jetcityimage

Article Thesis

Ulta Beauty (NASDAQ:ULTA) is the leading operator of beauty chains in the United States, with 1,318 stores across the country. Although the business is maturing, Ulta still has several levers for continued shareholder returns: incremental store growth, on which they earn a 30% ROIC; leveraging a powerful brand to drive comparable same-store-sales (SSS) growth; and share buybacks. These three pillars of earnings per share growth are likely to drive high single-digit to low double-digit share price returns over the coming years. I prefer slightly higher annual return estimates and will start buying if shares go below $350.

Well-Defined Growth Strategy

Bricks-and-mortar retailers generally have two levers to pull for revenue growth: building out new stores and increasing sales per store. Ulta has been largely successful at both, which has helped drive exceptional growth.

Incremental Store Growth

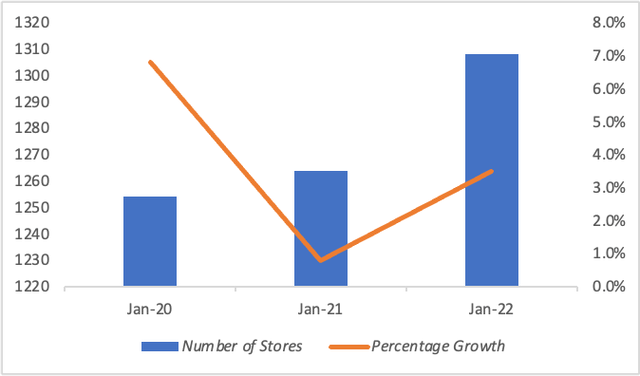

Over the past three years, Ulta Beauty has averaged net new store growth of 3.5% per annum, even managing to grow their store count during the depths of the COVID-19 pandemic. Since building new stores are a large use of capital, delving into the store-level economics is useful.

Ulta Beauty new store growth (Author’s own work)

It costs Ulta, on average, $1.4 million to open a new store, and NOPAT per store roughly equates to $750,000 per year (NOPAT / number of stores). Adjusting for incremental capital investments in stores, investments to support their supply chain, and working capital, Ultra’s ROIC works out to just over 30%. This is an extremely attractive internal investment profile and explains how Ulta was able to compound EPS at 20% annually over the past decade.

Ulta’s management has stated that they believe their market will not begin to saturate until they reach 1,500 to 1,700 stores in the U.S. (200 to 400 stores more than today). This leaves at least four more years of consistent growth before Ulta will have to push into other markets for continued growth.

Additionally, Ulta has a partnership with Target (TGT), which allows them to open 800 mini-stores at 1,000 square feet each in Target locations across the country. The exact economics are unclear, but given that Ulta currently collects ~$650/square foot in revenue, the mini-stores could add ~$520 million in revenue over the mid-term to Ulta’s top line.

In addition to the Target push, I believe Ulta can conservatively grow their net store count by 50 per year, equating to annual investment of $70 million and incremental NOPAT of $37.5 million (3.8% growth over TTM numbers).

SSS Growth

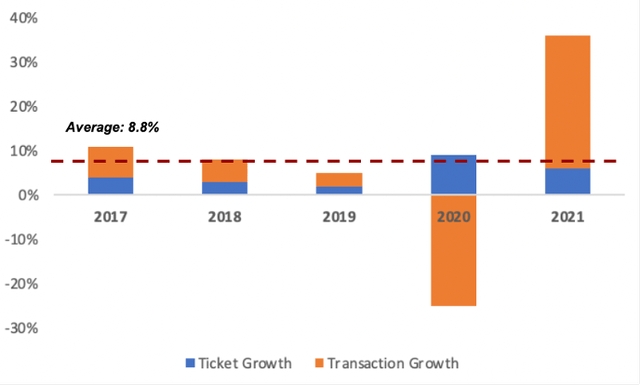

The other key lever for growth is comparable same-store-sales growth, an area which Ulta has been weakening in over the past couple years. SSS can be increased in two ways: growing the number of transactions and increasing the amount of money spent on each transaction (i.e., ticket growth).

Over the past five years Ulta has seen stronger growth in tickets than transactions, with the former also being more stable, as is illustrated in the chart below.

Ulta Beauty SSS growth (Author’s own work)

In the long-term, SSS growth will moderate well below the five-year average of 8.8%, as management has noted that mature stores tend to realize only low single-digit SSS growth. As the business matures, all stores will likely eventually trend toward these levels.

Powerful Brand Value, a Competitive Advantage

Building up competitive advantages is key to success and maintaining above average returns on capital in any industry, and retail is no different. Notably, Ulta has a brand which is beloved by those in Generation Z, as was evidenced in the most recent semi-annual Piper Sandler Generation Z Survey.

In it, an impressive 48% of respondents ranked Ulta Beauty as their top beauty destination. This surpassed the number of respondents who ranked rival Sephora, owned by LVMH (OTCPK:LVMHF), by a ratio of 2.5 to 1.

Brand loyalty has also been demonstrated by Ulta’s loyalty card, which has over 37 million members and drives higher ticket value across all retail channels.

Having a generation of consumers overwhelmingly prefer your brand to competitors bodes well for the long-term success of Ulta and supports the idea that Ulta will continue to be able to drive market share and wallet share gains from competitors and consumers, respectively.

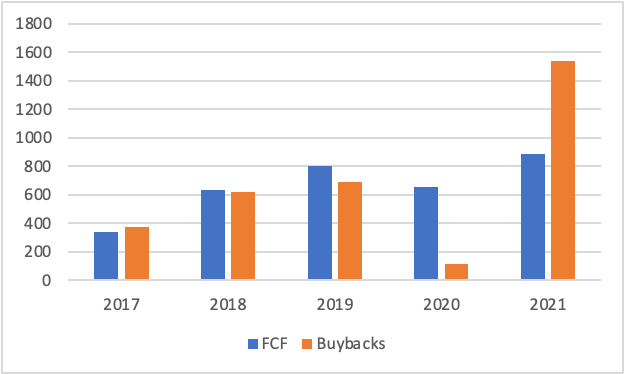

Large Capital Return Program

In response to slowing growth and enormous free cash flows, Ulta has embarked on an aggressive capital return program, returning $1.23 billion to shareholders through share repurchases, net of issuance, over the past twelve months. This equates to a buyback yield of nearly 6%. Since 2017 alone, Ulta has returned nearly all their free cash flow to investors via share repurchases, deploying $3.3 billion and reducing shares outstanding by 15.9%.

Ulta Beauty Buybacks ($mm) (Author’s own work)

While the most recent year’s pace of share buybacks is unsustainable given the company generated $950 million of FCF in the TTM and plans to more than double capex spend in 2022, $1.87 billion remains under the existing authorization and management has guided for $900 million of buybacks in 2022, equating to a 4.2% buyback yield.

In my view, investors should cheer Ulta on for making high ROIC investments in their business, even if it means near-term capital returns are lower.

Valuation

I’m going to value Ulta in three ways: on a relative basis with multiple comparisons to peers, on an absolute basis via a DCF, and through a reverse DCF to see what assumptions are baked into the current valuation.

Relative

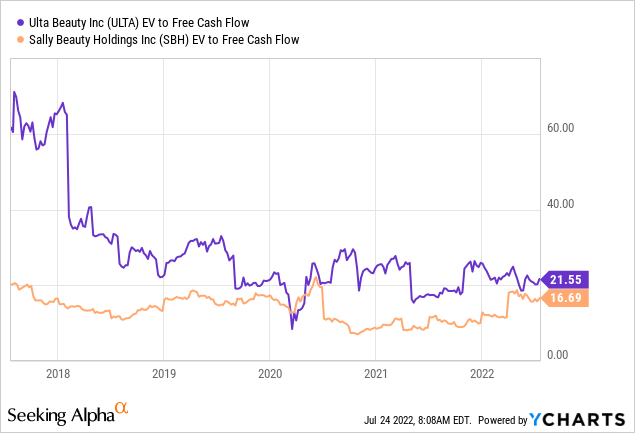

Ulta doesn’t have a lot of public competitors, as they tend to either be boutique shops, or rolled up into a larger company, such as Sephora in LVMH. Their only consequential public competitor is Sally Beauty Holdings (SBH), which has a less attractive growth profile and returns on capital.

Keeping this in mind, SBH trades at 5.3x forward earnings, 17x EV/FCF, and has a PEG ratio of 1.6. Ulta Beauty trades at 20x forward earnings, 21.5x, EV/FCF, a multiple which has declined precipitously over the past five years, and sports a PEG ratio of 2. This relative comparison makes me believe that Ulta is currently near fair value based on a comparison with an arguably weaker peer.

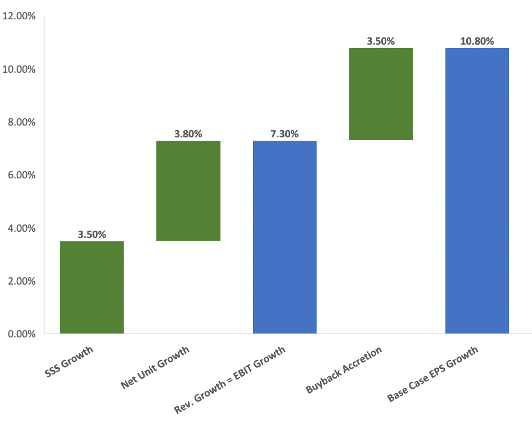

Based on my own estimates, Ulta can comfortably compound EPS at 11% per annum through at least 2025, based on a simple and conservative formula of SSS growth + net store growth + buyback accretion = EPS growth. A PEG ratio of two would justify a P/E of 22x and implies just over 11% annual share price appreciation.

Ulta Beauty EPS bridge (Author’s own work)

Discounted Cash Flow Model

For those who subscribe to the idea that a business is only worth as much as the present value of its future free cash flows, a DCF is a necessity when valuing a business.

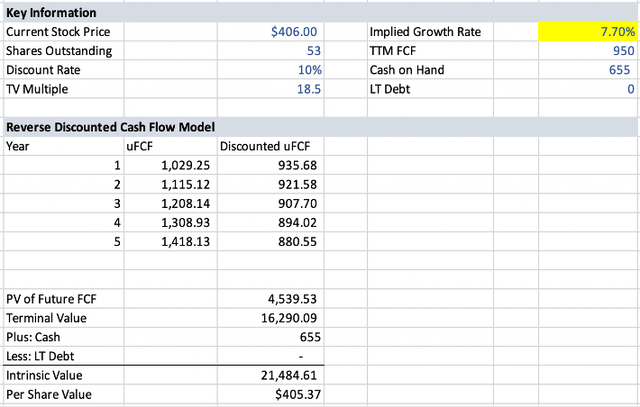

In my model, I come to estimated annual free cash flow growth in the 8% range, predicated on 3.5% annual SSS growth, 3.8% annual new store growth, and margins largely consistent with the targets laid out by management at their 2021 Analyst Day (i.e., 13-14% operating margin). Discounting these cash flows back at 10%, I estimate that the present value of Ulta’s future free cash flows through 2026 is ~$7.25 billion. I think a terminal multiple of 18.5x is reasonable for such a high-quality business and builds in a sensible margin of safety. Using these outputs, along with a net cash position of $655 million, excluding leases, I arrive at an estimated equity value of $19.5 billion, or $370/share. This is 10% below the current share price of $405.

Given the quality of Ulta and their tendency to surprise to the upside, I’m willing to start buying shares in the sub-$350 range based on the DCF.

Reverse Discounted Cash Flow Model

Using the same discount rate and terminal multiple assumptions in the DCF, it appears as though the market is pricing in 7.7% annual FCF growth over the next five years off a base of $950 million. These assumptions seem fair and suggests there is limited upside in the current price range.

Ulta Beauty reverse DCF (Author’s own work)

Risks

There are three key risks facing Ulta Beauty: declining same-store-sales growth, the law of large numbers, and a potential recession which could weaken their customers’ ability to spend.

- Declining SSS growth: Pre-COVID, Ulta’s SSS growth had been spiraling downwards due to a maturing store base. Fortunately, this risk is mitigated by management’s commitment to reverse this trend and drive 3-5% annual SSS growth through 2024, though it remains to be seen whether they can pull this off.

- The Law of Large Numbers: Ulta is likely to open ~50 stores per year moving forward, which on a growing base means that yearly percentage unit growth must decline over time. Lower percentage growth may result in a lower market multiple, potentially diminishing future returns.

- Recession: High inflation and potential future job losses could pressure consumers’ ability to spend. However, according to a 2020 white paper from McKinsey, the beauty industry has proven resilient during economic downturns, even expanding during the 2008 Great Financial Crisis.

Takeaway

Ulta Beauty is an incredibly high-quality business which earns exceptional returns on capital and reinvests those proceeds at equally high rates of return. However, there’s no such thing as a great stock at any price, and Ulta’s current share price gives me pause from beginning to buy shares. I’ll likely start buying if ULTA falls below $350 and will build a full position if they decline below $300.

Be the first to comment