zoom-zoom/iStock via Getty Images

By Alejandro Saltiel, CFA

After the Russell 3000 Index rose an impressive 25.66% last year, the index has now fallen close to 20% from its January 3, 2022, peak and is now flat over the last 17 months.

During this period of high volatility, strategies targeting factor diversification and lower volatility have exhibited differentiated performance and reduced correlation to equity market swings.

WisdomTree U.S. Multifactor Fund

The WisdomTree U.S. Multifactor Fund (USMF) seeks to provide investors with consistent exposure to six investment factors that academic research has demonstrated have tended to outperform the broad market in both absolute and risk-adjusted terms over longer periods.

USMF uses a composite score to rank companies by low correlation, momentum, quality, and value, and selects the top 200 out of the 800 largest U.S. companies.

These stocks are then weighted by a composite multifactor score and the inverse of their recent volatility, giving investors an inherent exposure to the size and low volatility factors.

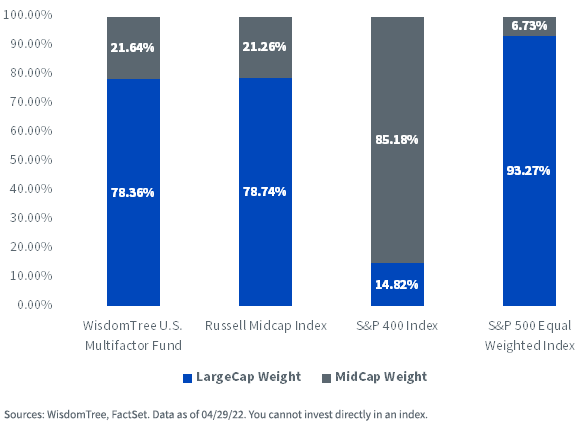

In the graph below we can see how USMF’s market cap exposure is comparable to the Russell Midcap Index.

MarketCap Exposure

Author

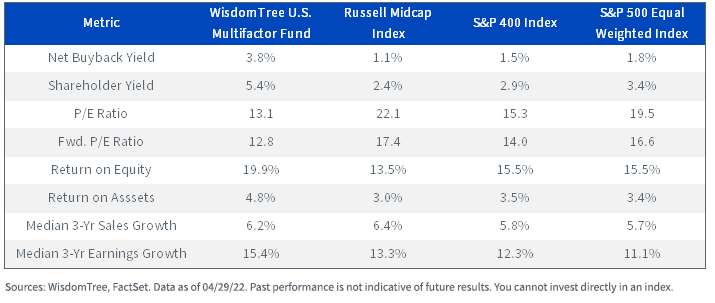

This combination of factors in the underlying index methodology results in a basket with attractive valuation, growth, and profitability metrics that stacks up well against other funds in the mid-cap core category – where it is classified by style analytics firms like Morningstar.

Contrasting USMF’s fundamentals to comparable benchmarks, we can see the effectiveness of the multifactor methodology implemented.

USMF has significantly lower trailing- and forward-valuation metrics and more attractive distributions to investors in the form of net buyback yield. The profitability of USMF’s basket exceeds its benchmarks, and looking at trailing three-year sales and earnings numbers, we can see that constituents selected for the basket have shown solid growth over the period.

Author

Not the Low Volatility You’re Used to…

There have been several criticisms to using low volatility as a stand-alone factor.

The first is that it has not generated absolute excess returns versus the market over the last 50-plus years.

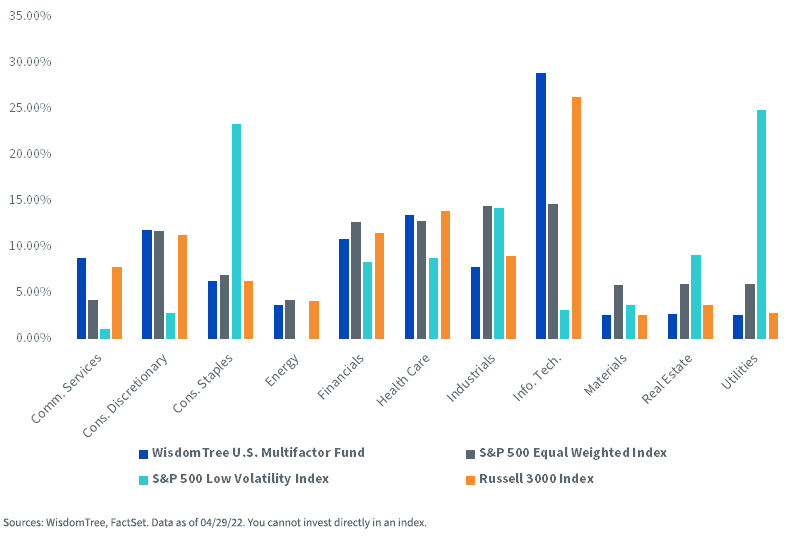

Second, historically, the low-volatility factor has been extremely sensitive to interest rates, generally underperforming in rising rate environments due to its increased exposures to the Utilities, Real Estate, and Consumer Staples sectors. USMF maintains sector neutrality to the broad market, reducing its interest rate sensitivity while keeping a low volatility tilt stemming from its portfolio construction methodology.

Sector Exposures

Author

Even though USMF is not using low volatility as an alpha-seeking factor, we are aware of its prowess in risk-adjusted terms and therefore use it as part of our strategy’s weighting mechanism.

Also, given some of our factor definitions, like risk-adjusted returns for momentum, the composite multifactor score rewards lower volatility companies and implicitly tilts the strategy toward this factor.

Bottom Line: 5-Star Performance

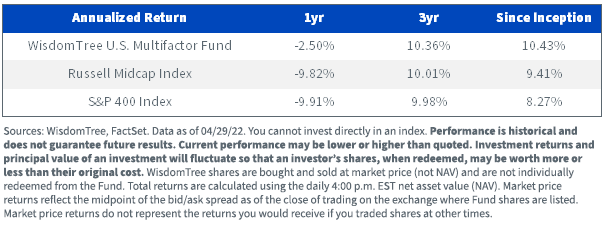

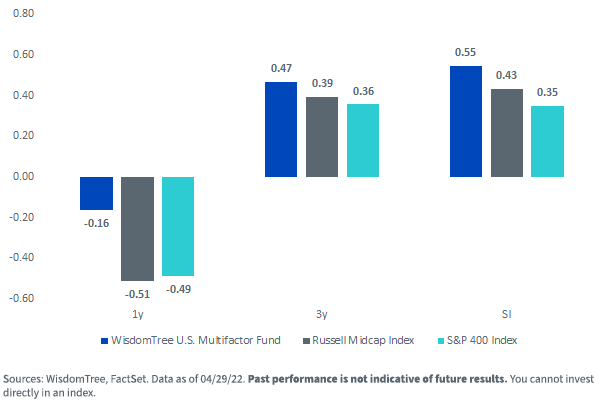

USMF’s combination of alpha-seeking factors and low volatility tilt in its weighting has paid off with strong relative performance versus its mid-cap blend benchmarks.

Author

For the most recent standardized performance, 30-day SEC yield, and month-end performance click here.

Since its inception on June 29, 2017, almost five years ago, USMF has exhibited higher absolute and risk-adjusted returns than the S&P 400 and Russell Midcap indexes.

Risk-Adjusted Returns

Author

With volatility expected to continue in the near term, USMF can be an interesting way of positioning a multi-factor exposure to the core of your portfolio.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Investing in a Fund exposed to particular sectors increases the vulnerability to any single economic, political or regulatory development. This may result in greater share price volatility. Due to the investment strategy of the Fund,

it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Alejandro Saltiel, CFA, Director, Research

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s passive indexes and is involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment