Marko Geber

CVS Health Corporation (NYSE:CVS) and Walgreens Boots Alliance (WBA) are the two largest pharmacies in the US with more than 18,000 locations between them. A distant third place is Rite Aid Corporation (RAD) with a little over 2,000 locations.

Both companies are expanding their service options to include in-store clinics, on-site services, flu and other shot administration, and even insurance.

Both companies not only face fierce competition from each other but also from the third parties such as Amazon which offers not only prescription and non-prescription drugs but online medical consultation via Amazon Clinic.

With an aging population and the recent COVID-19 experience, the question becomes which one looks like the better investment option based on their most recent 12-month results.

In this article, I will examine the most important factors in deciding which company is the best investment choice going forward.

Financial metrics.

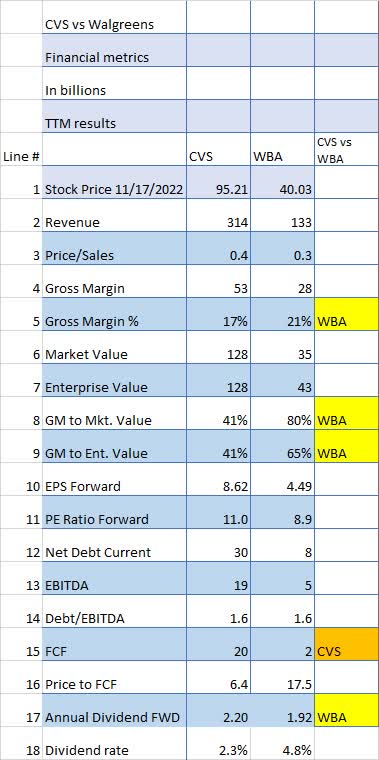

When we look at the financial metrics comparing the two companies on a TTM (Trailing Twelve Month) basis, several metrics jump out including the fact that Walgreen’s Revenue (Line 2) is less than half CVS’s.

That’s also shown by WBA’s higher Gross Margin % (Line 4) of 21% vs. CVS’s 17%. But based on GM to Market Value Percentage (Line 6) Walgreen’s margin is much higher than CVS’s 80% to 41%. And it is true also for GM to Enterprise % (Line 7). Again, this would indicate that Walgreens is underpriced relative to CVS.

Walgreen also has a PE Ratio (Line 11) that’s 20% lower than CVS’s.

Seeking Alpha and author

Both companies are well funded with a debt/EBITDA (Line 14) of 1.6.

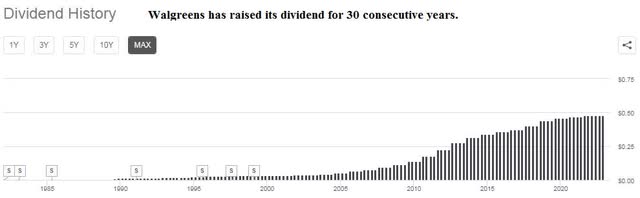

The dividend rate (line 18) is much higher for WBA at 4.8% compared to CVS’s 2.3% and WBA has a 30-year record of raising the dividend annually.

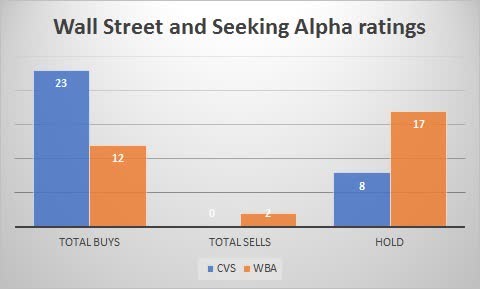

Wall Street Analysts’ ratings show CVS is well liked by the quant community.

Wall Street analysts appear to have strong feelings for CVS, with Wall Street plus Seeking Alpha analysts combined showing 23 Buys and zero Sells. WBA is almost as good with 12 Buy recommendations and only 2 Sells.

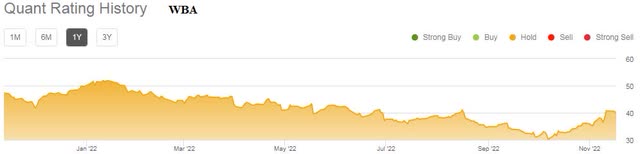

Seeking Alpha

Quant ratings over the last year for both stocks are lackluster at best, showing nothing but Hold ratings for both CVS and WBA over the entire time period.

Seeking Alpha

Seeking Alpha

Perhaps the quants know something that the other analysts don’t?

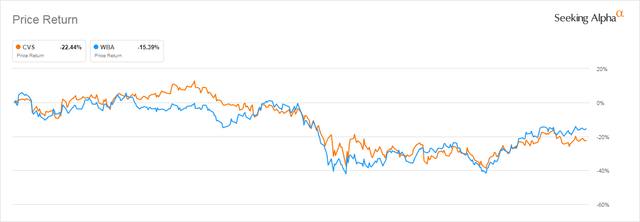

Neither CVS nor Walgreens did well in the last recession.

If you’re concerned, as I am, of a looming recession in the next year or 18 months, knowing how a company did in the last recession can provide some investment insight.

December 2007 through June 2009 is the last recognized recession period and neither CVS nor Walgreen did well. Walgreen fell by 15% and CVS fell by 22% over that particular recessionary period.

Seeking Alpha

Dividends and share buybacks.

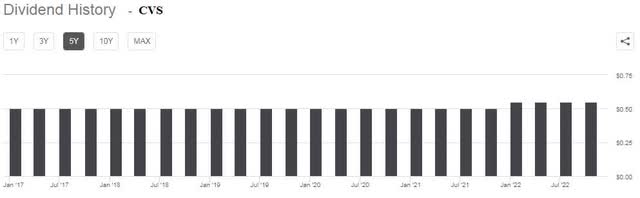

CVS raised its dividend recently from .50 to .55 per quarter. For the four prior years, the dividend was stuck at .50.

Seeking Alpha

On the other hand, Walgreens has consistently raised its dividend and is in fact a Dividend Aristocrat having raised its dividend for 30 consecutive years, an impressive achievement.

Seeking Alpha

So if you’re looking for a steady, consistently increasing dividend, the choice is easily WBA.

As for share buybacks, CVS recently announced a $10 billion buyback plan or approximately 8% of its market value.

Walgreens currently has no stock buyback plan in force.

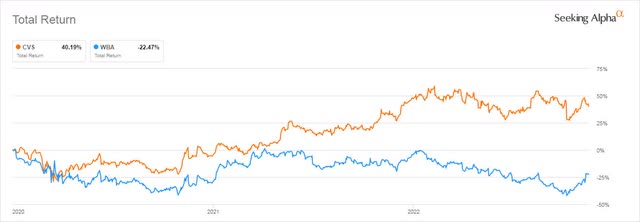

Share price since the COVID outbreak has had significantly different results.

If we look at the total return (which includes dividends) for both companies using the date of Jan. 1, 2020, as the beginning of COVID-19 we can see that CVS has done extremely well with an increase of 40% while Walgreen has actually fallen by 22%. This might imply that CVS is more resilient in difficult economic times than Walgreen is.

Seeking Alpha

Risks.

One problem with any insurance-related business is government regulation. It can change in a moment and on a political whim.

In a volatile environment like we’re facing now, cash is always a viable alternative. CD rates are now in excess of 4% a number we haven’t seen literally in years.

In addition, there could be a recession coming or even a depression according to several economists. That may make profits elusive at best and provide losses at worst.

“Economic data in the near future will be not just bad, but unrecognizable,” Credit Suisse economists led by James Sweeney wrote last week. “Anomalies will be ubiquitous and old statistical relationships within economic data or between market and macro data might not always hold… There is no blueprint for the current shock, and uncertainty about the extent of contagion and the economic consequences is overwhelming.”

So please, do your own due diligence on every investment option.

Conclusion:

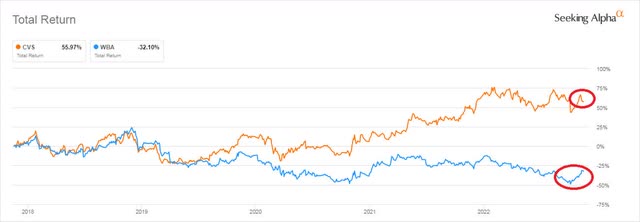

Comparing CVS and Walgreen over the last five years it’s obvious that CVS has dominated in terms of stock performance. However, recent price action actually shows WBA going up while CVS is headed down. Obviously, the time period involved in that price change action is not conclusive, but it may indicate a turnaround is beginning for Walgreens.

Seeking Alpha

Looking at these two companies I see CVS as slightly better financially, especially considering its $10 billion share buyback plan.

On the other hand, WBA’s iconic dividend policy makes for a strong argument for buy and hold waiting for the price to go up while pocketing steadily increasing dividend payments.

Based upon the above analysis, CVS is a Hold, and Walgreens is a Buy.

Be the first to comment