MikeMareen

Introduction

Despite their best efforts to stage a recovery during 2021 and early 2022, the overleveraged and struggling Summit Midstream Partners (NYSE:SMLP), saw common unitholders getting squeezed out of their earnings and assets by preferred unitholders and debt holders, as my previous article warned. To my surprise, they have just announced their $305m DJ Basin acquisition, which effectively sees them trying to spend their way out of overleverage, as discussed within this follow-up analysis.

Executive Summary & Ratings

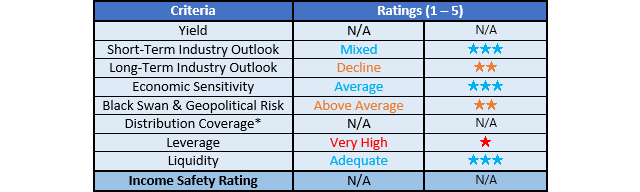

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

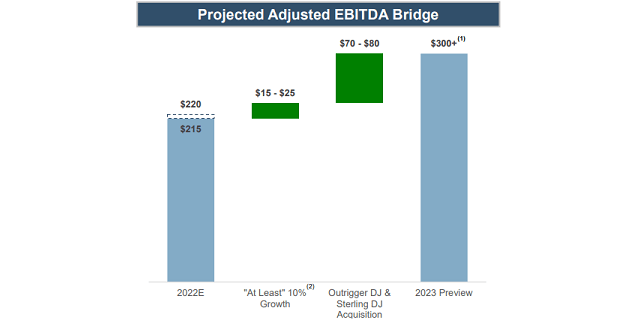

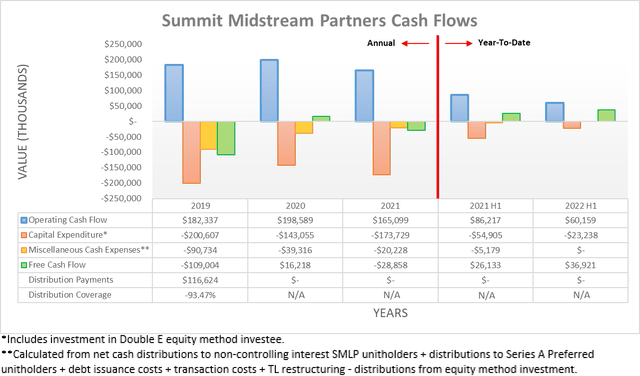

Following their weak cash flow performance during the first quarter of 2022, quite unsurprisingly, this continued into the second quarter with their operating cash flow during the first half of $60.2m down 30.22% year-on-year versus their previous result of $86.2m during the first half of 2021. This does not change too significantly even if removing their temporary working capital movements, as their underlying operating cash flow during the first half of 2022 was $61.1m and thus still down 23.39% year-on-year versus their equivalent previous result of $79.8m during the first half of 2021. Whilst interesting, the bigger story right now is rather their freshly announced DJ Basin acquisition for $305m that management forecasts will materially boost their financial performance, as the graph included below displays.

Summit Midstream Partners DJ Basin Acquisition Presentation

When looking at their guidance for 2023, they forecast their upcoming DJ Basin acquisition will boost their adjusted EBITDA by $75m at the midpoint and if examining their accompanying notes, they also expect this to generate $60m of unlevered free cash flow, as per slide six of their DJ Basin acquisition presentation. Since they have only generated a meager $36.9m during the first half of 2022, at first glance this stands to help their deleveraging outlook but alas, I am skeptical. It should be remembered that free cash flow can be estimated several ways and thus whilst not necessarily wrong from a legal standpoint, it nevertheless opens the possibility of not fully reflecting how much cash will actually land in their bank account.

The experienced investor would have likely noticed their free cash flow guidance was pre-phrased with the word “unlevered”. As expected, given the choice of wording, this refers to the amount of free cash flow generated before financing costs, most notably, interest expense. Generally speaking, there is nothing necessarily wrong with this measurement but in this situation, it is not too useful given their overleveraged financial position. Obviously, they are funding this acquisition with debt because as subsequently explained, they certainly do not have $305m of cash sitting on hand and given their market capitalization is consistently sub-$200m, it leaves an equity issuance off the table.

Since their credit facility only retains $249m of availability, it alone cannot fund this acquisition and even if this was increased in the interim, running down most of their credit facility would leave them vulnerable to sudden shocks and thus they will almost certainly tap debt markets. Even in normal times, this would be dicey given their overleveraged financial position but right now, it is very brave with central banks sending interest rates soaring and pulling liquidity out of the system.

It remains to be seen what terms they are forced to take as this acquisition was only just announced within the last day as of the time of writing, although when they last issued debt back in November 2021 when monetary policy was still relatively loose, their 2026 secured notes were issued with a high yield of 8.50%. Given the current situation, it is difficult to imagine their new debt carrying a yield of less than a very high 10%, if not even north of 12% depending upon the term length. Even if opting for the bottom end of this estimated range, it would still see an additional interest expense of $30m per annum, thereby instantly wiping out half the benefit, despite being optimistic.

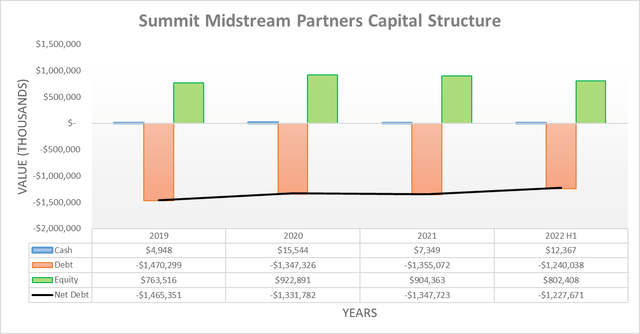

Notwithstanding their continued weak cash flow performance, their net debt still decreased during the second quarter of 2022, although this was largely due to an already known $75m divestiture of their Delaware basin assets. Since this was directed towards repaying their credit facility, their cash balance remains at only a relatively modest $12.4m and thus as alluded to earlier, it cannot fund their upcoming DJ Basin acquisition. Regardless, this now sees their net debt at $1.228b and thus a handy $85m or 6.50% below its level of $1.313b when conducting the previous analysis following the first quarter and whilst helpful, obviously much more is required to restore fiscal health.

When looking ahead, apart from their upcoming $305m DJ Basin acquisition, they have also recently announced another relatively small $40m divestiture of their Bison gas gathering system. Whether they bank the latter against the costs of the former remains to be seen but regardless, it should not materially change the already discussed outlook. It seems reasonable to expect fewer assets will equal fewer earnings and thus any savings via less interest expense would likely be offset by fewer earnings.

Once both of these transactions are completed, it would see their net debt hitting $1.493b, before considering any benefit of their upcoming and likely meager free cash flow. If they were to generate another $30m per annum of free cash flow from their DJ Basin acquisition, it would still only amount to circa 2% against their net debt. This would barely help expedite their deleveraging, which is concerning as once again, it was assuming an optimistic scenario for their interest expense. Whilst their additional earnings should help push their leverage lower, this remains a wait-and-see situation, thereby making it redundant to reassess their leverage and liquidity in detail at the moment since nothing material has changed since the previous analysis.

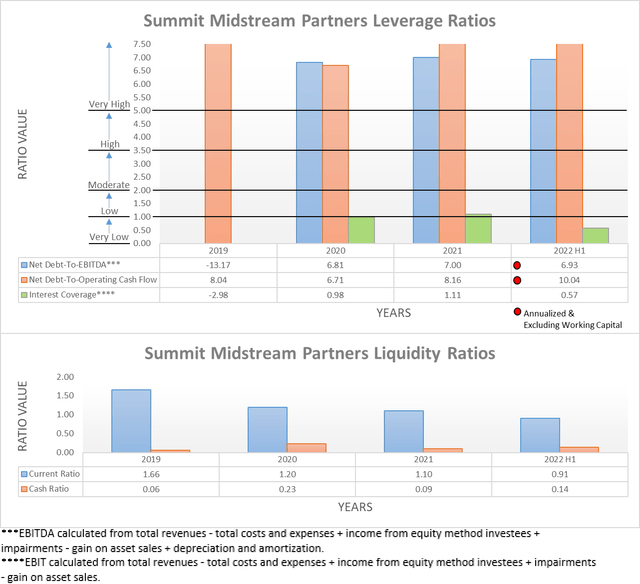

The two relevant graphs have still been included below to provide context for any new readers, which show that similarly to when conducting the previous analysis following the first quarter of 2022, their leverage remains far into the very high territory following the second quarter. This is evident with their respective net debt-to-EBITDA and net debt-to-operating cash flow at 6.93 and 10.04, versus their previous respective results of 6.89 and 9.78, all of which sit far above the applicable threshold of 5.01. Meanwhile, their liquidity remains adequate given their respective current and cash ratios of 0.91 and 0.14 are quite similar to their previous respective results of 0.81 and 0.09 across these same two points in time. If interested in further details regarding these two topics, please refer to my previously linked article.

Conclusion

It would be wonderful for unitholders if management could simply buy their way out of their overleverage but alas, this does not appear to be possible. If it were this simple, then every distressed company or partnership would simply fix themselves through buying more assets. Even if their upcoming DJ Basin acquisition helps reduce their leverage via boosting their earnings, they still appear to have a long road ahead as their net debt far outstrips their free cash flow and with interest rates only heading higher, the pressure appears set to continue during the foreseeable future. When combined with the increasingly concerning economic outlook on the horizon, I continue to believe that my sell rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Summit Midstream Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment