Olivier Le Moal

I’ve been following UiPath (NYSE:PATH) closely for a year now as I believe in UiPath’s long-term potential.

In this article, we’ll review UiPath’s Q2 results. Enjoy!

Investment Thesis

“I can’t see a way through,” said the boy.

“Can you see your next step?”

“Yes”

“Just take that,” said the horse.

The excerpt above illustrates UiPath’s current situation.

Macro factors such as currency exchange and the Russia-Ukraine war are weighing down on UiPath, and it’s hard to tell when conditions improve.

However, UiPath is taking the “next step” it can, as we’ll discuss more in this article.

Valuation appears expensive for now, given underwhelming growth and macro uncertainty.

But UiPath’s growth thesis remains intact given its best-in-class software and increasing adoption of robotic process automation (RPA).

Growth

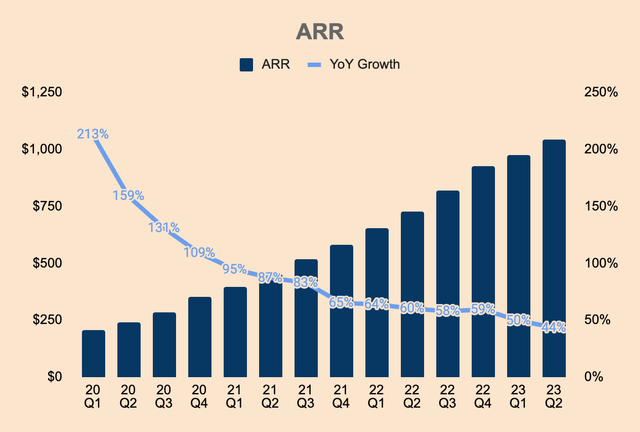

Annual Recurring Revenue, or ARR, crossed the $1 billion mark for the first time. Q2 ARR was $1,043 million, up 44% YoY. As you can see, growth is decelerating meaningfully, dropping below 50% for the first time. This is expected as the company grows over a larger base.

UiPath Investor Relations and Author’s Analysis

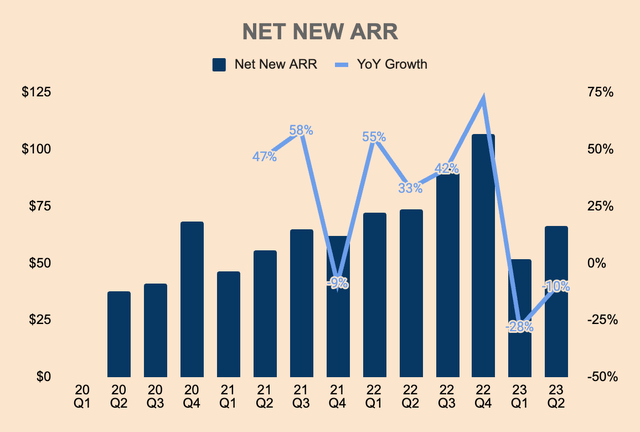

Being that as it may, ARR growth was driven by $66 million of Net New ARR, which dropped 10% YoY. Demand seems to be waning as Net New ARR falls below FY2022 levels. FX also created an $8 million headwind to Net New ARR. With the company facing macro headwinds such as rising inflation and interest rates, it’s also safe to assume that the days of 50%+ growth rates are over.

UiPath Investor Relations and Author’s Analysis

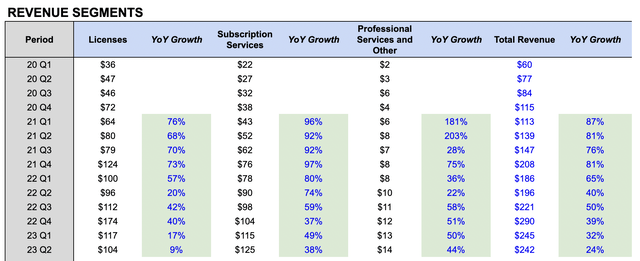

Since the company is transitioning from Licenses (on-premises) to Subscription Services (Automation Cloud or cloud-based SaaS offerings), we are likely to see Revenue Growth slow down substantially.

This is because Licenses Revenue is recognized upfront while Subscription Services Revenue is recognized ratably over the contractual period of the agreement.

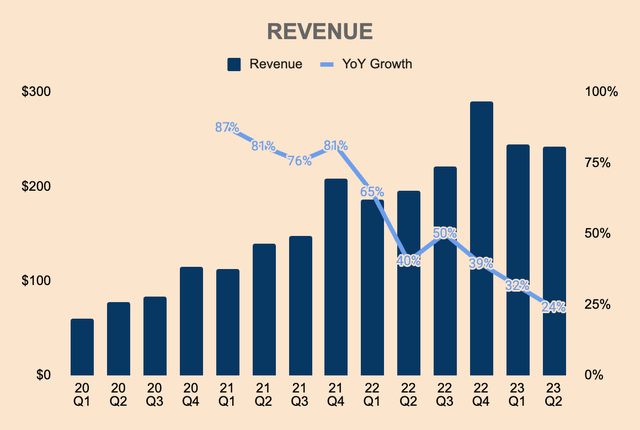

We’re already seeing that transition affect the company’s top line. As shown below, Q2 Total Revenue grew by only 24% to $242 million, a slowdown from last year’s 40% growth rate and Q1’s 32% growth rate. This is due to the lagging Licenses segment which only grew by 9% YoY, as well as a $20 million FX-related headwind. Without the FX impact, Revenue would have grown 35%.

UiPath Investor Relations and Author’s Analysis

On the other hand, Subscription Services Revenue grew by 38% YoY. Higher growth in Subscription Services is better as the segment is much more stable and predictable than the Licenses segment.

Even so, given the transition to the Automation Cloud, we can see how Revenue growth is slowing down more prominently than ARR.

UiPath Investor Relations and Author’s Analysis

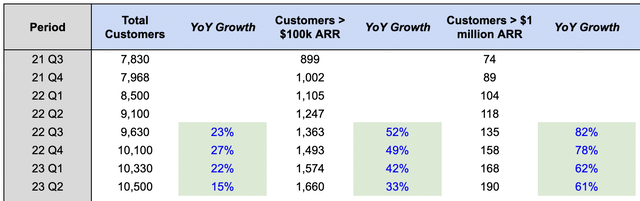

38% of Revenue growth was due to new customers with the remaining 62% attributable to existing customers. Total customers grew 15% YoY to 10,500, adding only ~170 net new customers QoQ.

On a positive note, customers with at least $100,000 ARR grew 33% while customers with at least $1 million ARR grew 61%. It’s good to focus on these larger customers because 1) they’re usually more financially stable compared to smaller customers 2) they tend to invest more in UiPath’s platform and 3) they tend to stay longer in the platform.

UiPath Investor Relations and Author’s Analysis

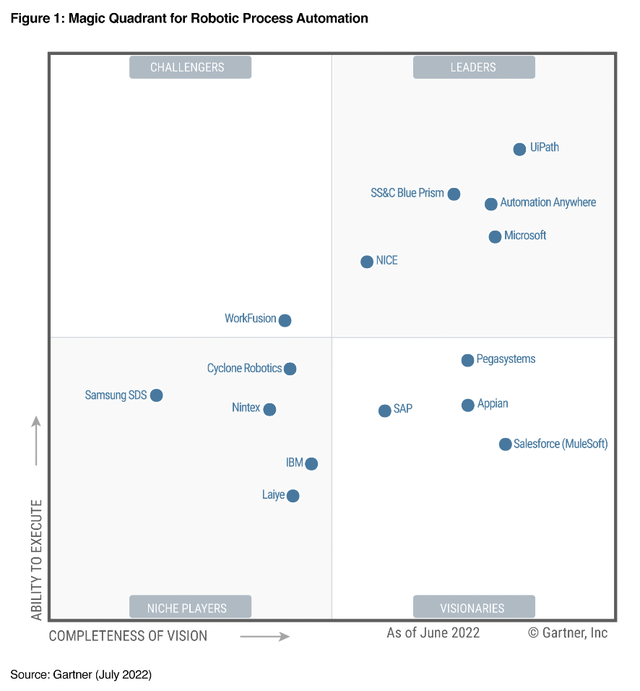

Customers continue to invest in the platform as UiPath is recognized as the leading RPA provider in the market.

-

A Leader in the 2022 Gartner Magic Quadrant for Robotic Process Automation for the fourth consecutive year.

-

A Leader and a Star Performer in Everest Group’s PEAK® Matrix for Process Mining Technology Vendors for the third consecutive year.

That’s why customer retention — although not quite as high as the 140%+ rates from prior quarters — is still decent, which proves the technological value proposition and overall stickiness of the platform.

- Net retention rate: 132%

- Net retention rate (ex-Russia an FX impact): 135%

- Gross retention rate: 98%

Growth is obviously slowing down — perhaps, faster than investors would’ve liked. To make matters worse, a shaky global economy is forcing companies to cut back on investments as they prepare for the worst (i.e. recession).

But despite macro uncertainty, UiPath is still marching forward, taking the “next step” to fulfill its long-term vision of delivering the fully automated enterprise.

Recently, UiPath:

- Partnered with Snowflake (SNOW) to allow robots to collect, validate, and store data in Snowflake.

- Partnered with Workday (WDAY) to automate human resources and financial transaction processes.

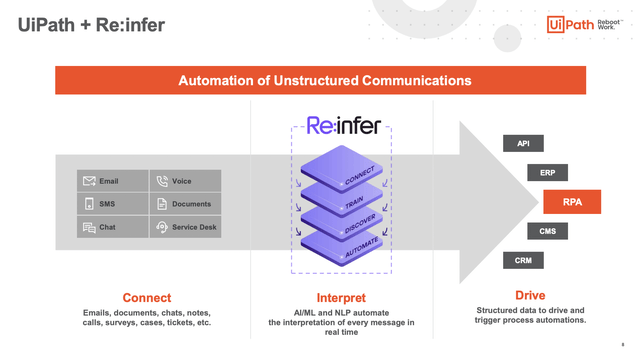

- Acquired Re:infer, a natural language processing company for unstructured documents and communications, for $45 million, according to its 10-Q.

PATH FY2023 Q2 Investor Presentation

Profitability

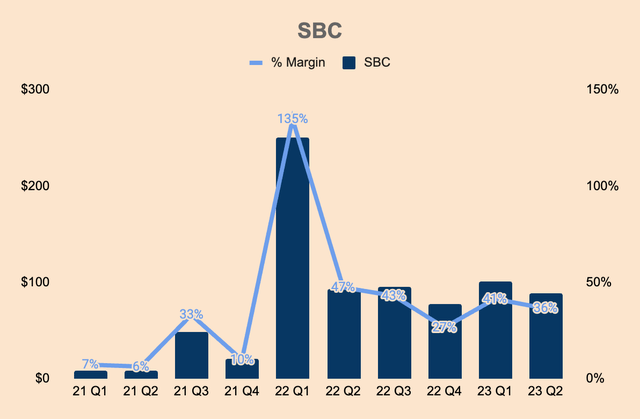

As with most growth stocks that recently went public, UiPath’s share-based compensation (SBC) is quite high, which distorts margins. That said, I’ve included non-GAAP measures for reference, which exclude SBC and one-time expenses.

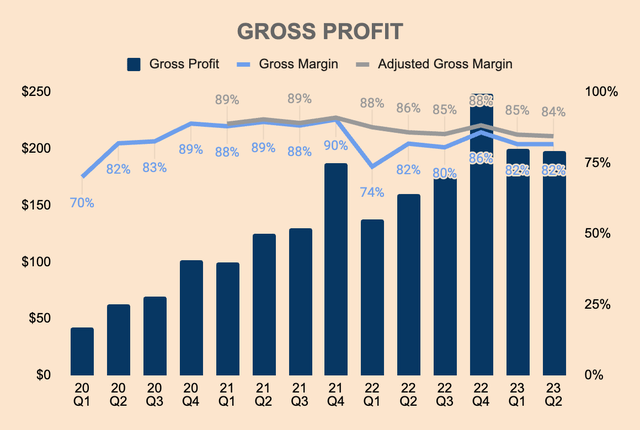

Q2 Gross Profit was $198 million, up 24% YoY. Gross Margin was 82%, and 84% on an adjusted basis. As seen below, Gross Margin is trending downwards slightly due to the company’s ongoing investments in its growing cloud business. Moving forward, management expects Gross Margin to be greater than 80%.

UiPath Investor Relations and Author’s Analysis

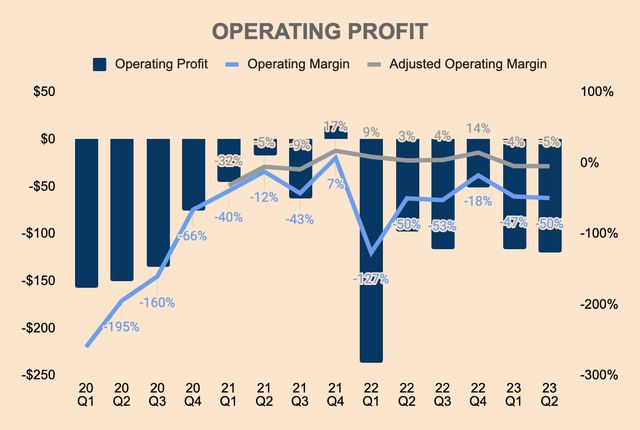

Even with a high gross margin of 80%+, UiPath is still unprofitable. In Q2, Operating Margin was (50)%. Adjusted Operating Margin is also negative, at (5)%. Of course, these numbers could’ve been much better if not for FX and Russia headwinds.

UiPath Investor Relations and Author’s Analysis

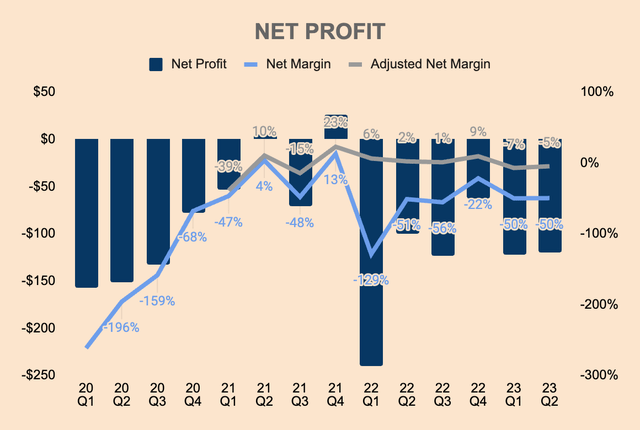

Here, we can see the same trend for Net Profit, or in UiPath’s case, Net Loss.

UiPath Investor Relations and Author’s Analysis

Earnings potential remains high, as demonstrated by its high Gross Margin. But the company still fails to manage Operating Expenses to a sustainable level, which is why UiPath is still chronically unprofitable on a GAAP basis. This is probably the number one bear case against UiPath.

Financial Health

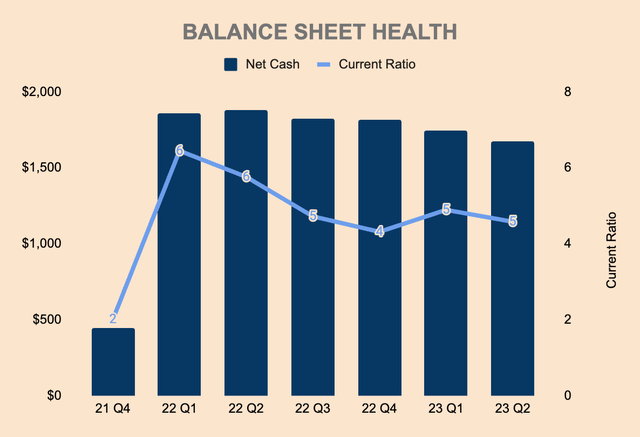

While unprofitability remains a concern, UiPath still maintains a strong balance sheet. The company has a Net Cash position of $1.7 billion with virtually zero debt. Current Ratio stands at 5x which shows high liquidity.

UiPath Investor Relations and Author’s Analysis

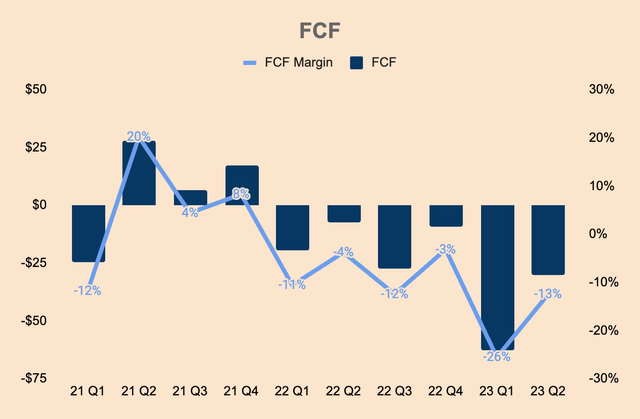

Free Cash Flow is also negative. For the trailing twelve months, FCF was $(130) million. Despite the cash burn, UiPath is still in good financial standing given its high Net Cash position of $1.7 billion.

I understand that management is reinvesting into growth. But if the cash burn worsens, that could put even more pressure on the stock.

UiPath Investor Relations and Author’s Analysis

Outlook

Investors can accept unprofitability. But what took many investors by surprise was the company’s guidance.

Here’s what management guided for Q3 and FY2023 — in the last column, I’ve included last year’s growth rate for reference.

| FY2023 Q3 Guidance | ||||

|

Midpoint Guidance |

Growth/Margin | FX Impact | FY2022 Q3 Growth/Margin | |

| ARR | $1,092 | 33% | $(5) | 58% |

| Revenue | $244 | 10% | $(10) | 50% |

| Non-GAAP Operating Loss | $(28) | (11)% | $(5) | 4% |

| FY2023 Guidance | ||||

|

Midpoint Guidance |

Growth/Margin | FX Impact | FY2022 Growth/Margin | |

| ARR | $1,156 | 25% | $(15) | 59% |

| Revenue | $1,005 | 13% | $(25) | 47% |

| Non-GAAP Operating Loss | $(15) | (2)% | $(15) | 8% |

As you can see, growth is expected to significantly slow down. Just compare the third column with the last — it’s a nightmare.

Here’s why guidance was so weak:

First, we guide to what we see in the pipeline, which continues to fluctuate given the choppy macroeconomic environment, which we anticipate will continue.

Second, more than half of our business is outside the U.S., and we price in local currency, including euro and yen. And as a result, there is a material FX headwind for both ARR and revenue that has significantly increased as we move through the year.

Lastly, going forward, as Rob said, profitability is a core pillar of our go-forward strategy. While the reduction in our top line near-term forecast reflects the FX headwind of the macroeconomic environment and our internal repositioning, we are committed to our goal of achieving non-GAAP profitability and positive adjusted free cash flow in fiscal year 2024.

(CFO Ashim Gupta — Q2 Earnings Call)

The good news is we can expect a return to non-GAAP profitability in the near future — Q4 to be exact.

Here’s the calculation:

- FY2023 Non-GAAP Operating Loss Guidance = ~$(15) million

- First 3 Quarters Non-GAAP Operating Loss = ~(50) million

- Thus, Q4 Non-GAAP Operating Profit = ~35 million

So in spite of the slowdown in growth, it’s great to see that management is taking proactive measures to achieve profitability, a small step towards generating sustainable, long-term shareholder value.

As Co-CEO Rob Enslin highlighted during the earnings call, the company is “strategically repositioning” by focusing on four strategic objectives as shown below.

PATH FY2023 Q2 Investor Presentation

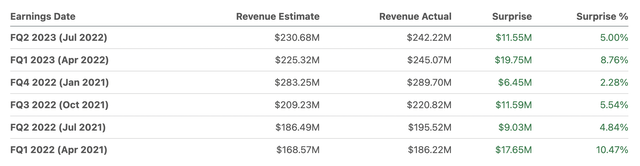

Yes, the guidance was downright disappointing. But keep in mind that management has always been conservative when it comes to guidance. Furthermore, the company has a perfect track record of beating analyst estimates, so I won’t be surprised if UiPath outperforms expectations once again.

Valuation

There are a lot of changes going on for UiPath, both internally and externally. But the growth story for UiPath remains intact, albeit rather slowly due to macro factors.

Given UiPath’s competitive positioning and the growth of the RPA industry, I have no doubt that UiPath has a bright future ahead.

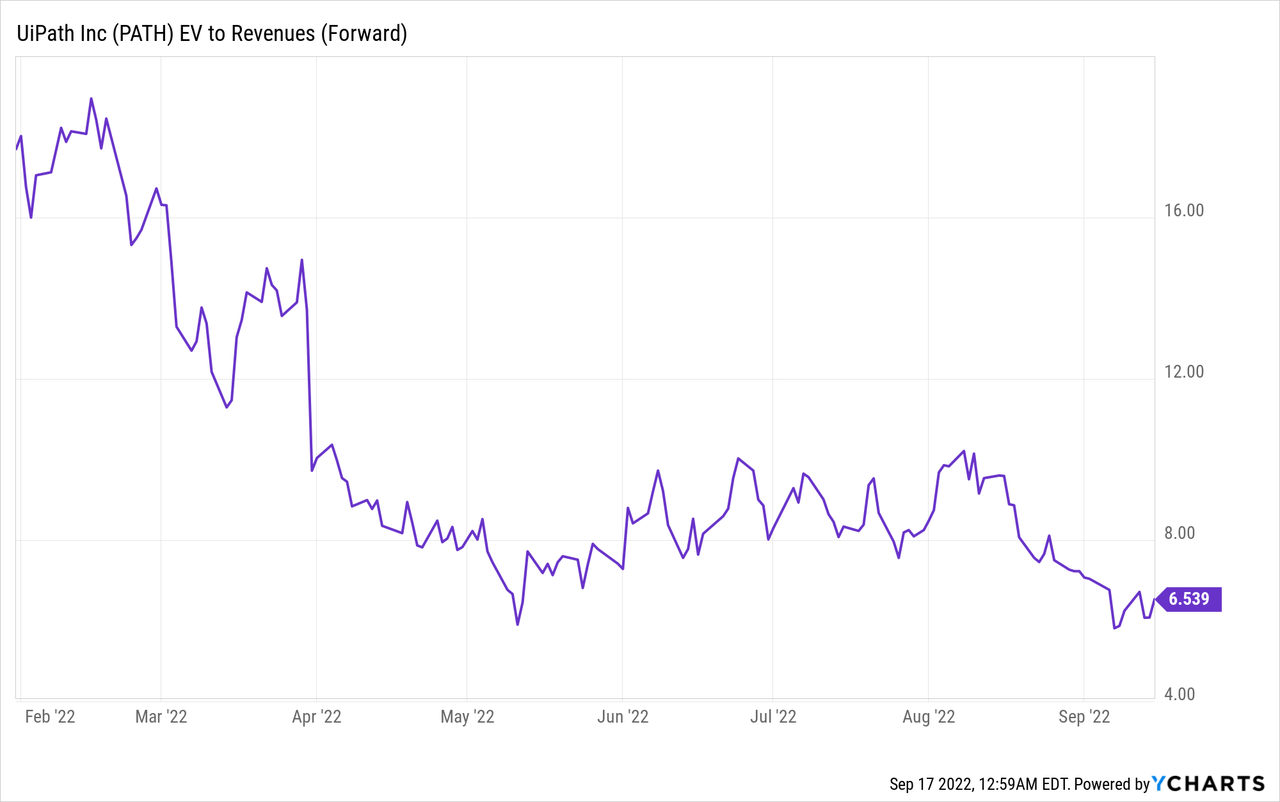

However, its valuation seems rich — UiPath trades at 6.5x EV to NTM Revenue. Even though the stock is far off from its highs of $85, its valuation seems rather expensive given lagging growth and unprofitability.

I was expecting a reacceleration of growth in the second half of FY2023. However, management expects otherwise.

We don’t know how long the situation with Russia and currency pressures will persist. If they extend longer than expected, we could see growth cut down to single digits, or worse, negative.

If that happens, we can see another round of selloff.

That said, I think the risk to reward is not very attractive, so I caution investors to tread carefully.

Risks

- Competition: UiPath faces tough competition from other RPA and other automation solutions providers such as Automation Anywhere, Blue Prism, Pegasystems (PEGA), Salesforce, ServiceNow (NOW), and Microsoft Power Automate (MSFT).

- Currency Pressures: More than half of UiPath’s business is outside of the US, and given the strengthening of the US dollar, we could see more FX-related headwinds for UiPath.

- Dilution: As mentioned, UiPath issues excessive SBC which dilutes shareholders, adding pressure to the stock. SBC was $88 million in Q2, which was 46% of Revenue.

UiPath Investor Relations and Author’s Analysis

Conclusion

Going back to my analogy on the boy and the horse, UiPath is bravely taking the necessary steps to jump back into growth mode — despite being compromised by macro uncertainty.

But proceed carefully. The stock could see further downside due to factors outside of its control (FX, Russia, etc.).

UiPath gave disappointing guidance which got many wondering: “is UiPath’s growth story over?”

Not all hope is lost though — its industry-leading software, the growth of the RPA market, and the path to profitability by FY2024 are still compelling bull cases for UiPath.

Investors could nibble a few shares on the way down or maybe wait for the next quarterly update.

I’m choosing the latter.

Be the first to comment