sanjeri/E+ via Getty Images

Frank Holmes reached out to me after my first article covering U.S. Global Investors (NASDAQ:NASDAQ:GROW) with a simple acknowledgment and appreciation of the article. It was a gracious gesture and I took the opportunity to see if Mr. Holmes would be willing to respond to some specific questions I thought might give investors more insight into the company. He agreed.

Before turning to that conversation with Mr. Holmes, I’d like to share some updates regarding the company and my original thesis. Since first writing up GROW in July 2022 they have filed their FY22 10-K which gives more details on the company’s financials.

What’s presented in this article builds off my original coverage and I would encourage folks to revisit that if they need further context on the company overall.

U.S. Global Investors Company Updates

A couple of noteworthy things have happened since July. Part of the original thesis was related to an offer that Echo Lake Capital made to purchase the company for $5.30 per share which the company promptly rejected in July. Following this Echo Lake published a letter critiquing Frank Holmes’ performance particularly in relation to repeated instances of his son Nigel Holmes being hired at the company without disclosing this. Here’s an excerpt from the letter dated July 6th, 2022.

The Authors condemn Holmes’ apparent decision to hire his son on three separate occasions at GROW and not disclose it to shareholders. The Authors question if these actions violated securities laws and if these actions harmed the company’s shareholders and other employees. The Authors believe Holmes’ actions were unethical and not best business practices which seems ironic considering Holmes recently created the “Frank Holmes Centre For Leadership, Ethics & Entrepreneurship at Huron University.”

The company responded to this claim via a July monthly update:

This is a misleading accusation. The Company is aware of and in compliance with SEC §229.404 (Item 404), which requires a company to disclose a transaction in which the company was or is a participant, “and the amount involved exceeds $120,000, and in which any related person had or will have a direct or indirect material interest.”

No further information has come forth from Echo Lake Capital on the GROW front. My research into Nigel Holmes showed that prior to ever being hired at GROW he had worked as an Investment Banking Analyst with GMP Securities for two years right after college. Then GROW hired him as an Investment Analyst which to me aligns with his theoretical skillset. I don’t see anything necessarily nefarious or unethical here. Readers can decide for themselves though if they think a college degree and two years of experience warrants an Investment Analyst role at U.S. Global Investors.

Another thing I noted in poking around about Nigel is that he was a seed investor along with Frank in HIVE Blockchain Technologies (NASDAQ:NASDAQ:HIVE). Frank Holmes became further involved in 2018 becoming HIVE’s interim CEO, a title he continues to retain making him CEO of both companies. Additionally, GROW owns a HIVE convertible debenture worth $14.1m and out-of-the-money warrants in the company as well. With GROW’s equity value at $56.496m the debenture represents 25% of the value.

One bear argument that comes up with regard to GROW is that the HIVE investments need to be discounted. I think part of this comes from a negative sentiment associated with crypto mining companies and crypto generally. Back in July when my first article was written there was even greater concern about HIVE’s status given their annual report had been delayed.

On July 22nd HIVE’s annual report was filed which showed them paying down the debenture by $4m and generating $79m in earnings for the year. For reference, the HIVE’s market capitalization as of writing is $422m. From my reading into the situation it seems that the HIVE debentures should continue to be money good though the warrants may never be.

GROW 2022 Earnings Report

Net income was $5.5m in 2022 which suggests a P/E of 9.89x. In the company’s press release they note that earnings were down year-over-year due to mark-to-market unrealized losses. Average assets under management (AUM) for the year came in at $3.9b though at the end of year AUM was only $2.9b. This is down 31% from the 2021 end-of-year AUM of $4.2b.

Management contextualizes this as a result of “a global stock market decline and higher interest rates.” June 30th, 2022 is when this $2.9b AUM number came in so we can look at S&P 500 returns over the year period from last June as a reference point here. Using the SPY ETF (SPY) as a proxy the closing price was $433.72 on June 28th, 2021 and $381.24 on June 27th, 2022. This is only a 12% loss as compared to the 31% AUM decline at GROW.

Their cash and liquid investments positions at year end equaled $34.452m which is 63% of the current market capitalization of $54.44m. I asked CEO Frank Holmes about the capital allocation strategy moving forward which we’ll cover below. The company has an open $5m stock repurchase program which they have been using very minimally. As of their September 12th update the company has utilized only $300,000 of the $5m and in the month of August they repurchased only 2,381 shares. With an equity value of $56.496m and a market cap of $54.44m the stock is trading at a P/B of 0.96x.

U.S. Global Investors Thesis Updates

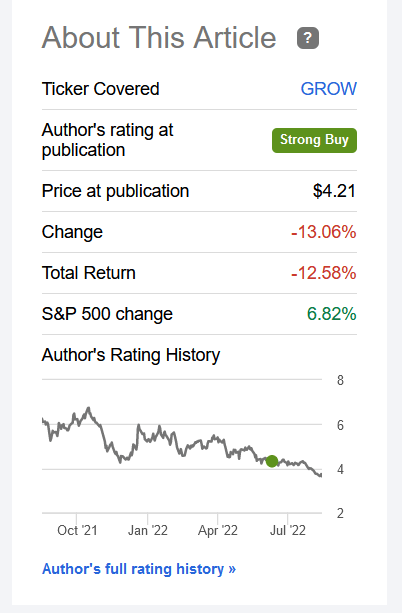

My original GROW thesis was published on July 6th, 2022 when it was trading around $4.21. Since then it has not performed very well shedding 13% of its price.

Seeking Alpha

The original thesis relied predominantly on a valuation of the ETF portion of the company’s business suggesting $6.66 in value for that portion of the business. Overall I believed there was downside protection in the name given (1) recent offer to buy the company at $5.30, (2) 40% of the market cap represented in cash, and (3) my valuation of the ETF business at $6.66 per share.

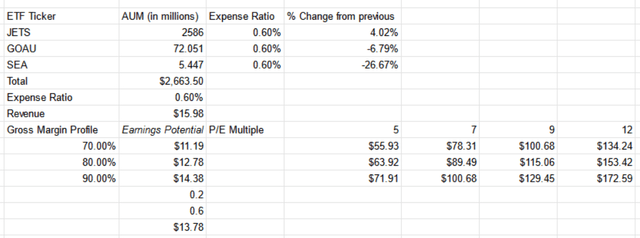

If we apply the same ETF valuation that I used in my last article we’d get these results.

Author’s Calculations

What this table shows is that based on the current AUM of each of GROW’s exchanged traded funds (JETS, GOAU, and SEA) and their expense ratios I estimate annual earnings potential between $11.19 – $14.38m. In my last article I suggested a 10x earnings multiple may be appropriate which if applied to the low end would suggest a valuation of $111.9m which is more than double current prices.

Given the increase in value of JETS since the last time I did this analysis, this sum-of-the-parts technique actually suggests more upside now. If we review my downside protection elements from earlier, I could make much the same argument:

GROW has downside protection given (1) recent offer to buy the company at $5.30, (2) 63% of the market cap represented in cash, and (3) my valuation of the ETF business at $7.48 per share.

This argumentation seems even stronger than before and yet I’m not recommending investors buy here. For full disclosure, I closed out my position on August 4th for a total return of -3.70%.

Let’s turn to the interview to see why my recommendation has changed.

Frank Talk: A Q&A with U.S. Global Investor’s CEO

I sent my questions to Mr. Holmes on August 1st. His responses were shared with me on August 23rd. I have been working on a number of other articles and investment ideas so until recently have not had the time to turn back to these. Here are the questions I asked and answers from Mr. Holmes.

In light of the recently rejected $5.30 per share offer, is GROW considering a deal to either go private or be acquired? If so, at what price would management consider for the company?

The Board will always consider legitimate offers to purchase the Company. Included in this consideration would be any offer which reflects the total value of the Company. U.S. GAAP has specific rules notating what, and the value of, assets that are included in financial statements.

For example, per U.S. GAAP, our investment contracts are not valued or included as an asset on our balance sheet. In addition, the building which we own is not marked to market value on the balance sheet either.

The fair market value of these assets would need to be considered when reviewing any purchase proposal, even though they are not included on the Company’s balance sheet.

As CEO of HIVE and GROW you are both the lender and borrower with regard to the HIVE debentures on GROW’s balance sheet. Does this represent a conflict of interests?

U.S. Global Investors made the original investment in HIVE Blockchain because we recognized early on the SEC’s resistance to allow a Bitcoin ETF due to various regulatory concerns. However, we learned quickly that mining operations for cryptocurrencies, such as Bitcoin, did not have these regulatory risks. Noting the SEC’s resistance to allow for a cryptocurrency ETF, we decided the best way to offer GROW shareholders exposure to this industry was to invest in a cryptocurrency mining company – HIVE Blockchain Technologies. We wanted to create a win for GROW shareholders.

In December 2020, the Company sold its equity investment in HIVE. We had an initial investment of $2.4 million resulting in a gross $18 million gain. In January 2021, the Company purchased convertible securities of HIVE for $15 million. The purchase of the convertible securities in HIVE, we believe, was fortunate timing in that HIVE could use the funds for its growth and GROW could reinvest the profits from the original investment in an investment with an interest rate which essentially is positive for U.S. Global and less expense for HIVE than borrowing in the capital markets.

You’ve noted that shares are repurchased using an algorithm. The most recent July update indicated that 5,897 shares were repurchased that month at an average price of $4.24; this is compared to 13,255 shares bought back in June at an average price of $4.45. Average prices of GROW were lower in July than they were in June. So are we to understand that the algorithm believed the company was more undervalued at $4.45 last month than it is at a price of $4.24 this month? And if so, why? Any color on how this algorithm works would be appreciated.

Our algorithm allows us to buy back our stock when the price is down from the previous day. Therefore, we purchase on down days, not solely based on the opinion that our stock is being undervalued.

Given management’s discussion of shares being undervalued, what is management’s preferred tactic moving forward to increase shareholder value? Is management considering further buybacks? A possible tender offer? An acquisition? A one-time special dividend? A sale?

We focus on the ROIC (return on invested capital) model. We create products, maintain broad awareness of our existing successful products, and then look for acquisitions.

With surplus cash we could buy back stock, increase our dividend, or make an acquisition. To make a meaningful acquisition and to help weather the storm of volatile markets, we need to build our cash, which we have been focused on, but at the same time we have raised the dividend twice and increased our buybacks.

The shareholder structure as such means that you have voting control of the company. What do you have to say to minority shareholders who are concerned about your control of the company?

I would remind shareholders that U.S. Global Investors has two outstanding classes of common stock – class A and class C. Class A shares are non-voting and trade on the Nasdaq Exchange under the ticker symbol GROW. Class C shares are voting shares that are not publicly listed. I own approximately 99% of the voting class C shares currently.

Owning approximately 17% of the shares outstanding encourages me to make decisions that increase shareholder value. Therefore, I believe my interests are aligned with minority shareholder interests.

If there is a significant change in control of the investment manager, the fund board would have to approve the continuation of the advisory agreement along with the approval of the shareholders of our funds. Our share structure allows the Board more control over a significant change in control.

Some Final Reflections

With my questions I was trying to discern from Frank what his near-to-mid-term capital allocation strategy might be as well as understand his ethics a bit. With regard to capital allocation I’d say I was left with little more clarity than before. It could be argued that an acquisition is perhaps the approach given Frank’s comment that “To make a meaningful acquisition and to help weather the storm of volatile markets, we need to build our cash.”

My question regarding the share repurchase program yielded little as well. I will say that it seems that repurchasing shares near equity book value would generate little return. If one believes that intrinsic value is hidden in the equity then perhaps repurchasing shares would unlock that. Given the slow rate at which management has been repurchasing shares their own algorithm might be suggesting that shares are not undervalued at current prices.

In the absence of a clear capital allocation strategy and the company trading near equity value I think it’s likely fair valued despite the high earnings power of the ETF business. It’s possible that an offer could be made for the company though my guess is that’s unlikely given Frank’s ownership and the HIVE investment. What’s perhaps more likely is that management could be looking for an acquisition as the markets continue their volatility.

Regardless, I have a suspicion that the market will continue to experience downward pressure into the next year which will also pressure investment businesses like GROW.

In terms of Mr. Holmes’ ethics, he seemed straightforward in his answers and I appreciated the detail regarding the original investment strategy with regard to HIVE. He did not have to engage with these questions at all so I appreciate the time and effort he put into the responses to try and give investors further information. Nothing that I turned up seemed to suggest anything unethical though I do continue to believe it is a high order for one person to run two public companies, one of which being a lender to the other.

With the company’s own algorithm suggesting fair value in the stock price and an unclear capital allocation strategy moving forward I think it’s reasonable to either sell or hold here. I sold my shares here as I found other opportunities with a better risk/reward ratio by my judgment like a fintech trading at a P/FCF of 2.97x. A hold thesis here could be that there is a latent M&A catalyst with the cash on hand and activity in the sector overall.

Be the first to comment