Pgiam/iStock via Getty Images

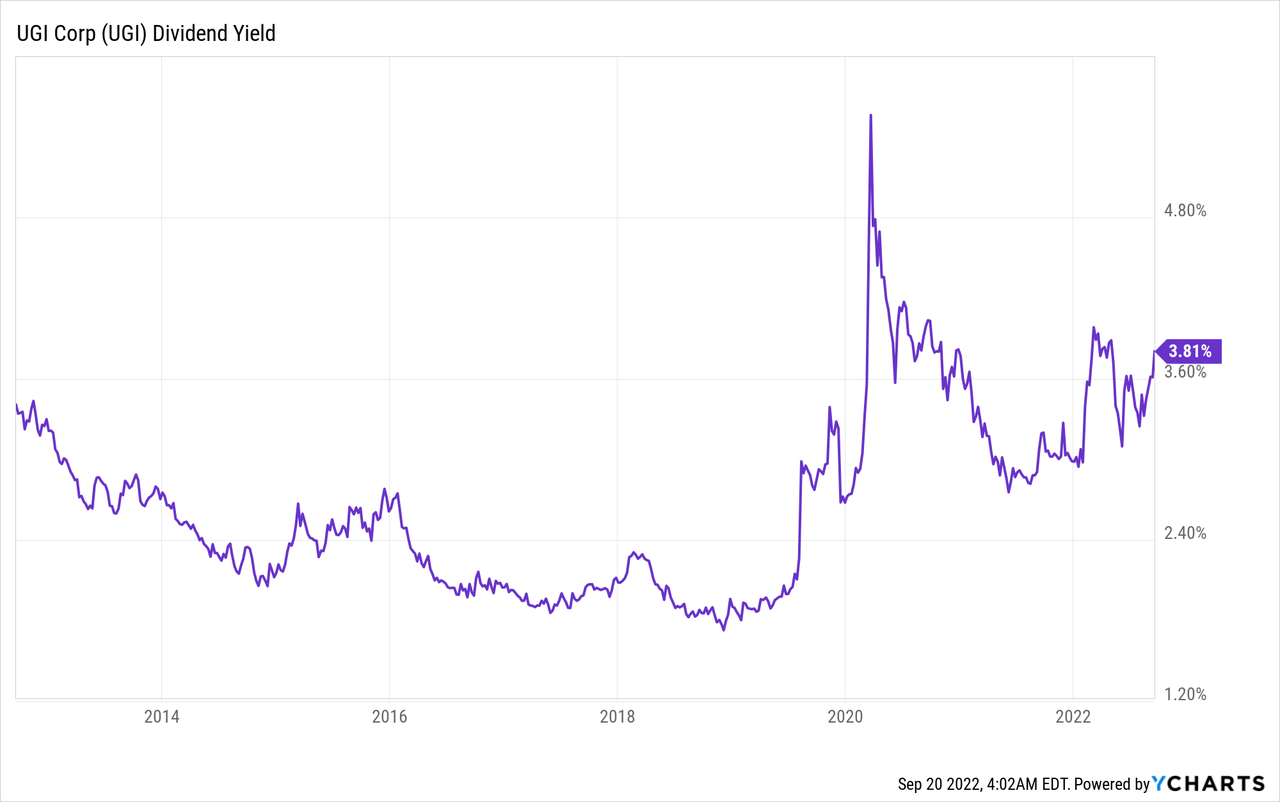

The S&P 500 is going through a painful bear market this year due to the surge of inflation to a 40-year high and the increasing risk of an upcoming recession. During this tumultuous period, UGI Corporation (NYSE:UGI) is offering a safe haven to investors. It passes under the radar of most investors due to its mundane business model, but it is resilient to recessions. It also has reliable growth prospects, a nearly 10-year low valuation level and a 10-year-high dividend yield of 4.0%. Therefore, I think investors should consider purchasing this Dividend Aristocrat around its current price.

Business Overview

UGI operates natural gas and electric utilities in Pennsylvania, natural gas utilities in West Virginia and distributes LPG in the U.S. (through AmeriGas) and in international markets. It enjoys a wide business moat in its regulated business, but the distribution of propane and LPG is sensitive to the gyrations of weather. As a result, UGI is considered by many investors somewhat more volatile than a typical regulated utility.

However, the company has exhibited a remarkably consistent performance record. To be sure, it has grown its adjusted earnings per share in 8 of the last 9 years, at a 10.9% average annual rate. As 2012 formed a relatively low comparison base, it is important to note that UGI has grown its earnings per share by 7.6% per year over the last five years. This is likely a growth rate that is more representative of the growth potential of the company.

It is also worth noting that UGI is doing its best to reduce its sensitivity to the underlying weather conditions. It recently reached an agreement with regulatory authorities. According to this 5-year pilot program, UGI is allowed to adjust the bills of its customers if the weather deviates more than 3% from the 15-year average. This is undoubtedly a favorable development for the company.

In the fiscal third quarter, UGI enjoyed wide margins in its natural gas businesses, but its global LPG division was hurt by warm weather and high cost inflation. As a result, its adjusted earnings per share decreased from $0.13 in the prior year’s quarter to $0.06. In addition, UGI is expected by analysts to incur a 4% decrease in its earnings per share in fiscal 2022, which ends at the end of this month.

Nevertheless, the utility segment of UGI, which has an approximate 11% growth rate of its rate base, is on track to deploy a record level of capital for the expansion and maintenance of infrastructure. In addition, the company has added more than 11,000 new residential heating commercial customers so far this year and management remains committed to meet its long-term financial target of 6%-10% growth in earnings per share and 4% dividend growth.

Analysts seem to agree with the guidance of management, as they expect UGI to grow its earnings per share by 13% next year, mostly thanks to an expected reversion of weather to more normal conditions as well as meaningful rate hikes in the regulated business. Moreover, analysts expect UGI to grow its bottom line by another 6%-8% per year during 2024-2026. This is certainly an attractive growth rate for a utility stock.

Inflation – Valuation

Inflation has skyrocketed to a 40-year high this year due to the immense fiscal stimulus packages offered by the government in response to the coronavirus crisis and the invasion of Russia in Ukraine. High inflation increases the cost basis of most companies, and thus, it exerts pressure on their profit margins. However, as a regulated utility, UGI can pass most of its costs to its customers, and hence, it is resilient to inflation. As UGI also has some non-regulated divisions, it is not absolutely immune to inflation, but it is highly resilient. The benign 4% decrease in its earnings per share this year is a testament to the resilience of this company to the highly inflationary environment prevailing right now.

Inflation also has another negative effect on stocks. It significantly reduces the present value of their future cash flows, and thus, it exerts pressure on the valuation of most stocks. UGI is not immune to this effect. The stock is currently trading at a nearly 10-year low price-to-earnings ratio of 12.8, which is much lower than the 10-year average price-to-earnings ratio of 15.5 of the stock.

On the one hand, the cheap valuation level of UGI can be partly justified by the surge of inflation this year. On the other hand, it is important to realize that the Fed is doing its best to restore inflation back to its normal level of 2%-3%. In fact, the Fed has set the restoration of inflation as its top priority, and thus, it is raising interest rates aggressively. As a result, the economy has almost fallen into a recession and hence I think inflation is likely to begin to subside in the upcoming months or next year. When inflation begins to subside, the earnings multiple of UGI will probably expand from its currently depressed level.

It is also remarkable that UGI is currently trading at only 9.4 times its expected earnings in 2026. Inflation will almost certainly revert to its normal range by 2026 and hence UGI will probably revert towards its average price-to-earnings ratio of 15.5 by that year. Therefore, the investors who can wait patiently over the next four years are likely to be highly rewarded by UGI thanks to its depressed valuation level.

Dividend

UGI is a Dividend Aristocrat, which has paid uninterrupted dividends for 138 consecutive years and has raised its dividend for 35 consecutive years. This is certainly an exceptional dividend record.

Moreover, thanks to its cheap valuation, the stock is currently offering a nearly 10-year high dividend yield of 4.0%.

Furthermore, UGI has a solid payout ratio of 55%, which is better than the median payout ratio of 64% of the utility sector. UGI also has a rock-solid balance sheet, with interest expense consuming only 14% of operating income. Given also its aforementioned growth prospects, the company can easily continue raising its dividend meaningfully for many more years. UGI has grown its dividend at a 7.3% average annual rate over the last decade and at a 7.9% average annual rate over the last five years. These growth rates are much better than the median dividend growth rates of the utility sector of 4.6% and 5.6%, respectively.

To cut a long story short, UGI is a highly attractive Dividend Aristocrat, which is suitable for the portfolios of income-oriented investors, especially now that the stock is offering a nearly 10-year high dividend yield with a wide margin of safety.

Risks

As a utility, UGI enjoys a wide business moat and generates reliable cash flows. Therefore, the risk of surprisingly poor business performance is minimal. The company has exceeded the analysts’ earnings-per-share estimates in 7 of the last 10 quarters. Some volatility is inevitable due to the sensitivity of the segment of distribution of propane and LPG to weather conditions, but total performance has proved resilient.

A potential risk for UGI is the adverse scenario of persistent inflation for several years. In such a scenario, the valuation of the stock is likely to remain under pressure for an extended period. While inflation has already persisted longer than initially expected, it is likely to subside next year thanks to the aggressive stance of the Fed, which has prioritized the restoration of inflation to its normal range. Given the aggressive interest rate hikes of the Fed, inflation is likely to begin to correct at the latest next year, in my opinion.

Final Thoughts

Due to its “boring” business model, UGI passes under the radar of the vast majority of investors. However, this Dividend Aristocrat is an ideal candidate for the portfolios of income-oriented investors, especially in the ongoing bear market. UGI has proved resilient to recessions, it is trading at a nearly 10-year low valuation level and is offering a nearly 10-year high dividend yield of 4.0%, with ample room for material dividend raises for many more years. Those who can wait patiently for inflation to subside are likely to be highly rewarded by UGI.

Be the first to comment