Melpomenem

Investment Thesis

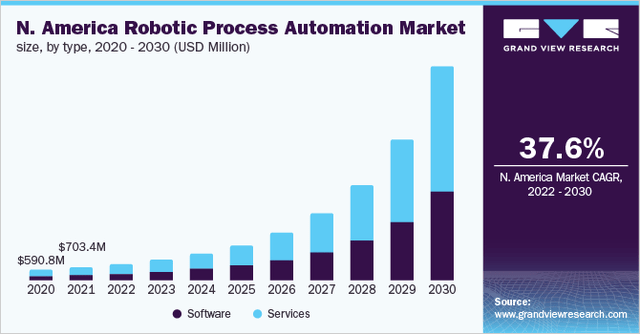

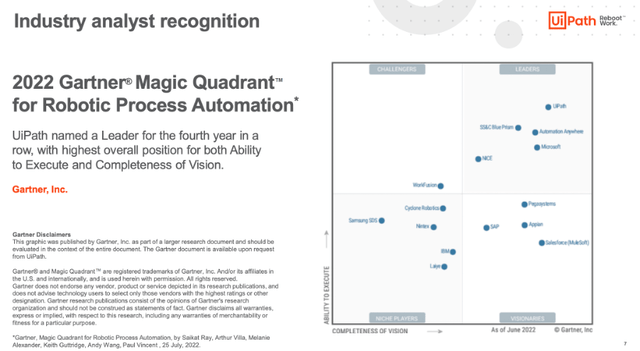

UiPath Inc. (NYSE:PATH) is a leader in robotic process automation, a software technology that makes it easy to build, deploy, and manage software robots that emulate human actions. The technology is exciting to say the least, and Grand View Research expects the RPA (robotic process automation) market in North America to achieve a 37.6% CAGR through to 2030.

Grand View Research

Given that UiPath has been the top dog in this emerging industry for a long time, it made sense for me to take a closer look at the company earlier this year – and it ticked many of the boxes I look for: very high switching costs, a founder-CEO with plenty of skin-in-the-game, and a resilient balance sheet. I outlined my full analysis of UiPath in a previous article.

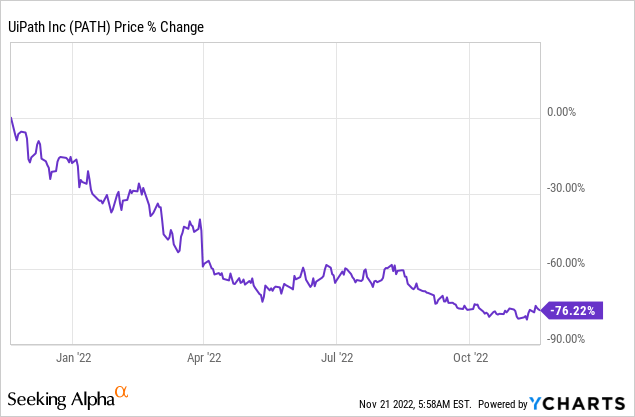

Unfortunately, the last twelve months really haven’t gone to plan for investors in UiPath. Shareholders have suffered from the bursting of another tech bubble, combined with substantially slower-than-expected revenue growth from this business – a combination that the market has hated, with shares of UiPath falling over 75% in the past year.

Q2’23 results were particularly disappointing, with revenue only growing 24% YoY and management’s outlook for Q3 implying revenue growth of a meager 11% – not what investors in a ‘high growth’ business such as this would’ve been expecting.

UiPath’s Q3 earnings are scheduled for December 1, but the company released preliminary results last week that seemed to please the market, with shares jumping 16.5% on the news.

So, let’s take a look and see if these preliminary results indicate a turning point for investors.

UiPath’s Preliminary Q3 Earnings Overview

It’s worth highlighting that these results are not finalised and could potentially change, and that UiPath only shared limited Q3 figures with investors in a recent SEC Filing.

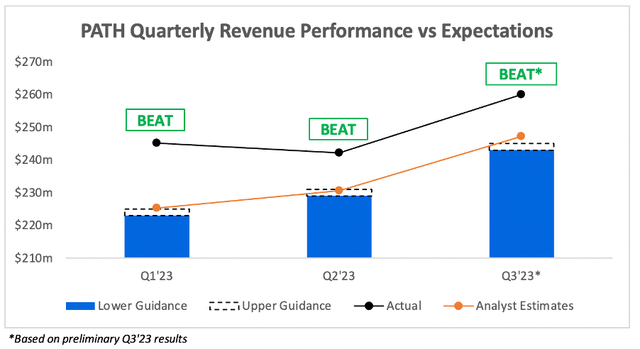

Starting from the top, UiPath’s revenue grew by 17.7% YoY to reach ~$260m. This came in comfortably ahead of management’s guidance of $243-$245m, also beating analysts’ expectations of $247m.

Seeking Alpha / Author’s Work

Let’s not forget, however, that back in Q2 management had offered investors an extremely disappointing guide. This growth rate of 17.7% is certainly below what this robotic process automation leader should be achieving, especially in an industry that’s expected to achieve a CAGR of 37.6% through to 2030 in North America. On the plus side, UiPath’s share price has certainly pulled back to a level that indicates a lowering of expectations – but more on that later.

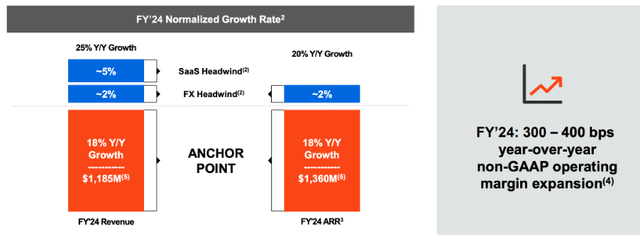

We don’t have any guidance yet for Q4; that won’t arrive until UiPath reports its full Q3 earnings, however management recently reiterated its FY24 revenue and ARR figures in its 2022 Investor Day, implying that investors will not be surprised when this company offers up Q4’23 guidance.

UiPath 2022 Analyst Day

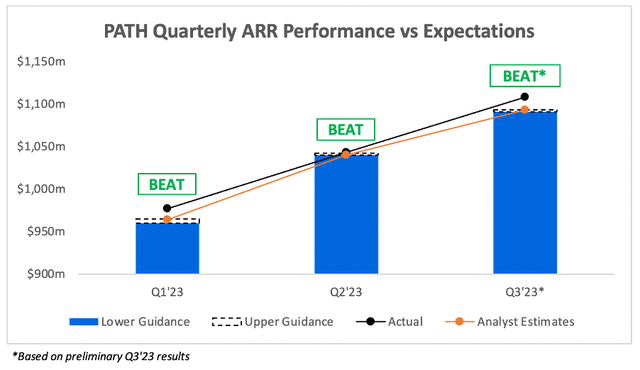

Moving onto ARR (Annualized Renewal Run-rate), as this figure was also provided for Q3 in the preliminary results. UiPath delivered ARR of $1,108m, which came in ahead of management’s guidance of $1,091-$1,093m, and also beat analysts’ estimates of $1,093m.

Seeking Alpha / Author’s Work

Eagle-eyed readers might have noticed consistent beats across the board for UiPath over the last few quarters, and may perhaps wonder why shares have been hit so badly?

Well, the problem with UiPath has been guidance over the past twelve months – it has been so pitifully low on a regular basis that, even though the company has gone on to beat estimates, it’s clear the company has not been delivering results that are good enough for a business with UiPath’s growth potential.

Yet this quarter felt more comfortable than others, and the reiteration of management’s FY24 revenue and ARR outlook implies that UiPath’s earnings may have finally stabilised. Whilst investors won’t know any more information until the start of December, these preliminary results certainly should come as a welcome surprise.

Further Headcount Reductions

UiPath shares would have also been boosted last week as the company announced plans to make a further 6% reduction to its global workforce this year (on top of an existing 5% reduction announced in June), which would be approximately 242 employees. This will result in increased one-off restructuring expenses of ~$30m in FY23, up from the previously estimated ~$15m, but should create a leaner, more efficient organisation.

Whilst it’s extremely disheartening to see share prices rise on such news, it’s a story that has been seen across the technology world in 2022. From Meta Platforms (META) to Shopify (SHOP), many companies have admitted to hiring too aggressively based on the spike in demand that occurred in 2020 and 2021.

Now, with the global economy facing a number of headwinds, demand has dropped sharply, and businesses have found themselves severely overstaffed, with revenue growth unable to keep up with the rising cost of additional employees – sadly, it appears that UiPath is in the same boat.

PATH Stock Valuation: Resetting Expectations

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether UiPath is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

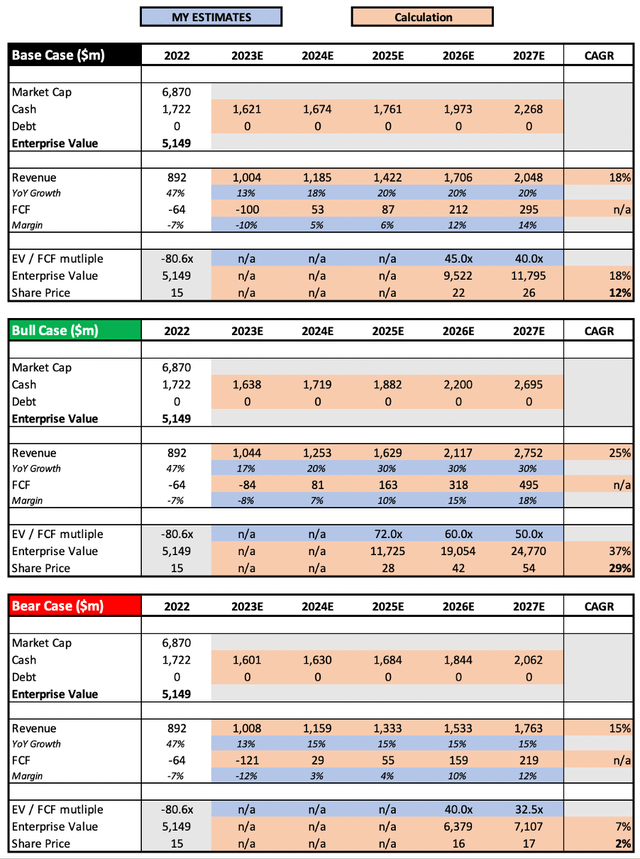

Author’s Work

I have changed a few assumptions from my previous article, based on management’s latest guidance. My biggest changes to the base case scenario involve a lower revenue growth rate (18% CAGR rather than 22% previously) and a slightly higher free cash flow margin, based on both management’s FY24 guidance and analysts’ FCF margin estimates.

The theses behind the bull and bear case scenarios remain the same. In the bull case scenario, I envision UiPath riding out the macroeconomic storm and then going on to fulfil its potential as the leader in this rapidly growing industry, with FCF margins that expand as the company scales up. The bear case scenario effectively assumes the opposite; that this pain is here to stay for UiPath, and that it is a company-specific problem rather than a macroeconomic issue.

Put all that together, and I can see shares of UiPath achieving a CAGR through to 2027 of 2%, 12%, and 29% in my respective bear, base, and bull case scenarios.

Bottom Line

Right now, I believe UiPath’s financials have stabilised, and that investors should no longer see consistent cuts to revenue growth rates. The appointment of Robert Enslin as Co-CEO back in May should help the company to scale with enterprises as he starts to have more of an impact, combined with a macroeconomic environment that will eventually be less horrible.

Despite the difficult year, UiPath remains a brilliant technology company. It is still the undisputed leader when it comes to robotic process automation, and given the bright outlook for this industry, I for one would not bet against UiPath’s future success.

UiPath Q2’23 Earnings Presentation

I had previously changed my rating from a ‘Buy’ to a ‘Hold’, and would remain in this position until seeing signs that UiPath’s downward spiral was easing up. Well, I believe I have seen enough signs in these preliminary results and in UiPath’s investor day, so I will upgrade my previous rating to a ‘Buy’.

This doesn’t mean that I think the pain is over for UiPath; this pain may well continue. Yet I’m back at the point where I feel comfortable continuing to accumulate shares, for a minimum 3-year holding period.

Be the first to comment