pp76

Investment Thesis

Marqeta (NASDAQ:NASDAQ:MQ) has seen its share slide 60% since my bearish call on the name.

Author’s work

Today as we look ahead, there’s very little to get excited about this name. In fact, I believe that investors today are more likely to see $6 per share than they are $10 per share.

And even if I’m wrong on this assumption, I very much doubt that investors will see the $21 per share seen at the time of my bearish call. Why?

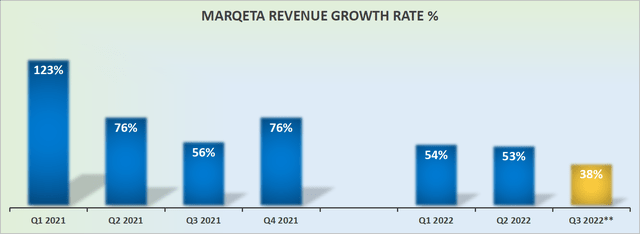

Because Marqeta positions itself as a high-growth payment solution provider. But in doing so, it struggles to consistently report high growth rates.

Its revenue growth rates are slowing down and gives investors no confidence as to what its normalized revenue growth rates could stabilize at.

Hence, I keep my sell rating on this stock.

Marqeta’s Revenue Growth Rates Are Slowing Down

Marqeta faces a key issue.

Not only are its revenue growth rates moving in the wrong direction and consistently decelerating. But as we look beyond Q3 2022 and start to think about Q4 2023, I suspect that Marqeta could struggle to compare against that tough hurdle.

While there’s no doubt that investors should think longer-term than just out to the next 90 days, the fact remains that there are serious question marks facing Marketa and any attempt at getting confident in its normalized revenue growth rates.

What’s Next for Marqeta?

Marqeta is a card payment issuing company. The company is focused on facilitating digital payment technology. It services verticals in digital banking, buy now, pay later, and on-demand delivery.

Next, recall that Marqeta is inextricably tied to Block’s (SQ) fundamentals as 69% of Marqeta’s business comes from Block. Given that Block is hardly a thriving business right now, with its own stock similarly sold off in the past year, there is clearly a very clear customer concentration risk facing investors.

After all, Block itself is under a lot of pressure to prove to its own investors that it cannot only grow at any cost but do so while reassuring stakeholders that it can grow while being wary of its own bottom-line profitability.

Consequently, there’s always the concern that Block could look to tighten its expenses and return to the negotiation table to seek more favorable terms. For now, this will remain an overhang for Marqeta’s shareholders. Particularly since the contract with Block’s Cash App is due for renewal on March 2024, 18 months away.

Profitability Profile Turns South

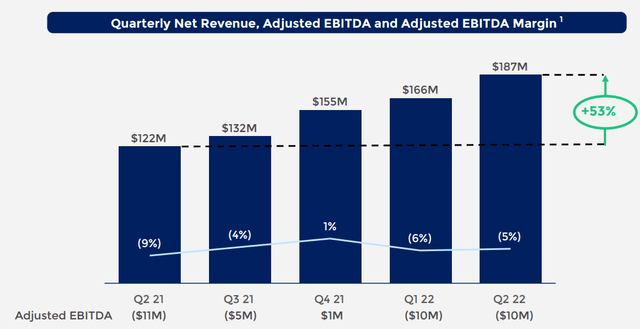

MQ Q2 2022 investor presentation

It appears that Q4 2021 marked the high point for Marqeta’s business model. Meanwhile, its Q3 2022 guidance now points to negative 8% EBITDA margins.

That means two things.

- Firstly, that’s there’s a significant trend reversal in the quarterly profitability improvement that investors saw last year.

- Secondly, and perhaps more pertinent, the direct comparison with the same period a year ago will be noticeably worst.

More specifically, Q3 2021 saw negative 4% EBITDA margins, while Q3 2022 is expected to be around negative 8%. Even if management is lowballing to allow for an easy beat, this perspective still holds water. Marqeta’s profitability profile is not compelling.

On a positive note, we should keep in mind that Marqeta’s balance sheet carries more than $1.6 billion with no debt. Thus, it has the firepower to right its ship.

MQ Stock Valuation – 5x Next Year’s Revenues

If we presume that Marqeta’s revenues grow by 30% in Q4 2022 and it reaches $200 million, that would mean that 2022 as a whole would see its revenues reach $740 million.

Then, if we look into next year and assume that Marqeta’s growth rates in 2023 grow by 30% y/y, that would see Marqeta report over $965 million.

That puts Marqeta priced at approximately 5x next year’s revenues. This is a multiple that I simply do not believe provides investors with a sufficient margin of safety. Hence, I’m avoiding this name.

The Bottom Line

I recognize that when it comes to investing in tech companies, to ask for a margin of safety is an oxymoron.

But at the same time, we have to admit that if more investors requested a margin of safety over the previous 18 months, investors wouldn’t be at the receiving end of a more than 60% sell-off in this name.

As we look ahead, I struggled to believe that paying 5x next year’s revenues for Marqeta is compelling. Particularly given its significant customer concentration in Block – a customer that is also struggling and facing many of its own issues.

In summary, despite the stock being down so significantly, I keep my sell rating on this name.

Be the first to comment