Vertigo3d

I briefly mentioned being long SIGA Technologies (NASDAQ:SIGA) in the recent earnings roundtable and received quite a few questions in response. I figure with WHO declaring monkeypox a global health emergency, now is a good time to give my thoughts on SIGA for Seeking Alpha readers.

Monkeypox Is Not 2019-nCoV

Let me start by tooting my own horn while also warning some readers that this is not a repeat of my past success. I was the first person on Seeking Alpha to recommend hedging against a market crash due to the outbreak of Covid-19 (then called 2019-nCoV), so it might seem as though I have a knack for this sort of thing. Whether I do or not, those asking me whether monkeypox will be another 2020-type event for the market should know that I don’t think monkeypox represents the same type of downside threat and thus we aren’t looking at shorting the entire market.

Rather, I believe that monkeypox will have the same type of effect on vaccine stocks that Covid-19 did, without the strong downside pull on the entire market that Covid did. Thus, we are looking at long positions on companies comfortably positioned to profit from monkeypox instead of short positions on stocks that are likely to fall hard (as we did in 2019 with cruise stocks).

After much research, I recommended my subscribers take a position in SIGA. I’ll say here what I told my newsletter subscribers: This position is a lottery ticket but with a risk/reward that greatly favors the buyer. So far, the play has paid off, but the upward movement thus far has been due to hype more so than actual fundamentals – but that might just be enough to make quadruple-digit ROI regardless of the long-term trajectory of monkeypox.

SIGA’s TPOXX and Monkeypox

Clearly, I could not have known that WHO would call monkeypox a global emergency when I made the recommendation, but I believe both WHO and I were working with the same data. I worked on mathematical virus models for my senior project for my BS in mathematics in the University of Washington, and I had applied that knowledge to both the initial data of 2019-nCoV and monkeypox before putting my money down. I think, if anything, WHO’s declaration only adds strength to my hypothesis that monkeypox will spread exponentially, creating urgent need for treatment, which is where SIGA comes in.

SIGA distributes TPOXX, an anti-viral treatment for human smallpox caused by variola virus. Variola virus is a family of virus, similar to coronavirus being a family of virus that causes Covid, SARS, and the common cold. Monkeypox belongs to the variola virus family and is thus a target for TPOXX.

Although it has not been used in human studies, TPOXX has shown efficacy in cell culture studies, reducing virus-induced cytopathic effect by 50% for monkeypox. It has also been used in primate studies, greatly increasing the survival rate of cynomolgus macaques injected with lethal amounts of monkeypox. The initial data at this point shows TPOXX to be an extremely promising treatment for this “global health emergency,” and SIGA stands to profit greatly.

The Upside

The main downside up to this point has been red tape. Doctors have been consistently reporting difficulty in dealing with the bureaucracy in prescribing TPOXX, despite doctors recommending and patients asking for this treatment. With WHO declaring an emergency, we can reasonably believe that – as with the Covid-19 vaccines – the red tape will be cut away for the sake of saving lives. Naturally, the result is more TPOXX sales, leading to better financial numbers for SIGA, thereby increasing stock price.

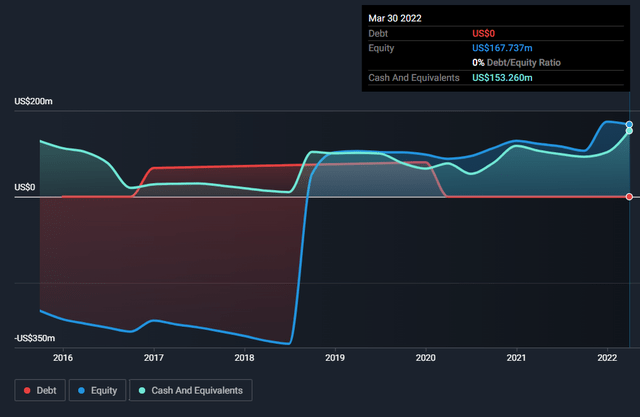

So the idea here is a huge upside, based on the spread of monkeypox. But one reason I recommended this stock is its financial health. This is not an unprofitable, unproven meme biotech hype stock. The downside is quite low, judging from the fundamentals.

For example, this is a debt-free company sitting on $150M in cash.

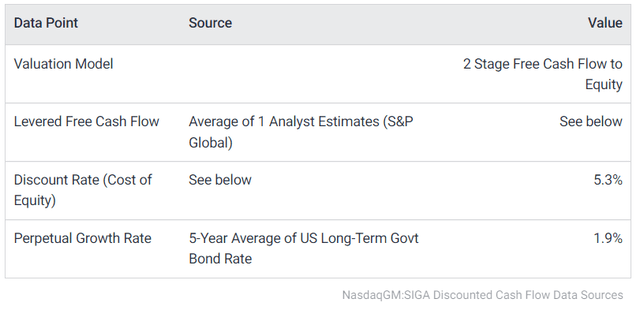

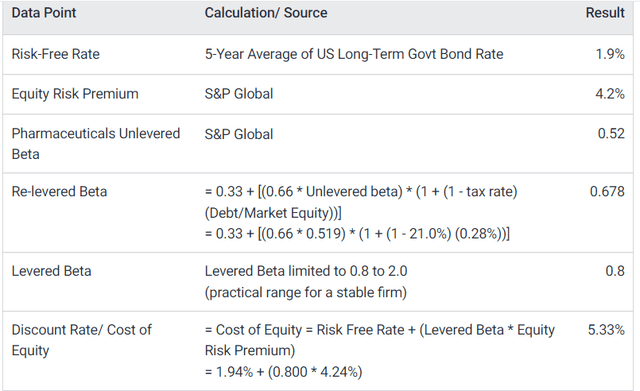

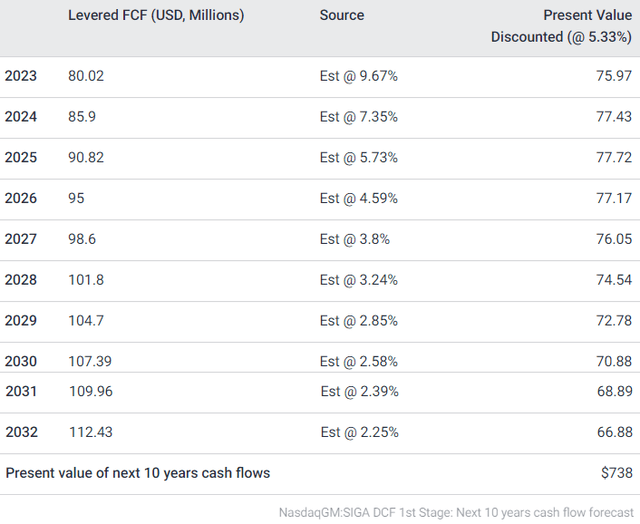

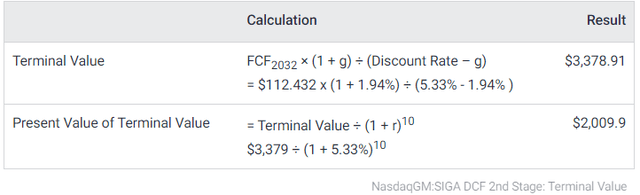

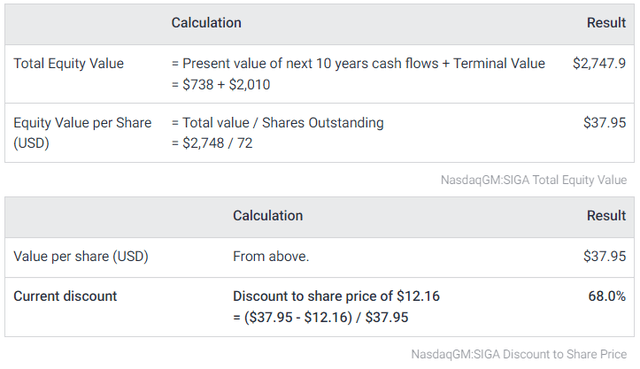

With increasing TPOXX sales, we should expect a significant jump in cash flow, which naturally raises the probability of dividends as well as the valuation as per a discounted cash flow analysis. And on that note, even the current DCF analysis determines SIGA to be undervalued:

Damon Verial Damon Verial Damon Verial Damon Verial Damon Verial

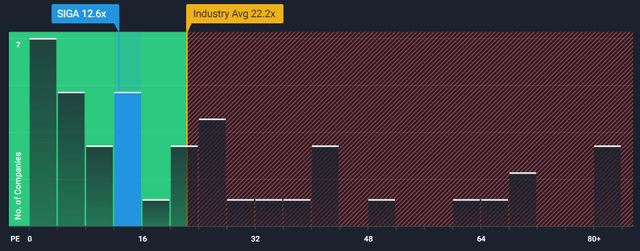

From a price-to-earnings perspective, too, SIGA is underpriced. The average pharmaceutical stock has a PE of 22x, while SIGA trades at a little over 12x:

My point here is that anyone looking at the SIGA chart, seeing the pump, and thinking it’s too late to get in still has quite a bit of upside, both from a fundamental (valuation) perspective and a macro (monkeypox) perspective. So, for those who’ve asked me: no, I don’t think it’s too late to take a position in SIGA.

The Play

As for my recommended play, I told my newsletter subscribers to buy the Dec16 $22.50 calls. These are considerably more expensive now than when I first recommended them. Right now, I’m more biased toward at-the-money calls due to this trade looking increasingly like a gamma trade (faster-than-expected upward movement).

I like the Dec16 $12.05 calls right now, simply because so many traders have stepped into the OTM call “lottery ticket” trade. Now, SIGA looks more like a standard buy (if you’re a stock-buyer) and an ATM-call buy if you’re an options trader. The risk of this play is capped at the debit spent on the calls, which is currently $340 per call.

Let me know your thoughts in the comments below.

Be the first to comment