Denis Linine/iStock Editorial via Getty Images

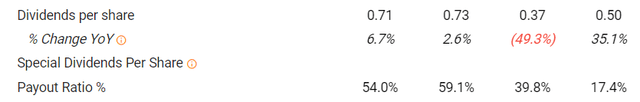

Before the stock exchange’s opening bell, UBS Group AG (NYSE:NYSE:UBS) released an important update on its shareholder remunerations ahead of the next quarterly results. Despite the market turbulence and after a complex Q2 for the banking environment, the Swiss entity will increase its ordinary dividend per share by 10% compared to the previous year’s total coupon payment for a payment consideration of $0.55 per share versus the $0.51 paid in 2021. UBS’s board intends to request the new dividend proposal at the next AGM schedule in 2023. This snap below represents UBS’s dividend evolution starting from 2018 and we can note that is still below the pre-COVID-19 level.

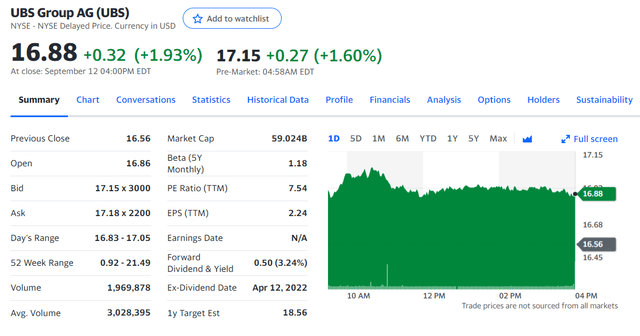

Additionally, the Swiss bank led by CEO Ralph Hamers forecasts to exceed its $5 billion share repurchase target for this year. Indeed, as we can note from the press release: “as of 9 September 2022, UBS has already bought back USD 4.1bn of shares”. So, the company is raising the bar on its shareholder distribution policy and this will positively influence UBS’s stock price evolution. In the pre-trading session, UBS is already up by 1.6%.

UBS Group AG stock price evolution

Half-year performance and Conclusion

In the first half of the year, UBS Group delivered revenues of $18.29 billion, an increase compared to the $17.57 billion achieved in the same period of 2021. Net profits were also higher from $3.83 billion to $4.24 billion, confirming an outstanding result at the capital requirement level (CET1 stood at 18.9%). However, as we already analysed, the second quarter alone disappointed analyst expectations. On the occasion of the Q2 publication, CEO Hamers said he was confident of UBS “underlying performance which reflects a good result in an environment with lower asset levels, higher volatility and rising interest rates“. During the Q&A call, the CEO also indicated a positive view on UBS’s franchises in the third quarter, emphasizing an incremental $1 billion in net interest income on a year-on-year comparison. Moreover, despite inflation, the bank is “fairly confident” to achieve its 70-73% target on cost/income on a reported basis.

We were already supportive on UBS’s valuation and now, we are even more confident with the company’s latest news. Bank valuations are benefitting from the ECB’s rate hike by 75 basis points and with a higher remuneration expected, we confirm our buy target at CHF 22 per share derived on a sustainable return on tangible equity at an average of 14.5%.

Be the first to comment