David Commins

Ubiquiti Inc. (NYSE:UI) will most likely benefit from the increase in demand for network devices. It is worth noting that recent increases in research and development and new hiring will likely lead to an acceleration of product development. Let’s note that in the last 10-Q, investment in new prototypes increased. Even taking into account different risks from China and Asia as well as the failures in demand forecast, under normal circumstances, Ubiquiti looks like a buy. Under my discounted cash flow (“DCF”) model with conservative assumptions, the fair value of each share stands at $393.

Ubiquiti

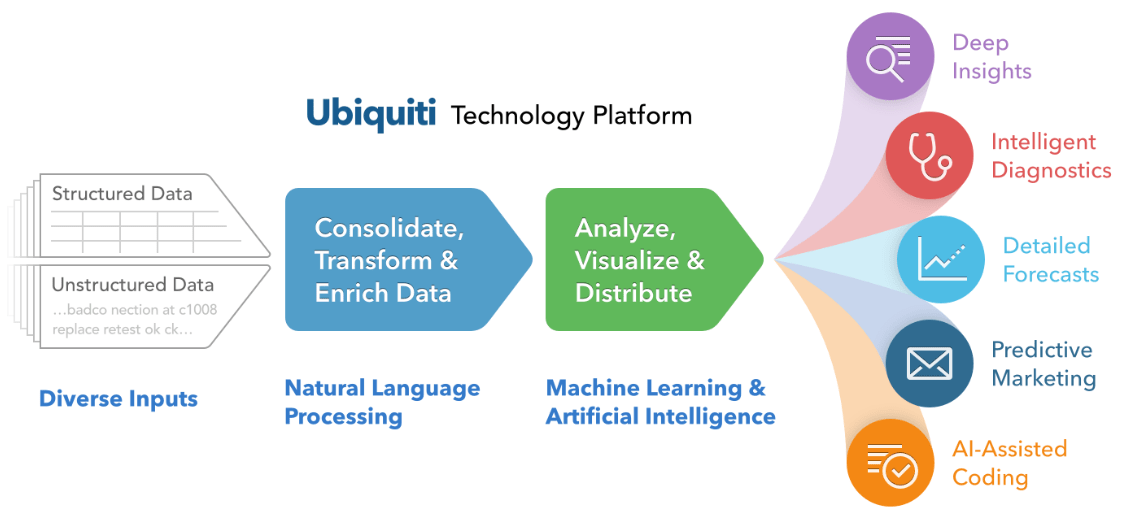

Ubiquiti sells equipment and software platforms with the purpose of democratizing network technology on a global scale. Thanks to Ubiquiti’s systems, clients can analyze large data sets with machine learning and AI technology. The results include intelligent diagnostics, predictive marketing, forecasts for many industries, and technology-assisted coding.

Source: Company’s Website

Ubiquiti offers services to a number of industries, which I believe multiplies the total target market. Clients in the manufacturing industry, automotive sector, or healthcare are interested in the company’s products.

Source: Company’s Website

Finally, let’s also note that the demand for networked devices will most likely explode up from 2023. As a result, the company’s products could increase significantly in the coming years.

According to Cisco (CSCO) Annual Internet Report, internet users as a percentage of global population will be 66% in 2023, an increase from 51% in 2018. Additionally, it is estimated that there will be 3.6 networked devices per capita connected to IP networks in 2023, up from 2.4 networked devices per capita in 2018. Source: 10-k

Double Digit Sales Growth And 31% FCF/Sales Margin

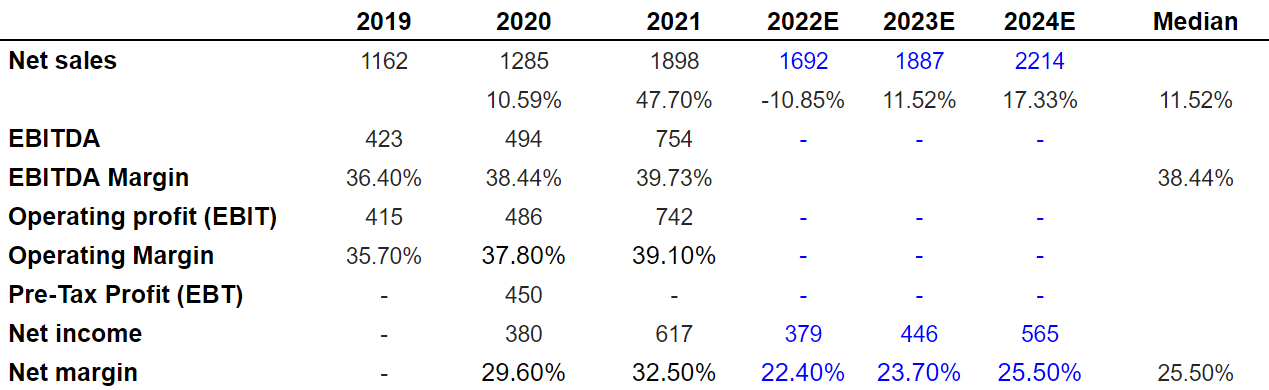

Ubiquiti came across my screen mainly after I saw the expectations delivered by other analysts. I believe that readers may be interested in other analysts’ expectations, median sales growth close to 11%, an EBITDA margin of 38%, and net margin at around 25%-26%. The numbers are really impressive.

Marketscreener.com

I didn’t find a lot of information about the free cash flow expectations for the next two years. However, the free cash flow in 2021 was close to $594 million, and the median FCF/Sales, in the past, stood at close to 31%. With these figures in mind, I believe that most financial advisors would consider executing a DCF model.

Marketscreener.com

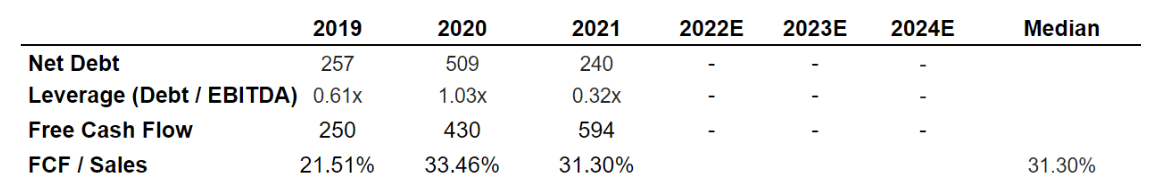

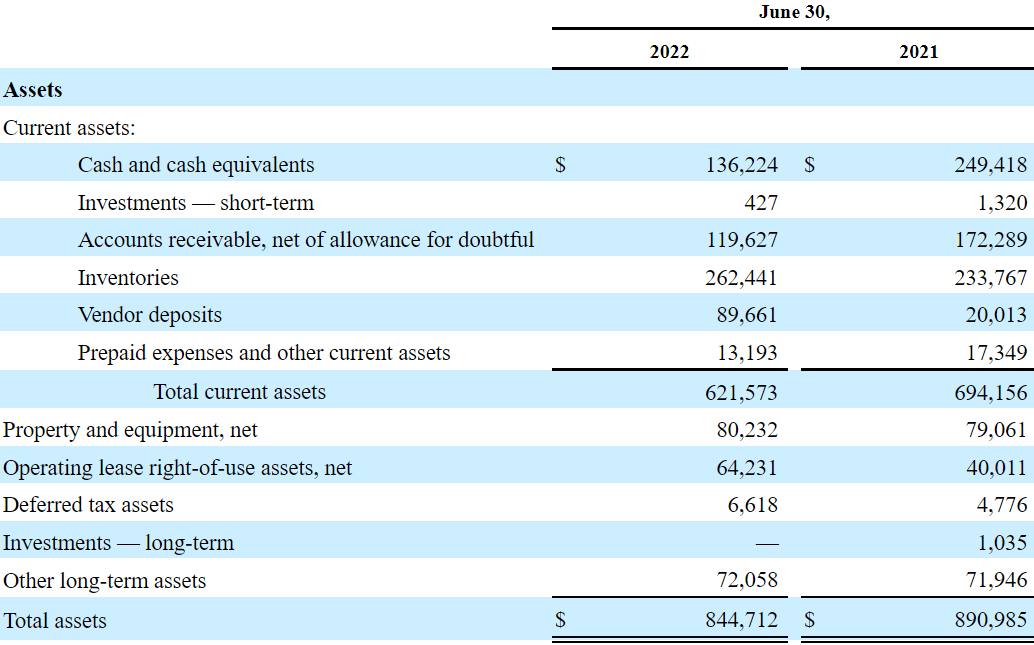

Balance Sheet

With $136 million in cash and an asset/liability ratio under one, some investors may not appreciate the company’s financial stability. I understand the skepticism, however, with sales growth and future free cash flow, the value of assets will likely exceed the liabilities in the near future.

10-Q

The total amount of liabilities includes long term debt worth $762 million and short term debt worth $23 million. In 2024, analysts are expecting a net income of more than $500 million, so I don’t believe that the total amount of leverage is excessive.

10-Q

With The Amount Of Investments In R&D, Under Standard Conditions, Ubiquiti Could be Worth $393 Per Share

In my view, the most impressive thing about Ubiquiti, apart from the target market growth, is the expense in research and development. With more than $137 million in R&D expenses, in my view, we can expect significant product generation in the coming future.

Our research and development expenses were $137.7 million, $116.2 million and $89.4 million for fiscal 2022, fiscal 2021 and fiscal 2020, respectively. We expect that the number of our research and development personnel will increase over time and that our research and development expenses will also increase. Source: 10-k

In line with my previous note, let’s also say that in the last quarterly report, management noted higher employee related expenses and prototype testing expenses. It appears clear that the company is hiring more, and designing new prototypes.

The increase in R&D expense for the fourth quarter fiscal 2022 as compared to the comparable prior year period was primarily due to higher employee related expenses, prototype testing expenses and depreciation and amortization expense. Source: Quarterly Report

It is also worth noting that donation organizations having a role in the conflict between Russia and Ukraine could bring an enhanced reputation to Ubiquiti. If other companies involved in the conflict decide to cooperate with Ubiquiti, revenue growth could also increase.

The increase in fiscal 2022 SG&A expenses as compared to fiscal 2021 was primarily driven by travel expenses and donations to humanitarian relief organizations addressing the military conflict between Russia and Ukraine, offset in part by lower professional fees. Source: Quarterly Report

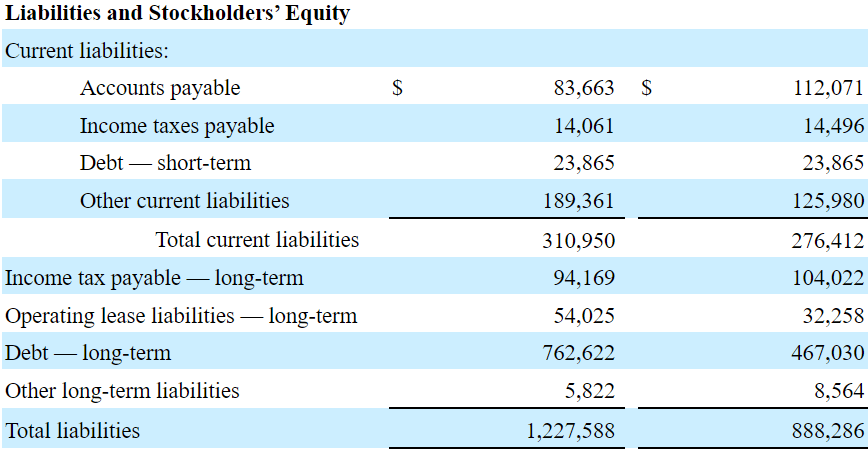

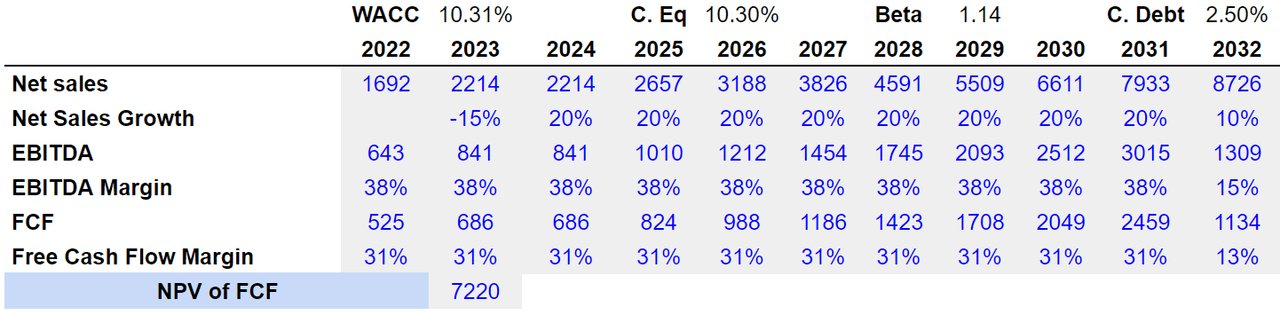

If we assume sales growth around 20%, an EBITDA margin of 38.4%, and FCF/Sales close to 31%, 2032 FCF would be $1134.1 million, and 2032 EBITDA would be $1.309 billion. I believe that my numbers are achievable.

Author’s DCF Model

If we also include an EV/EBITDA of 35x along with a discount of 10.3%, and cost of debt close to 2.5%, the terminal value discounted would be $17.2 billion. The NPV of future FCF from 2023 to 2032 would be around $7.21 billion. Finally, the equity value would stand at $23 billion, and the fair price would be $393 per share.

Author’s DCF Model

Worst Case Scenario

Ubiquiti depends on a short list of distributors and network operators to obtain revenue. The company may not have sufficient information about market demand, and may have issues while negotiating with clients. As a result, I believe that the EBITDA margin and FCF/Sales margin may decline in the near future.

We do not employ a traditional direct sales force. Sales to our distributors have accounted for the majority of our revenues. Our distributors do not make long term purchase commitments to us, and do not typically provide us with information about market demand for our products.

Although we have a large number of distributors in numerous countries who sell our products, a limited number of these distributors represent a significant portion of our sales. Source: 10-k

Ubiquiti may also fail to predict demand for certain products and services. If it designs products that clients don’t need, revenue growth may be significantly lower than expected. As a result, final free cash flow may also be lower than expected by investment analysts. If investors sell shares, the stock price could decline.

We may over or under forecast our customers’ actual demand for our products or the actual mix of our products that they will ultimately demand. If we over-forecast demand, we may build excess inventory which could materially adversely affect our operating results. Source: 10-k

In fact, Ubiquiti has a significant amount of exposure to the markets in Asia. In my view, new tensions and tariffs in the frontiers with the United States may drive down the company’s profitability. Let’s note that the tariffs affected the company’s margins in the past.

In June 2018, the Office of the United States Trade Representative announced new proposed tariffs for certain products imported into the U.S. from China. These tariffs have already affected our operating results and margins. Source: 10-k

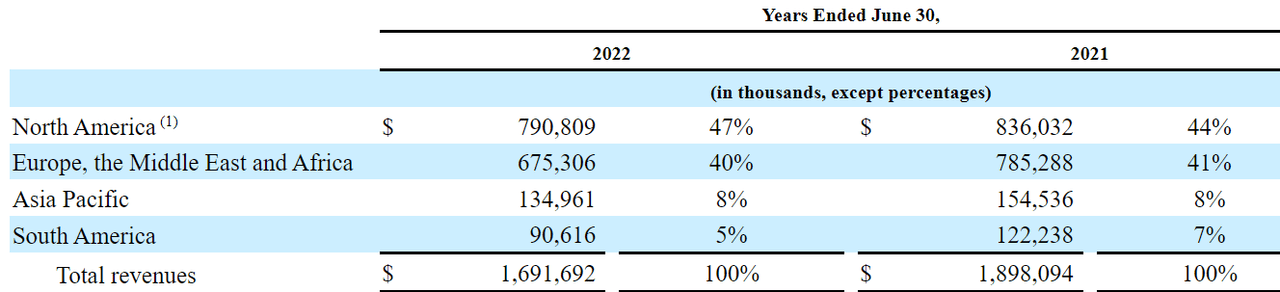

Source: 10-k

Finally, let’s mention that the company may suffer in the near future from the global shortage of available components. In the last quarterly report, the company already mentioned that it is continuing to experience supply chain issues. If Ubiquiti can’t solve these issues, production may slow down. Besides, management may have to pay a bit more for certain devices, which may lower the EBITDA margins.

During the three months ended June 30, 2022, we continued to experience a disruption in our supply chain as a result of the COVID-19 pandemic and the global shortage of available components. Our future results are dependent on our ability to procure components and services and we expect the Company’s results to be negatively impacted until the ongoing supply chain and logistics issues caused by the global component supply shortage and the COVID-19 pandemic are resolved. Source: Quarterly Report

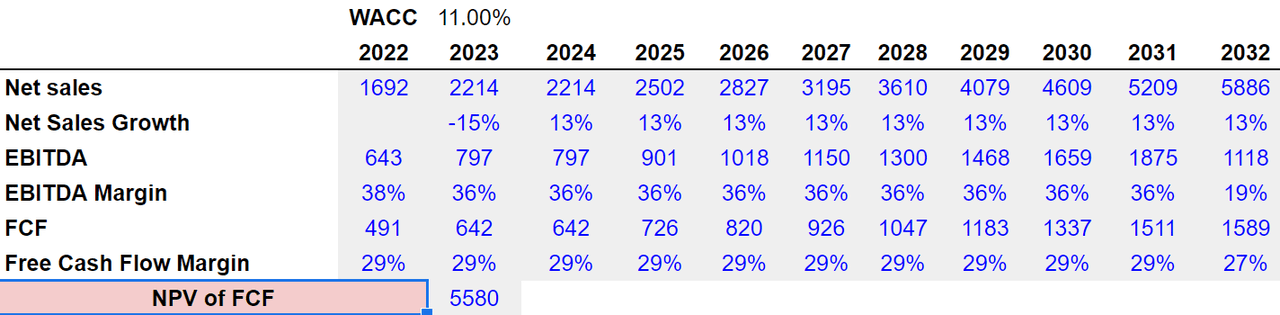

Under detrimental conditions, I believe that 13% sales growth from 2024 to 2032 could happen. Also, with an EBITDA margin around 36%, I obtained 2032 EBITDA of $1.118 billion. Finally, I assumed a constant free cash flow margin of 29%, which resulted in 2032 free cash flow of $1.589 billion.

Author’s DCF Model

Next, with a WACC of 11% and EV/EBITDA of 19x, the sum of the terminal value and the discounted free cash flow would be $13 billion. Finally, the equity value would be $12.4 billion, and the fair price would be $207 per share.

Author’s DCF Model

Conclusion

Ubiquiti targets an international market that seems to grow at a double-digit rate. In my view, under normal circumstances, the massive investments in research and development would lead to product generation. The company announced an increase in expenditures to design prototypes, so new products may be soon in the pipeline. Yes, I see some risks coming from the company’s exposure to China and perhaps failed demand forecasts. With that, under normal conditions, I believe that the company’s stock price is undervalued.

Be the first to comment