Goodboy Picture Company/E+ via Getty Images

Uber Technologies (NYSE:UBER) has faced a bumpy road as of late, but as I’ve written about last year – it’s not the near term which I am bullish on or think the company will do better or worse than peers or the broader market, it’s the company’s long-term potential in the autonomous vehicle space.

Given that Uber has penetrated most international markets and has their app on hundreds of millions of phones around the world with 122M active users, means that if they are able to take the driver out of the equation – they can increase their profits (and lower the cost of trips) by so much that they can be worth about tenfold their current valuation.

But after a recent conversation I had, I came to realize that that future may not be as bright as I once thought. Here’s why.

The Premise: Huge Margin Expansion

The premise of the long-term thesis is simple:

Millions upon millions of people have the Uber app on their phone and use it on a day-by-day basis for rides. While in some cities they are significantly more expensive during peak times, or ‘surges’ as they’re dubbed, they still remain one of the most common modes of personal transportation after owning a personal vehicle, and they’ve consistently grown their business worldwide.

However, the company only derives a relatively tiny fraction of each ride, as the driver gets to keep most of the price of the ride and Uber taking in a small fee. This can dramatically change if autonomous vehicles come into play.

The first is that the company can lower the cost of the rides by 50% and make taxis virtually obsolete. This is because they don’t really have any expenses beyond the fuel and maintenance, which, when split amongst however many hundreds of thousands of rides it can make over the course of the lifetime of the car – means they can charge a fraction of what they do now.

The other thing is that with this price decrease, they don’t have to go all in and instead simply take in the extra money as pure profit, after investing in purchasing the vehicles for themselves or alternatively ‘rent’ them from people who own them.

Either way, they are set to incur a potentially huge windfall to both their top and bottom lines as a result of this. But there’s a fundamental problem with this thesis even before they can do either of the aforementioned options.

The Question: Can They Compete?

If Tesla (TSLA), Apple (AAPL) and Alphabet’s Waymo (GOOG) (GOOGL) come out with their own self-driving technologies, why would they simply sell it to the highest bidder and not start a service of their own?

All 3 companies have an independent spirit where they either venture off to a new market on their own or buy up companies which can help them penetrate into that new market.

While there are certainly technology companies which are coming up with their own autonomous vehicle software which Uber can use, as well as them simply buying up 100,000 Tesla cars like Hertz (HTZ) did recently – how are they expected to compete if any owner of a iPhone or Android phone may have the capability to order an Alphabet or Apple car service?

While there may certainly be avenues for the company to get into partnerships or agreements with one of the above companies in order to leverage their reach into people’s phones – there doesn’t seem to be an incentive for the larger companies to do so at this time, given that they have a near total monopoly on the global population’s smartphone users.

Furthermore: Regulatory Burdens?

While in theory Uber can just buy 100,000 Tesla, Waymo or Apple cars, if they ever go on sale like that, it’s hard to see what the regulatory framework will be like.

While the regulatory question of when, or whether, federal and local regulators will allow fully autonomous driving vehicles to take the roads freely or not, it becomes even murkier when you factor in current labor laws.

The people most affected by this potential are current Uber and Lyft (LYFT) drivers as well as taxi drivers the world over. They are certain to put up quite a fight if autonomous vehicles ever become a reality, and that may as well doom any potential widespread adoption Uber can leverage to cut out the drivers.

The Risk/Reward Profile Is Sketchy

One of the things I deem important in my evaluation of the long-term potential of Uber is whether the business seems ready to withstand pressures until they emerge into a mature industry.

Overall Performance Decline

Currently, Uber is struggling to turn a profit even as rides increase after the COVID-19 pandemic and as price surges help their margins. This means that even if they would, in theory, enjoy some percentage increase in their margins, it may take too long.

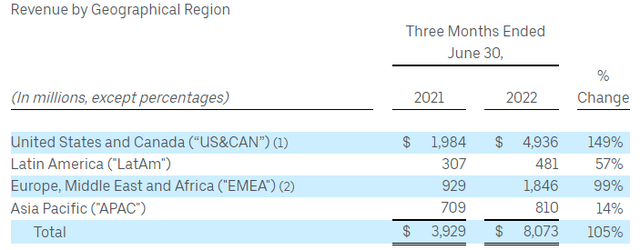

Currently, the company is set to report declining sales growth rates for the better part of a decade due to the saturation of the market, competitive pressures with Lyft and other taxi services which are making it back into business across the country’s major cities and suburbs.

Leverage, The Bad Kind

The company also has an issue with long-term debt in a rising interest environment. They’ve taken on a load of debt during the pandemic to help stay afloat and now holds $9.27 billion in long term debt.

Not only is this debt a problem for the company’s leverage and valuation, since the interest rates in the United States have been rising, with them expected to rise further and stay there for a few years, the company has been paying more and more in interest expense – further hindering any hope of profitability.

Given that I believe the company will be paying over $550 million in interest expense in the coming year, followed by a further boost in the year after that (and that’s not taking into account any more potential debt intaking), it’s in quite a precarious position given growth projections.

So, What Does This Mean?

So, does this mean that Uber is a sell? A short candidate?

No, I don’t believe the company is a short candidate, especially given where the company’s current fundamentals and share price are. But given that one of the company’s brightest growth theories seems to have got a big fat question mark slapped on it – it may no longer be a buy.

Given that, as I mentioned last year, Uber is one of my long-term, 30-year investment holds, which is almost entirely backed by their prospects in the autonomous driving industry – I think it’s worth examining more of what role they will play, if any, in the emergence of that industry.

Therefore, I am going to pause my position building and wait for further information about what management is thinking about the direction of autonomous driving and whether they will try to go at it alone or whether they’re aiming to explore strategic partnerships with other companies.

Be the first to comment