 12.7, and 10.5, respectively. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 22.8 to a high of 297.3. In this scenario, two of the five companies were cheaper than our prospect. Using the price to operating cash flow approach, the range was from 11.9 to 129.1, while using the EV to EBITDA approach would yield a range of between 8.8 and 56.3. In both of these cases, only one of the companies was cheaper than F5.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| F5 | 27.3 | 12.7 | 10.5 |

| Juniper Networks (JNPR) | 24.5 | 53.9 | 13.2 |

| Ciena Corp. (CIEN) | 35.6 | 68.6 | 15.0 |

| Lumentum Holdings (LITE) | 27.7 | 11.9 | 8.8 |

| Calix (CALX) | 22.8 | 129.1 | 56.3 |

| Viavi Solutions (VIAV) | 297.3 | 20.2 | 20.9 |

Takeaway

All things considered, I understand why investors might be a little hesitant when it comes to F5 at this moment. It’s not great to see a firm show bottom line deterioration from one year to the next. Having said that, shares do still look cheap and management is forecasting some nice improvement in the 2023 fiscal year. Factoring all of these items in together, I do think that shares are cheap enough to warrant a solid ‘buy’ rating at this time.

Be the first to comment