Michael Vi/iStock via Getty Images

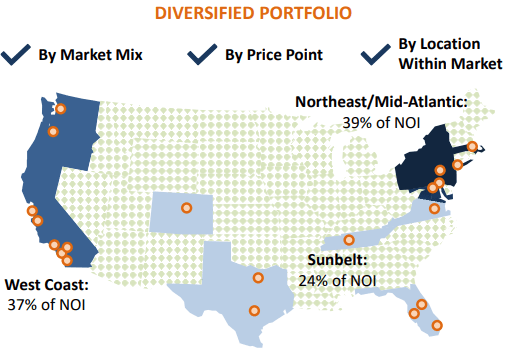

UDR, Inc (NYSE:UDR) is a multifamily focused REIT and S&P 500 component that has an interest in 160 communities with approximately 57K apartment homes. Their geographic footprint is concentrated primarily in the Northeast/Mid-Atlantic and West Coast regions, with the two accounting for 76% of NOI as of March 31, 2022. Their remaining footprint is in the fast-growing Sunbelt states, such as Texas and Florida.

June 2022 Investor Presentation – Geographic Concentration

The diversified characteristics of their portfolio include not only their presence in coastal and sunbelt locations, but also their mix of urban/suburban communities, which runs at a 30/70 split, respectively, and their mix of A and B quality communities, with a respective split of 45/55. UDR’s diversified portfolio with price points that cater to a wide variety of renters is one strength that reduces the volatility of their business and provides greater downside protection in recessionary periods.

In addition to a diversified portfolio of apartment homes, UDR also benefits from a high-quality resident base whose household income is on average 170% above the median income across the MSA’s in which the company operates. Additionally, the credit quality of their tenants has remained consistent, and their average rent-to-income ratio has remained in the low-20% range, despite incremental increases in rental rates.

YTD, UDR is down nearly 25% and is down 4% this past month. The broader S&P, by comparison, is down 20% YTD and 7% this past month. Though UDR has held up better over the past month, there is still room for further improvement.

The company operates on a solid foundation and has been a REIT for nearly 50 years. During this period, they have been a reliable dividend payer with steadily increasing payouts. At current pricing, shares aren’t too far off their lows. For investors seeking an entry point into a quality REIT with a reliable dividend payout and modest share price upside potential, UDR is one worth consideration.

Earnings Review And Other Reportable Events

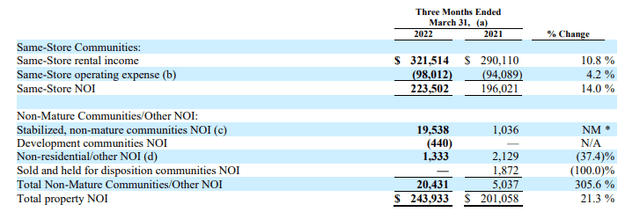

In the most recent filing period ended March 31, 2022, UDR reported total revenues of +$357M. This was 18.5% greater than the same period last year and slightly better than expected. In addition, same-store cash revenues were up 10.8%, which was higher than the range provided by management earlier in March.

The primary contributors to current period growth were blended lease growth of 14% and strong occupancy, which came in 100 basis points higher than a year ago. Additionally, annualized turnover decreased 530 basis points from a year ago and 570 basis points from their historical first quarter turnover rate.

Q1FY22 Form 10-Q – NOI Breakout

During the quarter, apartment demand displayed no signs of abating. According to management, the cost of renting across the company’s markets versus homeownership is currently 45% less expensive versus 35% pre-COVID. With the average portfolio loss-to-lease hovering between 10-11%, there is still upside to be had in rental rates moving forward.

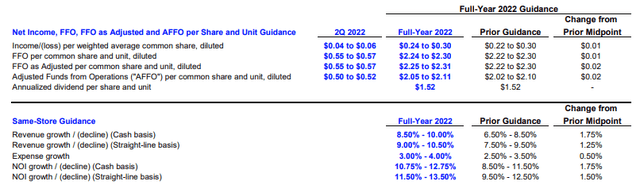

In the second quarter, management expects blended lease growth to be between 15-18% and occupancy to average around 97%. The expected build on top of a strong first quarter enabled an across-the-board increase in full-year guidance. At the midpoint, same-store growth is expected to be about 1.5% greater than prior guidance.

Q1FY22 Earnings Supplement – Full-Year Guidance

Overall, UDR experienced continuing rental growth in the current period, aided in part by robust demand and double-digit rental growth. With rent-to-income still around 20%, most tenants aren’t rent burdened and are likely to continue absorbing further increases, though growth rates are expected to decelerate in the latter half of the year as reporting runs up against more difficult comps and regulatory restrictions.

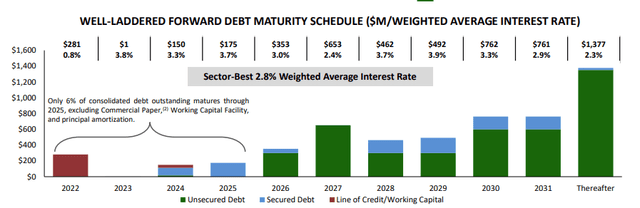

The Fundamentals

As of March 31, 2022, UDR had total assets of +$10.7B and total liabilities of +$6.0B. Total liabilities included +$1.1B in net secured debt and +$4.4B in net unsecured debt. Maturities on this debt are well laddered, with an average debt duration of 7.4 years. Additionally, less than 20% is due in the next five years.

June 2022 Investor Presentation – Debt Maturity Summary

At 6.4x EBITDA, net debt is higher than their peer group. Equity Residential (EQR), for example, reported net debt of 5.38x in their most recent earnings release. UDR is, however, making steady progress in lowering their debt burden. At 6.4x, leverage is down from 7x from a year ago and is on track to be approximately 6x by year-end.

In addition to total liquidity of +$1.7B, UDR also boasts of a sector-best 2.8% weighted average interest rate on their outstanding debt. With the debt profile being over 90% fixed-rate and due in later years, UDR is fairly insulated from heightened risks pertaining to higher interest rates. A solid fixed-charge coverage ratio of 5.3x provides further assurance of the company’s ability to meet their reoccurring obligations in the interim.

While inflationary pressures in the broader economy are a net negative to most businesses and consumers, multifamily REITs such as UDR benefit through higher rent growth that is correlated with increases in wages. Furthermore, higher home prices and the increased cost of improvements/replacements continue to force many into the rental market. Though rising costs do impact G&A and development, most of the costs in UDR’s +$700M pipeline have already been bought out and have adequate contingencies, which should limit any unexpected overruns.

At present, UDR’s annual dividend payout is $1.52/share. It was most recently increased in March 2022 by about 5% from the prior year. This continues a steady history of continuity and growth. At a forward AFFO payout ratio of 72%, the dividend is well-covered and in-line with the sector median. From a cash flow perspective, the company’s operating cash flows during Q1 covered the common payout by about 1.4x. Given UDR’s strong financial position and future earnings potential, there are no concerns at present regarding dividend safety.

Primary Risks

As of the full year ended December 31, 2021, nearly 60% of total NOI was generated from communities located in Metropolitan D.C., Orange County, Boston, the San Francisco Bay Area, and Seattle. While exposure to these regions provides numerous benefits, the concentration does pose a risk to the company. These five areas, for example, have been more adversely impacted by the COVID-19 pandemic than other markets, resulting in larger decreases in rental income, elevated rent concessions, and lower occupancy compared to other markets. If there were to be further deterioration in any of these markets, UDR’s results of operations could be materially impacted.

Various state and local governments in UDR’s operating regions have enacted and may continue to enact laws and regulations that could limit their ability to raise rents. With rates soaring to new heights, there is a heightened risk that political leaders will be called upon to act, especially during an election year. Any new or enhanced rent control and stabilization laws or lawsuits against UDR would have an adverse effect on UDR.

Fannie Mae and Freddie Mac are a major source of financing to participants in the broader multifamily housing market, including purchasers of the company’s properties. Elimination or significant changes in the traditional roles of Fannie Mae and Freddie Mac could involve a reduction in the amount of financing provided by these two GSEs. In the past, legislative proposals have been introduced that would wind down or phase out the GSEs, including a proposal by the prior federal administration to end the conservatorship and privatize Fannie Mae and Freddie Mac. If future efforts to change the status of these two GSEs are successful, UDR’s results of operations could be adversely affected

Since many of the company’s apartment communities are in areas that have in the past experienced severe weather events, UDR’s portfolio faces unique risks related to unpredictable weather-related catastrophes. Aside from property damage, increased frequency or more intense weather events could ultimately negatively impact demand for UDR’s properties. Furthermore, it is possible, too, that the company would not be able to recover in a timely manner or at all the costs of property damage through insurance claims. Additionally, changes in federal, state, and local laws and regulations in response to these events could result in increased compliance costs for the company.

Conclusion

UDR is a quality multifamily focused REIT that consistently delivers above-average total shareholder returns (TSR). Over the past five years, for example, their rolling 3-year TSR outperformed the NAREIT Apartment and Equity indexes 75% and 90% of the time, respectively.

The company’s geographically diversified portfolio with price points that cater to a wide variety of renters is a competitive strength that provides downside protection against market volatility and recessionary business environments.

With the cost of homeownership out of reach for many, UDR should experience continued demand for their multifamily units due to their relative affordability compared to both homeownership and rentals of single-family units. The company will also benefit from rising interest rates, as it will further drive up the cost of ownership and further decrease rental turnover.

At a CAPM-derived discount rate of 7.7% and an expected dividend growth rate of 4.5%, shares would be worth about $50 using a standard dividend discount model. That represents share price upside of approximately 8.5% at current pricing. In addition, investors would receive an annual dividend payout that is currently yielding 3.3% and growing steadily each year. With results already off to a great start, shares offer an attractive entry point for investors who are bullish on multifamily rental units.

Be the first to comment