MOZCO Mateusz Szymanski

Thesis

Uber Technologies, Inc. (NYSE:UBER) presented earnings on August 2nd and outperformed analyst consensus EPS expectations by more than 40% and EPS expectations by 9.5%. More importantly, the company reported the first quarter of net positive cash flow ever, after burning $25 billion of cash since the company’s inception.

But don’t be fooled by the company’s Q2 results. Uber is still highly speculative, and I argue the company’s positive net cash flow does not indicate positive economic net-profitability, given that Uber recorded more than 400 million of share-based compensation and other non-cash expenses such as unrealized losses on investments.

Uber’s Q2 Results

The Good

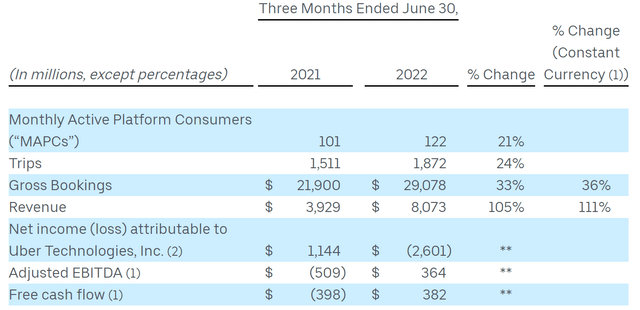

Uber, which is a global leader in ride-hailing and food-delivery, surprised the market with above-consensus Q2 performance. During the period from April to end of June, Uber’s gross bookings grew by approximately 33% year over year to $29.1 billion. Respectively, revenues grew by 105% to $8.1 billion. And by the end of the Q2 period, Uber’s application ecosystem had more than 112 million monthly active users.

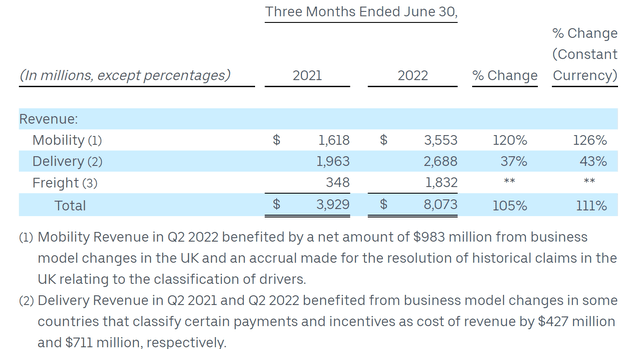

Breaking down by segment: revenues for “ridesharing” increased by 120% as compared to the prior period and “food delivery” Uber Eats, increased by 37%, respectively.

EBITDA was recorded at $364 million, versus a loss of $509 million in 2021. As the company recorded positive net-cash flow, CEO Dara Khosrowshahi announced:

We became a free cash flow generator in Q2, as we continued to scale our asset-light platform, and we will continue to build on that momentum.

Last quarter I challenged our team to meet our profitability commitments even faster than planned—and they delivered

Notably, Uber outperformed sell-side revenue and EPS expectations by 41% and 9%, respectively. And with reference to Uber stock’s surging stock following the announcement, the company’s Q2 results also outperformed buy-side expectations.

Uber guided Q3 gross bookings between $29 billion and $30 billion, which implies a 28% year over year increase and is about 2% below consensus of $30.01. Guidance for 3Q adjusted EBITDA was anchored on $455 million, which is about 20% above consensus. In that context, Nelson Chai, Uber’s chief financial officer promised sustained value generation:

This marks a new phase for Uber, self-funding future growth with disciplined capital allocation, while maximizing long-term returns for shareholders

The Bad

Despite a strong Q2 performance and bullish management commentary, I would like to highlight that Uber is not profitable. For the three months ended June 30, Uber recorded a loss attributable to shareholders of $2.6 billion, or a loss of $1.32 per share. While $1.7 billion of the loss was driven by “other expenses,” the loss from operation at $714 million is material.

The $1.7 billion loss is attributable to investments in peers such as Zomato and Grab (GRAB). In that context, Nelson Chai said that the company could

see swings from quarter to quarter due to the large size of equity stakes on our balance sheet

Having studied the business model and economics of these equity investments, I agree with the volatility. But personally, I do not expect significant moves to the upside. For example, I have written about Grab here: Grab Holdings: Speculative, Despite 85% Sell-Off

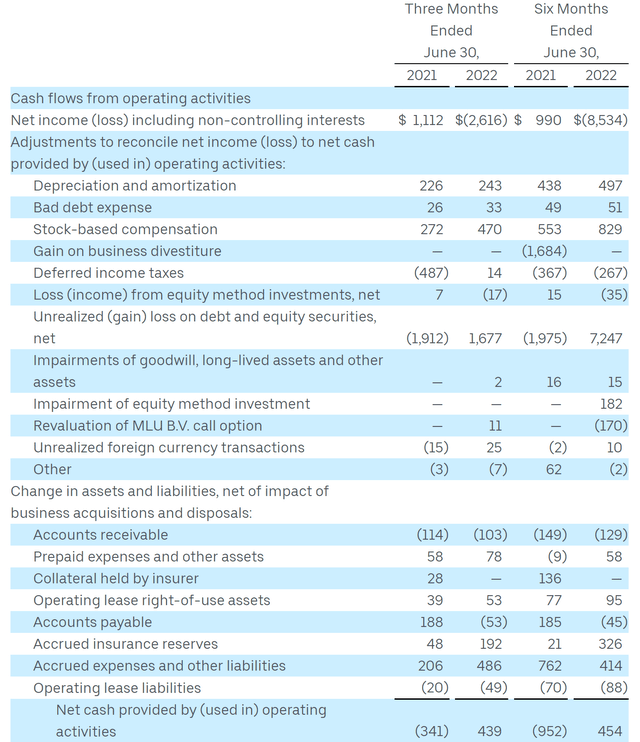

Moreover, I would like to challenge the company’s positive net-cash flow, which includes a non-cash adjustment of $470 million of stock-based compensation. Deduct this amount from the company’s cash from operations of $439, and investors will see that Uber is still a loss-making business.

Implication and Recommendation

Uber shares jumped more than 15% after the announcement and I believe the stock has room to trade even higher – given the negative sentiment that has surrounded the stock for so long. Moreover, speculators will rush likely rush to buy the stock given the expectation of continued and expanding profitability. However, I would remain cautious and argue the market has it wrong. While Uber achieved positive cash-flow, Uber does not yet show economic profitability.

That said, Uber currently trades at x2.2 P/Sales. Given the still elevated level of risk and uncertainty with regards to Uber’s business profitability, I believe this valuation is too risky. In my opinion, the stock should trade at x1 P/S. Accordingly, I see more than 50% downside. Concluding, as long as the company does not post positive GAAP EPS (forget the ‘adjusted’ EBITDA), I support a Sell rating.

Be the first to comment